The 2020 Year-In-Review

2020 has been, by all accounts, an immensely positive year for the cryptocurrency ecosystem. But globally, it has been a year of fear, loss and uncertainty. It has also been a year of compassion, unity in the face of adversity and discovery of internal and cultural strengths. As this holiday period gives us the opportunity to step back and reflect on the year that has been, let us turn the lens on global finance.

With the darkest shadows of the economic downturn hopefully behind us, we would like to take an opportunity to evaluate the worst and the best of what both financial and cryptocurrency markets had to offer this year. We also review some of the market trends that have transformed the cryptocurrency market and engrossed the world.

The March Crash

The month of March, precipitated by the COVID-19 crisis firmly embedding itself in mainstream consciousness, heralded a critical moment in economic history, when the Dow Jones closed the month 13.74% down, the worst since October 2008, and the worst quarter since Black Monday in 1987. The S&P 500 also fell 12.51% for the month and 22.56% for the quarter.

The aptly labelled ‘Coronavirus Crash’ was the fastest stock market decline in financial history. Nonetheless, it was also the fastest market event to bounce back; major US indices such as the Dow and the S&P began to look in much better shape, re-entering a bullish run as soon as a month later.

But why did markets bounce back up so quickly, relative to similar market crashes that have often taken years to observe recovery?

One possible reason begins with the World Health Organisation announcing the COVID-19 outbreak as a global pandemic. Consumers began ‘panic buying’ and exhausting a dwindling supply of traded goods, a result of international borders closing and lockdown measure laws, locally. Domestic businesses and service providers were put under immense pressure to adapt. Governments implemented a barrage of monetary policy measures and provisions to tackle unemployment, assist the struggling healthcare sector, and provide a critical lifeline to combat an impending global recession. There are several specific initiatives, such as the Jobkeeper subsidy program in Australia, or the CIGO in Italy. However, unconventional monetary policy, such as quantitative easing, is a strategy one often sees governments take on when times get tough.

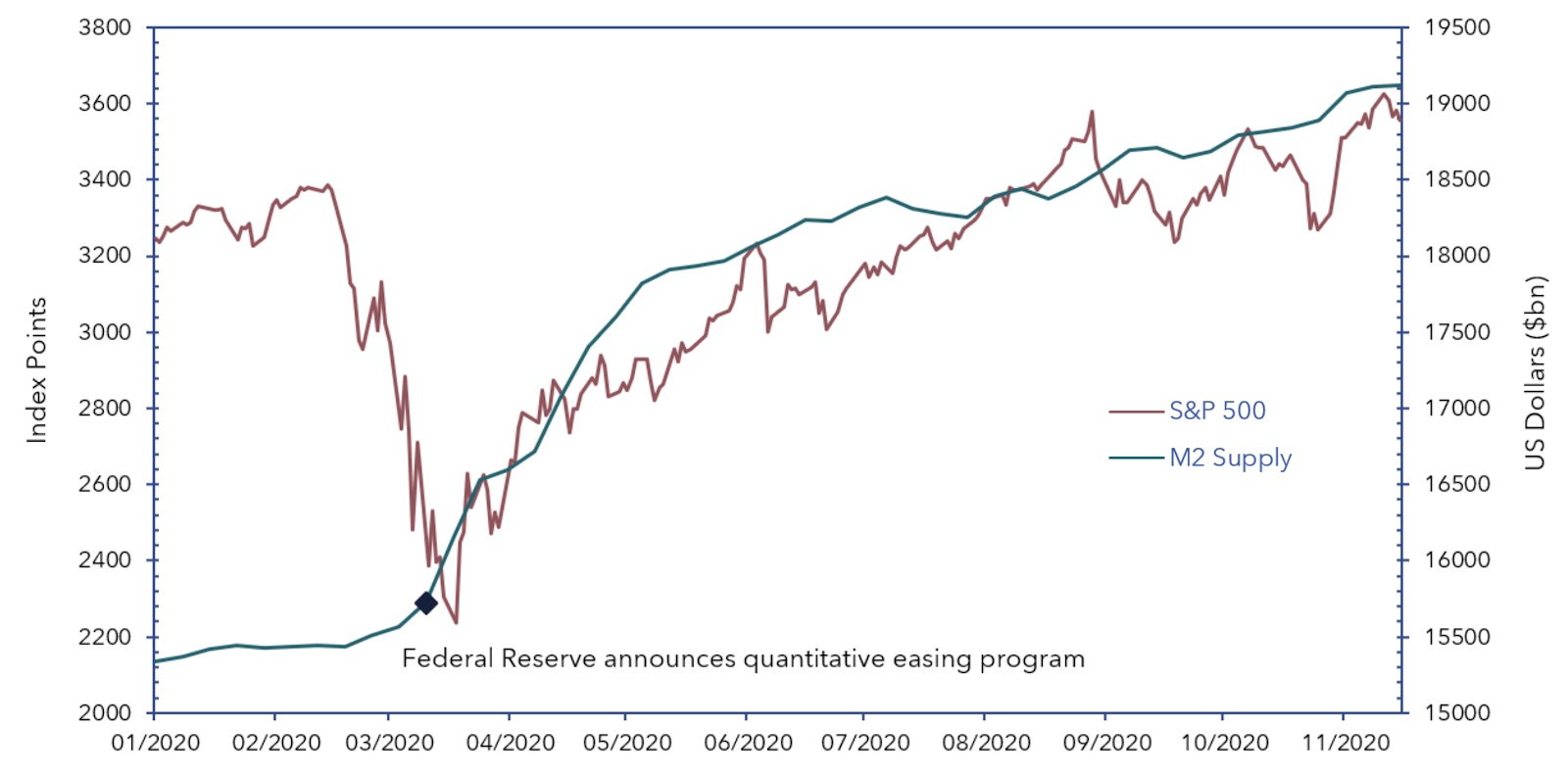

In particular, the United States conducted a highly intensive quantitative easing program after the crash ensued. Following March 23rd, the Federal Reserve announced its plans to conduct unlimited purchases of government bonds and mortgage-backed securities.

On cross-sectional observation, correlation can be made between increased money supply and the upwards trajectory of the S&P post-shock; that perhaps QE complemented the S&P recovery. Money printing and liquidity aimed to provide greater disposable income available to consumers. Banks were hence encouraged to facilitate loans in order to incentivise investors away from safer markets and into investments that permitted taking on more risk, and hence return on lifetime wealth, such as shares and property.

But still, whilst governments tried to pull the economy out of a riptide, a significant proportion of people cast their vision far from the figurative shoreline.

The Crypto Ship Sets Sail

The economic downturn in March mirrored the likes of the GFC and the Great Depression. In such times where market pressure and systematic risks are high, people turn to safer bets; assets that can sustain, or hedge, against market risk. Hence, cash and other safe haven assets became the symbolic lifeboat for investors to board as the global economy began to resemble a sinking ship. Yet, Bitcoin enjoyed the spotlight this year, even shadowing the lustrous gold bullion, a long-standing investment in such times of crisis.

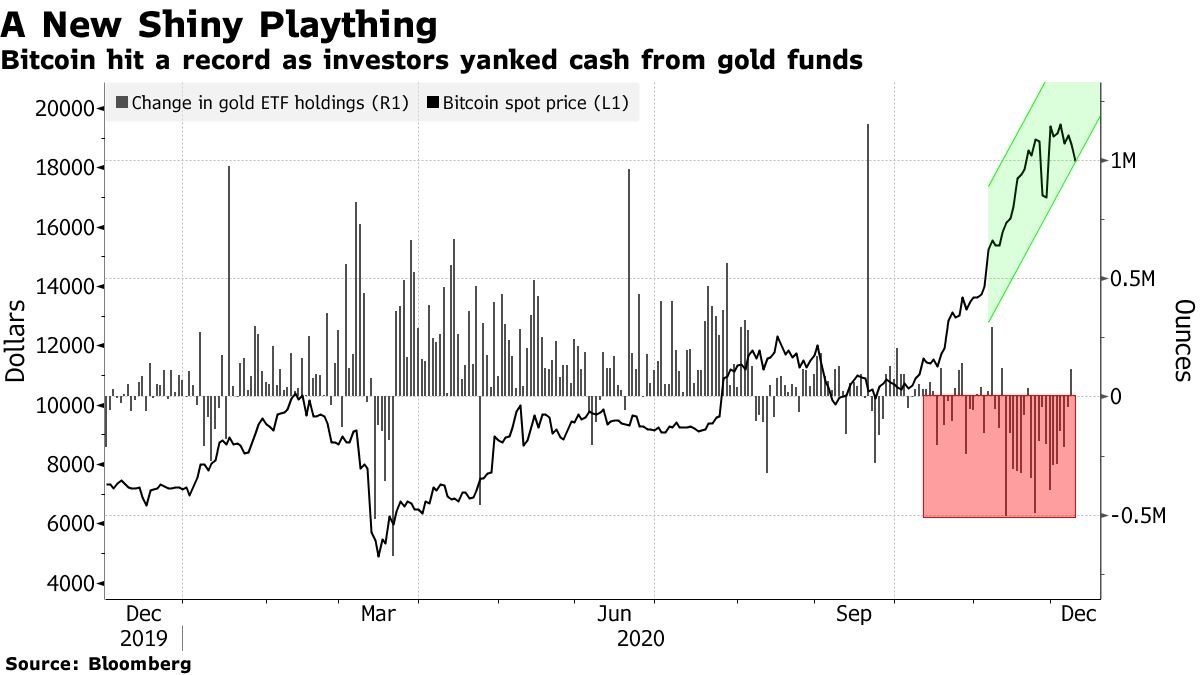

According to JPMorgan Chase & Co., the rise of cryptocurrencies in mainstream finance is coming at gold’s expense. Since October, a popular Bitcoin trust, Grayscale, has seen its capital fund increase by over $2 billion, whilst gold-backed ETFs have been bleeding cash, experiencing an outflow of $7 billion. It looks like money could be moving out of gold and into Bitcoin, a trend that could likely continue as digital assets continue to see more popularity.

Bitcoin’s market capitalisation is approximately 4.4% the size of gold’s. An increase to 5% would see Bitcoin’s price exceed $30,000 USD, and 10% (About $1 trillion) would see Bitcoin’s price surpass $50,000 USD, both of which seem quite feasible when you consider that a lot of the qualities that make gold valuable are identical to, if not improved by, Bitcoin. Scarcity is one of them. With a finite supply limit of 21 million mineable tokens, Bitcoin can be quantitatively measured using a stock-to-flow ratio as with precious metals such as gold and silver. This relationship has been extensively modelled in a famous article studying the stock-to-flow model authored by the anonymous curator, PlanB@100trillionUSD. Considering the price patterns that he suggested, it is no surprise that investors believe that the cryptocurrency space may become increasingly lucrative as time progresses.

But, despite the optimism, why then did Bitcoin crash by half of its market value on the 12th of March?

Though the answer is likely multifactorial, perhaps the unexpected liquidation of $1 billion highly leveraged BitMEX futures contracts had considerable influence. Especially in volatile periods, leveraged trades can lead to a major market correction, and March was a prime example. In speculation of margin calls and a higher premium on the USD, many investors were left without a choice and major selloffs occurred.

In a fortunate turn of events, Bitcoin returned to its prior level by the following month, and the price has been rising since, seeing increasing public interest and market growth. Observe (below) how some of crypto’s major players have performed compared to tech company behemoths such as Apple in terms of market cap even with the success that the crypto market is having, it seems the crypto market’s room for growth remains considerably sizeable and makes for an exciting proposition to watch in the coming years.

(Photo taken from Binance Blog)

The Expanding Crypto Universe

2020 saw significant milestones for the Cryptocurrency space and it is not all about Bitcoin.

The Third Bitcoin Halving

This year proved to be a difficult test for Bitcoin. The COVID-19 pandemic significantly impacted Bitcoin’s early performance given the crash, and it would be the first halving in the asset’s history to be influenced by higher market risk and volatility relative to 2012 or 2016. As such, many were divided at the time on whether Bitcoin would truly see the bullish run it usually has in succession to the event, or contrarily remain stable, or even crash once more.

By May, the price of Bitcoin had returned to a level equivalent to pre-March, and this month would mark the third Bitcoin halving event. (Note: the halving is a significant phenomenon integrated within the Bitcoin economic model, in which the block reward that a Bitcoin miner receives is ‘halved’, effectively reducing the inflation rate and the supply rate of tokens. From May, miners receive 6.25 BTC per block mined in comparison to 12.5 BTC per block that one mines when verifying transactions on the Bitcoin blockchain.)

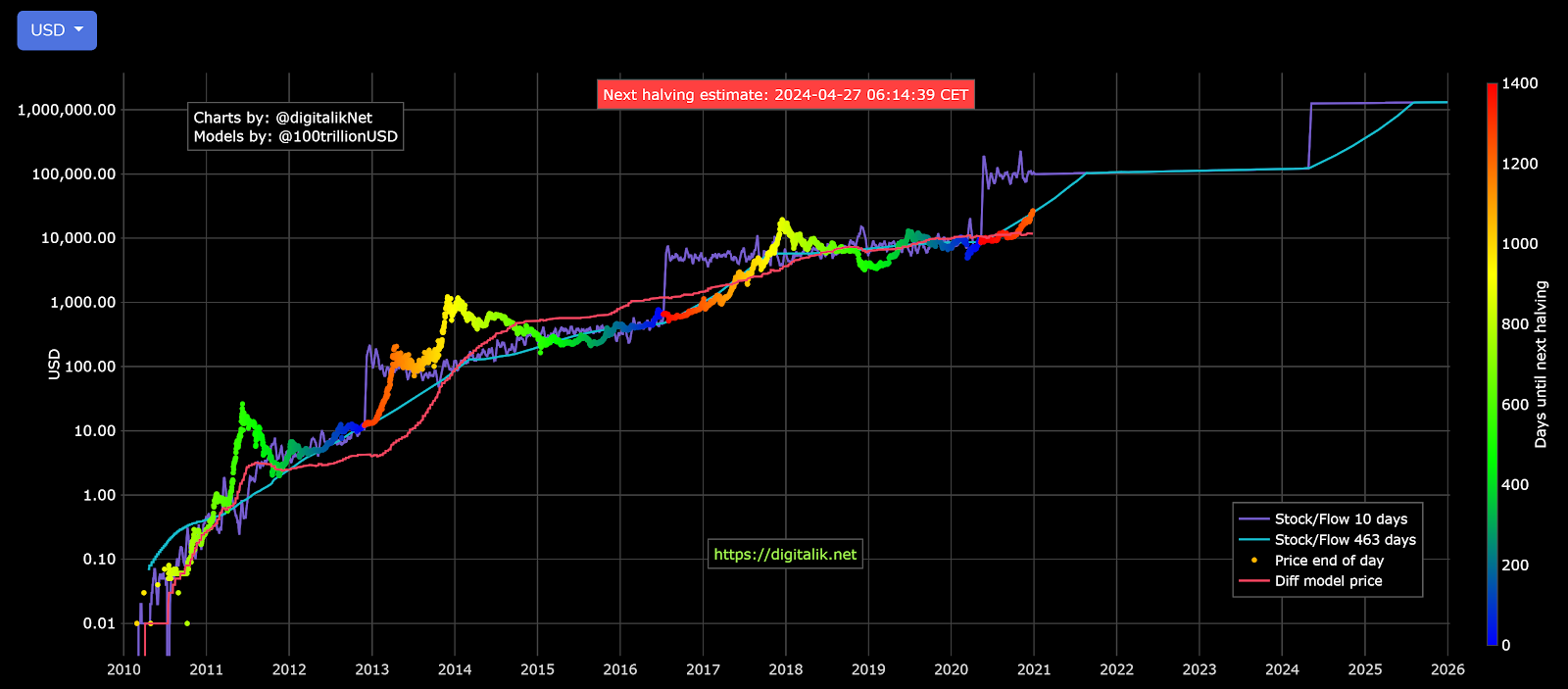

The halving receives significant interest from cryptocurrency market participants because it has historically led to a significant price increase in Bitcoin in the following years, and further strengthens the argument that scarcity drives Bitcoin’s price mechanism, as described by PlanB@100trilllionUSD’s stock-to-flow model.

In this logarithmic price scale of Bitcoin, the rainbowed line illustrates the end-of-day price of Bitcoin over time; the colour variations are determined by how much time is left until the next halving, as denoted on the right vertical axis. It is modelled alongside the model price predictions based on different metrics. For further elaboration on Bitcoin’s Market Cycles, feel free to continue reading here.

Indeed, the stock-to-flow model is not without its blind-spots and as much as it has received support, it has equally received heavy criticism, and the price pattern may or may not be realised accurately in the long term. But what can be said is for the past few years and certainly the last several months, Bitcoin has not only followed the stock-to-flow model predictions somewhat closely. In doing so, it has scattered many clouds of doubt, as Bitcoin broke past its own limits and reached an unprecedented height.

Bitcoin Achieves All-Time-High

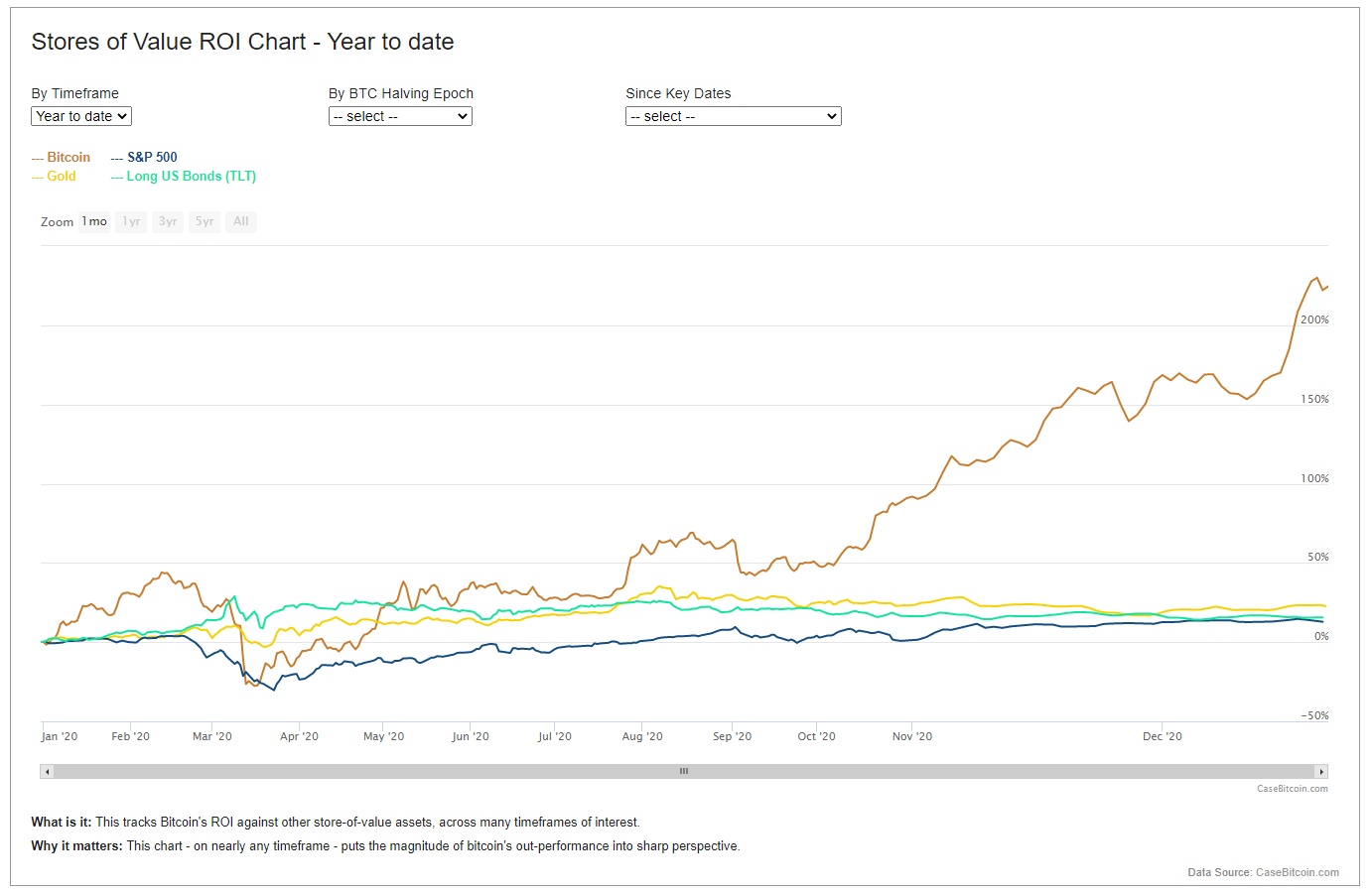

For any avid cryptocurrency enthusiast, Bitcoin breaking past the elusive $20,000 mark as of December 17th, was a moment to cherish. As the best performing asset of the year, Bitcoin was lauded for tearing apart ROI metric standards set by traditional assets.

Given the year’s tumultuous climate and despite economic adversity, Bitcoin and cryptocurrency adoption has not decelerated. Blockchain.com has seen 19 million wallets created in this year alone. Gold hedgers, asset managers, hedge funds, corporate institutions, business magnates and the common investor alike have, at some point dipped their hand in the Bitcoin cookie jar, with attention and liquidity coming into the space from traditional market players. From PayPal to Paul Tudor Jones, from Morgan Stanley to MicroStrategy, the world is opening up to the digital asset universe and realising the value that cryptocurrency assets hold, and Bitcoin’s success this year is at the forefront of the crusade.

However, Bitcoin has not taken all the glory in 2020. One of the largest and most influential altcoins in history also had a tremendous year, going through a long-awaited upgrade to its blockchain ecosystem.

Ethereum 2.0

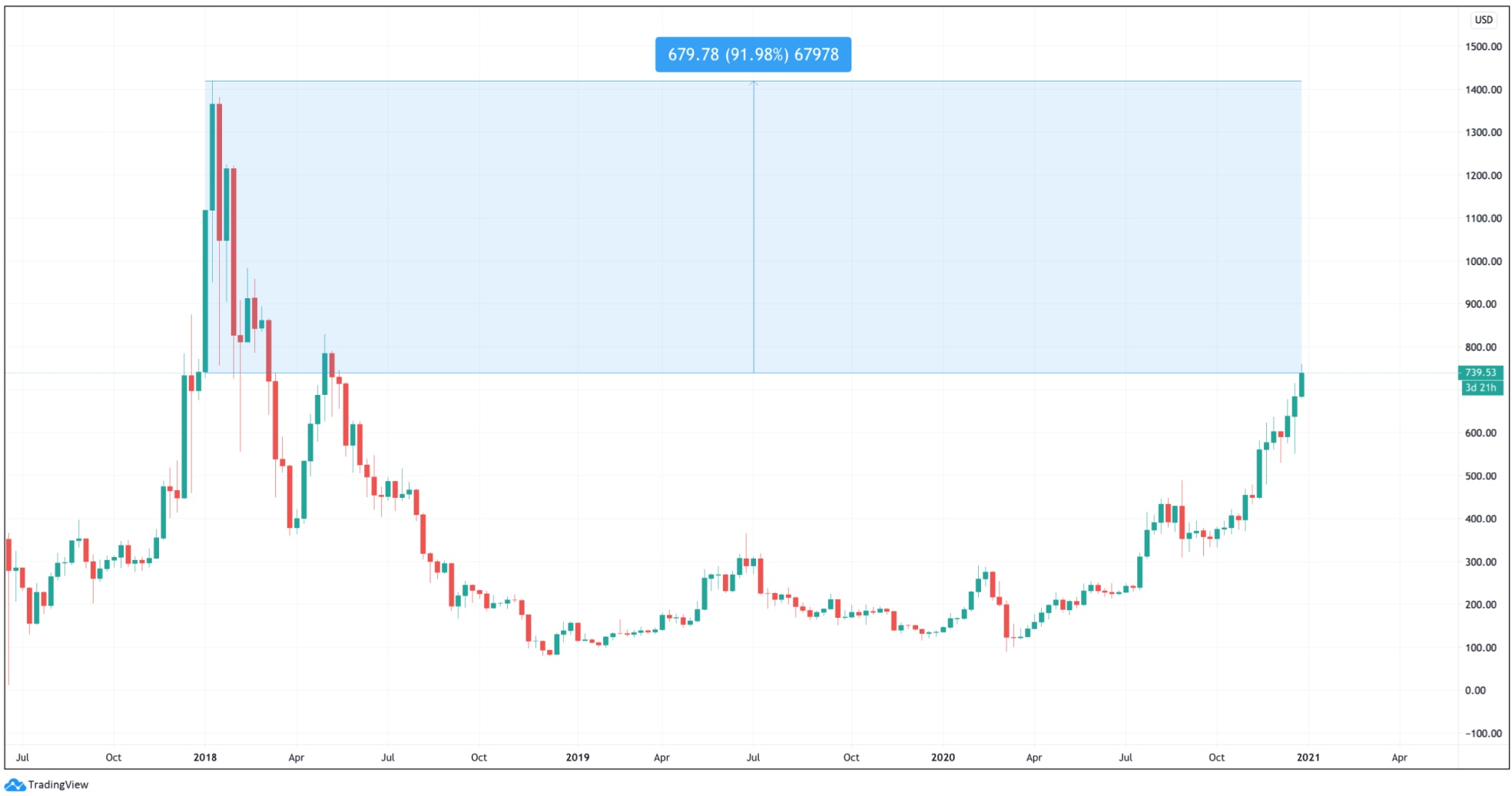

Now that Bitcoin has captured a new wave of untapped demand for cryptocurrencies, many will have a keen eye for new opportunities on the horizon. Ethereum has always been one of them and has not just been riding on the coattails of Bitcoin, with the second largest cryptocurrency by market capitalisation having risen over 300% YTD. Michael Sonnenshein, managing director at Grayscale, noted that, “Over the course of 2020 we are seeing a new group of investors who are Ethereum-first and in some cases Ethereum only.” Interestingly, whilst Bitcoin has reached a new ATH, Ethereum is yet to close in on its own, still over 90% from previous all-time-high.

Scalability is one of the primary limitations of Ethereum’s capacity to facilitate a mainstream decentralised financial infrastructure. To achieve this, the Ethereum blockchain must demonstrate an ability to scale to orders of greater magnitude than it can at current, an issue that Ethereum’s community of programmers are attempting to solve with Ethereum 2.0. Phase 0 was launched a few weeks ago and has since received extensive support, being the introduction of the beacon chain preparing for the implementation of the Proof-of-Stake consensus mechanism.

The long-awaited upgrade aims to improve the scalability dilemma, as well as enhance security and energy efficiency, without compromising on accessibility or decentralisation. The ETH token will also reportedly undergo several developments and attain qualities mirroring capital assets, commodities and a store of value, according to a Messari report.

Ethereum 2.0 looks promising and has certainly grabbed adequate institutional attention. As for its real impact, it is too early to judge. But, Ethereum has continued to be the blueprint for many altcoins and its utility as a platform has been the backbone for hundreds of protocols aiming to make their mark in this ecosystem.

A Year for Altcoins

It has been an incredible year for altcoins, with the overall market capitalisation increasing in multitudes, exceeding $200 billion. Ethereum aside, there are hundreds of projects, tokens and platforms with real use case scenarios’ emerging by the day. Many Altcoins have seen incredible returns this year, with some exceeding 1000% year to date returns.

The chart above illustrates the total market capitalisation of all the assets available in the cryptocurrency market with the exclusion of Bitcoin. Interestingly, the last time Bitcoin was at all-time-high in 2017, the altcoin market cap was more than double of what it is now, approximately $475 billion. This could indicate that we are on the verge of a large altcoin rally once investor eyes start to look elsewhere. Historically, most altcoins have bottomed (in terms of Bitcoin pairings), when BTC reaches its previous all-time-high, highlighting that it is possible altcoins may outperform Bitcoin in the coming months.

The Rise of DeFi

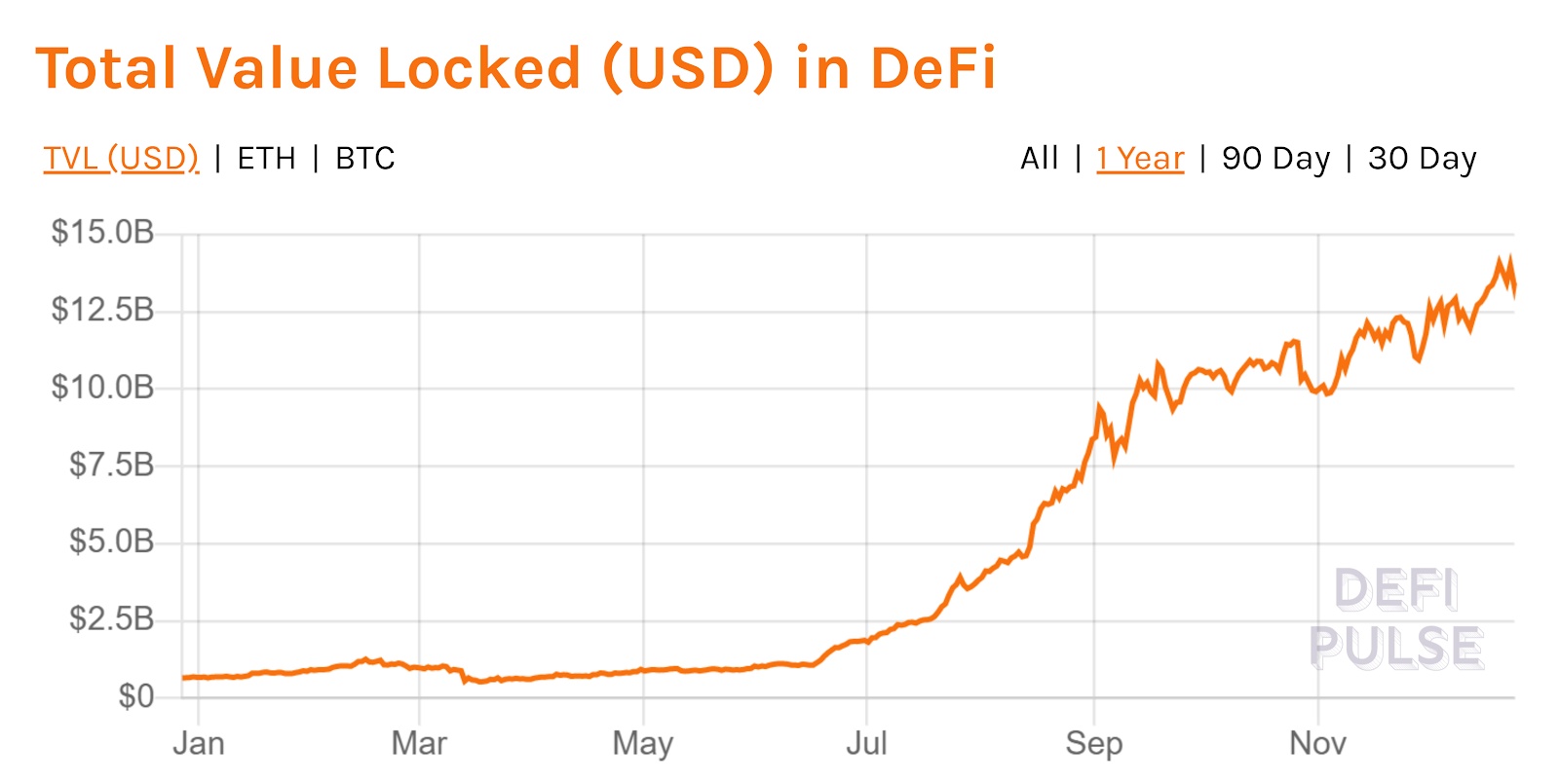

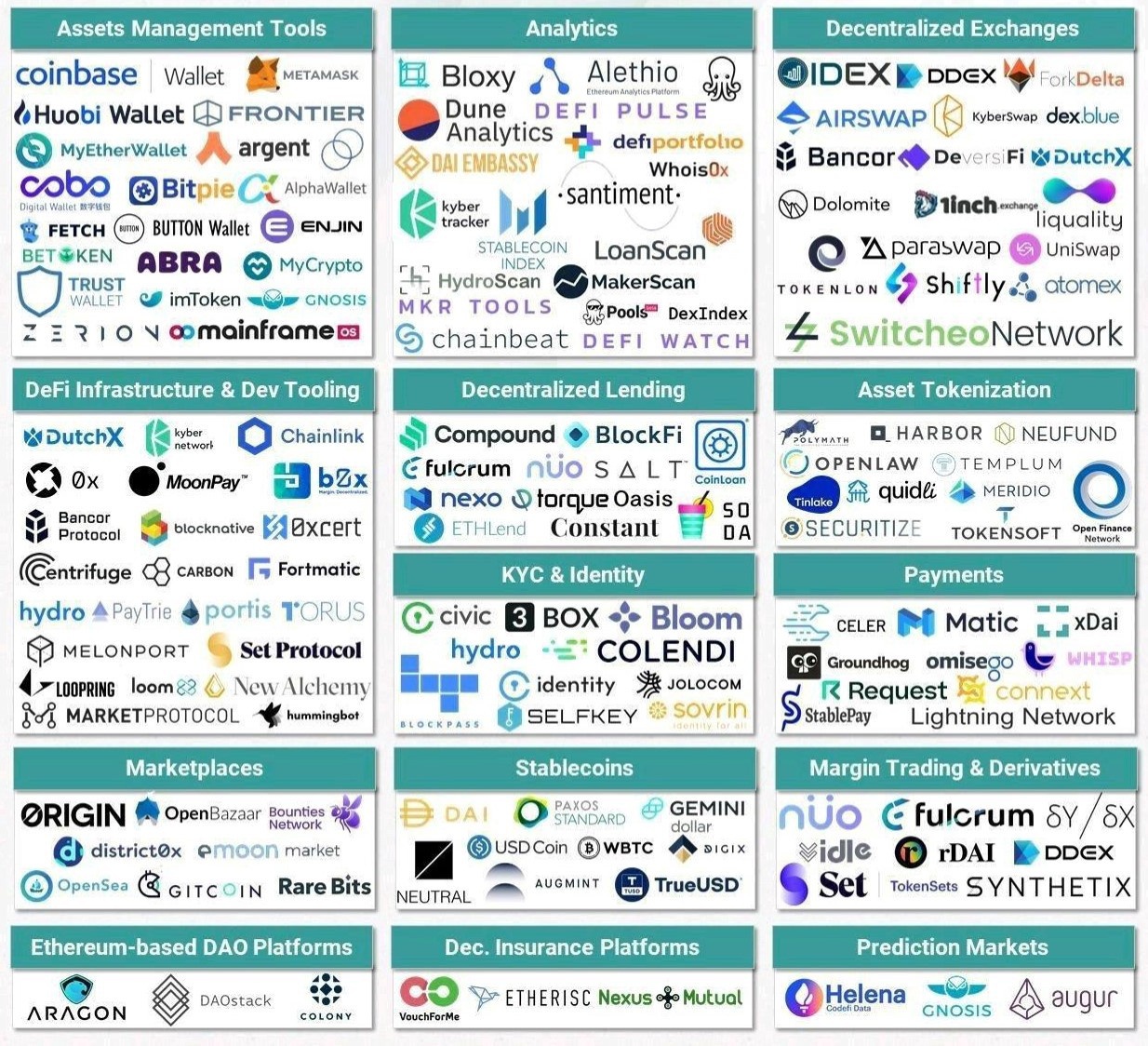

Decentralised finance, or DeFi, has become the crypto space’s new favourite buzzword this year. One of the fastest growing sectors in the industry, DeFi’s total value locked has increased from $1 billion to nearly $15 billion YTD.

DeFi is an umbrella term for a collection of disruptive financial products or ecosystems, using decentralised networks and blockchain technology to eliminate the requirement of financial intermediaries to establish trust whilst maintaining transparency. DeFi products can enable services unlimited to decentralised borrowing/lending of cryptocurrencies, yield farming, exchanging derivatives on underlying assets, staking, accessing stablecoins, and much more. For instance, DeFi startups such as Compound and Aave allow anyone to start earning an estimated interest of about 7% a year. Users on platforms such as these can lend and borrow money using stablecoins without the need to interact with any financial intermediaries.

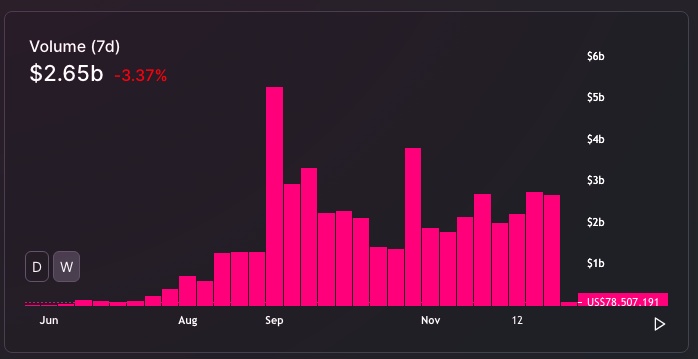

Alternatively, decentralised exchanges such as Uniswap, Curve and Bancor operate on liquidity pools, allowing the trading or swapping of one type of token to another, most commonly those built on Ethereum’s ERC-20 format. The practice of implementing smart contracts captures the non-custodial feature of these protocols that, again, effectively removes dependence on intermediaries to establish trust in a transaction. These exchanges became an integral part of the Crypto ecosystem this year, processing billions of dollars worth of trades each week. Uniswap, the largest decentralised exchange, usually sees weekly volume above $2 billion USD, but has seen as high as almost $6 billion USD in the peak of the DeFi hype. Interestingly, in the month of September, Uniswap did $1.8 billion more volume than major centralised exchange Coinbase.

Chainlink, Yearn.finance and Synthetix have all made a name and market for themselves, and there are countless more in the mix. The world of DeFi is brimming with projects covering a myriad functionalities, with many of them aiming to solve problems and inefficiencies in the current ecosystem. It would take forever to commemorate further, but one can always explore the projects in the space, both existing and developing, on websites such as DeFiprime or DeFi Pulse.

A selection of some DeFi projects in the space (Photo taken from Medium)

The path ahead looks bright for this market, but the path to mainstream adoption will be determined by how hurdles such as technical flaws of early-stage systems, inherent financial risks, and complexity of current systems are navigated. However, DeFi may be at a critical vantage point to penetrate out of the niche and one may remain optimistic about the future of DeFi’s role in angling cryptocurrency in a constructive direction.

Closing Remarks

If there is anything we have learnt from the cryptocurrency market this year, it is that you never know what’s around the corner. Though we have only scratched the surface of 2020’s defining moments, we think these highlights have been particularly important in advancing the space and garnering mainstream attention. Bitcoin has overall been undeterred by the economic downturn and has piqued the interest of even the most laggard of investor types. Altcoins have also made huge strides in making their own names in the Bitcoin-dominant space, creating their own market, their own innovations, and building a layered universe of hundreds of projects with different purposes and utilities. At the same time, new investors are moving in, and the intersection between traditional finance and cryptocurrency is becoming increasingly blurred, creating a fascinating synergy between two asset classes that are so very different and yet can realise the same kind of economic gains.

As more of the population appreciate this new wave of ideas and the problems that projects are solving, the increase in mass adoption is only going to make the market more credible, functional, and legitimate. With recent market progress as it is, 2020 has left us with a lot to think about, in more ways than simply the effects of COVID-19. But, as 2021 arrives, the outlook for next year is one of both intrigue and excitement for whatever is in store for all of us.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)