Bitcoin

The month of October started with Bitcoin breaking out of the $44,000 range and managing to pass through its prior local high of $53,000, the looming announcement of a possible Bitcoin ETF continued the bullish sentiment in the market resulting in a further 10% increase in price.

Bitcoin continued to rally up towards prior all-time-highs with very strong signs of support and fairly little resistance during its uptrend. On 20th of October, BTC set an all-time-high price of $67,276.79 after it was announced that a Bitcoin Futures ETF would begin trading on the 22nd of October. Since then, bitcoin has consolidated in a tight range holding $60K, something it was unable to do during its run earlier this year. With on-chain indicators still looking favourable, November will be an interesting month to watch.

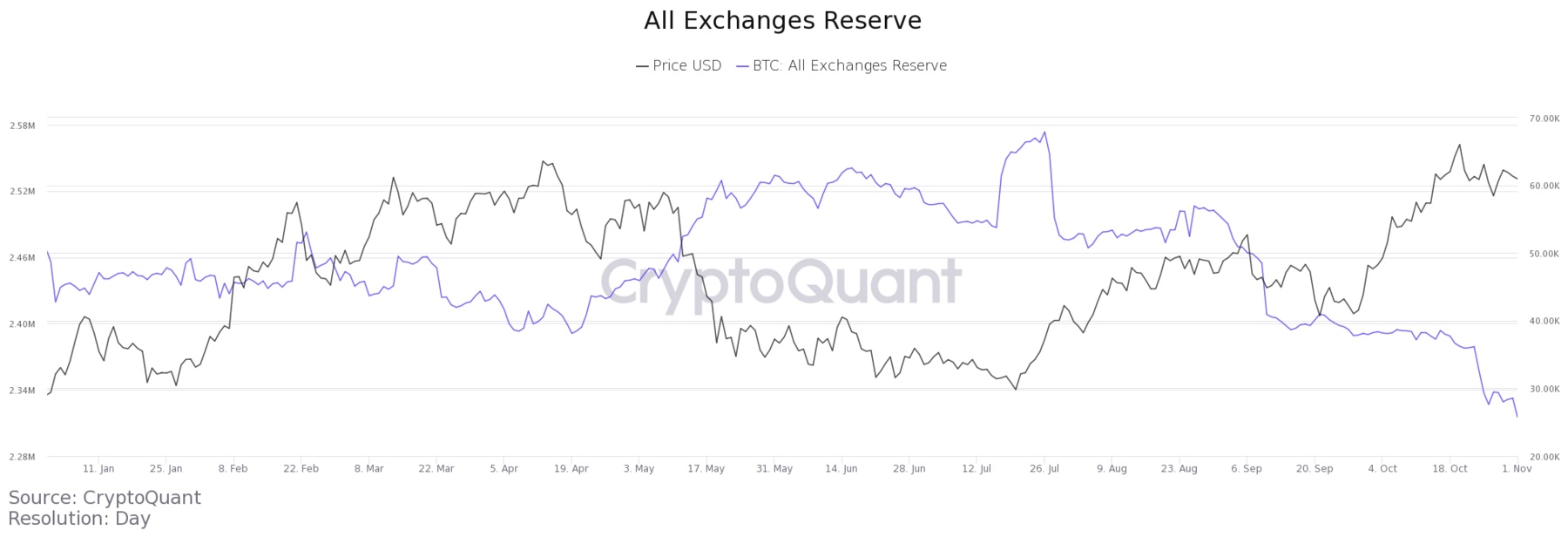

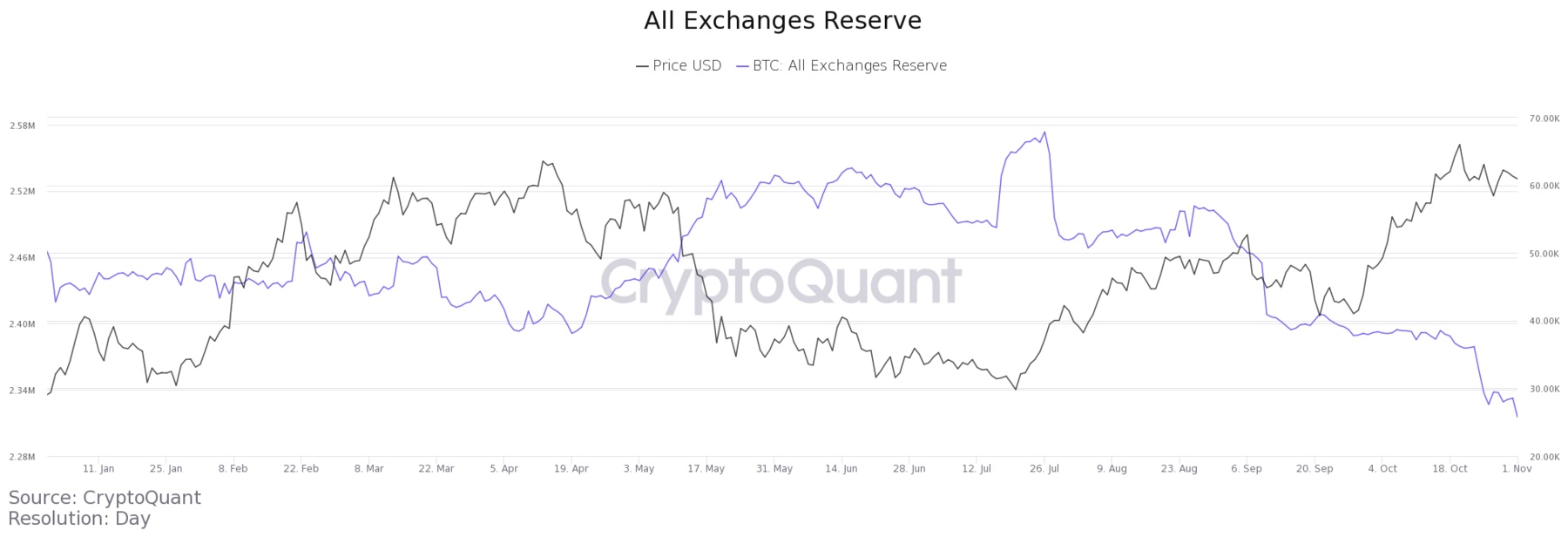

BTC Exchange reserves continue to fall, indicating a relatively tight amount of liquid supply, implying that bitcoin investors have no desire to sell in the short term despite the rapid movements up in price, thus continuing to store their BTC in personal wallets and off exchanges.

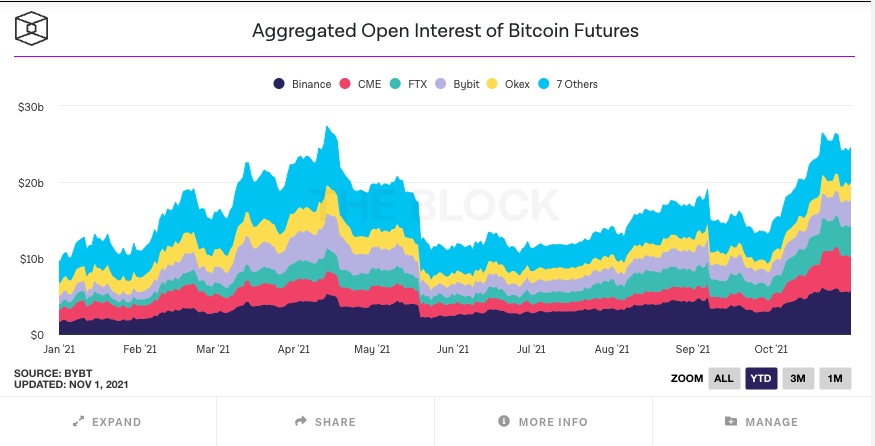

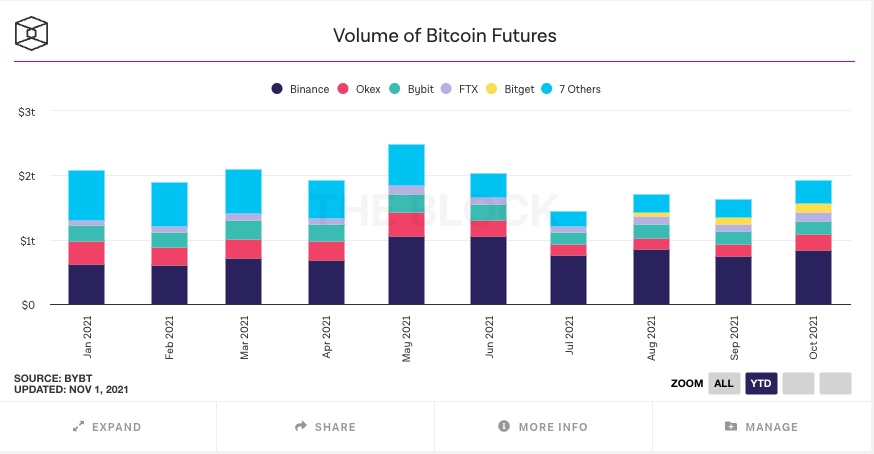

With the launch of the BITO ETF (Bitcoin ETF) product which utilises CME Bitcoin futures contracts as the underlying, the open interest (total amount of open positions) in CME contracts has exploded higher through October, rising by $3.95 Billion (265%), which set a new all-time-high of $5.44B for futures open interest on the CME exchange. On the day bitcoin reached a new all-time-high, trading volume also peaked at a new high of $7.66B. Levels like these were last seen in April during Bitcoins previous all-time-high run.

With futures becoming a larger part of the market due to the introduction of Bitcoin Futures Backed ETFs, its contribution to speculation and various short-term price fluctuations is increasing. Fundamentally, it is the spot-buying and spot-selling that drives the long-term price, while leveraged traders add increased volatility to the market, which can cause the sharp and rapid up and down movements in the market.

Ethereum

October was also a very successful month for Ethereum, instantly breaking through the $3,000 barrier. A week after BTC reached all-time-highs, ETH soon followed hitting a new all-time-high of $4,460 ending the month up over 40%.

Based on the Ethereum 2.0 lockup contract that continues to accumulate large amounts of ETH (over 8 Million ETH at the time of writing this) and as a consequence of that, ETH continues to be rapidly withdrawn from exchanges - even faster than BTC. It seems like a well-engineered environment for a supply squeeze which could cause further appreciations in price.

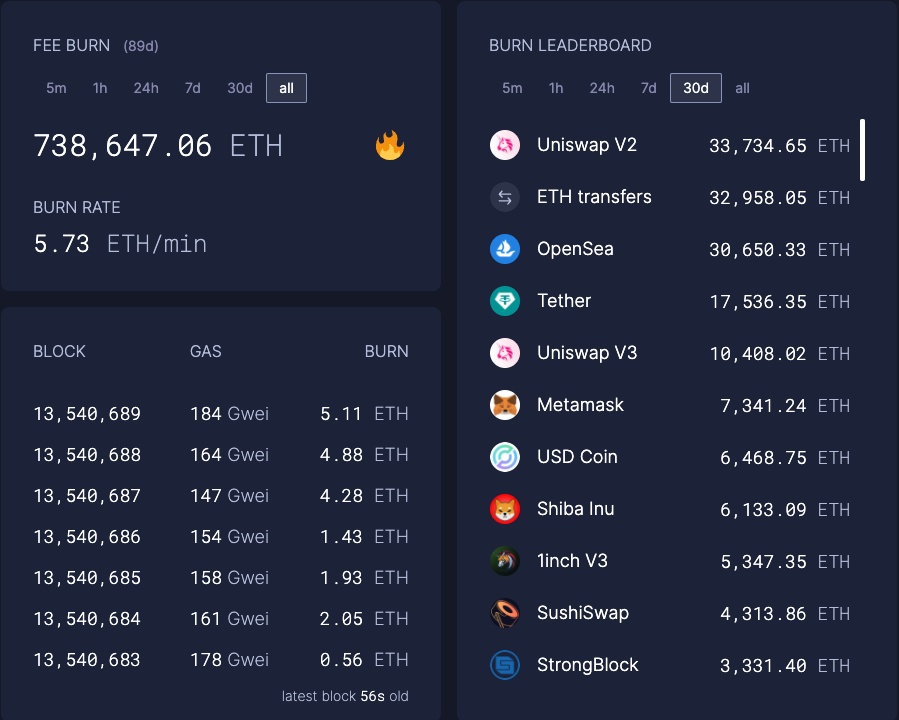

Ethereum's network has had a particularly busy second half of October, facing floods of transactions, so much so that the network burned more tokens than it minted. This has led to gas prices being much higher than before with the average gas price sitting at approximately 145 gwei. As of writing this, to date, 727,417.57 ETH has been burnt which is approximately $3.1 Billion.

The biggest consumer of gas has been Uniswap. Half of the ETH burnt from Uniswap V2 over the last month has happened in the last week. This would likely stem from dog tokens and other meme tokens performing well in recent times.

Lately, a newer dog-themed coin called Shiba Inu (SHIB) soared in price and briefly surpassed Dogecoin in market capitalisation (reaching a top Market Capitalisation of over 43 Billion). While Dogecoin is based on Litecoin (which is based on Bitcoin), Shiba Inu is an ERC-20 token that runs on Ethereum. The token itself is up over 90,445,650.6% for the last year (according to coingecko) meaning if you invested $1,000 1 year ago, it would now be worth about $904,457,506.

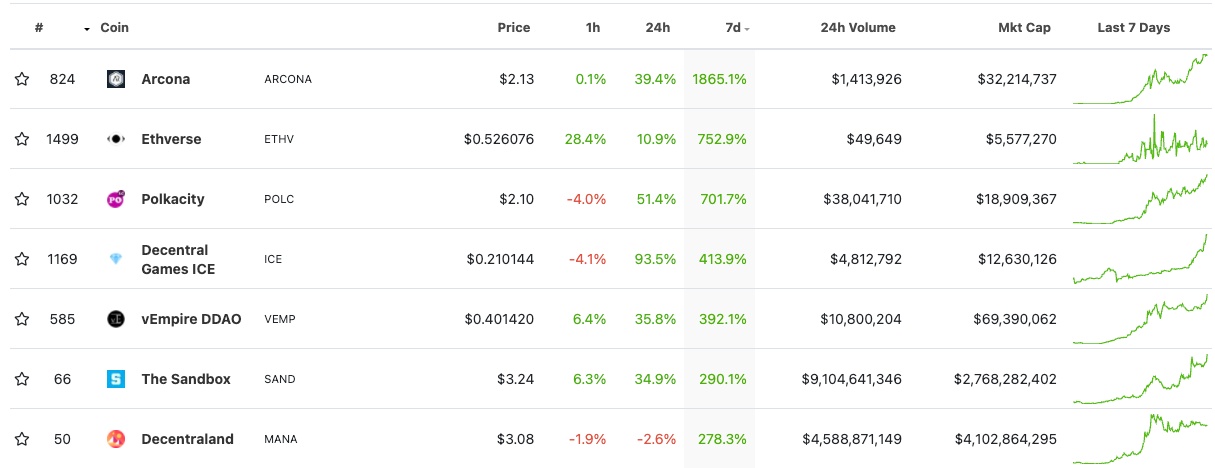

Also in recent days, a token called Decentraland (MANA) went parabolic after Facebook recently announced it is going to change its name to "Meta" in order to focus on Virtual Reality (VR) and similar themes. This rekindled speculation in similar virtual reality themed tokens like Decentraland. Unlike the altcoin run in April/May 2021, these token bubbles have been quite specific and all relate directly to gaming and the acclaimed 'Metaverse'.

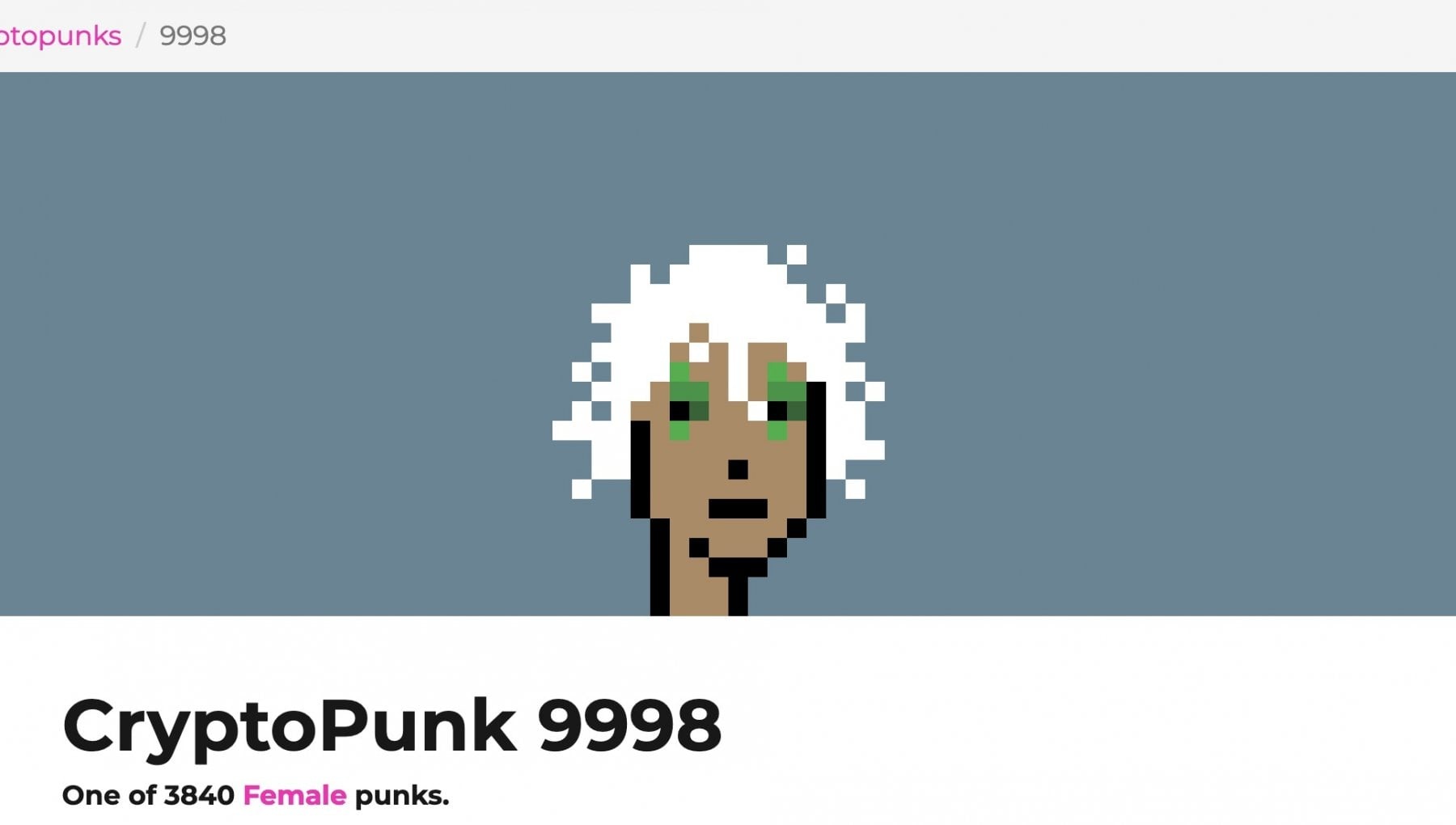

While the Ethereum ecosystem has received a large amount of adoption amongst influencers, celebrities and many retail investors due to the NFT mayhem, NFT volumes on OpenSea are trending down in recent weeks compared to their August 2021 peak. This could be due to a number of factors including Ethereums large appreciation in price and money being flowed into the wider Alt coin market. There has also been big concerns over the manipulation of NFT prices, particularly after the big $532 million self-sale of the crypto punk NFT.

For more context, an individual likely "sold" their Cryptopunk NFT to themselves from one blockchain address to another using a massive flash loan (a loan that is paid back nearly instantly). It was in other words, a fake and inflated transaction, one which only cost the perpetrator the gas fees involved in confirming the transactions as essentially no actual ETH was transferred at all.

Regulatory Updates

Stablecoins Under Pressure

Stablecoins have come under scrutiny from the US Government, in a recent report published at the end of October, stablecoins and the businesses behind them could face heavy regulations which may threaten their existence and ability to issue 1:1 backed tokens. The report published by a number of US federal agencies is asking for Congress to pass legislation that would require stablecoin issuers to become 'insured depository institutions'. This is a longwinded way of saying that stablecoin issuers would be required to become banks or rather classified as Banks.

If this were to happen, many stablecoin issuers would be governed under much stricter regulations surrounding what they are able to use as the collateral that backs their stablecoin as well as requiring them to pay for audits, compliance, insurance and other requirements banks have to follow. Many Issuers Such as Circle (Issuers of USDC the 2nd Largest US Dollar Stablecoin) welcome the regulation from Congress, as they highlighted the critical need for Federal banking supervision over Stablecoin Issuers.

Tether (the largest stablecoin issuer) has been specifically targeted a number of times for regulatory issues surrounding the collateral that is backing their US dollar stablecoin, USDT. Most recently, Hindenburg Research, a financial research firm that focuses on exposing fraud, has offered $1,000,000 to anyone who is able to provide "exclusive details" on Tethers "supposed reserves". Bringing regulation to stablecoins is defiantly needed, as it can protect investors against malicious tokens that are launched. However, new legislation should look at stablecoins as a new asset class not just a 'Bank' or variation of it. Doing this should allow the cryptocurrency space to flourish rather than stagnate due to an insufficient classification of stablecoins and their Issuers.

ETF Update

The SEC has extended its decision deadline for the Valkyrie Bitcoin ETF to 7 January 2022. This differs from the approved ETF's as this is for spot bitcoin, rather than a derivative. The SEC stated that "the commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised in the comment letters that have been submitted".

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)