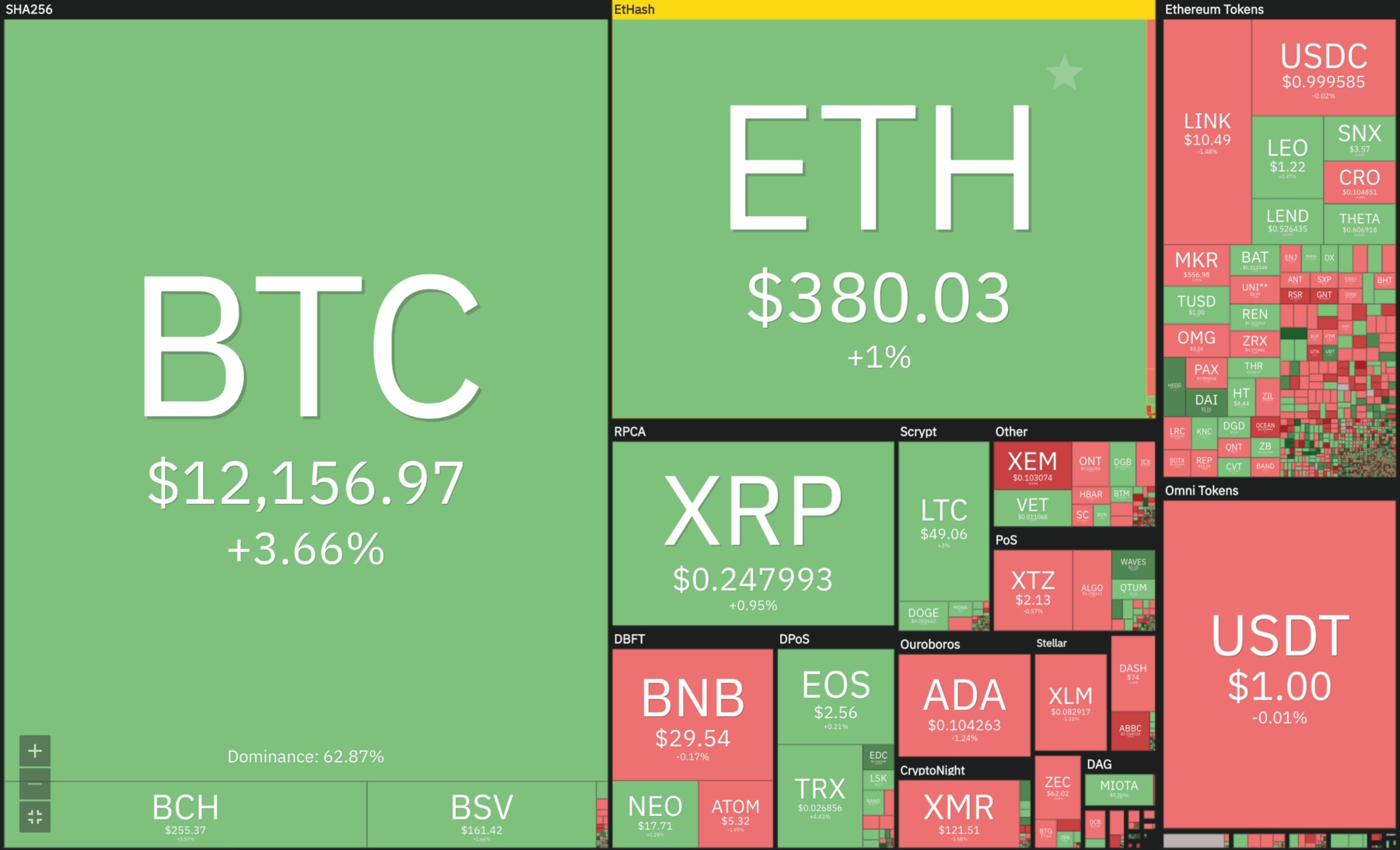

Market Summary

Bitcoin is trading at $12,156 USD at the time of writing. As we push closer to the $12,500 mark we note that Bitcoin dominance is back up to 62%. While many Altcoins are yet to clearly define their direction, Bitcoin is furthering the gap from the rest of the market.

Coin Heat-Map taken from coin360.com

A Breakthrough In Digital Currency

The creation of a central bank digital currency (CBDC) may have been put in the 'too hard' basket for a little while now, but as the global financial landscape shifts, traditional financial institutions are being forced to adapt to the digital age.

In a report issued this week, the G20 have established a framework for implementing official standards of regulation in regards to the issuing of digital currencies across the worlds banking systems. The European Union, along with representatives from 19 countries across every continent, have outlined efforts along with the International Monetary Fund (IMF), the World Bank and the Bank for International Settlements (BIS) on formalizing the creation of CBDC's and have projected a comprehensive plan to be finalized by 2022. Regulatory stable coin frameworks as well as a selection of CBDC designs and technologies have been included within this time frame.

The report issued by the Financial Stability Board (FSB), an international body formed after the 2008 financial crisis, asserted that global stable coin arrangements are needed in order to address the challenges facing cross-border payments. It is predicted that the IMF and the World Bank will have the capability to facilitate these transactions by 2025.

The world's central banks have agreed upon three core principles that are necessary for any publicly available CBDC:

- Coexistence with cash and other types of money in a flexible and innovative payment system.

- Any introduction should support wider policy objectives that do no harm to monetary and financial stability.

- Features should promote innovation and efficiency.

Cryptocurrencies such as Bitcoin and Ethereum have already proved the potential of digital assets, not only in their capabilities of improving cross border payments but in a breadth of functions - stimulus / emergency payments during the coronavirus pandemic being a particularly relevant example. In establishing a virtual currency, Central banks would borrow the distributed ledger technology already used in blockchain, however, CBDC's would not be anonymous and a centralized power would be capable of unilaterally withholding payments and altering the architecture or 'rules' of the system. The ability of Central banks to maintain access and visibility of identities executing CBDC payments would be a fundamental feature of the digital shift, diverging from current crypto models that allow users to mask their identity from central authorities.

Central banks push toward CBDC's comes in anticipation of China's experiments with a digital yuan - the most developed CBDC being trialed around the world. The Chinese Communist Party has begun issuing around US $1.5m in a citizens' lottery in the city of Shenzhen as part of their experiments with the digital currency. Citizens who apply will be randomly selected to receive around US $30 of the digital currency that can be spent at a designated shopping district using a mobile application. The digital currency is backed by the state-owned People's Bank of China and is well placed in a culture where digital payments are already widespread through apps run by prominent tech firms 'Ten Cent' and 'AliPay'. The governments push toward a centralized digital currency is no surprise considering it is much easier to track digital payments, making it a potential tool for state repression. While an increased privacy risk should be managed with the appropriate data security, CBDC's may prove an effective safeguard against financial thefts, tax evasion and money laundering.

The popularity of Bitcoin and other Cryptocurrencies have undoubtedly acted as a catalyst for the world's leading financial institutions to consider the prospect of a centralized digital currency. While fiat currencies are far from becoming obsolete, they are on a clear trajectory of digitization. The co-existence of CBDC's and their decentralized counterparts seems inevitable, and while each have their own strengths and pitfalls, together they will pioneer the future of money technologies.