- Introduction

- What is market sentiment?

- How to measure market sentiment?

- What is a Bull market?

- What marks the end of a Bull market?

- What is a Bear market?

- What marks the end of a Bear market?

- Is the Market Always in a Bull or Bear Phase?

- Market Cycles

- Investment Considerations

- Summary

- Navigating Bull Runs & Bear Markets With Support

Introduction

From dizzying highs to unpleasant lows, the cryptocurrency market’s extreme volatility can cause the sentiment of crypto investors to shift dramatically from fear to greed and back again at the drop of a hat. The trends that cause these contrasting emotions can be broken down into two different market regimes; bull and bear markets. You’ll likely have heard the terms ‘bull’ and ‘bear’ in conversations about cryptocurrency, stocks, real estate, or any other asset. But what exactly do they mean and why are they called this? Your answers lie below.

What is market sentiment?

Market sentiment reflects the general attitude or mood among investors in relation to an asset or market. Sentiment and asset prices tend to be highly correlated. When asset prices are surging, investors tend to become far more optimistic about its future. When asset prices fall, market participants can lose faith in an asset class, despite the fundamentals of some assets barely changing.

How to measure market sentiment?

Measuring market sentiment is relatively subjective, and therefore complex. However, there are various tools available online that aim to do so. Sentiment is typically measured by finding data points that show the views and actions of the investor population.

A popular indicator to measure cryptocurrency market sentiment is the crypto fear and greed index. AThe most popular version, developed by alternative.me combines several indicators that help measure the levels of psychological stability (or instability) within the market. This index provides a computer-generated score between 0 and 100 to describe the current sentiment of cryptocurrency investors.

What is a Bull market?

In traditional finance, the term ‘bull market’ is believed to have originated from a bull’s fighting style of thrusting its horns in an upward motion. Investors have since used this term to describe the overall market sentiment that exhibits a similar pattern — an uptrending price trajectory. A bull market, or bull run, can be characterised as a time of buoyancy, prosperity, and optimism.

A bull market is a period of time where the majority of investors are buying, demand outweighs supply, market confidence is at a high, and asset prices are rising. Investors tend to be confident in the long term vision of an asset, even when this view isn’t always supported by the asset’s current fundamentals. Think back to 2021, the end of 2023 and the start of 2024.

An investor that is bullish is known as a “bull”, and will expect asset prices to trade higher over a period of time. As investor confidence rises, a positive feedback loop emerges, which tends to draw in further investment, causing prices to continue to rise.

What marks the end of a Bull market?

History has shown that bull markets don’t last forever, and at some point, investor confidence will begin to decline. Markets in general are cyclical in nature, and the joys of summer are always followed by the colds of winter. The end of a bull market could be triggered by anything from unfavourable legislation to unforeseen events like the COVID-19 pandemic, or many factors that impact the wider economy. Similarly, bull runs can end after investors’ positive sentiment pushes asset prices far above their fair value. These overly optimistic asset valuations can cause what is known as a “bubble”. Once the bubble pops, a sharp downward price movement can begin a bear market.

What is a Bear market?

Similar to a bull market, the term ‘bear market’ is believed to come from a bear’s manner of attack, where it swipes its paws downwards. A bear market generally indicates a market in a period of decline, where the majority of assets trend lower in price. Supply of an asset outweighs demand (pushing prices lower) and market sentiment is overwhelmingly negative. Pessimistic investors who believe prices will continue to fall are, therefore, referred to as “bears.”

In traditional stock markets, a market is generally referred to as bearish when asset prices have declined 20% or more from their recent highs. However, given the more extreme volatility experienced in crypto markets, short and sharp downward trends can often be misinterpreted as the end of a bull run. Because crypto markets often experience day-to-day (or even moment-to-moment) volatility, this term is generally reserved for longer time horizons.

What marks the end of a Bear market?

It’s notoriously difficult to predict when the bear market might end and when the bottom price of an asset class has been reached, as it's influenced by many external factors such as economic growth, investor psychology, and world news or events. Bear markets generally end after investors’ negative sentiment pushes asset prices well below their fair value. Market participants can become forced sellers. Funds have to sell assets because their investors choose to redeem their capital. Companies in the sector may have to sell assets because they’re facing the prospect of bankruptcy. Retail investors capitulate their positions, unsure if the asset class will ever recover. Eventually, forced selling abates, value investors step in, and a bull regime may return.

Is the Market Always in a Bull or Bear Phase?

While markets can often trend up or down, they are not always in a bull or bear phase. Markets can remain without a trend, and exist in a more neutral state.

This happens when the supply from sellers is equal to demand from buyers. While prices will move, they will generally stay in the same range until demand outweighs supply, or supply overcomes demand. An investor can choose to enter a trendless market if they anticipate that a bull market will follow, or wait for other signs that a bull market has begun.

Market Cycles

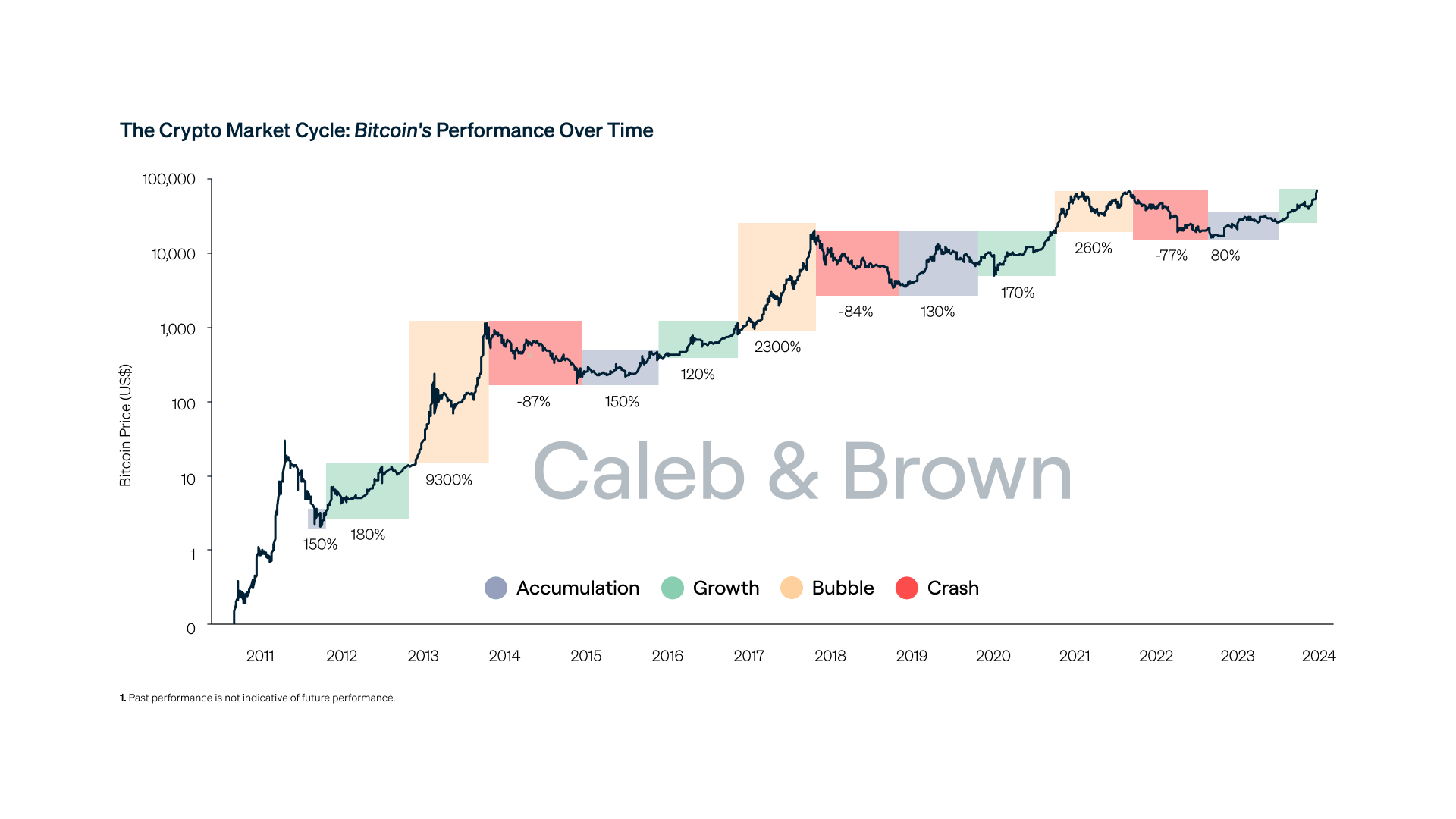

The bull & bear markets are synonymous with the four phases of the market cycles, which bull and bear runs span. Following the image below, charting recent market cycles, the four phases are explained:

Accumulation

Following a bear market crash, crypto enters a low-key buying phase. Prices stabilise after the drop, big investors accumulate holdings, and startups keep innovating under the radar. This accumulation phase lays the groundwork for the next bull run.

Growth

Following the accumulation phase, crypto transitions into a bull market. Optimism explodes, trading surges, and users flock to successful projects with real-world use cases. This marks a period of explosive growth fueled by innovation.

Bubble

After the bull run, euphoria takes over. Prices go parabolic, fueled by FOMO and frothy speculation. This bubble phase sees new investors pile in, driving prices to unsustainable highs before a predictable crash.

Crash

The bubble bursts. Fear grips the market as prices plummet in a crash. Retail investors flee, leaving behind a volatile freefall. This bear market is a period of harsh reality checks as the market finds a new, lower baseline.

Investment Considerations

As bull and bear markets are driven by the sentiment of market participants, it is tremendously difficult to pinpoint the top or the bottom of a market. However, financial markets and crypto in particular, have shown to be cyclical in nature. When investing, it’s important to understand how market cycles and market sentiment work. While a market can trend for a very long period of time, bull and bear markets eventually end.

Investors are likely to feel overly optimistic near the top of an assets cycle (when assets become significantly overvalued), and overly pessimistic closer to the bottoms of a market cycle (when some assets can become undervalued). While companies, assets, and projects can fail in bear markets, markets do tend to recover. This can present opportunities or challenges, depending on how you have positioned yourself.

Summary

Bull and bear markets have unique characteristics that prospective investors should consider and look out for. The metaphor of raging bulls and hibernating bears aptly describes the cyclical nature of financial markets. These investing seasons present different trade-offs, with opportunities and challenges aplenty. Understanding market cycles, and the effect that sentiment can have on markets is an important skill that can help an investor to navigate the volatile nature of the crypto markets.

Navigating Bull Runs & Bear Markets With Support

You don’t need to weather the crypto market alone.

Caleb & Brown is the world's leading crypto brokerage for beginner and advanced investors alike, with over 30,000 clients leaning on our expertise and market intelligence to best position over market cycles.

Our personalised broker service makes crypto investing simple and informative. A dedicated member of our broker team is always on hand to guide you along the way, giving you the confidence you need to navigate the world of crypto. Not to mention key features such as:

- No joining or signup costs

- Industry-leading storage solutions

- 24/7 customer support

If you are ready to take the next step and invest, contact your crypto broker today.

Not yet a client? Sign up for your free consultation.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.