Bitcoin

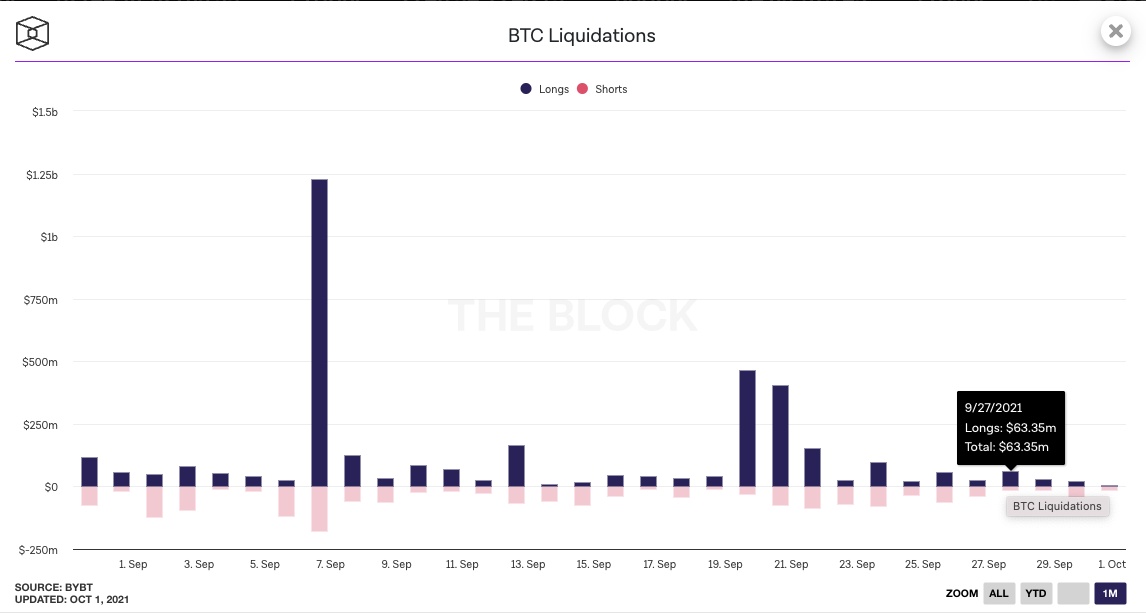

Bitcoin started September off with bullish sentiment, rising over 14% to its session high of $53k. This is after mostly ranging between $47k-$50k in the month of August. However, on the 7th of September, Bitcoin crashed from its highs of $53k to just below $43k. This was attributed to El Salvador experiencing technical glitches to the official digital bitcoin wallet. This headline was then exacerbated by mainstream media which initiated a snowball of sells and in turn, liquidations on the over-leveraged derivatives market.

There were over $1.2 Billion USD of liquidations, just for bitcoin on the Bybit exchange. While some of the sell off may have stemmed from this news, the below graphic demonstrates that it was amplified by an over-leveraged market.

The bearish view is that bitcoin has put a big double-top or bull trap in place, and the highs for the cycle has been reached. Conversely, the bullish view is that bitcoin has put in a higher low in September of $40k compared to the $29k lows of July 2021, and this will act as support for strength late into this year.

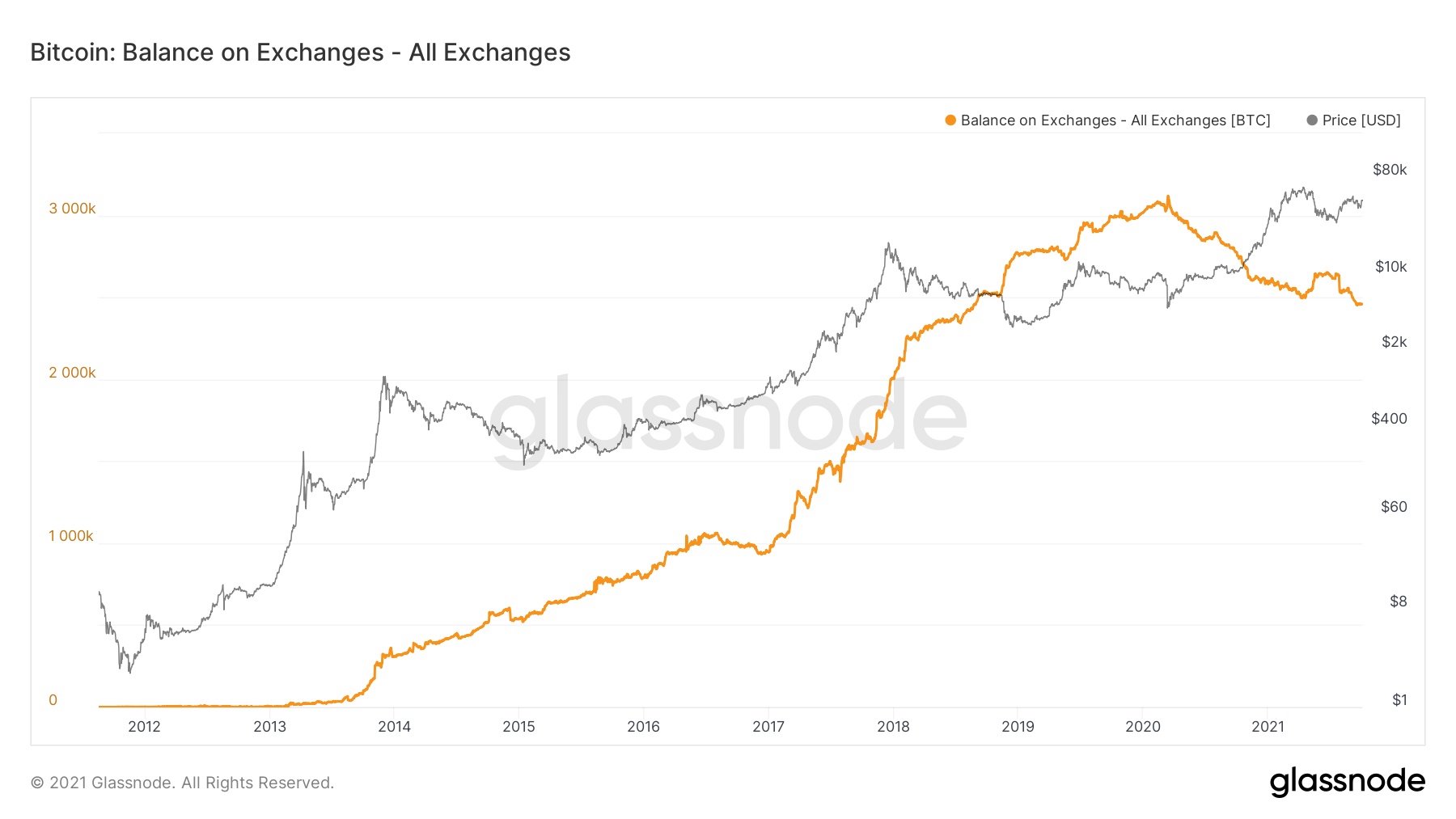

One of the bullish catalysts for bitcoin relates to the exchange supply. For a long time, the number of bitcoins on exchanges has steadily increased, this is until March 2020 when it peaked around 3.1 Million coins (out of a fully-diluted total of 21 Million coins). Since then, the number of bitcoins on exchanges has been in its longest downtrend ever, which potentially sets up a structural supply crunch, which is heavily bullish.

A few theories as to why this is happening is the decreasing number of new bitcoins generated per year due to block subsidy halvings as well as the cultural shift in investors. Rather than speculative trading, many investors have moved to treating it like a savings account, which consistently removes bitcoin from exchanges into cold storage. This makes it more resistant to selling and thus naturally raises the bottom support level.

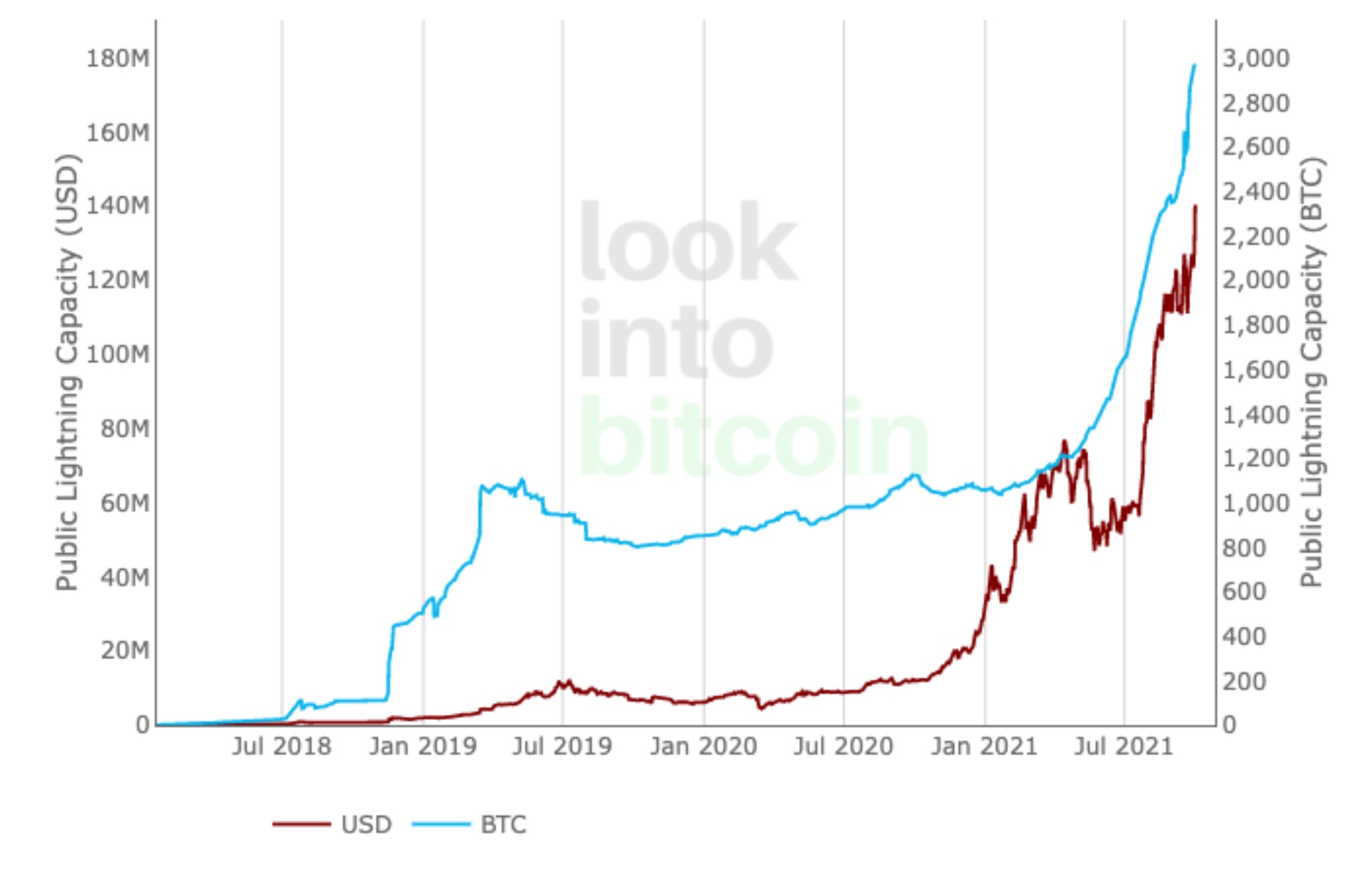

On another note, over the past month, the Lightning network continues its period of rapid growth, mainly fuelled by adoption due to El Salvador's president tweeting out stats for Chivo Wallet, which he claims has over 2.7 million users (40% of El Salvador's population) and is processing over $1 million in remittance payments per day. Even major companies like McDonalds and Starbucks now accept Lightning payments in El Salvador. External data providers confirm that Chivo Wallet is currently the most popular app in El Salvador for both Google and Apple app stores. Recently, Twitter rolled out "Bitcoin tipping" to its 300 million active users, which allows them to send or receive tips to one another using Lightning.

Ethereum

Similar to Bitcoin, Ethereum started September off in extremely bullish fashion, rising over 17% and holding just below $4000 USD which was only 8% off all time highs. However, the highs were short lived with a highly over-leveraged market and some looming bad news from El Salvador, the market tumbled causing ETH to fall over 25% in a day. The rest of the month saw progressively downward movements in the market as the news of Evergrande's possible default followed by China's nationwide cryptocurrency ban caused another 25% fall from the $3700 range all the way down to sub $2800 levels.

Taking a closer look into the first drop in the market for September, it was a very similar situation to the sharp increase in price that occurred in July due to massive short liquidations but in this instance it was over-leveraged longs that caused the fall to snowball over 25%. The end result was over $827 Million in ETH long positions liquidated within 12 hours. Although flash crashes cause great pain for the market as a whole, for many investors, they present buying opportunities as the market can be very oversold, resulting in much lower entries that are very quickly bought up.

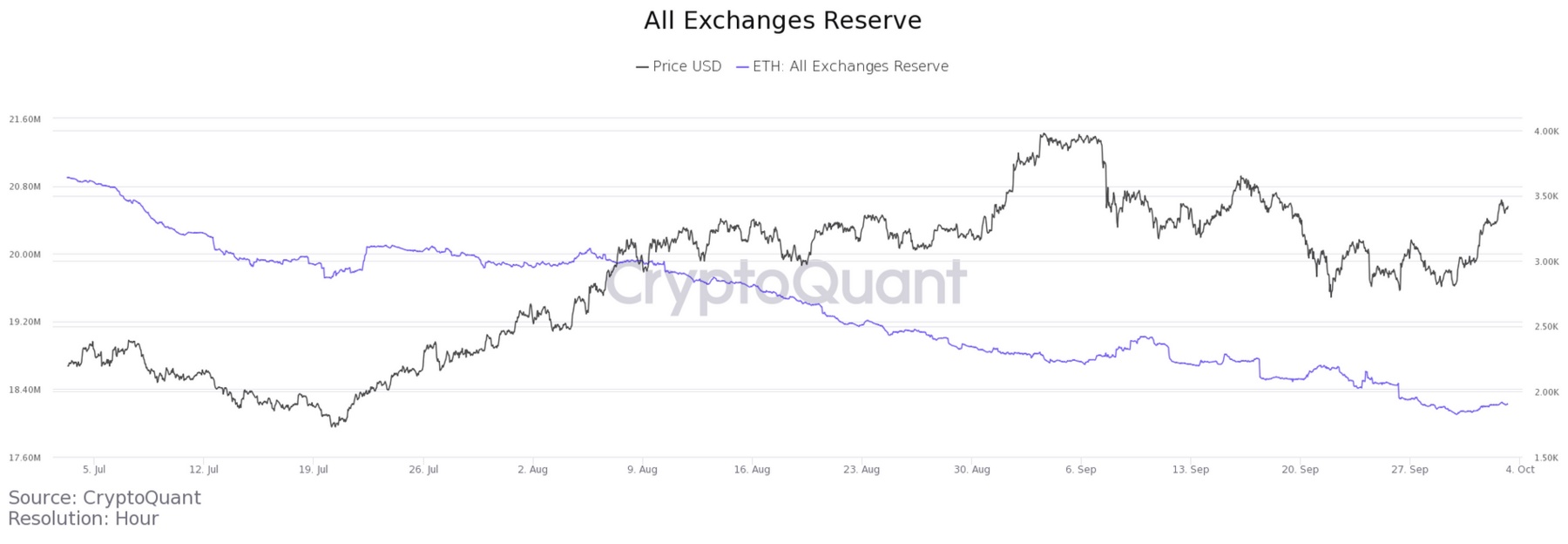

Regardless of the markets conditions, ETH exchange reserves have been continuing to fall. September was no different with 500,000 ETH removed from all exchanges. The lowering amount of ETH on exchanges is very bullish news as if the fall continues, it could result in supply shortages. Especially in the case where the market is hit with another upturn like the one we saw earlier this year.

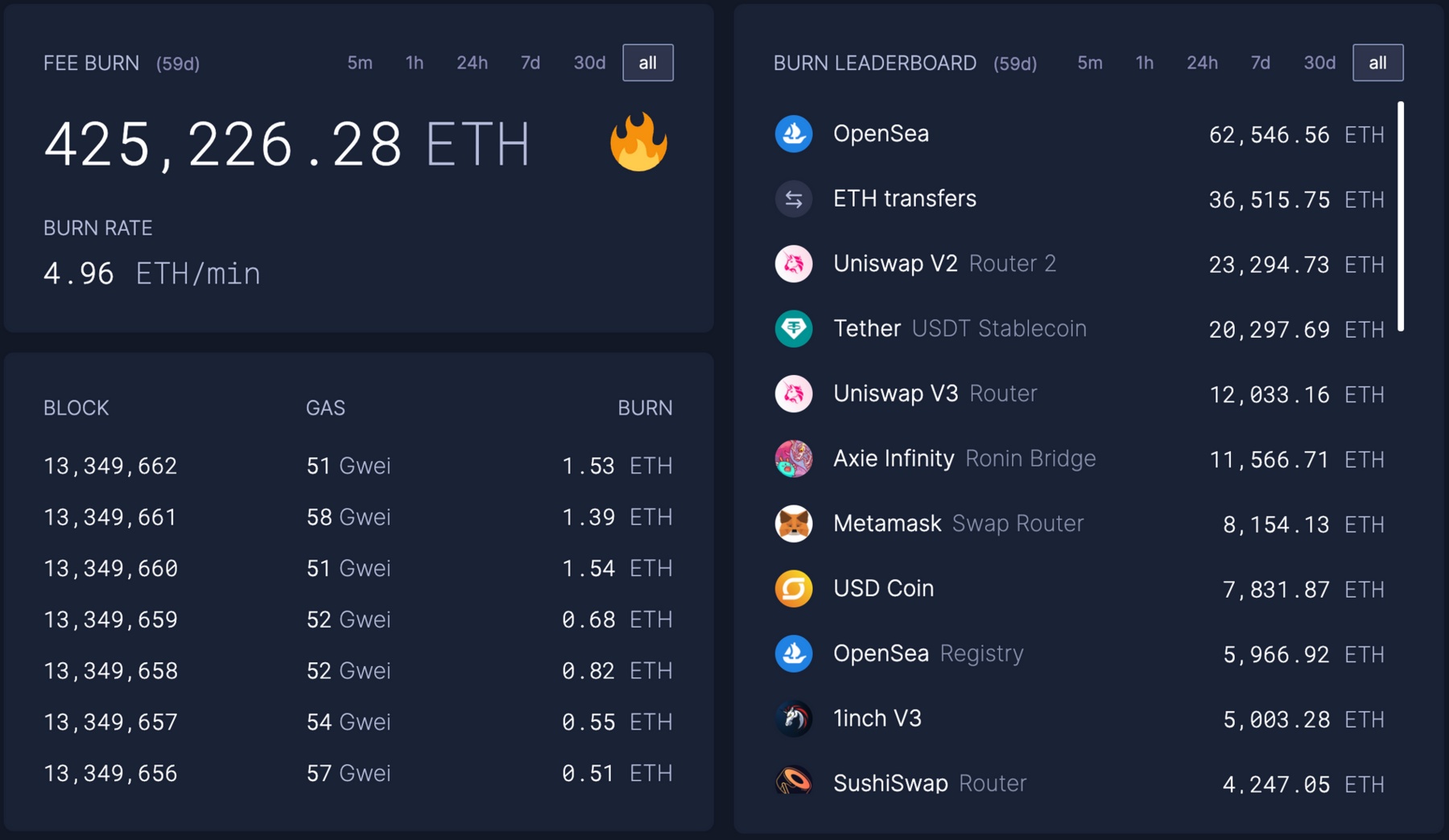

Further to the lowering ETH exchange reserves, EIP-1559 continues to have a huge effect on the Ethereum Network and the ETH tokenomics. To date, the amount of ETH burned is 425,226 ETH which is equivalent to $1.4 Billion worth of ETH. OpenSea continues to lead the burn leaderboard by a considerable margin, fuelled by the roaring NFT market. Notably, NFTs such as Bored Ape Yacht Club, CrypToadz, Cool Cats, Pudgy Penguins are but a few that have been on fire for the past month.

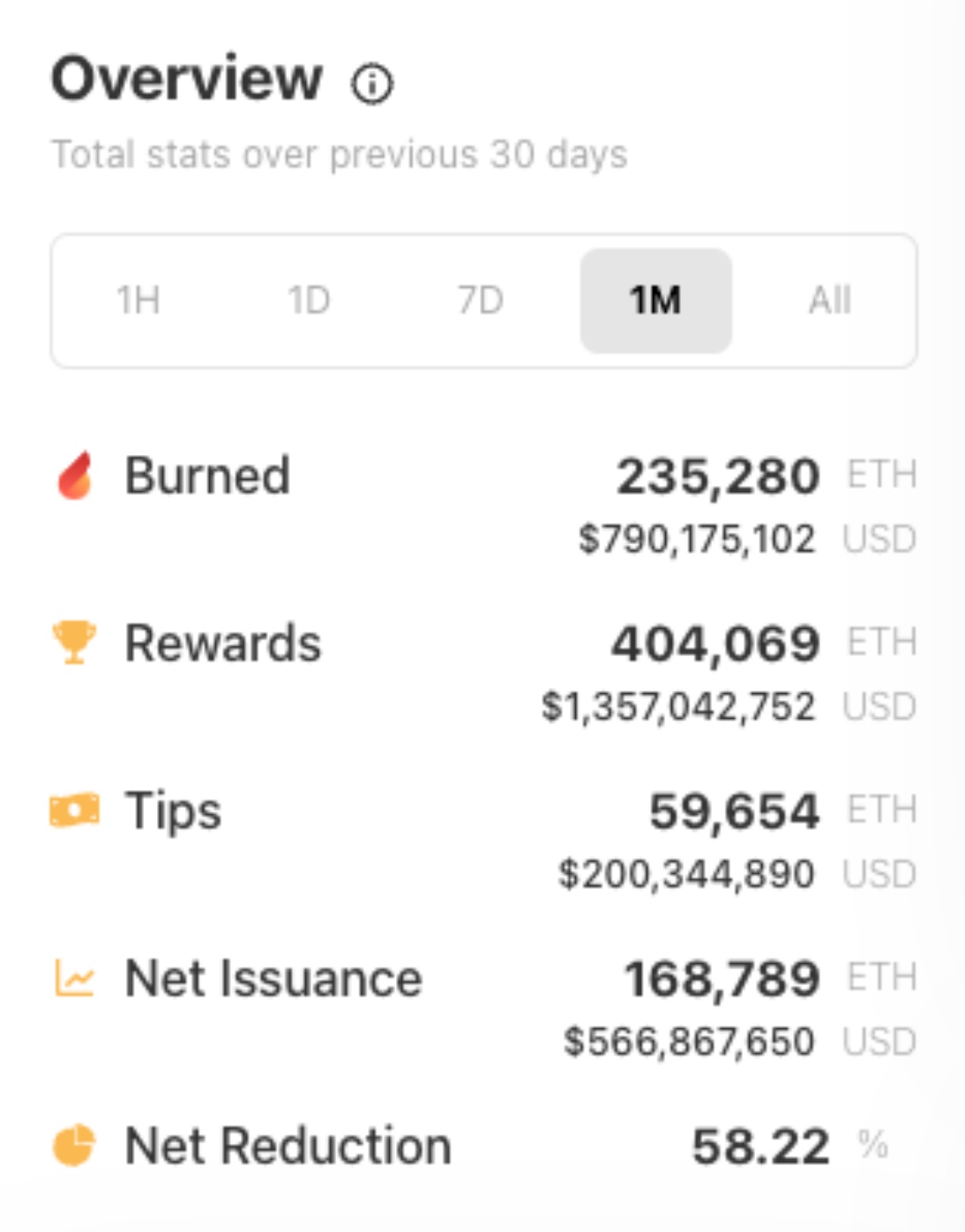

The resulting effect from over 230,000 ETH (Over $700 Million) burned throughout September is a net reduction of 58% on new ETH supplied, equivalent to the effects of the bitcoin halving. However, ETH still possess the ability to become deflationary during high congestion periods, temporarily reducing the overall supply of Ethereum. Pairing this with the lowering exchange reserves paints a very bullish picture for Ethereum as we move through the rest of 2021 and approach the possibility of the launch of ETH 2.0.

Altcoins

China's latest crackdown on the crypto industry highlighted crypto's decentralisation and was the catalyst for Chinese traders to move into the decentralisation finance (DeFi) space. DeFi protocols, specifically decentralised exchanges (DEXs) such as dYdX skyrocketed over 35% after China's crackdown, with trading volumes surpassing $6.3 billion in derivatives and $3 billion on spot markets. Other major DEX tokens were on the rise as well, with Uniswap (UNI) and Sushiswap (SUSHI) recording 30%+ gains 24 hours after the ban. Many theorised that the enormous influx of volume was from Chinese investors moving over into DeFi as shelter for their crypto holdings.

Recently, the fifth-largest DeFi project on Ethereum, known as Compound, suffered a bug that gave out tens of millions of dollars worth of tokens to a subset of users from Compound's comptroller contract. This was not a 'hack', but rather a poorly-written smart contract with loopholes that was both exploited and behaved erratically. Although Compound is an open-source project, it is tightly associated with Compound Labs, a VC-backed centralised firm. This has been an ongoing debate as most decentralised finance protocols have clearly centralised hubs behind them. For example, Uniswap and Uniswap Labs.

Regulatory Updates

Fed chairman Jerome Powell was asked in front of Congress if he had any intention to ban cryptocurrencies in the US, and he said no. He also reiterated a view that stablecoins need to be regulated. Meanwhile, SEC chairman Gary Gensler has been cracking down on the broad crypto space, to apply existing securities laws against many of them as unregistered securities. Crypto projects that raised capital and used that capital for the development of the project, are all at high risk of being considered unregistered securities since they pass the Howey Test. Bitcoin, since it raised no capital and has no central development organisation, doesn’t pass the Howey Test, and is considered a commodity rather than a security under applicable securities laws. However, there is much debate surrounding Ethereum and if it passes the Howey test or not. A key risk is also the many Ethereum projects potentially passing the Howey test. This could be pretty easy attack surfaces for regulators to go after.

Overall, broad crypto-related companies face a lot of legal challenges at the moment, while bitcoin-only companies are generally in the clear in the US under the current legal environment. The new financial quarter, Q4 will bring fresh allocation to cryptocurrencies with funds such as Grayscale having added Solana and Uniswap to their $495 million Digital Large Cap Fund in its latest quaterly rebalancing.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)