The 'Freedom Convoy'

The right to protest against one’s government in recent times has been viewed as an inalienable right of individuals, especially within western democracies. As of late, Canada has been facing increased resistance to governance with respect to coronavirus restrictions and mandates imposed on its citizens. Canadian truckers have been at the forefront of this movement using the slogan ‘Freedom Convoy’, with the trigger being the Canadian government’s attempts at mandating vaccinations for truckers crossing the US-Canadian border. This evolved into a broader form of protest with the goal of removing all covid mandates and restrictions in order to give Canadians more freedom to live their lives as they see fit. The grand scale of the protest has been extraordinary to see with the truckers’ convoy stretching up to 70km in length.

Centralised payment systems that attempted to raise funds for these protests have faced multiple problems in getting to the desired organisations and individuals, either due to technical or political reasons. The attention grabbing moment was on the 14th of February, with Canadian Prime Minister Justin Trudeau and his party declaring a public order emergency for only the second time in the country’s history. These emergency powers enable the government to freeze both personal and business bank accounts of anybody involved in the truckers' protest in order to impede their efforts without a court of law's consent.

JUST IN: Canada invokes emergency act to include #cryptocurrency in it's anti-money laundering and terrorist financing rules…

— Watcher.Guru (@WatcherGuru) February 14, 2022

The Bitcoin Network

This is where technology such as Bitcoin can be used to circumnavigate any potential capital controls that can be applied to an individual/organisation. Bitcoin is apolitical in its nature and of course decentralised, making it significantly harder to control in comparison to a centralised payment system. The Bitcoin network allows individuals to exchange value peer-to-peer without any government or bank intervening with the process, making this a huge selling point of adoption over traditional methods.

Further reading: The Philosophy of Bitcoin

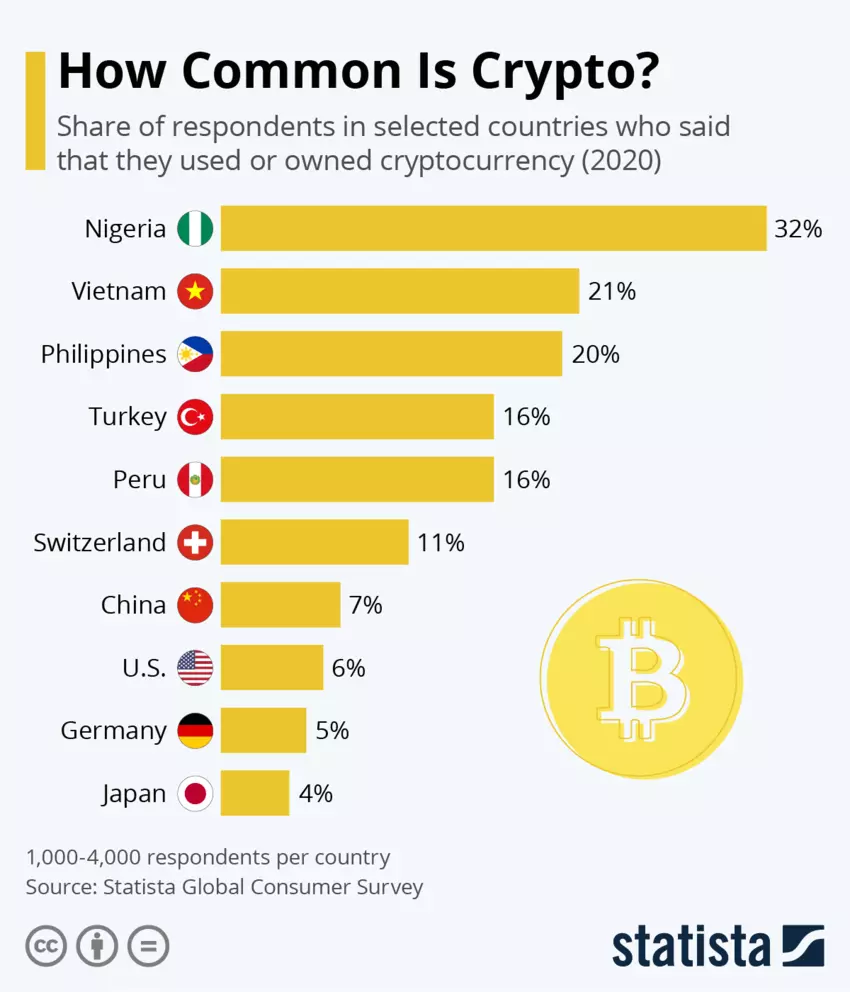

There is no inherent political bias that is encoded into Bitcoin’s monetary system meaning users of such a system do not carry the same concerns of seeing their accounts closed or blacklisted by institutions. These concerns are characteristic of government bodies seeking greater control and can partly explain the increased adoption of Bitcoin in countries such as Nigeria or Turkey which have faced increased capital controls at the orders of the state.

The lower barrier to entry of cryptocurrencies is an additional reason as to why they have become such an attractive proposition to both investors and the unbanked alike. To become a participant in such networks, all that is required is a device that can connect to the internet, making the onboarding process both easier and faster than traditional approaches. This offers significantly more opportunities to those in emerging economies trying to find avenues for wealth preservation and to avoid stringent controls on transactions.

However, there is an opportunity for ‘bad actors’ to take advantage in situations such as bank runs or capital flight as individuals act in haste and may not consider all the risks of their actions. A bank run is an issue faced in traditional finance systems and a symptom of fractional reserve lending; however, such issues cannot arise in a cryptocurrency system as tokens can be verified on the blockchain. A common scam is the promise of cryptocurrency to a user if they directly bank transfer the opposing party, rather than using legitimate exchanges. They may use fear mongering tactics such as claiming there is a threat of banks not allowing transfers to crypto exchanges and subsequent seizing of your funds if caught doing so. Users should be extra vigilant with their money and look to buy cryptocurrencies through trusted exchanges like Coinbase and Binance, or brokerages such as Caleb & Brown.

The Role of Regulation

As governments begin to regulate this new technology much of the regulatory framework is currently being drafted in real time, leaving investors and users of these networks in somewhat of a blind spot. The impacts from varying levels of regulation and how these differ between jurisdictions should be something to keep a keen eye on, along with how they are reacted to within governments and the populations they govern over.

Further reading: Blockchain Fundamentals: A Social Perspective

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)