It’s no secret that crypto markets are highly volatile. Significant price swings that would be considered major events in traditional financial markets are a regular occurrence in the world of cryptocurrency.

But is this crypto volatility a feature or a bug? While most investors accept that crypto asset prices can fluctuate, few understand the reasons behind it. This article explains why crypto is so volatile so that investors can better understand the risks and opportunities volatility presents.

What is Volatility?

Volatility in financial markets refers to how much the price of an asset has increased and/or decreased over a period of time. High volatility is indicated by larger and more frequent price movements, while the opposite holds true for low volatility.

Generally, the more volatile and unpredictable an asset is, the risker it’s considered to be as an investment. This brings with it the potential for greater returns or greater losses over shorter time periods compared to less volatile assets.

Comparing Crypto Volatility to Traditional Markets

Still a relatively new asset class, crypto continues to be highly volatile and, therefore, riskier than traditional asset classes. Stocks, for example, display a wide range of volatility, from the relative stability of large cap stocks (like Google and Berkshire Hathaway) to the often erratic penny and small cap stocks. Bonds are lower risk still, as they typically see less dramatic price movement, especially in the case of higher grade bonds such as a US Treasury.

Crypto market volatility is in a different league altogether. A glance at historical price action on charts confirms this; skyrocketing rises and aggressive drops have occurred at an extreme pace in crypto compared to prices of assets in mainstream markets.

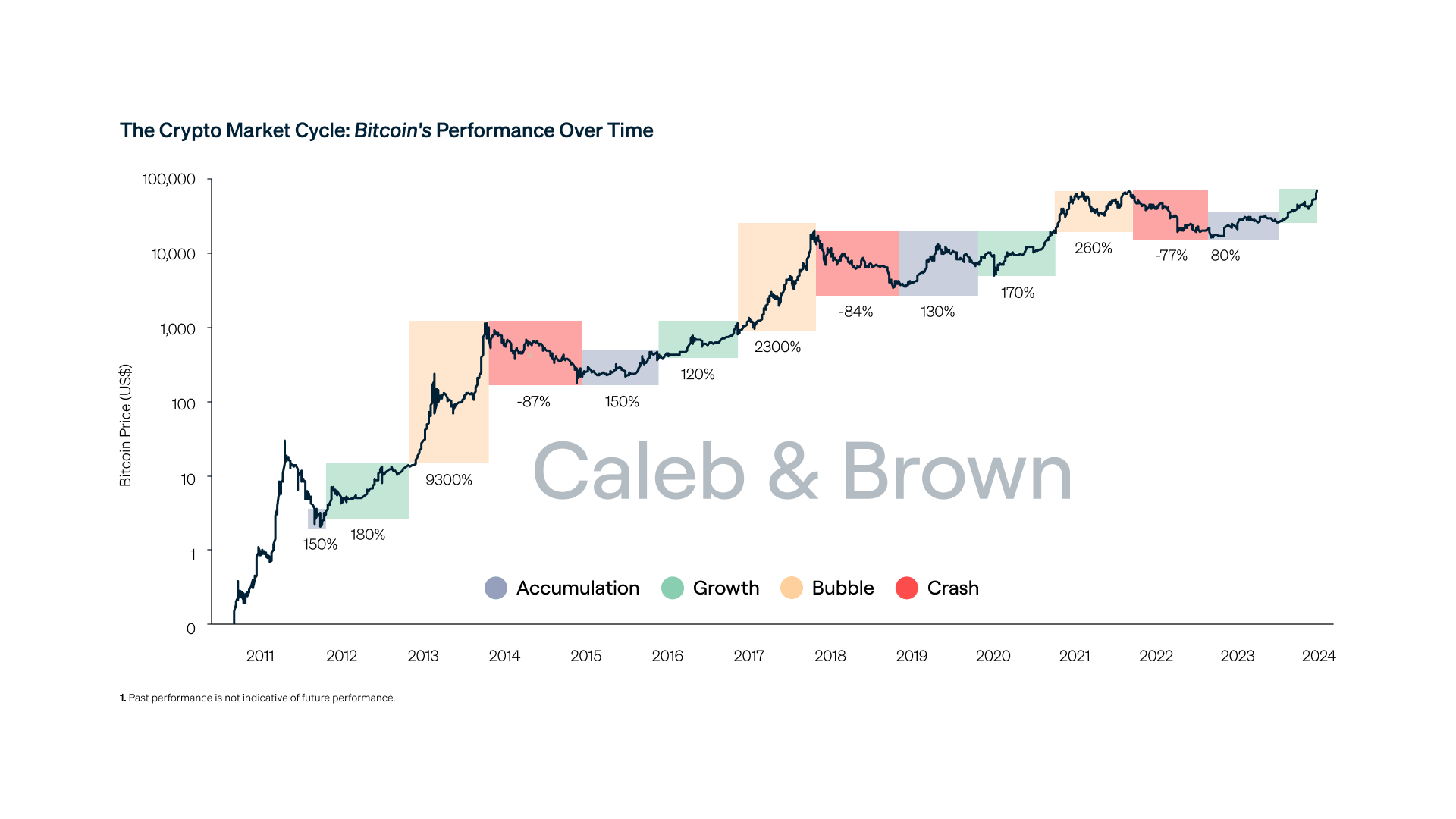

Using Bitcoin (BTC) as an example below, you can see BTC has witnessed over eight 50% corrections in its 15 years of existence. However, at the same time, Bitcoin has managed to recover from each correction over the course of a full cycle to make new all-time highs, including its most recent all-time high of US$73,000 in March of 2024.

Many of the reasons for price volatility in mainstream markets are reflected in crypto markets as well. Speculation and news events such as COVID-19 drive price swings in crypto and mainstream markets similarly. However, the effects of these events are often exaggerated in crypto due to the unique features which characterise the immature nature of the digital asset space.

Factors affecting Crypto Volatility

Price Discovery

All new concepts take time to settle and be accepted and the same holds true for crypto. The asset class, the market, and its investors/speculators are still finding their feet during this early and high growth phase.

Bitcoin has only been around for 15 years– a while longer than most crypto assets, so they are still in price discovery. This means that prices will fluctuate more, as new participants continue to enter the market trying to establish consensus on the fair value of digital assets in the process.

While crypto is now mainstream following unprecedented adoption rates, faster than other innovative technologies (like the Internet), the asset class is still considered an outlier versus traditional assets like stocks or commodities. Growing acceptance and maturity of the market go hand in hand. Until investors gain more certainty in crypto’s long-term, future utility and regulatory standing, price discovery will continue to be a major driver of crypto volatility.

Immature Markets

Rapid growth comes with growing pains. Many of the financial products and instruments within the crypto ecosystem are still very much in development. Compared to assets like stocks, crypto is more difficult for investors to gain exposure to (which is why it is so retail heavy). Though institutional adoption of crypto is increasing, derivative products and other ways of hedging are still in their early stages, so investors are constrained in how they manage their exposure to crypto.

The relatively small size of the crypto market means there’s less liquidity and depth to accommodate larger traders. For perspective, the total crypto market cap is a fraction the size of the total U.S. stock market; in early 2024 the former stood at $2.6 Trillion compared to the latter's $40 Trillion.

Whereas a few major stock exchanges such as the New York Stock Exchanges (NYSE) facilitate the majority of trading in traditional markets, crypto liquidity is fractured across many different exchanges. Therefore, it is difficult for large players to enter or leave the market at ‘size’, without affecting prices and moving the market.

Supply and Demand Dynamics

The distribution between supply and demand plays a major role in the volatility and price movements of any asset. However, it is particularly nuanced in the crypto space due to the unique supply dynamics of many digital assets.

The limited supply of certain assets often creates conditions where sudden increased demand can put even greater upward pressure on prices, increasing volatility. The most prominent example of a fixed supply digital asset is Bitcoin, which has a limited supply of 21 million coins.

This pressure can be compounded further when large holders - often called whales - buy or sell significant quantities of a particular asset, potentially sending its price soaring or tumbling. The crypto markets are not yet efficient enough to absorb these supply and demand shocks without significant price impact, wholesale. Due to limited liquidity, smaller market cap assets are particularly susceptible to the movement caused by whales’ trades and are often more volatile and risky as a result.

Sentiment

Crypto markets are heavily influenced by investor sentiment. The immaturity of the overall crypto market means that positive or negative views can spread like a contagion. This is down to the psychology of the crypto investor, who is typically an individual /retail investor that is less informed and more impressionable compared to more seasoned traditional investors.

A great example of this is when Tesla bought Bitcoin in Jan 2021 and the markets reacted with exuberance and over-optimism, buying up BTC which ignited price rally to an all time high of around US$69,000 in the months that followed.

The FOMO (Fear of Missing Out) factor is prominent with speculative assets as investors often hear stories of prices rising during a bull market and people taking profits, provoking them to enter the market and tell their friends and family to follow. This can create a positive reflexive feedback loop with high (but unsustainable) demand for an asset, causing major price movements.

Lack of Regulation

Regulation is an important factor of market volatility. The crypto market is not comprehensively nor clearly regulated by any government bodies, globally, like traditional financial markets are. The unique digital and decentralised characteristics of cryptocurrencies present major challenges for regulators globally. The need for regulation to protect consumers to legitimise the industry has long been called for by prominent figures participating in the industry, but lawmakers have been slow to answer the calls.

The lack of clear regulation prevents exchanges from listing specific assets under investigation by regulatory bodies as part of a lawsuit. Following the SEC’s announcement in 2020 of its case against Ripple, $16 billion, or 63%, was wiped off XRP’s market cap in the trading period following. Meanwhile, the crypto market remained relatively steady.

24/7 Trading

Crypto markets don’t sleep.

Unlike traditional markets that trade between set hours, Monday-Friday, such as the NYSE, the crypto market doesn’t close. Coupled with the lack of regulation, this means there are no circuit breakers like in traditional markets.

Circuit breakers are interventions by exchanges in order to dampen volatility, caused by panic selling or destructive events internal or external to the stock market. With no training wheels or guard rails in place, crypto’s free market dynamics are susceptible to high volatility.

Closing Thoughts

The crypto market is still an infant asset class; relatively underdeveloped, immature, and highly volatile. This volatility is a feature and a right of passage, rather than a bug, of crypto’s high growth phase, presenting both challenges and opportunities for traders and investors alike.

As time goes on, many of the factors that drive volatility will subside. We are already witnessing the introduction of different players into the market; increased institutional participation and regulatory oversight which will reduce volatility in the future as the asset class matures.

To better understand crypto market volatility, get set up with a personal broker today.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)