Bitcoin

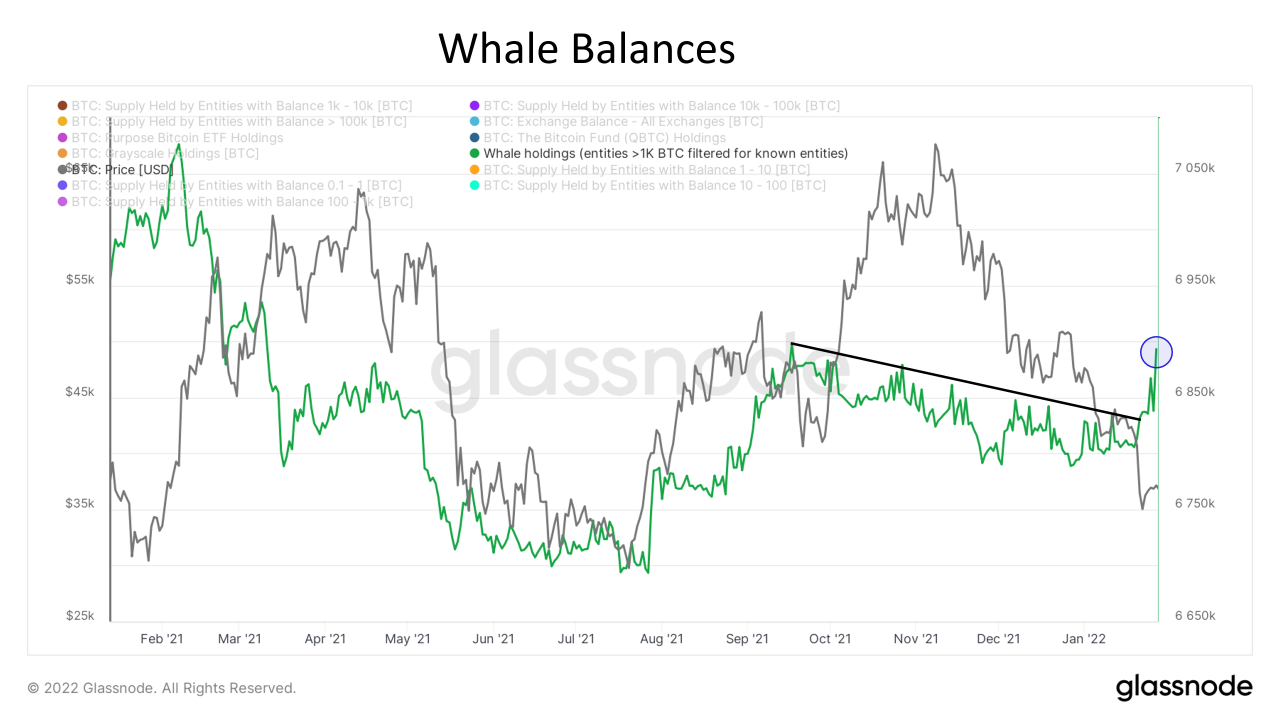

January was another month of downwards price action, with Bitcoin beginning the month at the $47,000 level and ending the month at approximately $37,000, representing an overall drop of 22%. Much of the chatter within financial news circles has been around the sustained threat of inflation along with central banks’ increased hawkish tone in looking to make interest rate hikes as a response. The most recent inflation numbers from the US Bureau of Labor Statistics indicated a 7.0% year-over-year increase, the highest figure seen in the last 30 years indicating that this rise in prices seems larger and more sustained than previously thought. Coupled with talk of raising interest rates, this leads to a risk-off environment with high growth tech and crypto being the most aggressively sold off as investors look to play more defensively. Aside from looking at pure price action, on-chain metrics have actually indicated bullish signs with Bitcoin whales (wallets with over 1,000 BTC) beginning to reaccumulate, further reducing the liquid supply available.

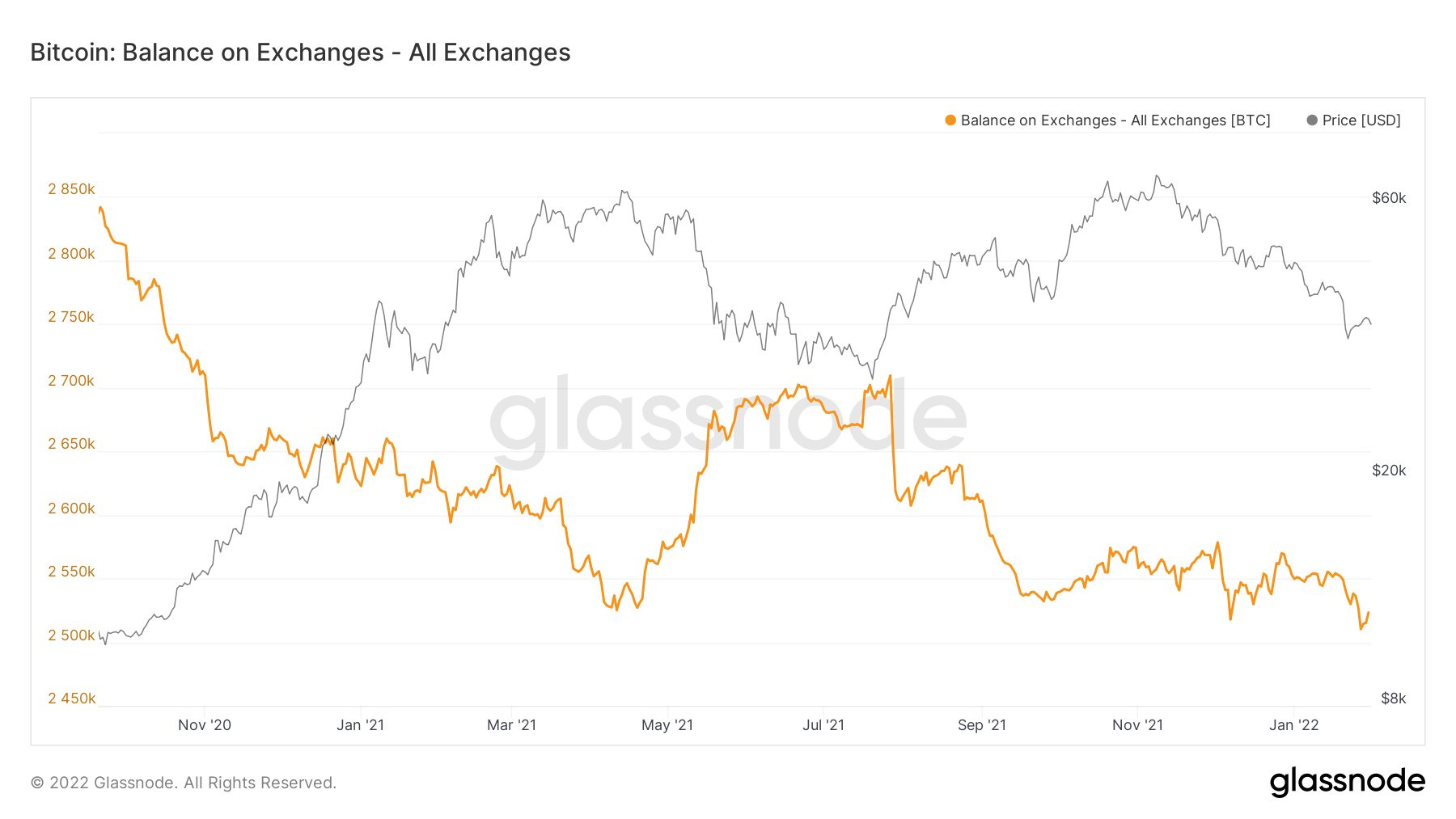

Bitcoin continues to be taken off exchanges with balances reaching new lows just as recently as a few days go. As more and more of the supply is held, this reduces the tradable amount of Bitcoin and can lead to ‘supply shocks’ increasing demand, resulting in aggressive upwards price movement.

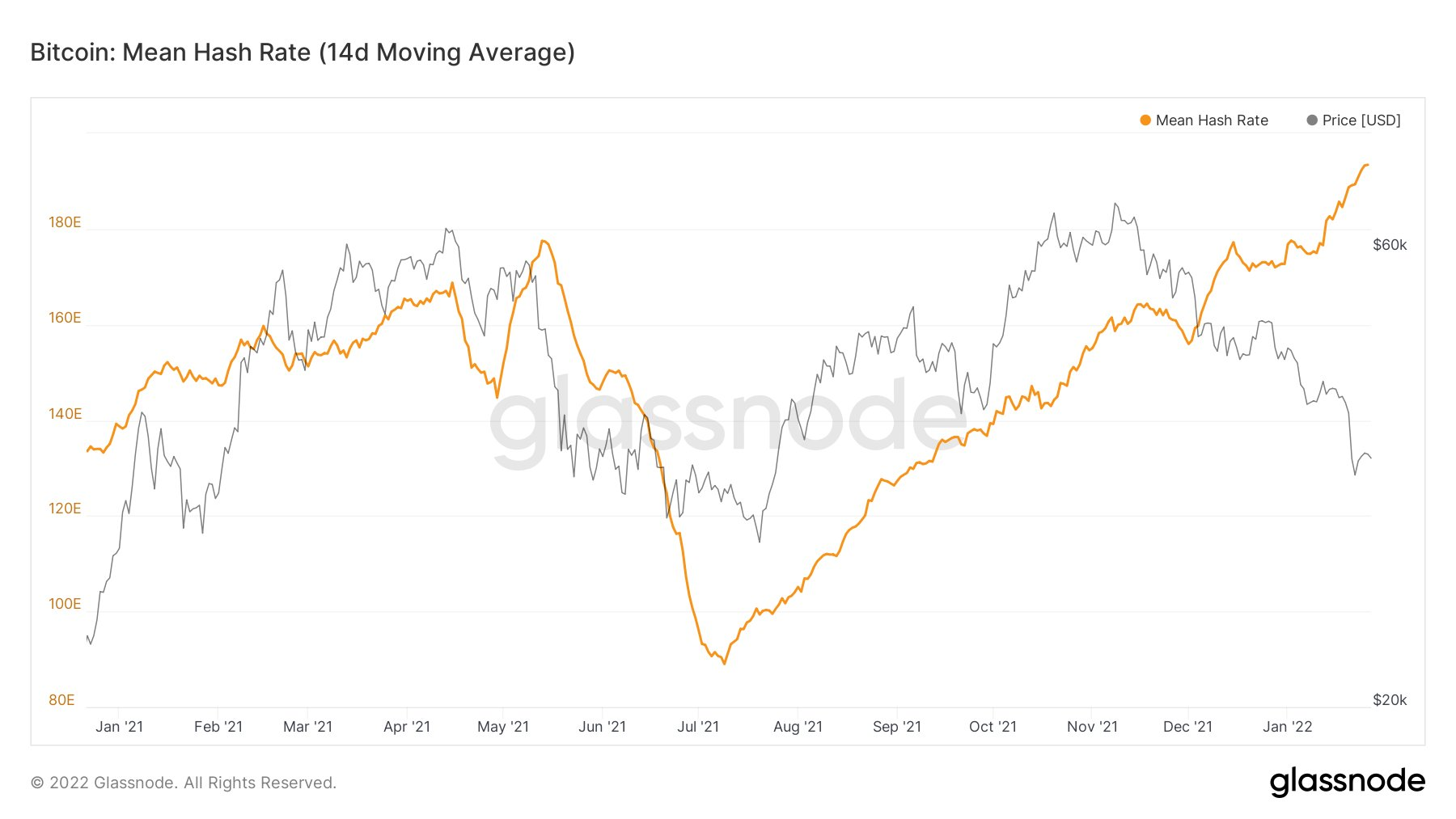

In terms of network security, the hashrate continues its incredible bounce back from the China mining ban, consistently hitting all-time highs. This only goes to demonstrate the strength and economic incentives of the network along with the decentralised nature whereby mining hardware continually comes online worldwide. Russian President Vladimir Putin also pushed for a regulatory framework to be created for Russia as they look to expand into the mining industry. This industry poses many advantages to Russia geopolitically, representing an asset not directly tied to the U.S. financial system, allowing Russia to circumvent sanctions and to make use of alternate payment and transaction methods should the U.S. act upon threats of removing Russia from the SWIFT banking system. Being an energy rich country, Russia now has viable means by which to monetise this advantage.

In other news, Nayib Bukele met with Turkey’s President Erdogan who is facing a currency crisis of his own. The meeting no doubt included discussion around using Bitcoin as a central bank asset and a form of legal tender part within Turkey. Following that meeting, Erdogan pushed for a regulatory framework for digital assets, potentially signalling another country preparing to follow in El Salvador’s footsteps. Overall, although the month of January has had negative price action, the fundamentals behind the scenes strengthen week by week in terms of the network, on-chain metrics and international adoption.

Ethereum

The performance of Ethereum (ETH) has continued to decline going into the new year when considering its price action. January has seen ETH fall in price from a region of approximately $3,700 all the way down to a level of approximately $2,500. This 32% decrease in price dwarfed the previous fall in price that ETH experienced in December 2021 by over 10%. ETH’s price action throughout January 2022 is illustrated by the following chart:

A possible explanation for the sudden drop in the price of ETH towards the latter end of the month could be attributed to opportunistic crypto exploiters lurking on OpenSea. Users on the OpenSea platform have been estimated to have lost over $2 million after a bug on the platform allowed exploiters to purchase highly valuable items at extremely discounted prices before escaping with a significant realised profit. This could have possibly impacted the price of ETH as NFTs spiking in popularity can lead to greater selling pressure on ETH. Around the time of this event (Jan 24th), ETH reached new lows for 2022, dropping by approximately 12% to the $2,160 price level. Since this event, ETH has recovered slightly and has increased in price to the $2,500 level.

Despite the slow start to 2022, ETH is still looking forward to new developments, however ETH protocol has decided to move away from terminology relating to ETH 1 and ETH 2. Instead, the ETH foundation is rebranding new ETH 2.0 features as part of their consensus layer. This does not mean that ETH 2.0 is cancelled, though, as the network is still planning on migrating to a greener Proof of Stake (PoS) mechanism that will phase out the mining process. This process is shown below:

- ETH 1 → execution layer

- ETH 2 → consensus layer

- Execution layer + Consensus layer = Ethereum

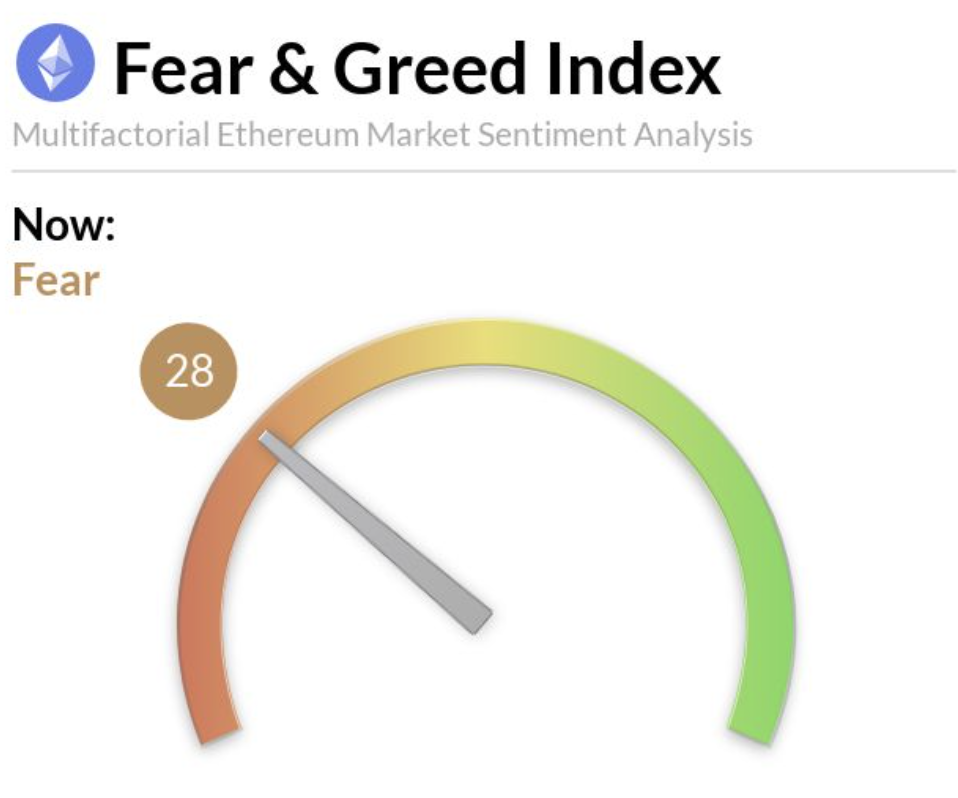

Ultimately, the short-term market sentiment for ETH is bearish when considering that January is its worst performing month since March 2020. However, DeFi in general has made a small recovery to close January, with ETH itself ending the week on a 2.4% high. The total value locked (TVL) in the DeFi market has increased by more than 5% in the last week. As TVL is a popular metric to measure market growth, February could present further opportunities for growth in the crypto space. However, this is not necessarily a guarantee as DeFi’s TVL figure has fallen below $200 billion (from a previous level of $250 billion in December 2021) as of January 23rd. Moreover, this uncertainty could be associated with high levels volatility driven by fear as illustrated by the index above.

Altcoins

January saw altcoins outperform the majors such as Bitcoin (BTC) and Ethereum (ETH). Whilst major cryptos have fallen and are currently stuck in a range with little volume and momentum, making it hard to establish any clear direction, the altcoin market was home to some substantial gains with the best performing sector being that of the native tokens associated with cross-chain interoperability protocols such as Moonbeam’s Glimmer (GLMR), Moonriver (MOVR) and Celer Network (CELR).

Interoperability has the potential to be a key theme in the cryptocurrency market in 2022 as a vast number of projects within the ecosystem release integrations allowing for cross-chain compatibility. Whilst this has been one of the long-term goals of the crypto ecosystem in terms of establishing an interconnected network of protocols, in doing so it has given rise to a new DeFi market for multi-chain bridges and further development of decentralised finance.

In regards to performance, some of the top altcoins have rebounded after the previous crash, experiencing the following gains: Synthetix (SNX) and Loopring (LRC) had the strongest recoveries, up 38.4% and 33.8% respectively; Theta Fuel (TFUEL) was among the strongest performers for the week, up 29.5%; Avalanche (AVAX), the Ethereum challenger, is up 22% in the past week to nearly $72, while Dogecoin (DOGE) and Polygon (MATIC) are each up 11% in that time.

Solana (SOL) had an eventful week. A brief glance would show Solana to be up 1.4% on the week, but on Monday, Solana had lost almost 16% of its value in 24 hours and was down 42% in seven days, after high network congestion led to a ‘partial outage’ last weekend.

Of the top 20 cryptocurrencies (by market cap) the largest loss was experienced by Terra (LUNA), which was down 27% on the week to a value of $51. Additionally, Ripple has announced that it has bought back the shares of investors who financed its Series C funding round of $200M in December 2019.

CRV, the governance token of decentralised exchange (DEX) Curve.Fi, is extending its five-month winning streak as the battle between DeFi protocols for control leads to a demand-supply imbalance. More protocols are building off of Curve, and an entire ecosystem is emerging. A revived interest in Layer 1 is fuelling growth in some tokens even as bitcoin shows signs of weakening. For example, the native tokens of the Fantom and Near blockchains surged more than 20% over the past week.

Regulatory Updates

In light of the recent Opensea exploit, many crypto natives are asking for regulatory input into how sellers using the platform can be better protected against future issues related to incorrect listings on the platform. Already, Opensea has reimbursed 750 ETH (around $1.7 million), however the actual lost (stolen) figure is estimated to be well over $2 million. The reimbursements themselves represent an unsatisfactory resolution for many investors, as their assets were never meant to be sold in the first place, even if they have received the “Fair Value” of the asset, they no longer own the asset.

The SEC has rejected the Fidelity Spot Market Bitcoin ETF, adding to the long list of SEC rejected spot ETFs. Since November, the SEC has rejected six applications for a BTC spot ETF with a further nine applications awaiting decisions. The same reasoning for this rejection was given as with previous instances; the SEC stated that Fidelity did not give sufficient evidence on how it would prevent fraud for consumers investing in their Cboe BZX Exchange product. The nine remaining applications still provide an opportunity for hope for a Bitcoin spot ETF to be approved in 2022, however, for the short-term we will all be waiting a little longer.

A draft version of the America COMPETES Act of 2022 "empowers the [Treasury] Secretary to prohibit any (or indeed all) cryptocurrency transactions at financial intermediaries without any process, rulemaking, or limitation on the duration of the prohibition.” This would extend to the Treasury Secretary, in theory, the ability to shut down cryptocurrency exchanges unilaterally. This Bill would also apply to all other financial institutions in the U.S., although the actual purpose of the Bill is to further counter money laundering issues. The current powers enable the Treasury Secretary to shut down any accounts connected to money laundering, but the public must be notified first and then must be given the opportunity to make comment. Further to this, any prohibition can't last longer than 120 days. However, under the new Bill, all those requirements will be forgone and instead the Secretary alone will wield the power to conduct ‘special’ in-depth financial surveillance.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)