What is the Bitcoin Market Cycle?

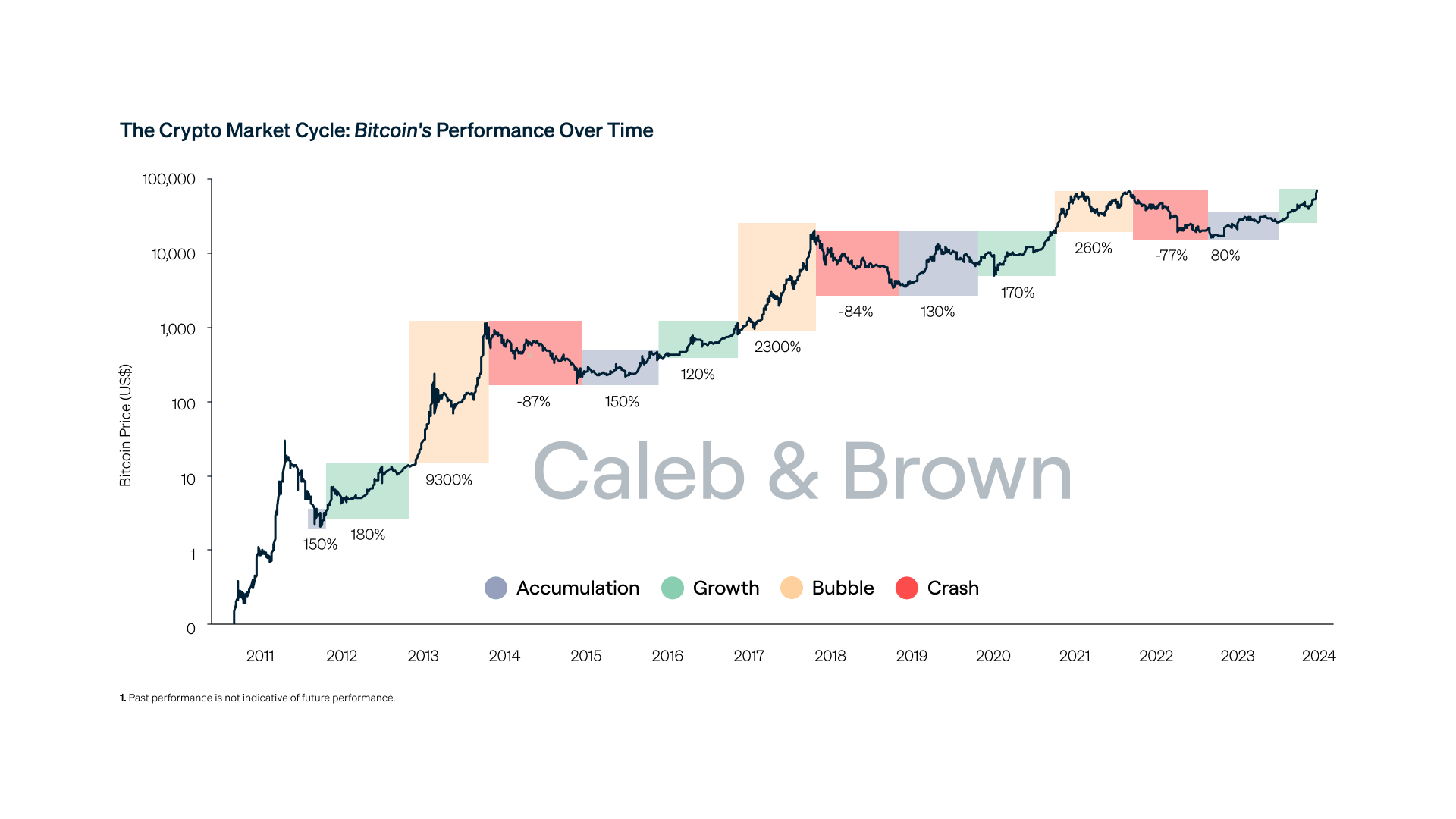

The Bitcoin market cycle refers to the recurring pattern of price behaviour in the Bitcoin market, characterised by alternating periods of appreciation and depreciation. This cycle is a result of market participants' perceptions and actions, such as buying and selling, and is influenced by a variety of factors, including market sentiment, regulatory changes, technological developments and the wider economy.

Historically, Bitcoin has followed a four-year cycle tied to Bitcoin halving events, which happen approximately every 4 years. A halving event marks a 50% cut in the Bitcoin reward miners receive for mining new blocks and verifying transactions; in effect Bitcoin supply continues to increase, but at a slower rate. The knock-on effect can be a steep increase in price, assuming the demand for Bitcoin remains the same or increases after a halving. The next halving is due April 2024, when the block reward will fall to 3.125 bitcoins.

What are the Bitcoin Market Cycle Phases?

Phase 1 – Accumulation

Occurs when prices are low, but small signs of growth appear. During this phase buyers will accumulate cheaper Bitcoin and so it represents the point of maximal financial opportunity.

Typically, there is bearish sentiment in the market so volume is low and prices are fluctuating in a tight range, near the bottom.

Phase 2 – Continuation

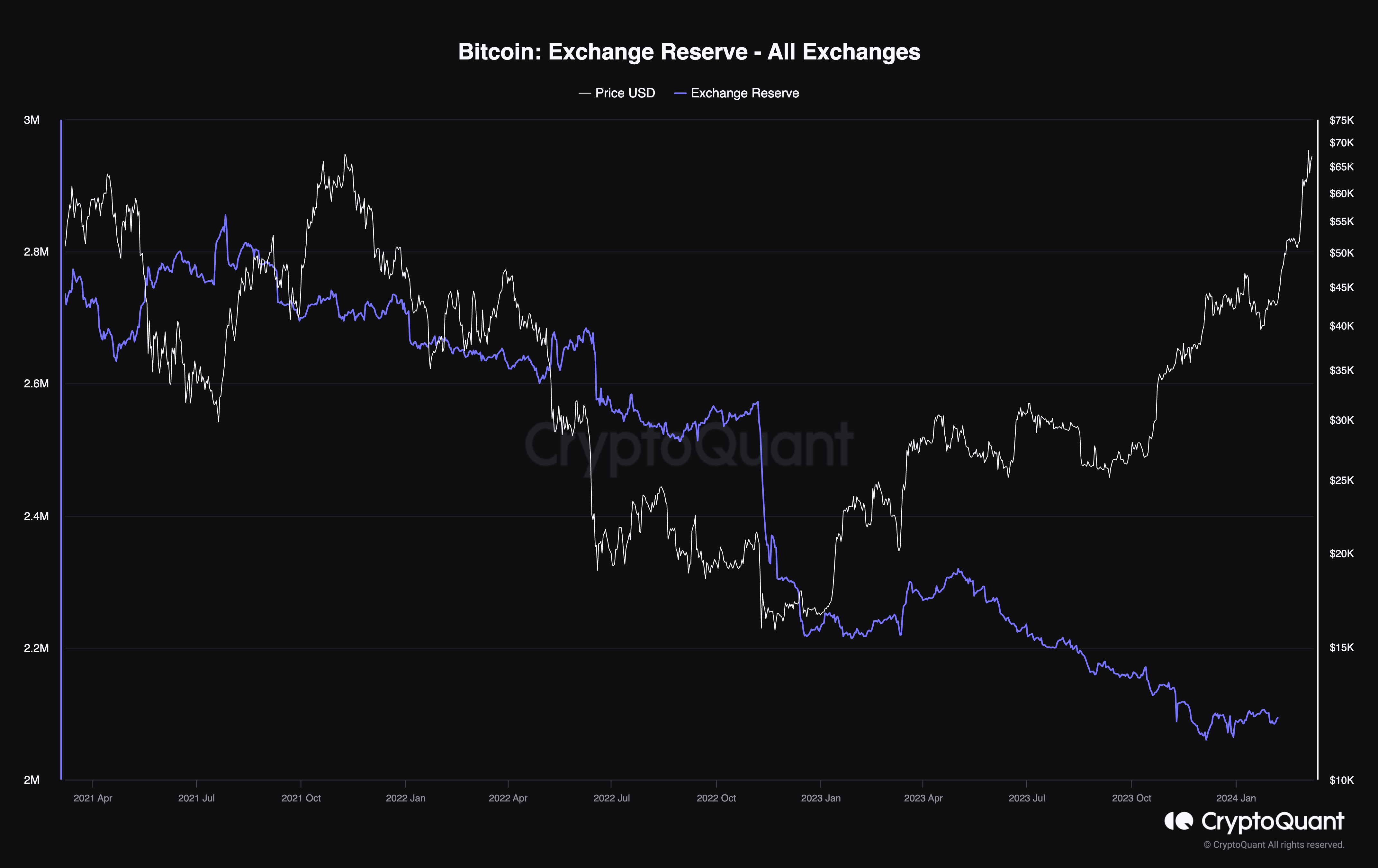

The price continues moving towards the all time high. A halving event has historically occurred here, coinciding with shrinking exchange reserves as buyers hoover up supply as they look to capture rising prices in anticipation of new all-time highs.

Phase 3 – Parabolic

When the price eclipses the previous all-time high, price action will start to move exponentially to the upside pushing the price to a new all-time high, which has exceeded the previous landmark by a significant factor. This phase is extremely volatile, with rapid price increases followed by large corrections

Sell volume builds as a portion of investors lock in healthy profits, while many market participants will continue buying believing the bull market has more room to run. As a result, price volatility is low given the buy and sell volumes begin to balance against a backdrop of overconfidence. At this point, many investors would see the Fear & Greed Index flashing Extreme Greed.

Phase 4 – Correction

Following the euphoria of the Parabolic phase, this is when the market will see a major correction to the downside. Previous bear market periods have resulted in approximately 80% drawdowns from the top and negative price action for approximately a year. The most recent example saw the price tumble from an all-time high of $69,000 (November 2021) to $15,476 (November 2022).

The chart below shows the cyclical nature of Bitcoin’s price and how it has played out in the past.

Telling Signs in Historical Bitcoin Cycle Patterns

In anticipation of a new all-time high, the amount of Bitcoin held in exchange wallets is low, highlighting that investors are holding out for higher prices. This HODLing reduces available supply (even further in a high-demand period) and as seen below, this results in sharp price increases.

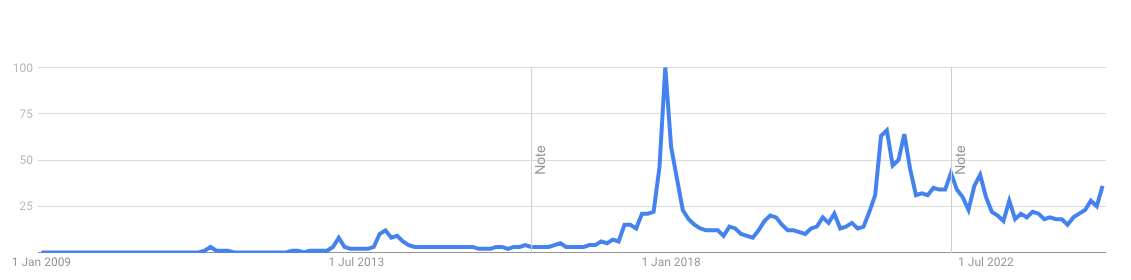

Gauging the Cycle with New Interest in Bitcoin

Peak interest in Bitcoin, as measured by Google search activity, was reached in December 2017 in tandem with a bull market run up to an all-time high. Since then, Google trends show search volume for 'Bitcoin' hasn’t reached the same levels of the 2017 bull run.

However, interest in crypto at large has surged since. Google search volume for ‘crypto’ topped out during the 2021 bull run; attention is now given to the whole ecosystem, which has evolved dramatically since the days of Bitcoin dominance.

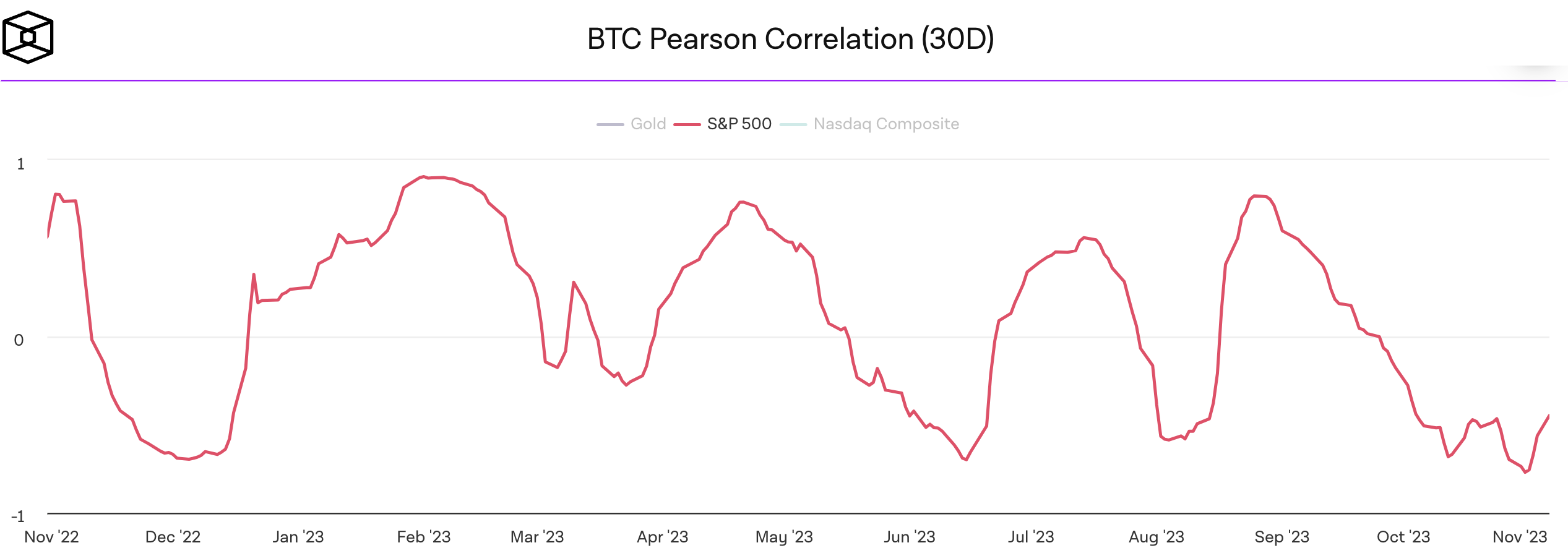

Macro & Bitcoin Correlation

The relationship between Bitcoin and the S&P 500 – referred to as a correlation – is largely positive. In other words, the prices of Bitcoin and the S&P 500 generally rise and fall together. However, they don’t always follow one another and when they do it’s not always to a similar degree or high correlation.

In recent years, as the cryptocurrency market has become more mainstream and institutional investors have entered the ecosystem, the positive correlation between Bitcoin and the S&P 500 has been noticeable. Based on coefficient readings taken on the first week day of each month, the average annual correlation to Bitcoin for the S&P 500 was 0.51, 0.43 & 0.53, in that order respectively from 2020 to 2022. Taking 2022 as an example, for every 10% BTC rose the benchmark index moved up 5.1%. However, in 2023 the correlation has been more varied, with sustained periods of negative correlation.

It's important to note that correlation can change over time and the relationship between Bitcoin and the S&P 500 can be influenced by a variety of factors, including macroeconomic events, geopolitical tensions, and regulatory developments.

Mainstream Adoption of Bitcoin

Mainstream adoption of Bitcoin has been on a steep curve. In January 2018, the value of BTC trading on Binance surpassed $11bn – a fraction of the $164bn traded on the platform in January 2023. Over this period, Bitcoin has proven itself to a growing community of retail and, crucially, institutional investors, including public companies: which held over 1% supply as of October 2023. The largest holder, Microstrategy, holds 158,000 units – purchased at an average price of $29,574 according to CoinGecko. Famously, Tesla also holds a stack of BTC on its balance sheet with over 10,000 units.

Only time will tell how Bitcoin’s and crypto’s mainstream adoption continues. While institutional interest has increased, focused around the successful launch of 11 Bitcoin ETFs, and the retail base has grown, large-scale destructive events in the crypto ecosystem, such as the FTX collapse, have highlighted a lack of regulation.

The lack of a legal framework for crypto is holding back many investors from entering the space. However, governments globally are ramping up their regulation efforts, which the results of will hopefully grant crypto the legitimacy many investors are waiting on to invest.

Beyond investors, there are companies accepting BTC as forms of payment such as Ferrari and countries, too. Beyond investors, there are countries backing Bitcoin. In June 2021, El Salvador became the first country in the world to adopt Bitcoin as legal tender. The country's legislature approved a law that requires businesses to accept Bitcoin as a form of payment for goods and services, in addition to the country's official currency, the US dollar. If other countries were to follow suit, mainstream adoption would spike and render Bitcoin a very appealing investment vehicle.

Recommended reading: Crypto Portfolio Basics: The Key to a Well-Balanced Portfolio

Invest in Bitcoin with Caleb & Brown

You don’t have to be an expert on Bitcoin's market cycle to invest in the original and largest cryptocurrency.

Caleb & Brown is the world's leading crypto brokerage for beginner and advanced investors alike, with Bitcoin and 100s of other crypto assets readily available for your portfolio.

Our personalised broker service makes crypto investing simple. A dedicated member of our broker team is always on hand to guide you along the way, giving you the confidence you need to navigate the world of crypto. Not to mention key features such as:

- No joining or signup costs

- Industry-leading storage solutions

- 24/7 customer support

If you are ready to take the next step and invest, contact your crypto broker today.

Not yet a client? Sign up for your free consultation.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3ikvwifNCbD6wUgfIV54O6%2Fb7f9988999a7817d47f416513efd3915%2FBlog-Cover_19_.jpg&a=w%3D200%26h%3D113%26fm%3Djpg%26q%3D80&cd=2022-08-04T05%3A04%3A04.468Z)