Bitcoin’s adoption as legal tender in El Salvador is a huge turning point for market sentiment and adoption worldwide. All in less than a week, the nation announced its plan to adopt Bitcoin, passed the bill to make it legal tender, offered solutions to mining and investment, as well as initiated a nationwide rollout. Surprisingly, the bullish news and major developments were not given much weight, as reflected in Bitcoin’s prices after the announcements were made.

Bitcoin Adoption

With US inflation hitting highs not seen since the 2008 financial crisis, developing nations that have been reliant on the US Dollar as a reserve currency will potentially favour Bitcoin in the months or years to come. Following the vote in the Salvadoran assembly, politicians in South American countries such as Paraguay, Argentina, Panama, Brazil, and Mexico took to social media to endorse and congratulate the decision. With South American countries warming up to cryptocurrencies, many of the continent’s nations may leapfrog ahead of others in cryptocurrency adoption thanks to the acceptance of its leaders.

El Salvador will be critical in establishing Bitcoin as a global standard and highlighting the benefits of adoption to other struggling and emerging countries. Apart from the South American countries, African and Southeast Asian countries are most likely prospects to follow suit next. Many of these countries have a much higher rate of political and economic turmoil. As a result, these nations face a great proportion of financial and socioeconomic tension. The combination of soaring inflation, brittle financial systems, and a high percentage of people without access to banking services, have made cryptocurrencies a clear-cut alternative.

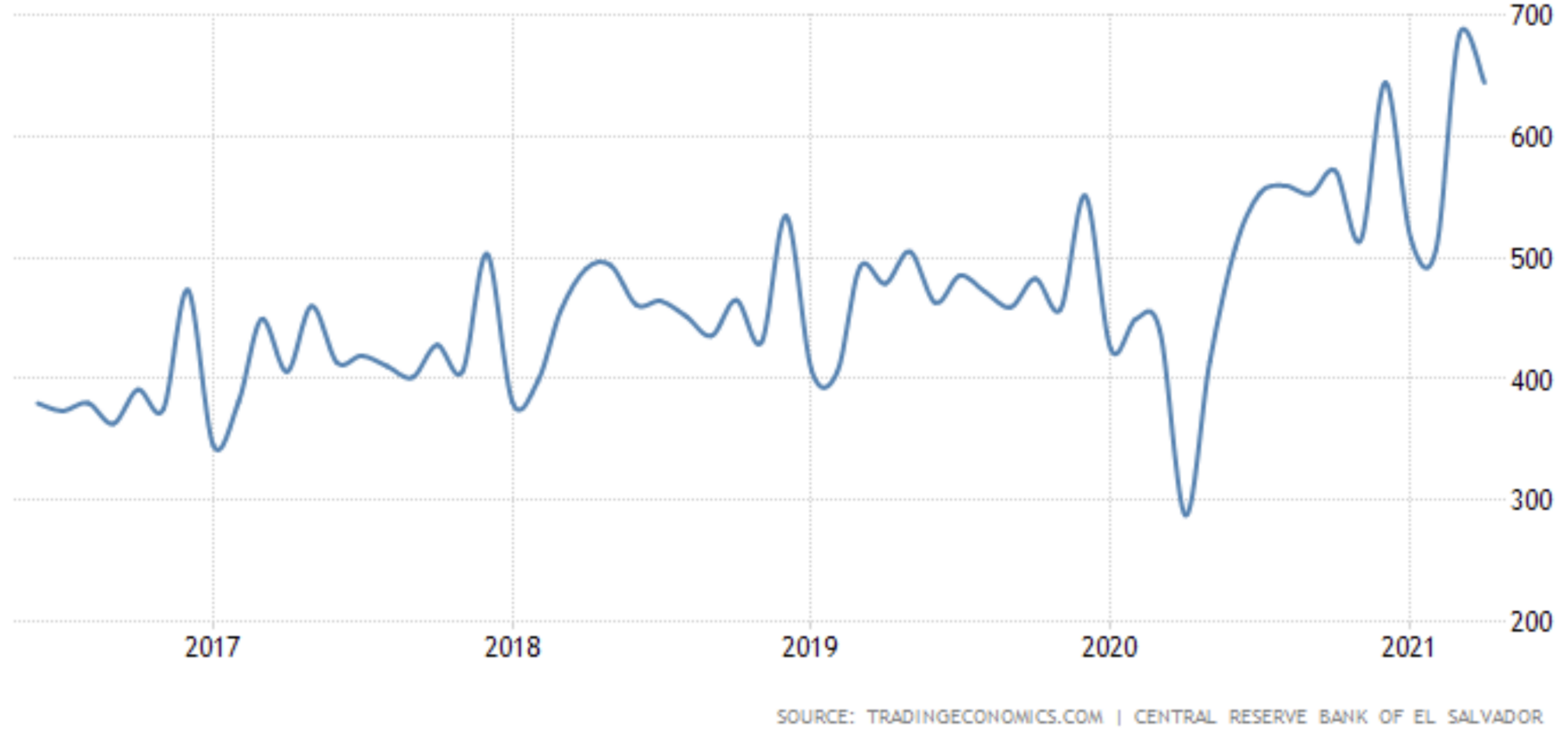

Across the globe, nations vary in wealth, power and status. In El Salvador, the official adoption of Bitcoin as legal tender was seen as a logical approach to removing the boundaries to one of its main economic drivers - remittances from abroad. Remittance is a term to describe any form of non-commercial transfer or payment of money to overseas communities, groups or individuals, with a purpose of providing income and financial support.

About 22% of El Salvador’s sizable GDP of $6.5 billion comes from migrant workers, predominantly residing in the United States. Of the income earned by these workers, a proportion is sent back to their communities or families. The adoption of Bitcoin is an extravagant move by the El Salvadorian administration to potentially bolster the economy. How Bitcoin could do this is by mitigating the fees paid for the money being sent back into the country each year by Salvadorans abroad, since most of these fees are being collected outside of El Salvador, eating up a lot of the actual quantity of money being remitted to their recipients.

In addition to helping Salvadorans without access to traditional banking services and a measure to bolster the economy’s main driver, the legislation can also act as a path to attract foreigners with Bitcoin holdings to invest in the Salvadoran economy.

With 62 out of a possible 84 votes, the Bill in El Salvador to make Bitcoin an official legal tender was passed - meaning that El Salvador has recognised by law that Bitcoin can be used to settle private or public debt or meet financial obligations. This includes paying taxes, contracts and legal fines or damages. This means that “every economic agent must accept Bitcoin as a payment when offered to them by whoever acquires a good or service”. As a legal tender, Bitcoin will not be subject to capital gains tax the same as any legal tender, such as the US Dollar wouldn’t be taxed between peer-to-peer exchanges.

Historically, El Salvador has not possessed its own native currency for some time. On January 1st 2001, El Salvador’s official legal tender changed from their own domestic currency (Salvadoran Colón) to the US Dollar, in an attempt to stabilise their economy from hyperinflation and create growth through more trade with their powerful neighbouring country. This essentially meant that El Salvador's Central Bank would no longer be in charge of monetary policy, but would instead be in control of domestic financial institutions, ensuring that they fulfil the requirements for their liquidity reserves of the US Dollar. Currently, the Central Reserve Bank of El Salvador has $5.7 Billion in assets, of which nearly half are US Dollar Reserves. This is important as Nayib Bukele, the current President of El Salvador, disclosed that the Government and Central Banks were not holding any Bitcoin. If we were to see even 5% of those US dollars invested into Bitcoin, it would equate to nearly $125 Million.

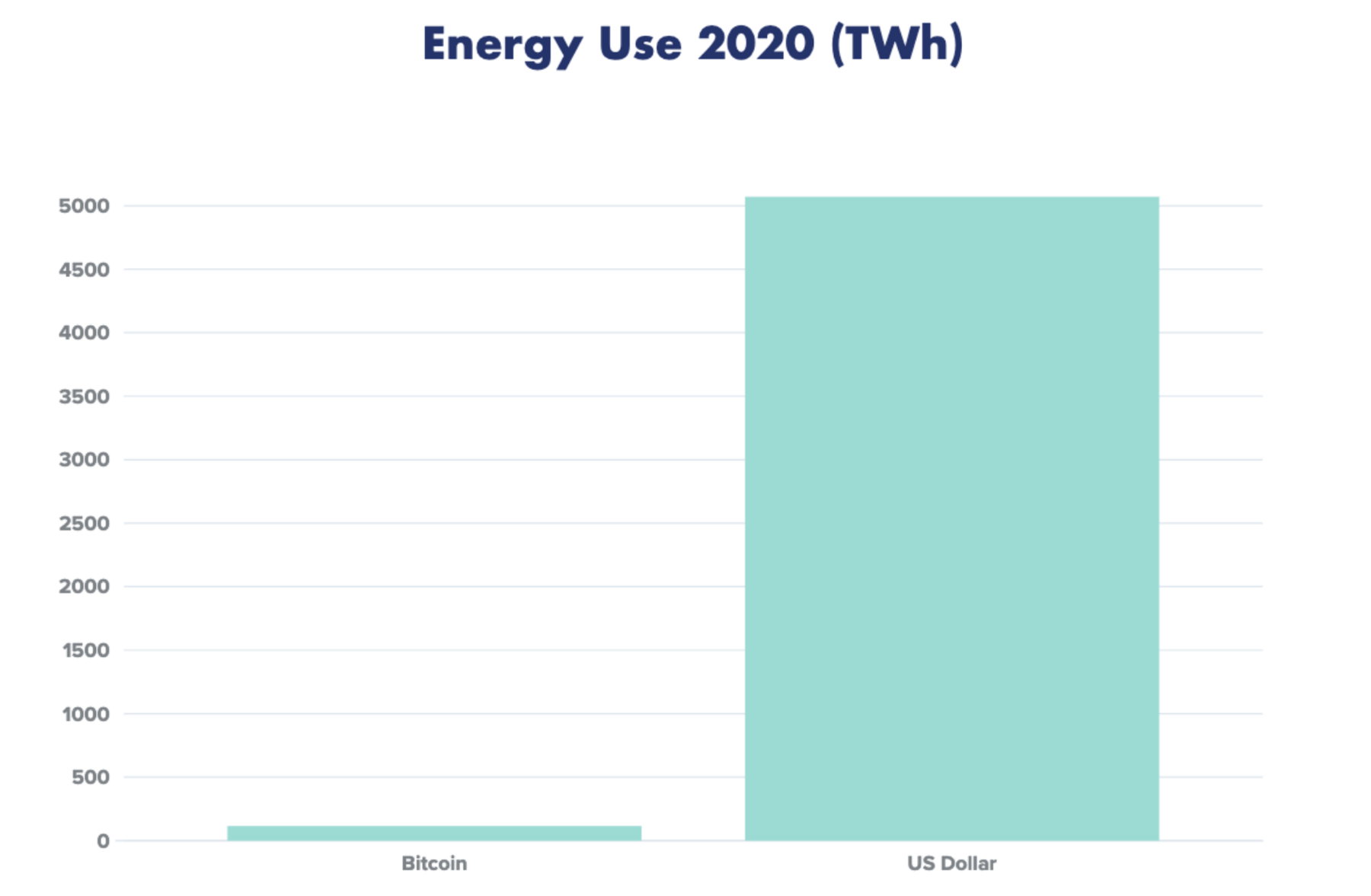

On June 16th, the World Bank stated that it could not provide any assistance in El Salvador’s adoption of Bitcoin, given concerns around the environmental drawbacks and relative lack of transparency. Unpacking this statement leads to questioning fiat currencies' environmental impact in comparison to Bitcoin’s. The narrative that Bitcoin uses excessive electricity has become commonplace in the mainstream media to discredit the news from El Salvador, but closer inspection into the discussion shows that the US Dollar has energy consumption issues of its own.

In the US, the finance and insurance industries make up 8.4% of the nation’s GDP. It is estimated that the carbon cost of a single dollar of GDP is approximately 1.5 kWh (Kilowatt hour) per dollar. In 2020, the US Federal Reserve created over $3.38 Trillion. Using the reported estimation, this equates to 5070 TWh (Terawatt hours) per year.

Put into perspective, it is estimated that Bitcoin uses 115 TWh (Terawatt hours) per year, according to the Cambridge Center For Alternative Finance (CCAF). By these calculations, the printing of US Dollars in 2020 in the aftermath of the pandemic was over 44 times more energy inefficient than Bitcoin.

Furthermore, whilst it is commonly explained that Bitcoin mining uses highly inefficient levels of energy, it is estimated that 73% of all Bitcoin energy consumption is now carbon neutral, due to hydropower in major mining hubs such as Southwest China and Scandinavia. In addition to this, El Salvador plans to utilise the state-owned geothermal electric company to harness volcanic energy which will be used to mine the cryptocurrency. To that note, Bukele said that the volcanic mining hub will be designed to utilise “very cheap, 100% clean, 100% renewable” energy from volcanoes to power their operation. If anything this highlights that the narrative being used by the mainstream media can be seen as an obstacle put in the way of Bitcoins wider adoption, one that holds little relevance when you discover that energy consumption has little weighting to higher carbon emissions when the majority of the energy used by the Bitcoin Mining network is carbon neutral.

Interestingly, nearly 70% of Salvadorans do not have any access to traditional financial services, suggesting that up to 70% of Salvadoran citizens may not have bank accounts. In fact, of their population of 6.5 million, only 5.7% have a credit or debit card, as their economic activity is heavily dealt with using cash. Furthermore there are over 9.47 million mobile phone connections in El Salvador, of which 72% have broadband connections, contributing to 50% of El Salvador’s population having access to the internet, and hence access to Bitcoin. Taking notice of this, Strike, a mobile payments app which is built on top of the Bitcoin network, happened to have just launched in El Salvador at the end of March. The app allows users to send and receive money anywhere, instantly, for free, by leveraging Bitcoin’s Lightning Network. How does that work?

Well, Strike moves fiat by buying and selling Bitcoin in real time over the Lightning Network. To explain the process, imagine shopping from a Japanese merchant whilst in the United States. Strike will first auto-convert USD into Bitcoin, which is sent to a Strike Lightning node residing in the jurisdiction of the other currency. An auto-conversion between Bitcoin and the Japanese Yen completes the transaction and deposits the fiat currency in their Strike app.

While the US Dollar is still being used as the main legal tender in El Salvador, Salvadorans have high incentives on using Strike. This is because Strike will be pivotal in easing the remittance process for communities and their families abroad as transactions are near instantaneous, coupled with low transaction fees.

Bitcoin Scarcity

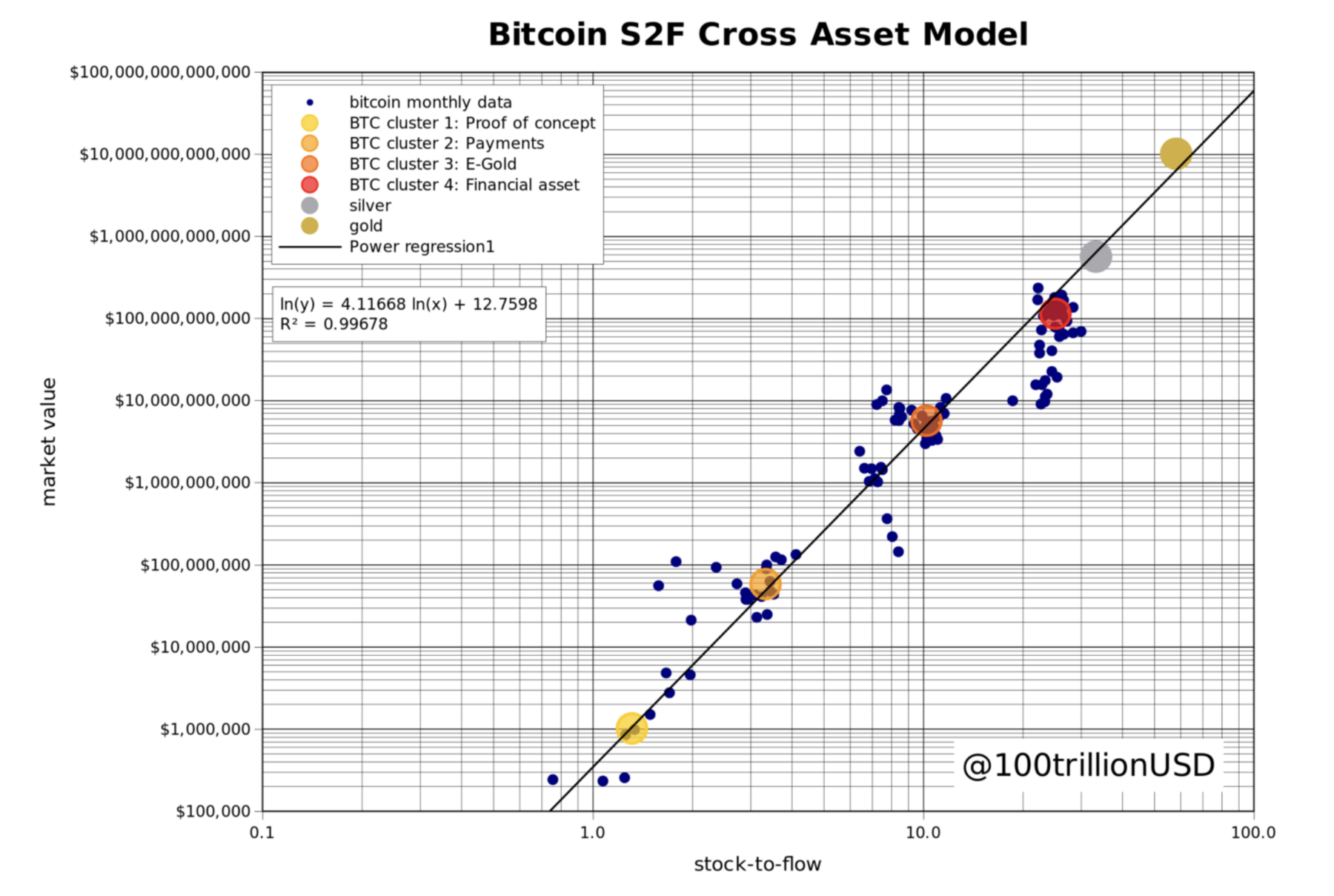

Despite a massive leap in broader acceptance, crypto-sceptics are still doubtful of Bitcoin being considered as a legitimate safe-haven investment and as an alternative reserve asset. Many typically compare Bitcoin to Gold, but aside from performance, the biggest difference between the two is the dynamics of supply. While both assets are viewed as scarce, Gold does not yet have a ceiling to supply, whereas ultimately, there can only be 21 million Bitcoin mined. Considering this, theoretically, Bitcoin is a finite asset, one that is definitively more finite than gold at the current capacity of our human resources to mine for physical gold sites across the globe.

From another perspective, we can talk about scarcity in terms of the famous stock-to-flow (S2F) ratio. Scarcity can be quantified by S2F by the simple equation:

S2F = Stock / Flow

Where ‘Stock’ refers to the size of the existing quantity in reserve, and ‘Flow’ is the yearly production.

The consistently low rate of supply of Gold and Bitcoin lends to its high S2F ratios, which sheds light on why Gold and Bitcoin are different from common commodities such as copper, zinc, nickel, and brass. This low rate of supply is also fundamentally the reason why Gold has maintained its monetary role throughout human history. But how does Bitcoin stack up to gold’s long reign?

The chart above shows the following elements: silver, gold, and Bitcoin, where the four ‘clusters’ are representations of Bitcoin’s perceived status at that moment in time and space. Despite Gold and Silver being in totally different markets, they are in line with the S2F model trend, and also form a perfect straight line; put simply, the higher the scarcity, the higher the ratio, and hence a greater quote on the market value.

Bitcoin’s S2F ratio is still less than the ratio for gold, but according to the data and charts, we can expect Bitcoin’s stock-to-flow ratio to overtake that of gold in the years to come. This brings us a lot of insight into the potential of Bitcoin having a commanding and lasting monetary role in the future, comparable to that of Gold.

Concluding Remarks

During the peak of institutional adoption in February and March, the price of Bitcoin was similarly hitting new all-time-highs as well. This was simply due to the increased demand for Bitcoin and decreasing supply of the asset. In addition to El Salvador’s adoption of Bitcoin and push to become a popular payment solution, with more countries looking to follow suit, Bitcoin’s scarcity will be exacerbated as demand will spike to levels never seen before. While cryptocurrencies are risky in nature, particularly given the extreme volatility, for some countries like South America, it is worth the risk as Bitcoin will continue to be a more attractive prospect during times of political and economic turbulence than the wholesale reliance on the US Dollar. We will be following the developments of El Salvador very closely in the upcoming months, especially the implementation of the decision.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.