Bitcoin

The month of March saw a welcome trend reversal in terms of price action for Bitcoin. Having started the month at approximately $44,500 USD after a considerable period of consolidation, the price rallied to end the month at $47,000 USD, with the price even briefly touching the $48,000 USD level. This gain of 5–6% has been promising despite the macroeconomic concerns around rising rates, energy shortages, gas price rises, and geopolitical instability stemming from the Russia-Ukraine conflict.

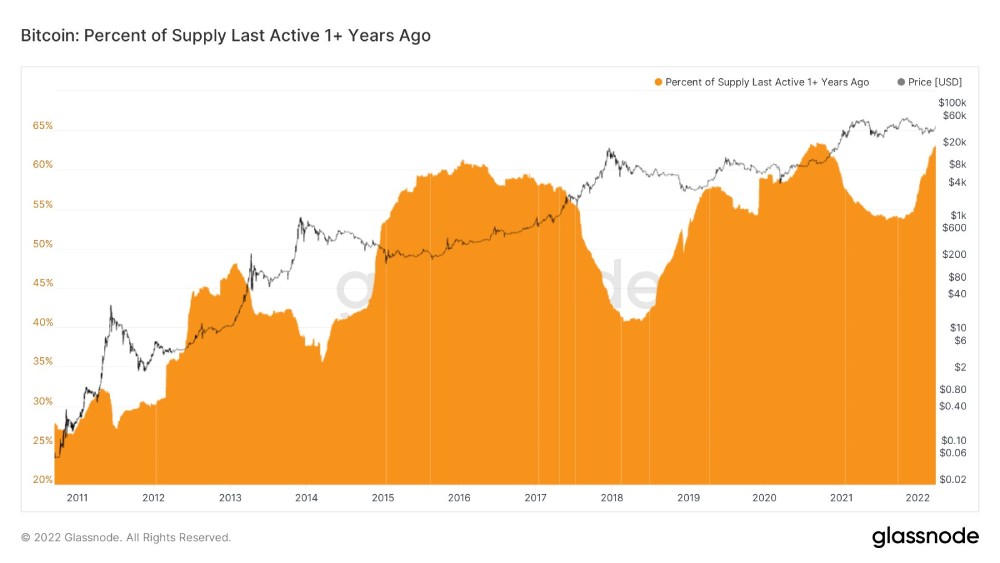

While investors may have concerns on the surface level, a closer examination reveals potentially bullish catalysts for the recent positive trend. Notably, with respect to supply dynamics, the percentage of inactive supply exceeding a one year period (moved between wallets and exchanges) is at its highest since September 2020 indicating that many holders and Bitcoin are currently sitting on the sidelines. When looking at this data point in the past, it has historically signalled aggressive parabolic price action as the tradable float (the quantity of Bitcoin that can be traded) shrinks and becomes more susceptible to demand spikes. However, a significant movement in market sentiment and demand for Bitcoin could lead to subsequent price action being very erratic.

Russia considers accepting Bitcoin for oil and gas. Image: Shutterstock

In terms of global developments, the head of energy for the Russian Duma Committee (the lower house of the Russian government) discussed at a conference the potential for Bitcoin to be used as a means of payment for oil and gas exports. This comes amidst increasing sanctions on Russian exports, largely led by the US, and the response by Russia to demand Russian ruble payments in order to receive their energy exports. While the move to accept Bitcoin for energy from Russia is very much in its infancy, it is an indication that digital currencies such as Bitcoin are now being more seriously considered as part of national strategy.

In the crypto-native sphere, this month saw a big development for the US Dollar stablecoin $UST, Terra’s decentralised algo-stablecoin. As the cryptocurrency market has grown, so too has the demand for stablecoins. Terra’s stablecoin has become the first to work off of a "Bitcoin standard" whereby reserves of the stablecoin are backed by Bitcoin. The Luna Guard Foundation has raised $2.2 billion through the sales of Terra (LUNA) with the goal of reaching $10 billion. Do Kwon, the co-founder, has openly stated his intentions and has begun accumulating Bitcoin, putting some buying pressure on an already increasingly illiquid supply. As the year progresses, these developments will be pivotal to the success of onboarding the early majority onto this new monetary standard and should help ease price movements as a result.

Ethereum

Ethereum's (ETH) performance in March surpassed that of February by a large margin. ETH experienced negative price activity in the first ten days of the month, falling 7.7% from $2,948.15 to $2,720.23. However, ETH consistently trended upwards from this point until the end of the month,peaking at around $3,466.52, representing a monthly percentage increase of almost 17.5%. This dwarfs the 11% price increase that BTC witnessed over the same time period.

The 'Ethereum Merge' was a hot topic in the ETH community in March, as the expectation for ETH's newest update grew. According to Google trend statistics, interest in this issue peaked in March. The significance of this is that the 'Ethereum Merge' will aid ETH's transition from proof-of-work (PoW) to proof-of-stake (PoS), which is set to take place in Q2. When you combine this unexpected rise in interest surrounding the 'Ethereum Merge' with the present growth of the entire cryptocurrency market (currently valued at over USD $2 trillion), the outlook for the performance of Ethereum throughout 2022 seems promising.

Altcoins

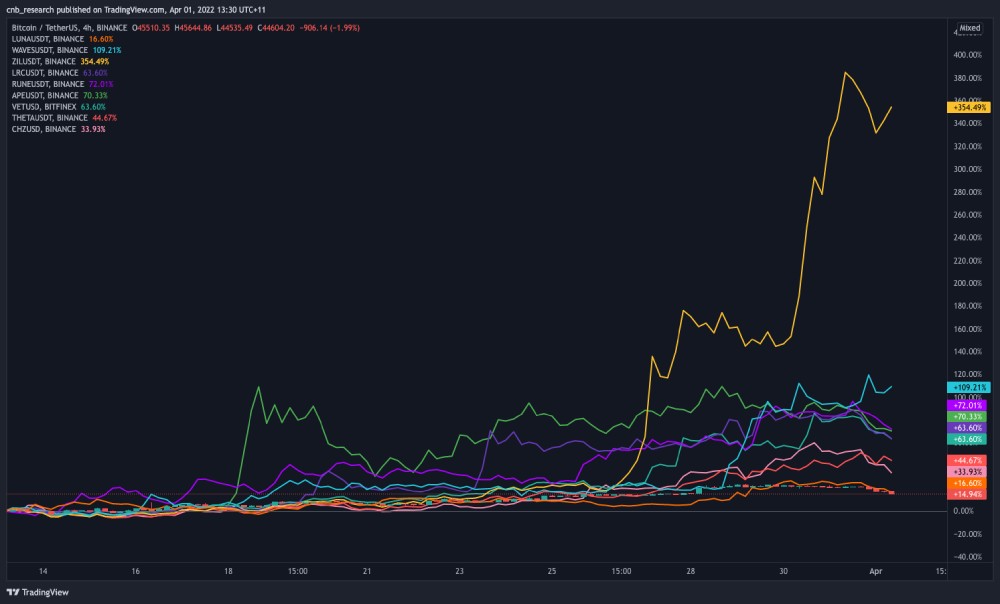

This month saw the majority of altcoins mimic the price movements of BTC and ETH, experiencing a steady increase in price after the initial dip during the first week. Having traded sideways for the majority of 2022, altcoins have picked up volume this month and ended March positively across the board. Most noticeably, Zilliqa (ZIL), Terra (LUNA), Loopring (LRC) and THORChain (RUNE) broke away from the general trend and saw huge gains over the last one to two weeks.

This outperformance can be attributed to a multitude of factors. As for Loopring, Gamestop announced earlier this month that LRC would be the blockchain network and native token to power its upcoming NFT marketplace. This caused the price of LRC to rally 57% over the next 48 hours. THORChain (RUNE) also experienced a sizeable gain following positive announcements earlier this month regarding developments to the ecosystem and the launch of synthetic assets on their trading platform. Over the past 30 days, RUNE is up approximately 236%.

Most recently, Zilliqa’s announcement saw ZIL gain over 350% over the past 5 days. The announcement confirms the first Metaverse-as-a-Service (MaaS), called Metapolis, to be built on the Zilliqa network, as well as confirming the partnership with Agora to aid with the project. Agora will be responsible for providing the blockchain solutions to the Zilliqa network. Further, the Metapolis project will be built on Unreal Engine, Unity, and Nvidia Omniverse. The use of Unreal Engine may mean that we will see graphics comparable to the top recent games such as Fortnite, Street Fighter 5, Valorant, or Gears of War.

Finally, Bored Ape Yacht Club (BAYC) launched their native utility token earlier this month, called ApeCoin (APE). The new ERC-20 token was available to claim by Bored Ape NFT holders and started trading live on Binance on the 17th of this month. The token is designed for utility and governance within the BAYC ecosystem as well as governance in community proposals. The roadmap also has plans for integrating the token into the BAYC metaverse space. APE closed the month at $12.70, up 53.5% from its initial price of $8.27 on Binance.

NFTs

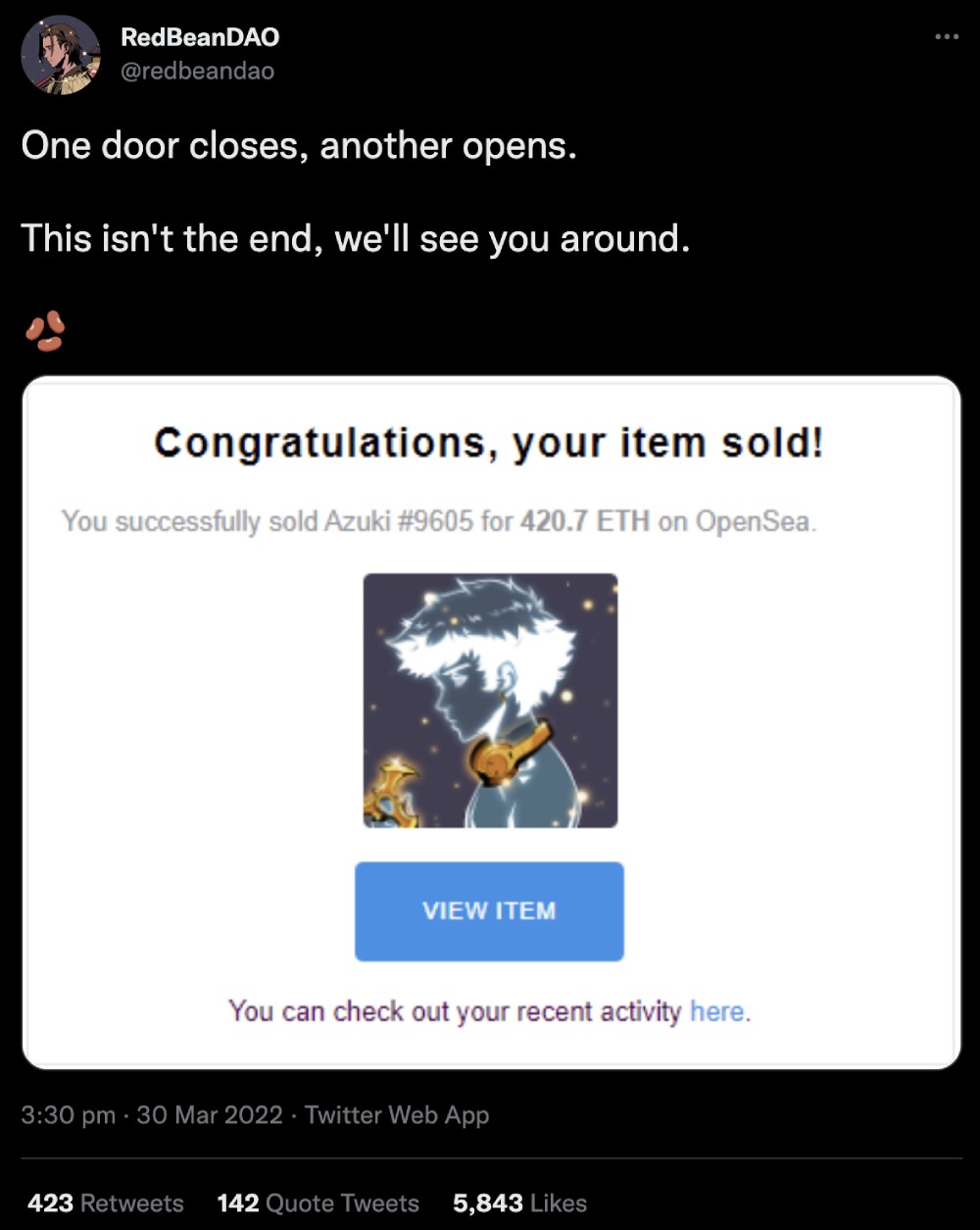

The Azuki NFT project, which debuted earlier this year, has had its first sale surpassing $1 million USD. The NFT follows in the footsteps of Bored Ape Yacht Club and CryptoPunks in that it is more focused around the artwork rather than on utility. Azuki #9605 sold for 420.69 ETH, which equated to $1.42 million USD, at the time of acquisition. Even without this milestone, Azuki is the top NFT project for 2022 based on trade volume alone, surpassing $500 million in sales volume. In the month of March alone, Azuki’s sales volume stood at $85 million, beating CryptoPunks’ $76 million. BAYC and Mutant Ape Yacht Club remain unbeaten with sales volume of $220 million USD and $150 million USD respectively over the last month, and are still the most popular NFT collections around.

Late this month, OpenSea announced its plan to introduce NFTs built on the Solana blockchain to its marketplace, with a launch date set for April. Solana is the second-largest NFT ecosystem, trailing only Ethereum in terms of scalability and gas fees. With the majority of NFT volume in OpenSea, this may be the catalyst that Solana requires to enter the market and potentially dethrone Ethereum.

Regulatory

In mid-March, the EU’s Committee on Economic and Monetary Affairs voted against a version of the Markets in Crypto Assets bill (MiCA) that could have effectively banned proof-of-work based crypto assets in the EU. It is understood that two versions of MiCA were set to be voted on, with one version including significantly more restrictive language that, according to a member of the Committee, was not supposed to emerge in the final draft. This controversial proposal to limit proof-of-work mining failed, with 32 members voting against and only 24 in favour. It is worth noting that these minority votes came largely from European political parties focused on environmental issues or progressive, redistributive policies. The version of MiCA that is set to advance does still contain provisions addressing environmental concerns, but allows the European Commission time to legislate in this specific region, with no requirements coming into effect before Jan 1, 2025.

Jumping to the U.S, the Biden Administration has finally clarified its upcoming plans for an Executive Order targeting crypto regulation in the United States. Throughout the Fact Sheet published by the Biden Administration, the Executive Order is described as addressing the implications of a crypto market on ‘consumer protection, financial stability, national security, and climate risk’. While the Executive Order appears to vest responsibility over crypto policy research and development with the Department of the Treasury, the Biden Administration describes the approach going forward as a ‘whole-of-government approach’.

Finally, after the Australian Government committed to exploring crypto regulation in December 2021, the Australian Treasury has published a consultation paper outlining potential approaches to crypto regulation. The consultation paper focuses on providing avenues to licensing for crypto asset secondary service providers (CASSPrs), as well as outlining possible crypto custody requirements. Throughout the consultation paper, the Treasury has acknowledged the growing importance of the crypto asset ecosystem to both the Australian and global economy, the need for regulatory certainty to foster innovation and competition, and to instil greater consumer confidence in their dealings with CASSPrs.

Further reading: The Game Theory of Crypto

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)