What an incredible start to 2021 the cryptocurrency space has experienced, as of writing we have seen new All Time Highs for Bitcoin ($64,804.72) and Ethereum ($2,399.57). Today, Coinbase went public, debuting on Nasdaq at $381 per share and wrapped its first day of public trading with a share price of $328 - a 31% premium from the reference price of $250. Bitcoin has also caught the attention of institutional and retail investors alike with many Banking Giants beginning to offer investment options to clients in ways we have never seen before. All this occurring while a global pandemic is destroying nations’ financial systems, forcing many individuals to finally turn to Bitcoin as a store of value and an overall hedge to the fiat monetary banking system.

Stimulus on Bitcoin

In mid-March, President Joe Biden signed the American Rescue Plan - a $1.9 trillion stimulus package into law. This represents the third such coronavirus relief stimulus check, worth $1,400.

So, how does Bitcoin fit into this?

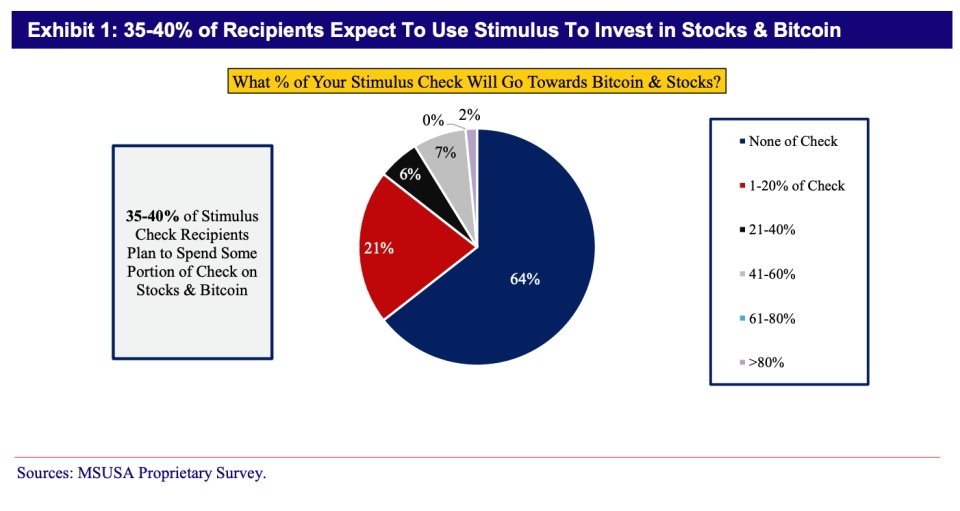

Survey results have shown that around 10% of funds, which would make up nearly $40 billion of the $380 billion in direct stimulus check deposits, may be used to purchase Bitcoin and stocks, with stimulus check recipients found to prefer Bitcoin. Analysis by Mizuho Securities found that stimulus check investments into Bitcoin “could add as much as 2-3% to Bitcoin's current $1.1 trillion market value".

One of the major reasons for this line of thinking is Bitcoin’s appeal towards the decline in value of the US Dollar. This has been good for Bitcoin’s investment case as a hedge against inflation and as digital gold. Unlike the US Dollar or any other fiat currency, Bitcoin was designed to have a limited supply, so it can’t be devalued by government interventions.

Another appeal is the mainstream growth that Bitcoin has had since the last stimulus payment in April 2020. If people had used their first stimulus check of $1,200, it would have funded the purchase of 0.18 BTC, which is worth roughly $13,500, an increase of 1025% in just a year.

Jumping back to April 2020, most Americans used their $1,200 stimulus checks on expenses such as bills, essentials and emergency savings, with only some Americans investing their entire check into Bitcoin. Nevertheless, during the month of April, we saw Bitcoin rally over 60%, with a lot of individuals speculating it was partly due to stimulus deposits.

With the stimulus checks getting sent out now, many crypto exchanges are waiting to see if there is any remarkable uptick in $1,400 purchases. Has the Bitcoin-buying bonanza ceased or will history repeat itself?

Visa and Paypal

Concurrently, in March 2021, Visa and Paypal announced that it would allow customers to use cryptocurrencies on their platforms. Visa would specifically allow the use of USDC to settle transactions with Visa over Ethereum. As for Paypal, they are now allowing US customers to pay with Bitcoin, Ethereum, Litecoin or Bitcoin Cash.

Both Visa and Paypal are joining the growing number of companies that are accepting cryptocurrencies as a form of payment. In early March, Tesla announced its acceptance of Bitcoin as a payment method. In 2018, Square launched a feature for Bitcoin on its Cash App.

As the use and acceptance of digital currencies accelerate, it will enable cryptocurrencies to make purchases with businesses around the world - the next chapter of driving mass acceptance of digital currencies. With more well-established companies driving the acceptance of crypto, peers and rivals will soon do the same.

Banks Banking on Bitcoin

Other than payment networks, Bitcoin is knocking on institutional investors' doors as well, with companies such as Goldman Sachs, JP Morgan and Morgan Stanley allowing their clients to gain exposure to cryptocurrencies like never before. JP Morgan strategists Joyce Chang and Amy Ho recommended to clients that a 1% exposure to cryptocurrencies in their overall portfolio should be used “in order to achieve any efficiency gain in the overall risk-adjusted returns of the portfolio”.

Goldman Sachs has decided to relaunch its cryptocurrency trading desk after the project was put on a 3 year hiatus at the end of 2017 due to regulatory issues. The banking giant will now support Bitcoin futures trading with its clients; this comes after the head of digital assets at Goldman Sach Mathew McDermott disclosed that “40% of clients currently have exposure to cryptocurrencies”. This should provide crypto markets with greater liquidity as investors are able to gain larger exposure to Bitcoin through OTC desks.

Morgan Stanley has followed suit, launching access to three different funds that enable the ownership of Bitcoin. Two of the funds on offer are from cryptocurrency investment firm Galaxy Digital, while the third is a combined effort from FS investments and the Bitcoin-centric company NYDIG. According to Morgan Stanley, the investment devices should only be used by those who have ‘an aggressive risk tolerance’ and will only be offered to those retail investors who already have at least $2 million in assets held by the firm. Investment firms need to have a minimum of $5 million to qualify for the new offering and further if trading through the Galaxy Institutional Bitcoin Fund LP clients will need a minimum investment of $5 million. If these numbers sound absurdly high to you then you are probably right, excluding individuals who do not have access to that amount of capital goes against everything cryptocurrencies and decentralised finance was built on. Whatever the case, this news is bullish for cryptocurrencies going into the future as it legitimises Bitcoin's store of value, something that has been argued against by the mainstream since Bitcoin’s inception all the way back in 2008.

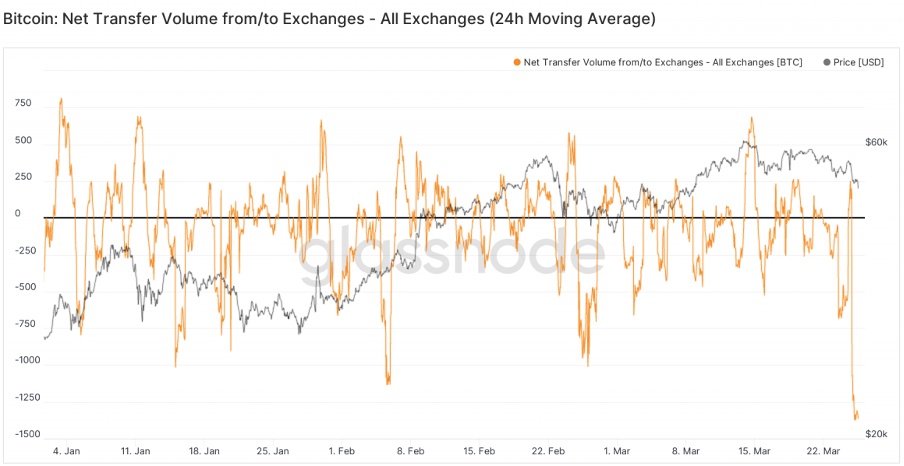

Exchange Data

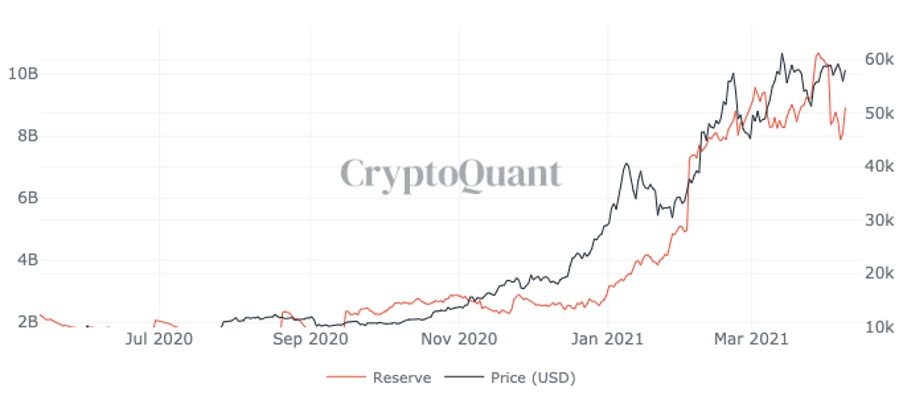

Moving to some strong signs for Bitcoin, large exchange withdrawals continue despite Bitcoin’s rising price over the last few months. This signals that many investors are considering longer term holding periods as threats of inflation or even hyperinflation face many nations’ fiat currencies around the world. More than 1350 BTCs (equivalent to $67 million USD) were withdrawn from exchanges on the 26th of March during the same time Bitcoin fell from $57000 to just above $50000. The plot below depicts this visually - there have been continuous large withdrawals as the price of Bitcoin increases, highlighting that many investors are locking in their bitcoin for a safer and longer term holding period.

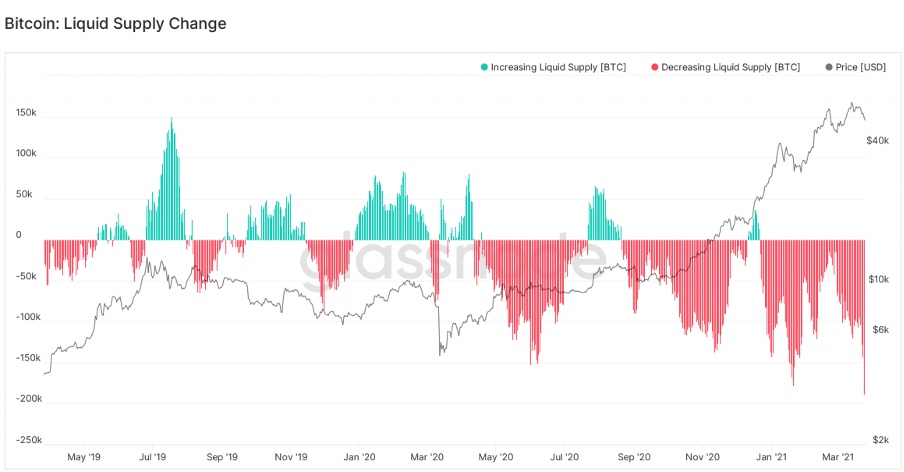

Further, the evidence that these holdings are being withdrawn and transferred to longer term holding positions is clearly evident when taking a closer look at the liquid supply change of Bitcoin. The net change in supply of liquid and highly liquid positions has pushed to the highest negative levels not seen since the last bull-run of 2017. This is a bullish indicator for Bitcoin as new investors can have greater confidence that the market they are buying into has a current sentiment to hold positions for a longer time period. It also indicates the use of Bitcoin as a hedge to the US Dollar after yet another round of trillion dollar stimulus packages were injected into the American economy.

Stablecoins on Exchanges

Stablecoin holdings on exchanges have exploded since January reaching as high as $10 billion on March 28th, showing the rapid adoption of 1:1 (dollar for dollar) paired cryptocurrencies such as Tether (USDT). These massive inflows can represent a greater intention to buy as it highlights the demand for long Bitcoin positions. Pairing the increased Bitcoin exchange outflows, the shift in liquid supply of bitcoin to negative levels and these large stable coin exchange inflows signals an increased demand to buy being the more probable case. This is a bullish outlook for holders as new and old investors alike look to re-enter the market once again despite the higher price.

Another factor that could be influencing these inflows is the news from Visa deciding that they would allow clients to settle positions using the second largest stablecoin by market capitalisation standards, USD Coin (USDC), which created a greater mainstream awareness around stablecoins’ use cases in everyday living.

Ethereum

Looking at Ethereum, we saw a new all time high of $2,198.36 USD on April 10th, this coming after the bullish news from Paypal as well as a market-wide rally. ETH has since rallied above an original support level of $2,135 to formulate a new all time high of $2,399.57 on April 14th.

It will be interesting to follow how ETH moves over the next few weeks as more Altcoins built on Ethereum, such as OMG and Populous, continue to see great success (93% and 121.5% gains over the last 30 days respectively), as well as the explosion of the NFT space which is largely supported by ETH. For a more in-depth analysis of the Ethereum space, check out our recent article discussing all there is to know about Ethereum now and into the future here.

Closing Remarks

The start of 2021 has been an exciting time for the cryptocurrency space. The involvement of many larger Banks has set the tone for those that will follow as more individuals look to immerse themselves with the cryptocurrency space. Bitcoin has performed extremely well and as we move further into the year following how bitcoin tracks as more people lose faith in the US banking system due to modern monetary policy will be interesting to watch . To sum up, the start of 2021 has been highly successful for bitcoin and cryptocurrency alike and we are all looking forward to what else 2021 will have in store.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)