Theta Network

The Theta Network is an open-source blockchain designed for decentralised video delivery, specifically high-quality video streams. The network efficiently delivers videos and live streams at low cost to developers as they don't need to construct expensive infrastructure. In addition to that, content creators can build specialised decentralised applications (dApps) on the blockchain. As for users, they can simultaneously watch video content and earn token rewards through sharing their spare bandwidth and computing resources. Users can contribute to the Theta Network on any PC, mobile device or smart TV.

For brand partners and platforms such as NASA, GFUEL, Coindesk, integrating Theta into their video delivery stack enables them to reduce their video delivery costs significantly compared to other venues such as mainstream media.

Use Case & Token Economy

Initially, Theta token started as an ERC-20 token until the first Mainnet launch at the end of March 2019, after which there was a swap to the Mainnet tokens. Along with Theta Token (THETA), there is also Theta Fuel (TFUEL) in the ecosystem. Both are core to the token economy as well as undertaking different roles.

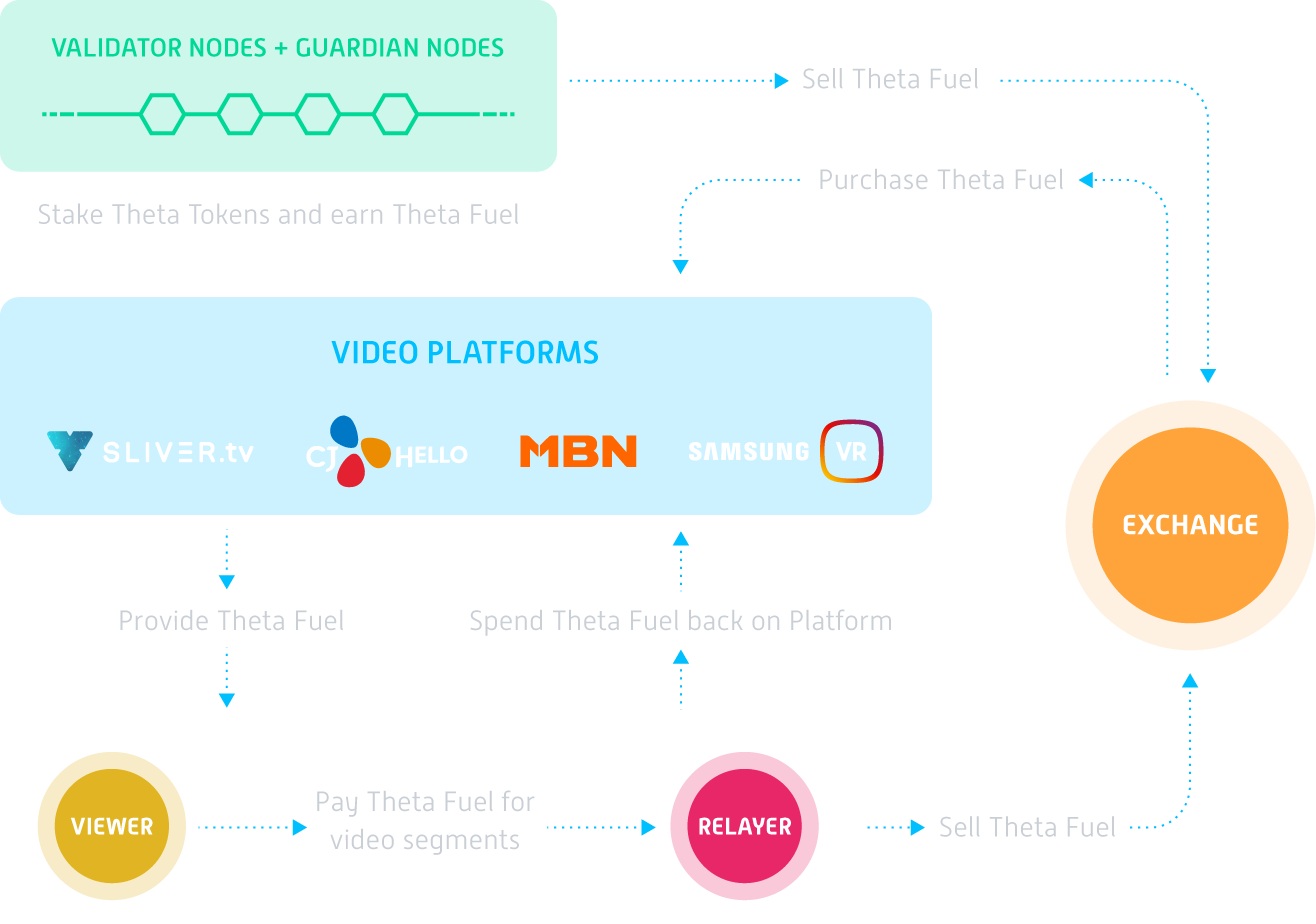

THETA is the governance token of the Theta protocol. Theta is used to stake as a Validator or Guardian node, contributing to the block production in the Proof of Stake (PoS) algorithm and the protocol governance of the Theta Network. By staking and running a node, users will be able to earn a proportional amount of the new TFUEL generated. The supply of Theta is fixed at 1 billion.

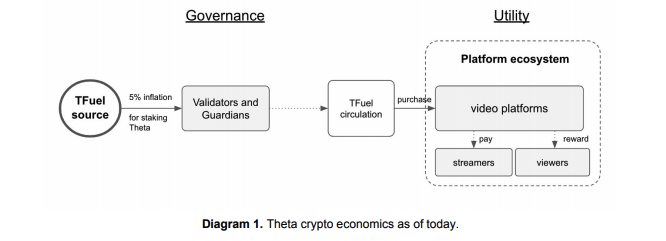

TFUEL acts as the operational token of the Theta Network, taking the role of fuel for the Theta Blockchain. TFUEL can be comparable to “gas” on the Ethereum network as it serves as a means of payment for transactions, setting up nodes or interacting and creating smart contracts. There were 5 billion TFUEL at the genesis of Theta Blockchain, and the supply increases annually at a fixed percentage set at the protocol level. With Mainnet 3.0, a new crypto-economics design for TFUEL will be introduced which will bring in TFUEL staking and burning concepts. This will broaden the capabilities of the network and maximise the utility value of TFUEL.

Theta Ecosystem Mainnet 2.0

Mainnet 3.0 Launch

First, we will explain a bit about how the Theta network operates, defining some terms that will allow us to better understand what impact these upgrades bring to the new Mainnet.

There are three types of nodes that currently operate on the Theta Network. They are Validator, Guardian and Edge nodes and we will quickly run through each one.

A node is a network of computers where each computer is connected and can communicate with all other computers (they don’t have to necessarily be computers but for the majority of the time they are the device used).

Enterprise Validator Nodes propose and produce new blocks in the chain, there are roughly 20-30 of these Validator nodes operated by Theta partners such as Google, Blockchain Ventures, Samsung, Sony Europe, Binance, gumi Cryptos, and Theta Labs. Validator Nodes are rewarded in TFUEL for providing their service.

Guardian Nodes seal blocks and act as a check on malicious or otherwise non-functional Validator Nodes. These Guardian nodes are run by Theta community members who have at least 1000 staked Theta units. Their role is integral to the performance of the Theta Network as they are providing a second layer of defence against potential attackers. Guardian Nodes are rewarded in TFUEL for providing their service.

Edge Nodes allow users to relay video streams over the Theta Network and are rewarded with TFUEL for doing so. Edge Nodes operate by running a Proof-of-Relay function. On a basic level, Edge Nodes are required to relay correct data back to the network and are rewarded according to how much correct data they actually relay.

Updates with the Mainnet 3.0 Launch

Firstly, Edge nodes will now be able to be upgraded to Elite Edge Nodes, which will enable ‘Uptime Mining’, the tokenization of internet bandwidth and availability. To create an Elite Edge Node, users will stake TFUEL to an Edge node, from which they will earn TFUEL proportional to their staked amount as well as earn additional TFUEL from video platforms for delivering high performance to the Theta Network. In fact, the term ‘Uptime Mining’ was chosen as Theta Network hopes these new incentives will convince more Edge node owners to have their nodes running longer on the network (more uptime) thus improving the overall efficiency of Theta’s Network. These new TFUEL rewards will come from a 2-4% token inflation hopefully incentivising Elite Edge Nodes to grow in numbers to 10,000s, supplying the sufficient bandwidth to the network catering to millions of THETA.tv users worldwide.

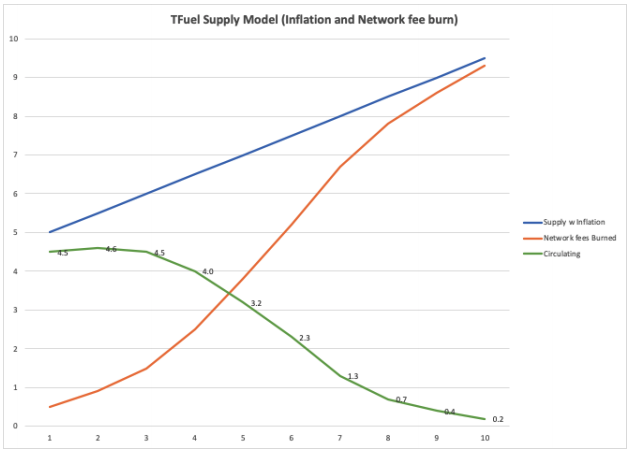

Theta Network are also introducing a TFUEL burn function, adding a level of deflationary (balancing) pressure to the token. The Elite Edge network will now enforce a rule whereby at least 25% of each TFUEL payment will be burned, this can be seen as a fee paid for using the Theta Network. This should increase TFUEL utility as any excess amounts of TFUEL will be burnt while the network grows and larger amounts are permanently removed. The Theta network will then be able to essentially match the burning rate of TFUEL to the inflation rate (remember TFUEL inflation rate is paid to node operators) creating a theoretically stable circulating supply, this effect is illustrated in the chart below.

Price Analysis of Previous Mainnet Launches

Mainnet 1.0 Launch

The first Mainnet launch of the Theta Network transitioned the token from an ERC-20 (Ethereum Network) token to one that now runs solely on the Theta Network. This saw the introduction and distribution of Theta Fuel (TFUEL) to be used for fees and rewards for users who are running nodes on the network. In the lead up to the first Mainnet Launch (15th of March 2019), the price of Theta increased as much as 300% from prices seen 2 months prior before having a general correction and finishing close to 200% higher on launch day.

Mainnet Launch 2.0

The lead up to the second Theta Mainnet Launch on May 27th 2020 followed a very similar pattern to the first. The price of Theta 2 months prior was as low as $0.049 USD. Following a large increase that peaked on Launch Day, Theta traded for a little under $0.59 USD which is a gain of over 1000%. Like previously, following the launch, there was a correction in the price back down to the $0.25 range.

TFUEL also followed a similar trend, starting as low as $0.0015 in the 2 months prior to launch before reaching its peak on May 27th of $0.024 or an increase of close to $1400%. TFUEL then corrected over the following days settling at the $0.01 range. Remember, TFUEL is currently sitting around $0.42 so even if you had bought that peak of $0.024, you would be up over 1500% today.

Today’s Price

Over the last two months, we have seen a market wide correction which has impacted Theta and TFUEL’s growth leading up to the Mainnet 3.0 Launch. Taking a closer look at Theta’s price action mapped against Bitcoin’s, it is evident that due to Bitcoin’s lowering in price Theta’s price has been negatively affected. This is quite typical of larger market cap coins, especially during Bitcoin retracement, we saw funds flow out of larger market cap coins creating some great buying opportunities. In this case, both Bitcoin and Theta’s prices have retraced roughly 40% over the last 2 months. However, the same cannot be said for TFUEL.

Over the last 2 months leading up to Theta’s Mainnet Launch, TFUEL has significantly outperformed Bitcoin by close to 40%, and at one stage by nearly 90% at its peak. This is a very similar pattern to what we saw before the second Mainnet launch, except this time TFUEL will be gaining much more utility with the new updates coming to the Theta Network. It will be very interesting to watch TFUEL’s performance in the coming weeks after the Mainnet launch due to the implementation of the new burning function being added to the network.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1PjLgWLIMUO2pzaZiPx5Dh%2F3348eab4e3ed605ef2edb43ec8e1f74f%2FBlog-Cover__15_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-02-28T02%3A58%3A44.085Z)