Bitcoin

Bitcoin started the month recovering from its topside rejection from $67,000 in October. After spending the week consolidating between the $60,000 and $64,000 range, Bitcoin looked to breakout, fueled by macroeconomic factors and strong sentiment aiming for the $70,000 level.

With block #709632, the long awaited upgrade to the Bitcoin network was triggered. The new protocol, Taproot, preserves privacy on the Bitcoin blockchain by obscuring complicated transactions. It also makes them cheaper and more lightweight. This is the biggest upgrade to Bitcoin since 2017. This fueled Bitcoin to blast past the $67,600 threshold and continue to rally, setting a new ATH of $69,000.

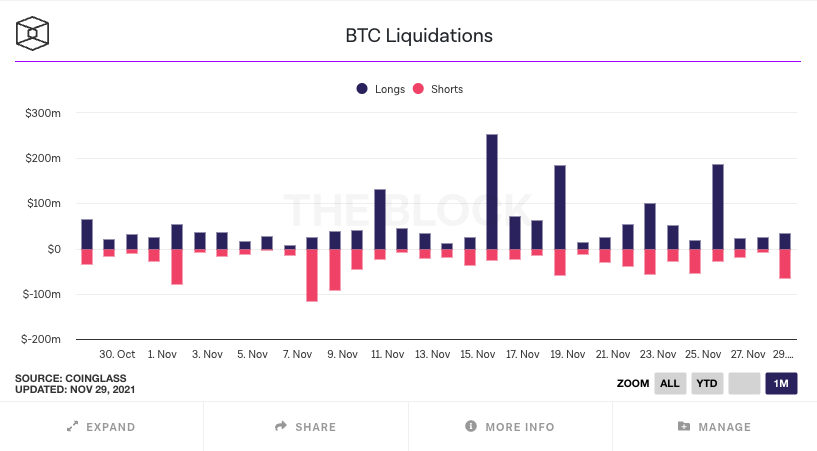

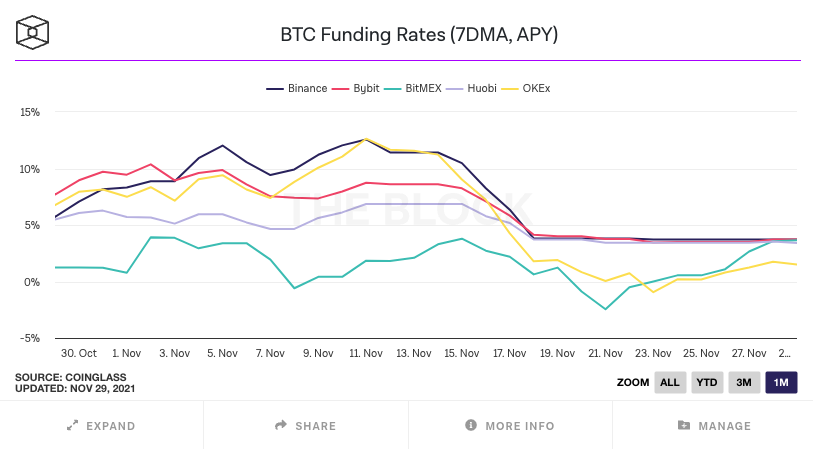

Shortly after, Bitcoin capitulated to under $60,000 dragging the market with it. An unanticipated rise in funding rates and an over-leveraged futures market, resulting in profit-taking and short interest, liquidating many longs. The crash was exacerbated by the $200 million of forced liquidations on derivatives platforms.

We briefly found support, consolidating in the $56,000 and $59,000 range due to retail (HODLers of 1 BTC or less) aggresively buying the dip. This was interrupted by a significant market sell-off on the 26th of November due to the COVID concerns surrounding the new Omicron variant, first reported from South Africa. The marketwide sentiment still remains fearful as the crash in May 2021 is still fresh in the minds of investors.

Since then, the market has bounced back strongly after software firm Microstrategy and President of El Salvador, Nayib Bukele, both tweeted that they bought the dip. Microstrategy purchased an additional 7,002 bitcoins and Bukele an extra 100. The spooked markets have also recalculated the Omicron risks with many reports that the symptoms have so far been "extremly mild", according to medical experts in South Africa.

The price action of the second half of November has washed much of the leverage out of the crypto ecosystem. With funding rates close to neutral and most derivative exchanges having annualised funding rates at around 3.5% A daily close above $60,000 now would likely signal the end of this short downtrend, but one cannot rule out a false breakout. For the last two years almost every Bitcoin sell-off has just been a function of an over-levered market, and has presented a solid buying opportunity. Will this time be different?

Ethereum

Ethereum had a relatively similar month to Bitcoin, with high volatility throughout the month, setting new ATHs before capitulating to previous supports just like BTC.

In the first half of November, Ethereum continued rallying and breaking new ATHs, outpacing BTC. ETH continued to outperform and set new ATHs till the 11th of November, just above $4,850. When Bitcoin capitulated, ETH followed suit, as did the rest of the market with a minority of assets outperforming.

Interestingly, Ethereum has shown strength against Bitcoin over the month. Usually Ethereum trades at a higher beta to Bitcoin which means that if BTC appreciates in value, ETH tends to follow at a higher rate. However, the flip side is true, if BTC falls, ETH tends to fall further. With this relationship, Ethereum would usually show weakness against Bitcoin throughout the month. Instead, ETH/BTC has continued to trend up.

One could attribute Ethereum's strength to a supply shock. ETH exchange reserves have continued to plummet, and it has become almost deflationary since EIP-559 was introduced. While high fees are not ideal for Ethereum, it is a sign that the protocol is still in high demand which is still quite bullish. Ethereum has also held its price level close to its ATH which cannot be said for Bitcoin.

Ethereum fees remain high during the month of November, with over 398,968 ETH ($1.7 Billion) paid to miners and 364,667 ETH ($1.5 Billion) burned. This left a net issuance of only 34,309 ETH ($148 Million). As for the burn leaderboard, the largest users and burners of ETH have remained constant. Over the last 30 days, Uniswap and OpenSea dominated transaction volume. This can be attributed to the explosion of Metaverse tokens as well as NFTs still continuing to perform well.

Altcoins

The dominant theme leading altcoin gains throughout the month has been the Metaverse. Facebook's announcement of their name change to Meta fuelled the narrative that there is a future and likely a large space of Metaverse-related projects moving forward. This caused a huge reallocation of funds from cryptocurrency investors from large caps to Metaverse-related tokens such as Decentraland (MANA), The Sandbox (SAND) and Gala (GALA) overperforming despite BTC crashing. MANA and SAND have returned over 1000% over the last month, with GALA up over 800% over the same timeframe.

However, the same cannot be said for the majority of altcoins. Of the top 10 cryptocurrencies, only three closed the month higher then they opened. This is to be expected as capital in altcoins are heavily dependent on the performance of BTC and ETH.

Regulatory Updates

Not only was the month of November highly volatile for crypto markets, there was also a lot of action in the regulatory side of things.

In terms of America, the US Infrastructure Bill, introducing an obligation for crypto transactions worth $10,000+ to be reported to the IRS, passed into law. The changes introduced to tax regulations mean that any individual using crypto or blockchain technology in connection with transactions worth $10,000+ will need to report to the IRS, including wallet testers, developers, etc. Given the broad scope of this requirement, legislators are already introducing bills designed to reduce reporting obligations for entities that are not exchanges.

As for Australia, ASIC chair Joe Longo, who spoke at the superannuation summit opined that crypto is a mysterious asset class. During his speech, he asked, "Who among us can say they really understand crypto assets and cryptocurrencies?" Longo was similarly unsure of how DAOs should be legislated, opining that it is unclear how a "DAO itself can be held accountable in a court of law".

RBA Head of Payments Policy Tony Richards addressed the Australian Corporate Treasury Association this month, sharing his views that cryptocurrencies are a "fad" and that surveys indicating that as many as 20% of Australians hold crypto are "implausible" and are attributable to "hype and misinformation". Ironically, Richards himself shared that he has "had a cryptocurrency wallet since June 2014" and has made purchases of cryptocurrencies since.

Jumping to the UK, HMRC (UK Tax Office) has updated its regulations to apply a digital services tax of 2% to cryptocurrency exchanges, indicating that it interprets crypto assets as being distinct from financial instruments under UK legislative definitions.

Last but not least, India’s lower house of parliament has on its winter agenda a bill designed to ban private cryptocurrency use and ownership. India’s Reserve Bank previously moved to ban private crypto use in 2020 but had its mandate overturned by the Supreme Court.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)