With today being Earth Day, it seems fitting to discuss the impact Bitcoin has on the environment and climate. Bitcoin sceptics have often critiqued the network’s Proof of Work consensus mechanism due to the energy expenditure that is necessary to secure the network. Are the concerns as egregious as the sceptics suggest? A more nuanced approach to this technology and its implications will hopefully offer readers a more complete picture from which to draw their own opinions.

Firstly, the biggest criticism of the Bitcoin network is its ""perceived"" negative affect on the planet due to its energy consumption. Bitcoin employs an energy-intensive process called proof-of-work mining in order to solve blocks (transactions bundled together), which are then added to the blockchain, and in return, miners are rewarded with new Bitcoins. This energy-intensive process is fundamental to the viability and longevity of this public ledger in two ways: firstly, by linking the digital network to the physical world through ""work"" (energy used for computational work/hashing), and secondly, by ensuring sufficient energy is used to deter/restrict bad actors from gaining control over the network. By having this consensus mechanism tethered to the physical world, it endorses energy production and use by miners, assuming the network continues to grow.

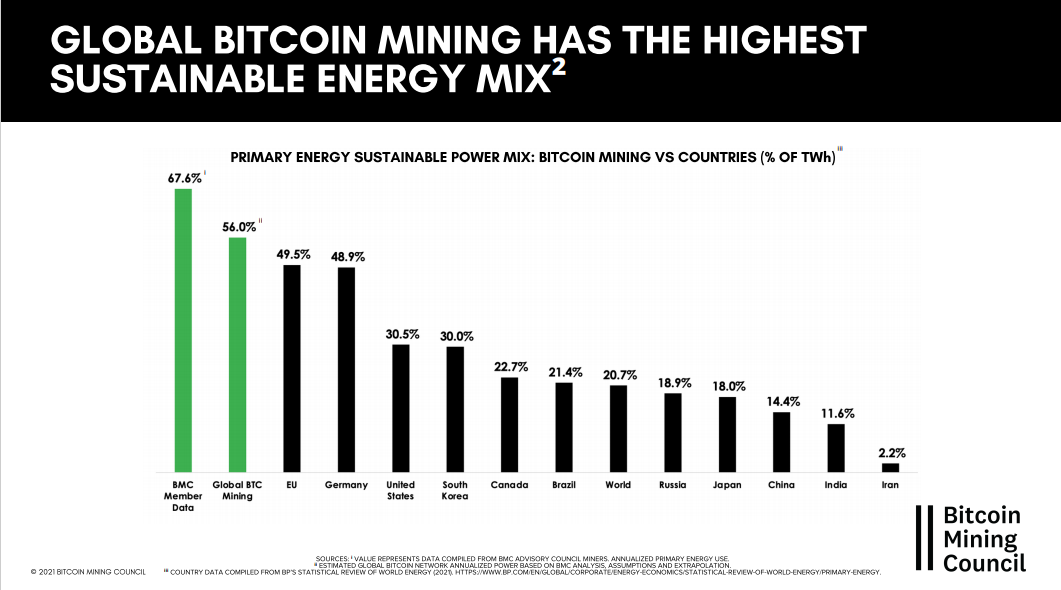

When focusing on the Bitcoin mining sector over the last year, analysts have been able to better gauge an idea of the energy mix that is involved in this process. Most notably, the Bitcoin Mining Council (BMC) was established, a voluntary forum of Bitcoin miners created to provide more transparency into mining operations in order to reduce much of the scepticism and negativity surrounding the industry. The most recent report (Q4 2021) from the BMC gathered survey results from over 46% of the network and demonstrated that of that percentage, there was a 66.1% sustainable power mix. Overall, from the surveys collected since the inception of the BMC, there has been a positive trend of miners' increasing efficiency and sustainability of their operations.

Bitcoin miners by nature can also be buyers of last resort when it comes to energy (as the main cost for mining is electricity when running). This essentially means miners are continually seeking out cheap and available energy that may have not been channelled towards productive uses or is low in demand. This in turn allows them to harness renewable energy sources (e.g., hydroelectric, wind, solar), and as Bitcoin as a technology monetises this energy, it will in turn incentivise greater renewable energy generation and push for renewable technology innovation. It helps to stabilise energy grids by absorbing excess power generation or alleviating shortages by turning off miners when required, ultimately bringing greater flexibility to power grids. This advancement should minimise the need for government subsidies on renewable technology, which frequently comes at the price of increased government spending and hence taxes on residents. An example of this undefined can be seen in the most recent infrastructure bill in the US, whereby $73 billion has been committed to clean energy. Overall, these improvements contribute to the provision of steady and inexpensive energy to consumers over time.

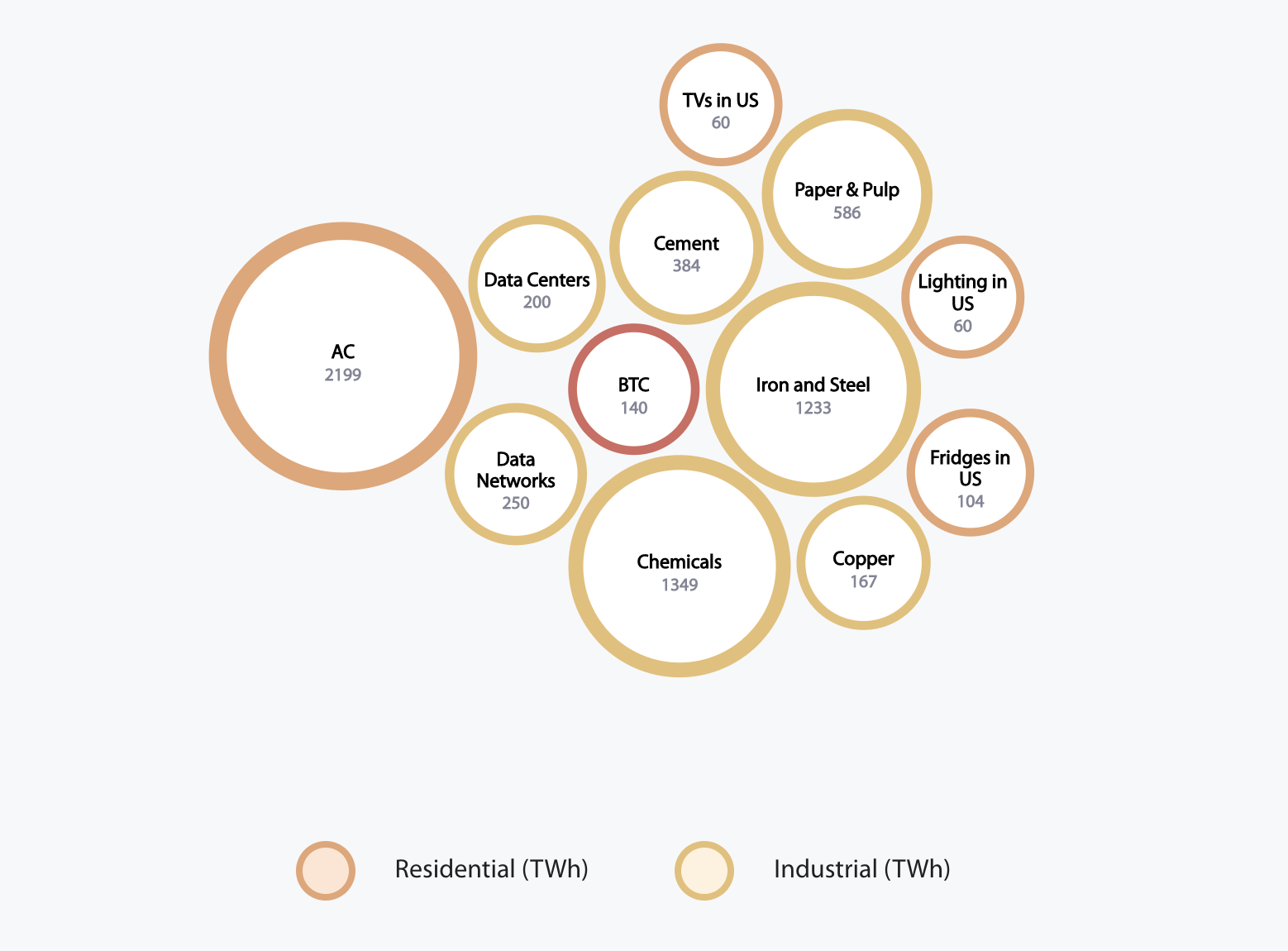

Using data collected from the Cambridge Bitcoin Electricity Consumption Index, the Bitcoin network consumes an estimated 142 terawatt-hours (TWh) of electrical energy a year. This is the equivalent of the estimated energy consumption of a country such as Poland (140 TWh), and at first glance, this seems like an extraordinary amount of energy use. However, when one digs more deeply into overall energy usage, it provides a greater level of perspective. Global energy consumption currently stands at approximately 22,000 TWh. The Bitcoin network then stands to use around 0.6% of this total consumption, providing a better gauge of how energy-intensive it is overall and how many industries are much more energy-intensive in comparison (e.g., military, construction, transportation, industrial mining). For example, the military industrial complex is a hugely energy-intensive industry, with military fuel and transportation using in the region of 1100 TWh as a singular example (to read further on this, visit here.

When looking at energy consumption, it’s also important to consider the moral and philosophical attitudes towards it. How does an individual or society determine what energy usage is deemed acceptable or not? How do you justify one energy usage in lieu of another? For example, does it seem reasonable to direct significant energy consumption to military and warfare purposes? The traditional banking system uses significantly more energy than the cryptocurrency sector, does it make sense to ban one and allow the other to thrive?

Bitcoin allows many of the unbanked to become banked, protects their right to have private property more adequately, and has protected millions of users from central bank currency debasement, something which has only accelerated since the coronavirus pandemic. There is no disputing that we have witnessed increasing state surveillance, sanctions, and confiscation of property in many jurisdictions in the last few years. As a result, for many, the relative trade off in energy consumption for such a technology appears to be more than justified and required than ever. Over time, individuals and society will have to determine whether the energy directed towards the Bitcoin monetary network is conducive to human advancement.

It can be sufficiently debated that the adoption of the Bitcoin network will help to cultivate society with a more efficient means of sustainable development and civilisational advancement. Whilst incentivising greater energy production and using increased renewable sources, the network can help play a pivotal role in improving living standards for all with respect to liberty, affordable energy and economic developments that have longer-term time horizons in mind.

Recommended reading: Bitcoin Mining: The State of Play

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)