Market Highlights

- Bitcoin (BTC) begins to show volatility around its all-time highs as Grayscale’s Bitcoin Trust sees giant outflows.

- Disgraced crypto founder, Sam Bankman-Fried is sentenced to 25 years in prison for his criminal involvement in fraud and conspiracy at FTX.

- The SEC is seeking US$2 billion from Ripple Labs in fines and penalties.

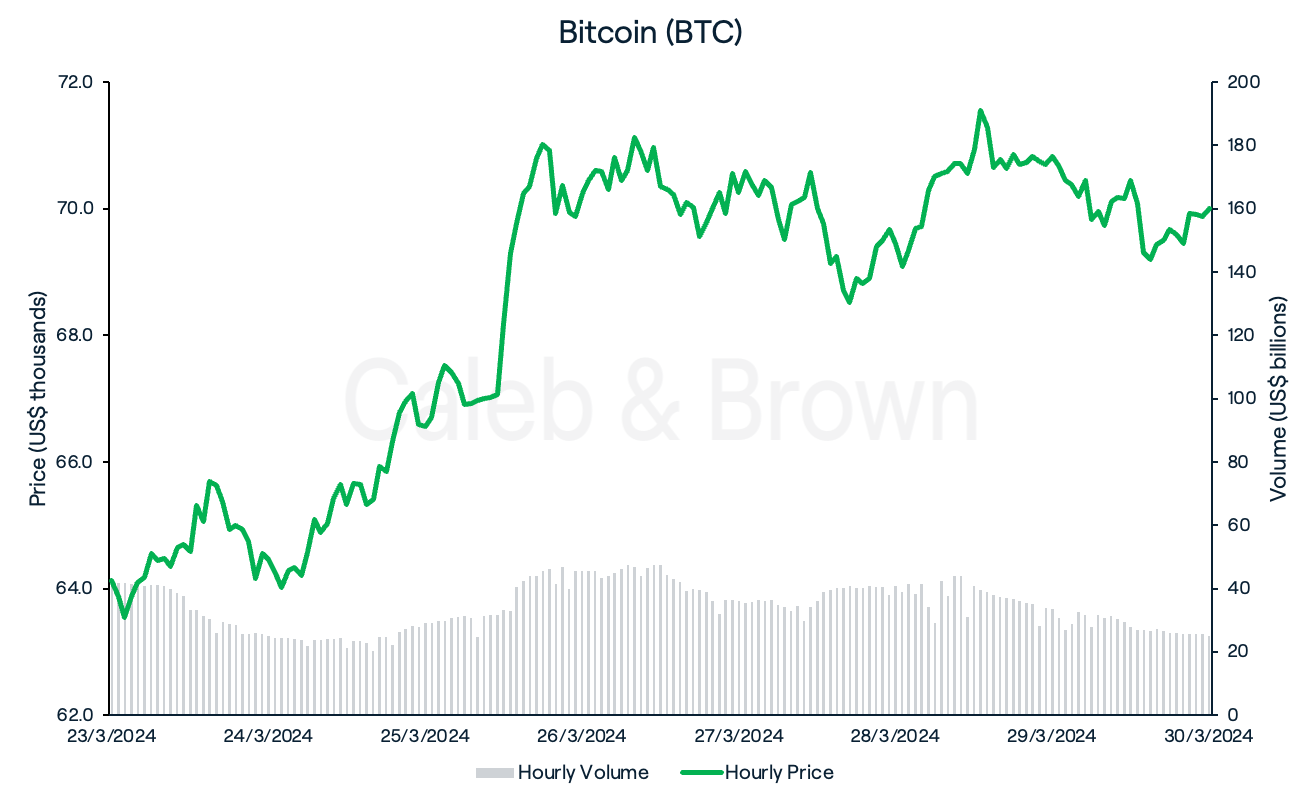

Bitcoin

After breaking all-time highs earlier this month, Bitcoin (BTC) has seen tumultuous price action the past couple weeks, likely contributed to by a number of factors.

First being the Bureau of Labor Statistics reporting an increase of annualised Consumer Price Index (CPI) of 3.2%, coming in slightly ahead of the expected 3.1% forecast.

Secondly, massive amounts of capital continue to flow out of Grayscale’s Bitcoin Trust (GBTC). The recently approved spot BTC exchange traded fund (ETF) has allowed investors to redeem their shares and lock-in profits.

While weekly outflows exceeded inflows this week, breaking the 7-week streak, Bitwise CIO, Matt Hougan shared insights from his interactions with investors and capital allocators this month, highlighting a “massive dispersion in the pace of adoption of bitcoin ETFs” and that ETF inflows can continue for years.

Despite these market conditions, BTC bounced back from its lows of US$63,500 as traders geared up for the Bitcoin halving, now under 30 days away. BTC closed the week at US$70,000, up 9.2% over the last seven days.

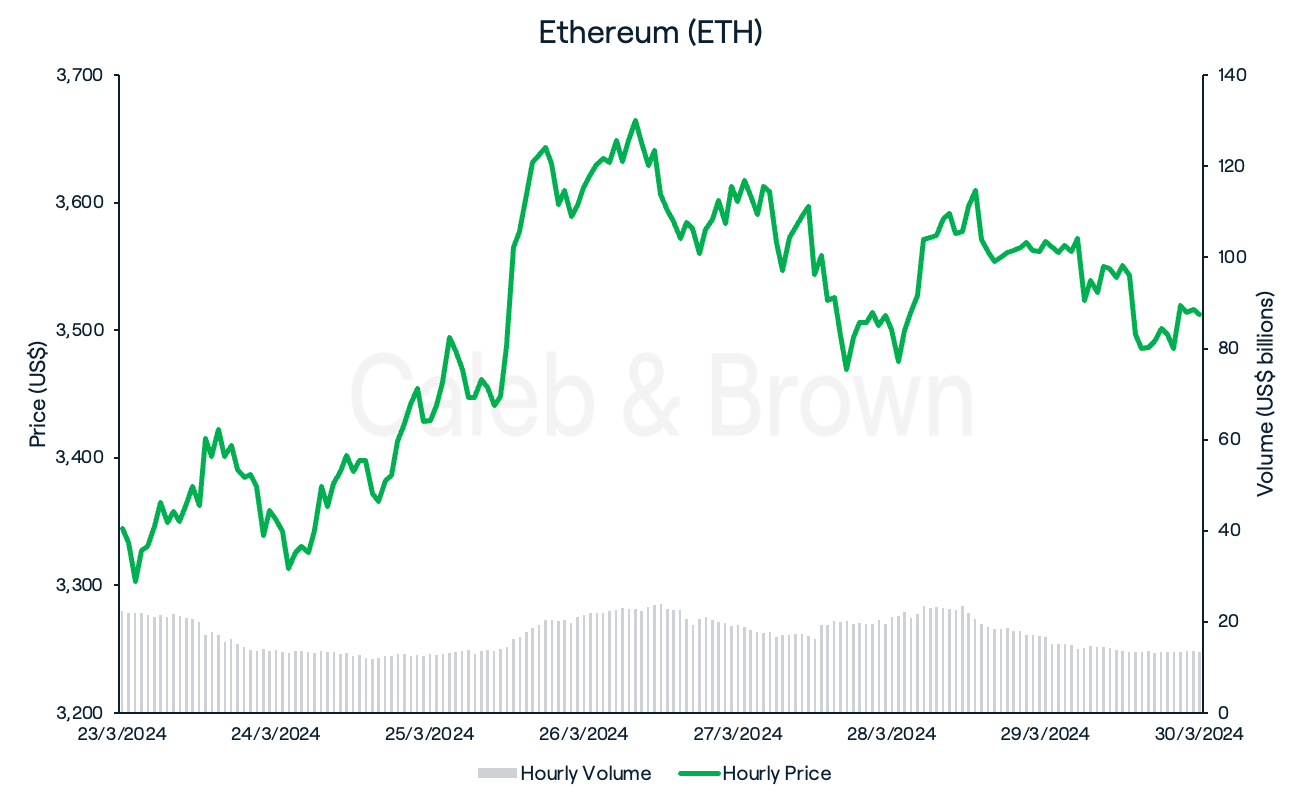

Ethereum

Ethereum (ETH) also experienced high levels of volatility this week, trading between the wide range of US$3,100 to US$3,680. This was likely spurred on by the news of the U.S. Securities and Exchange Commission postponing its decision to approve Grayscale Ethereum Futures Trust's ETF application with the new deadline moving from March 31 to May 30.

As such, ETH closed the week at US$3,512, up 5.0%.

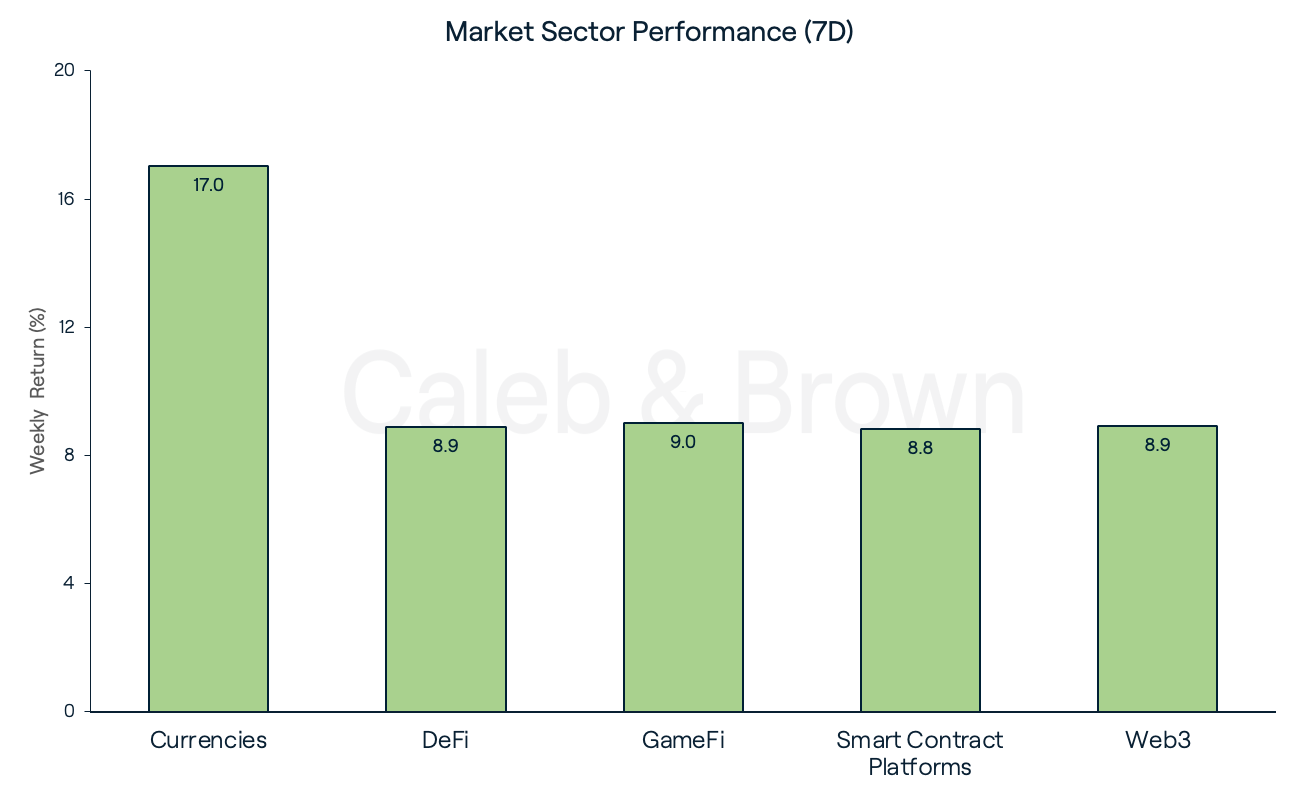

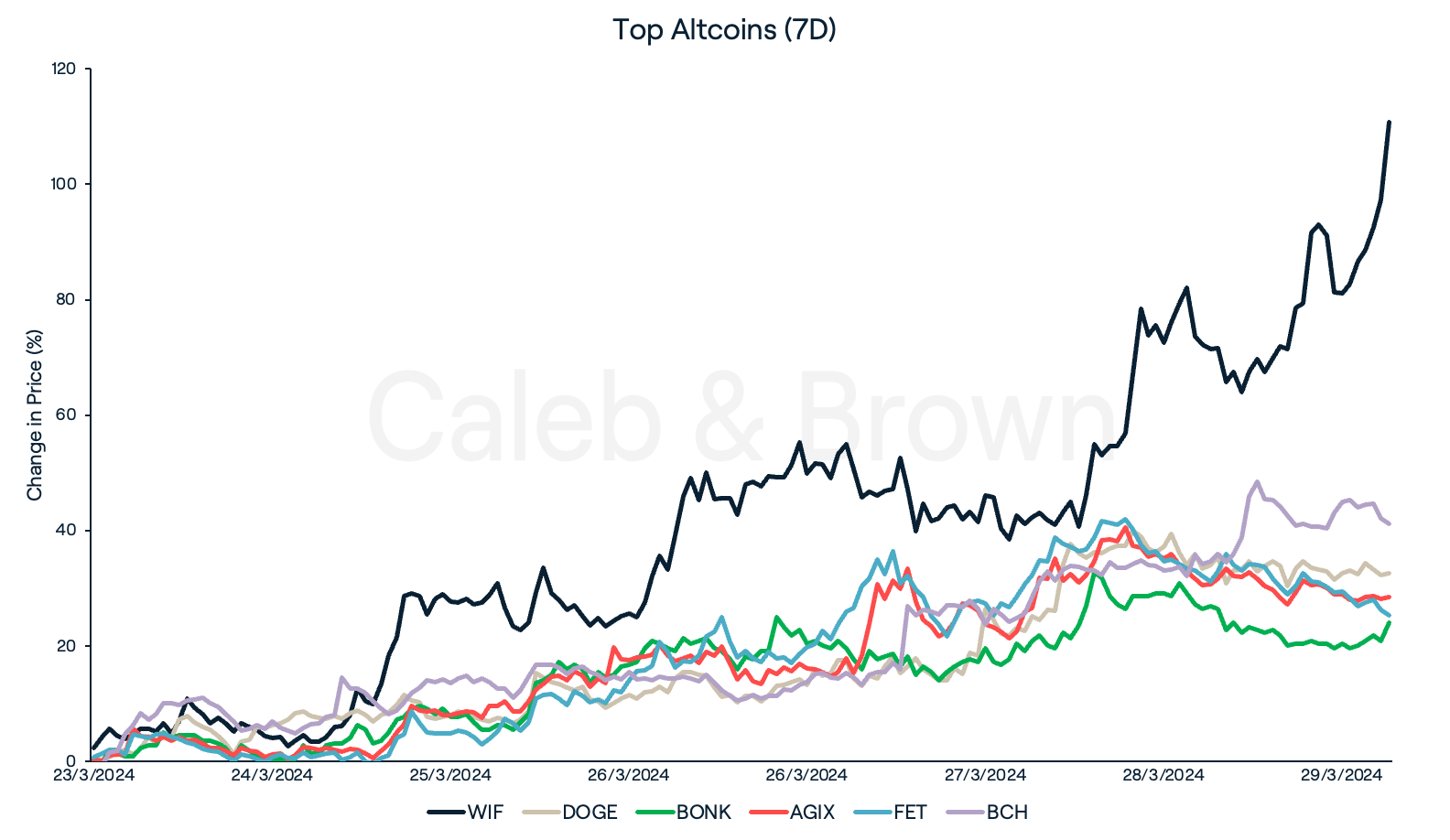

Altcoins

Market sectors were once again all in the green this week with Currencies leading the pack at a 17.0% gain. GameFi followed after surging 9.0% while DeFi and Web3 gained 8.9%.

Dog-related memecoins went barking mad once again this week as dogwifhat (WIF), Dogecoin (DOGE), and Bonk (BONK) ran ahead with respective gains of 110.7%, 32.6%, and 24.1%.

AI protocols, SingularityNET (AGIX) and Fetch.ai (FET) also found themselves amongst top performers again this week as they enjoyed gains of 28.4% and 25.3%, respectively. This could be attributed to the recently proposed merger of these two protocols with Ocean Protocol (OCEAN) to create a new decentralised AI ecosystem.

Finally, Bitcoin Cash (BCH) surged 41.1% ahead of its halving event which is now just five days away.

In Other News

On Thursday morning, a Manhattan federal judge handed disgraced crypto founder, Sam Bankman-Fried a 25 year prison sentence for his criminal involvement in fraud and conspiracy at FTX.

The United States Department of Justice filed charges on Tuesday against crypto exchange KuCoin and two of its founders, accusing them of conspiring to breach the Bank Secrecy Act by neglecting to maintain a compliant anti-money laundering program.

Regulatory

-

A federal judge presiding over the SEC’s extensive lawsuit against Coinbase ruled on Wednesday that the regulator's arguments against the crypto exchange are predominantly "plausible." This ruling allows the case to move forward and rejects Coinbase's motion to dismiss it entirely.

-

The SEC is seeking US$2 billion from Ripple Labs in fines and penalties, Ripple’s chief legal officer said on Monday. Ripple’s CEO, Brad Garlinghouse, responded on X that the US$2 billion sought by the SEC is unprecedented because the case “involved no allegations of fraud and recklessness.”

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)