Bitcoin

The new year has finally arrived with most of the world celebrating with their friends and families once again. However, the threat of social and economic turmoil looms over people’s heads as Omicron cases surge throughout the world. This state of trepidation is reflected in the cryptocurrency market as Total Market Capitalisation has fallen by ~10% so far this year, with volume also dwindling.

Bitcoin picked up from where it left off last month, trading with little volume and still within its tight $46-48k range. Since Bitcoin’s last all-time high in November, traders and investors have been aggressively buying the dip, using a significant amount of leverage each time. Multiple market wide liquidations have occurred since then, moving down the price of bitcoin each time. The biggest of these liquidations occurred in early December with more than $2.2 billion liquidated in one day. This has left investors buying back in with caution and with little leverage, which is one of the reasons for the lack of volume this year. The other reasons include sharply rising COVID cases and the risk of increasing interest rates in response to high inflation rates.

Chairman of the Federal Reserve Jerome Powell made an announcement pertaining to inflation rates on Wednesday, January 5th indicating that the Fed could move up their schedule for rate-hike cycle to as soon as mid-March. This would increase the cost of borrowing money and could lead to sell-offs in risky markets such as equities and cryptocurrencies as it would become much more attractive for retail investors/consumers to save under these conditions. This was the case on Wednesday when bitcoin decreased from $46,500 to $43,000 in response to the announcement, falling below $40,000 temporarily before it then increased back to $43,000 again. Additionally, Kazakstan’s government lifted their petroleum gas price cap which saw gas prices virtually double overnight. This resulted in political unrest and the government shutting down internet services and, therefore, mining nationwide. Considering Kazakstan is the second largest miner in the world, second only to the USA, the fall in hashrate may have signalled a subsequent fall in bitcoin’s price.

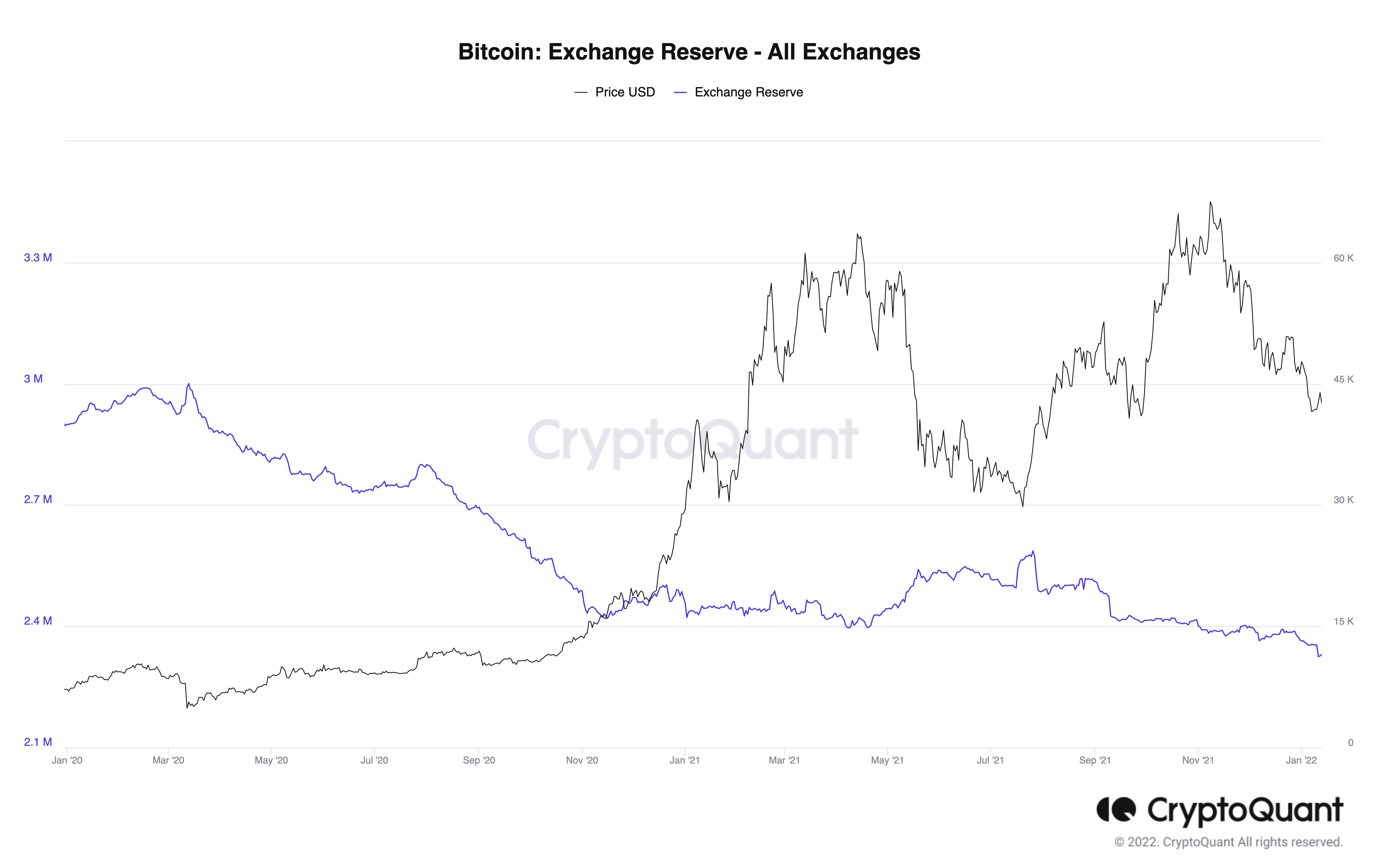

In the face of these global events however, on-chain metrics have remained quite bullish. Despite the current price action, exchange reserves continue to drop. This indicates that investors are still looking to accumulate and withdraw their bitcoin from exchanges. As the exchange reserves continue to drop, it could indicate lower selling pressure on exchanges and therefore more room for an increase in the market.

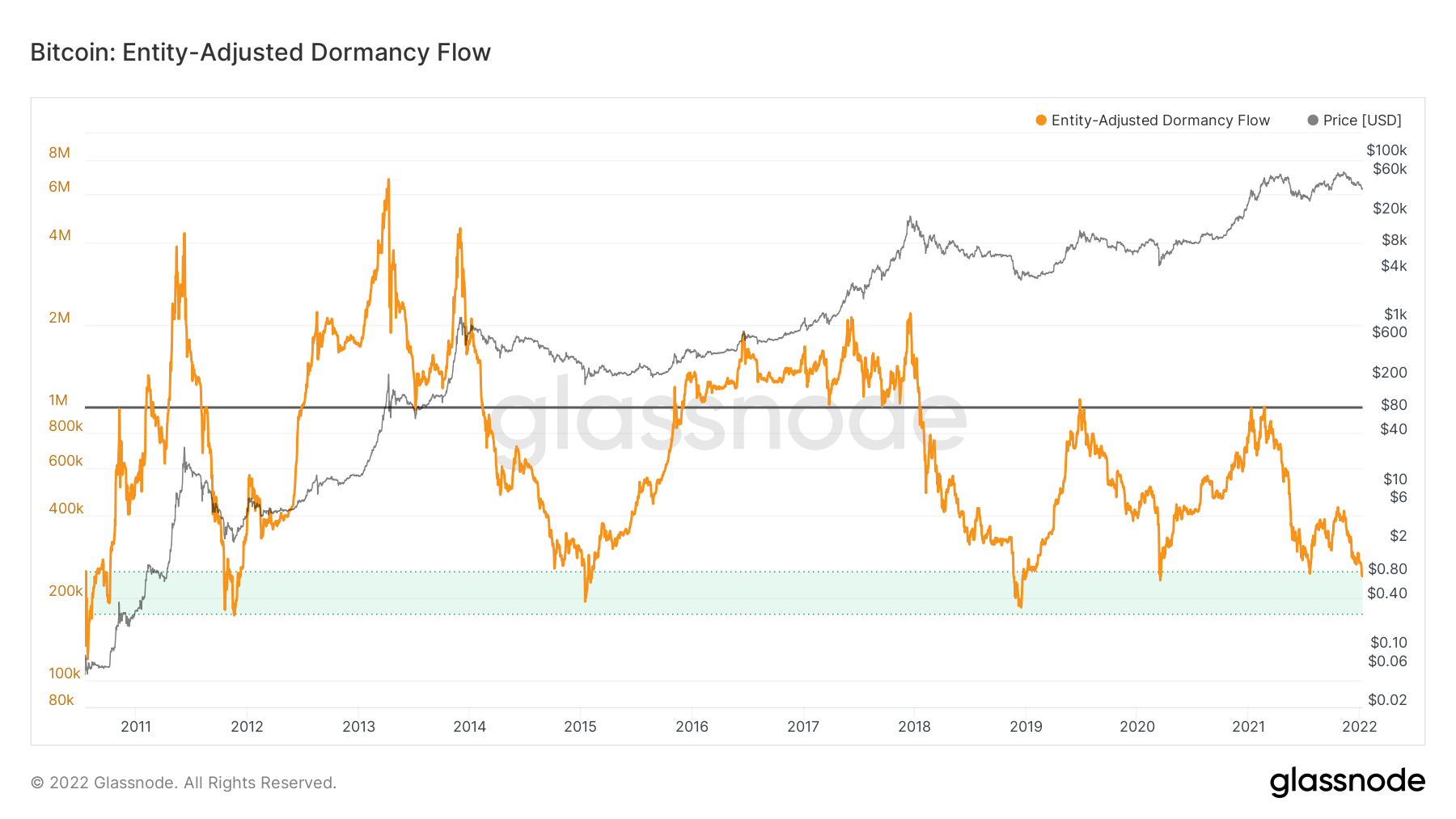

Entity-adjusted Dormancy Flow is the ratio of the current market capitalisation to the annualised dormancy value (measured in USD). Entity-adjusted Dormancy Flow could be used to time market lows by seeing if ‘smart’ money is selling. Currently, over three quarters of BTC are in illiquid wallets, meaning that most holders are staying put, patiently accumulating and waiting out. Historically, the area of under $250,000, which we are currently at, marked major price bottoms, as seen in the image below, provided by Glassnode.

With bitcoin having lost nearly 40% of its value in the past two months, the on-chain data metrics indicate we may be in the final stages of a bearish trend. The dropping exchange reserves explain the large amount of BTC in illiquid wallets which may constrict supply and thus boost demand in the long term.

Ethereum

Ethereum was not immune to bitcoin’s sell off over the last few weeks. It dropped almost 25% from its high of $3,893 earlier in the month, making a low under $3,000. It has since recovered quite strongly moving back through resistant levels to sit just under $3,400.

During the downturn, Ethereum underperformed BTC. The ETH/BTC chart below shows Ethereum dropping more than 10% during the pullback earlier in the month. It has since somewhat recovered. This isn’t all that surprising as Ethereum tends to outperform Bitcoin while the market trends up and underperforms while crypto assets more broadly depreciate in value. It would not be surprising to see Ethereum continue to outperform bitcoin if the market does rally.

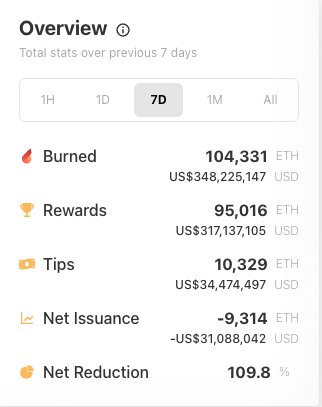

Fees on Ethereum have been quite high over the past few weeks. Basic transactions on the Ethereum network have attracted fees ranging from $15-$25 over the last few weeks, up from around $5-$10 in the previous month. While this does make the Ethereum network more burdensome to use, it does come with the benefit of burning more Ethereum and reducing the increase in supply. In fact, Ethereum has actually been deflationary over the last week. Miners were rewarded with 95,016 ETH over the last week for securing the Ethereum network, while 104,331 ETH was burnt. This resulted in a net issuance of negative 9,314 ETH.

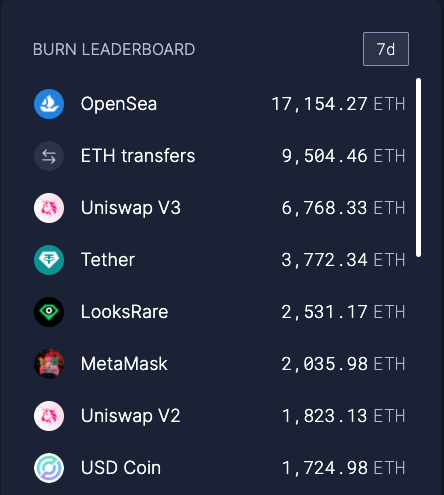

The platforms responsible for the most Ethereum burnt have continued to be OpenSea, Uniswap V3 and normal transfers of ETH. The share of ETH burnt by OpenSea has increased substantially over the last few weeks. This week, OpenSea was responsible for burning more Ethereum than Uniswap and ETH transfers combined, whereas ETH transfers and Uniswap had previously both accounted for more burnt Ethereum individually. This demonstrates that NFT volume has picked up significantly, which isn’t all that surprising as NFTs have largely performed well this month.

Altcoins

While BTC showed signs of recovery as the year turned, investors began to flock to altcoins and NFTs. Layer 1s were hot again with Harmony (ONE), Fantom (FTM), Cosmos (ATOM) and Algorand (ALGO) showing strong price action relative to the rest of the market. This quickly changed as bitcoin fell from its previous range of $46-48k down to $40,655, taking the rest of the market with it. As a result, the majority of altcoins corrected roughly 15-20% compared to last month while only a handful of coins like Chainlink (LINK), Internet Computer (ICP) and Harmony (ONE) increased in price this year. Chainlink is currently the largest blockchain oracle network and recently acquired Ex-Google CEO, Eric Schmidt as technical advisor to help continue the vertical scaling LINK had seen. Harmony’s positive price action may be an indication of DeFi activity as investors continue to rotate into different smart contract platforms and take advantage of their incentives. This is backed up by ATOM and FTM also holding up fairly strong relative to the rest of the market, with total value locked (TVL) increasing in these ecosystems.

Despite the strong finish to last year, metaverse tokens were down ~17% compared to last month’s highs as early investors continued to take profits. The hype for the metaverse has dwindled since Meta’s huge announcement which has been reflected in the subsequent price action of these tokens. While these projects look to push the boundaries of social interactions and how we interact with day-to-day life, the technology required is new and experimental and will take time to build out. Therefore, rallies in this sector will most likely come in waves as news and announcements roll out during the development stages.

Despite the correction in the wide crypto space, NFTs have made a fantastic start to the year. The largest NFT marketplace, OpenSea, saw their highest daily volume (USD$255.8m) performance since their peak in August last year (USD$322m) on just the second day of the year, with no signs of slowing down. This is most likely due to the increasing amount of major brand deals occurring between sports/fashion brands and NFT studios, further validating the use of the technology and potential of other collections. This saw a spike in OpenSea trading volume to over 9,000 ETH during the first week of the year, which continued to grow by 70% (15,100 ETH) in the second week.

Regulatory Updates

In terms of the regulatory front, Lisa Cameron, a UK Member of Parliament, established a lobbying group focused on promoting crypto legislation in the UK. The Crypto and Digital Assets Group, chaired by Cameron, will lobby for regulation or legislation that supports innovation, while protecting consumers from financial crimes, scams, and unregulated offerings. This is very welcomed as retail investors and newcomers should be advised and wary of the potential risks, dangers and scams in the cryptocurrency space.

Across the waters, in the United States, as seen regularly throughout 2021, 2022 started in the same manner with the SEC bringing yet another securities law complaint against an ICO issuer. On this occasion, a complaint was brought against the Crown Machine issuers, who launched CMCT in 2018. The token was traded for only four months, between January and April 2018. The SEC has deemed the token to be a security and is seeking penalties for its unregistered offering. The SEC will only continue the crackdown in the industry up until the introduction of clearer legislation. While the SEC continues cracking down on the industry, the question of whether cryptocurrencies should be classified as securities or commodities will continue to be the centre of debate in certain political circles.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F6KbiaLlIB8Tm3DJwtdfgDv%2Fd222d0acf493a72e192ac68ad237b66b%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-07T00%3A32%3A51.082Z)