What's in store for 2020?

2019 told a clear story in the Cryptocurrency industry. The tokens that outperformed BTC reveal that value is consolidating into revenue generating and heavily utilized projects.

- BNB, SNX, HT (Exchanges)

- CEL, CRO (Lending)

- LINK (DeFi Oracle)

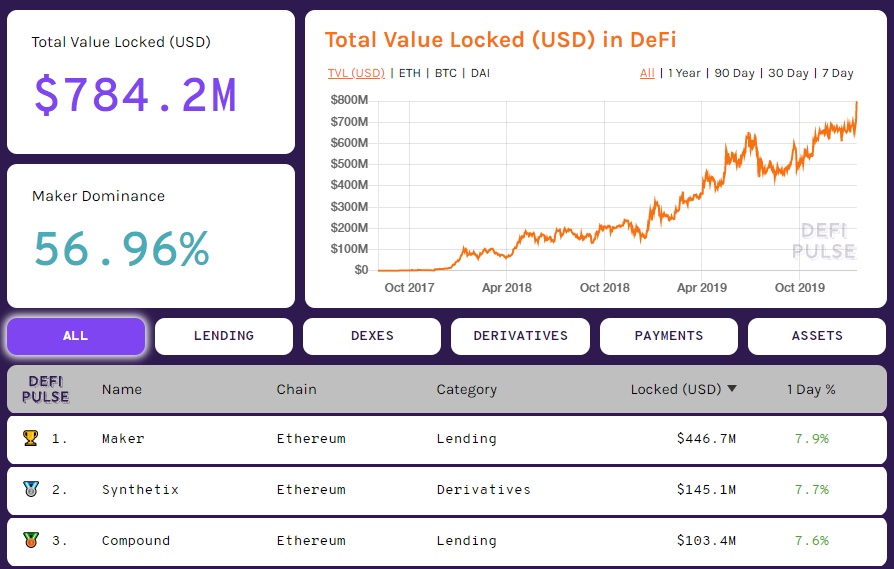

As the market matures, bets are being placed on revenue-generating projects and not a promise of utility alone, as starkly illustrated in the 2019 performers. An emerging story that fits the revenue generation criteria is in decentralized finance. DeFi is bringing financial applications to the permissionless ecosystem. Services previously available to a few such as borrowing and lending, have now become easily accessible by anyone. While certainly not mainstream by any measure, DeFi has been growing at a steady pace and has amassed a total value of $784m USD locked inside smart contracts. For context, it would sit around Rank 20 in market cap when compared with token market caps. In contrast, the centralized stable coin market sits around $5bn currently.

What will it take for DeFi services to go mainstream in 2020?

The three main hurdles for DeFi to overcome are product competitiveness, ease of use, and risk perception. Generally speaking, DeFi is making good progress in capturing market share, improving its ease of use and range of products. However, pricing competitiveness still needs work which will come as risk perception improves and liquidity grows.

Decentralized Lending

Lending has become a tremendously valuable service in 2019 with Celsius Network, currently the industry’s largest centralized loan originator, issuing over $4bn. Lending is currently the biggest use case in DeFi, with Maker and Compound representing 70% of the value locked in DeFi. The steady increase in staked assets demonstrates an improvement in risk perception. As users are able to borrow and lend cryptocurrency without having to trust their counterparty, they adopt smart contract failure risk and are transferring this trust to the system instead. As a comparison of value locked between the centralized and decentralized services, Celsius has $400m assets in storage and the DeFi marketplace’s leaders have a commendable $446m in stored Maker and $100m in Compound. Another growing advantage of DeFi is the ability to expedite ease of use in the on-boarding process without the KYC component required by centralized companies operating under their jurisdictional legal requirements.

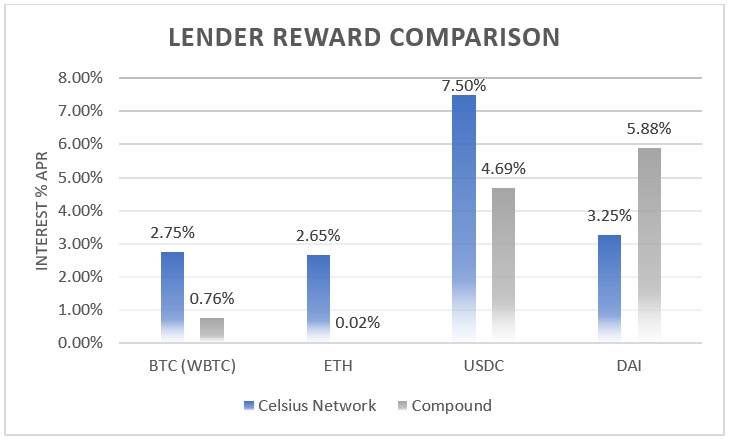

As for product competitiveness, currently, their biggest competitors are Nexo and Celsius, allowing lenders to earn up to 8% interest (approximately) on centralized stable coins, outcompeting the decentralized counterpart, DAI, currently generating 6% APR. The deeper margin books in centralized exchanges create greater demand than the DeFi ecosystem which requires the value to remain within the system (BTC is represented in Ethereum token as WBTC, for example). Meanwhile, centralized loan originators have a flexibility advantage in targeting more liquid pairings, enabling them to capture a greater market. The centralized advantage spans across most assets, shown below in a lender reward comparison between common assets in Celsius (centralized) and Compound (decentralized).

Decentralized Exchanges

Another use case of decentralized finance is in decentralized exchanges, or a “DEX” such as Uniswap, Bancor and Kyber Network. These provide simple interfaces for great ease of use to exchange tokens for other tokens via metamask plugin, skipping the KYC process on centralized exchanges. However, a number of key challenges hinder their product competitiveness. Without a fiat pairing, these DEX’s have a dependency on stable coins, which are far less liquid than fiat with the exception of Tether (which has its own set of problems). Additionally, the lack of fiat on-ramp means every user will need to use another service, reducing their customer’s dependency on their service.

Synthetic Derivatives

A recently emerging and rapidly growing application of DeFi is in derivatives. Almost entirely represented by Synthetix, the decentralized exchange allows margin trading of a variety of synthetic tokens, commodities and even equities. Some features are still in development. The system allows users to use collateral to mint synthetic tokens that track an asset’s price without actually needing to purchase the “underlying” asset. A benefit to synthetic derivatives is that you can exchange between synthetic versions of the underlying assets without needing to find a counterparty looking to do the opposite trade. It enables traders to trade in their domestic currency rather than being limited to USD for liquidity.

The potential of synthetic derivatives is quite grand, as it also allows “trades” to take place between pairings that otherwise wouldn’t exist and bypass the order book depth, since the user is simply unminting his “sell” currency and minting the new “buy” currency. This provides a liquidity benefit to the decentralized marketplace that is deeply required but may cause concerns for manipulation as the size of the synthetic derivatives ecosystem grows. All in all, DeFi is on a good track to continue growth in 2020, but a DeFi fever won’t come until the liquidity comes first.