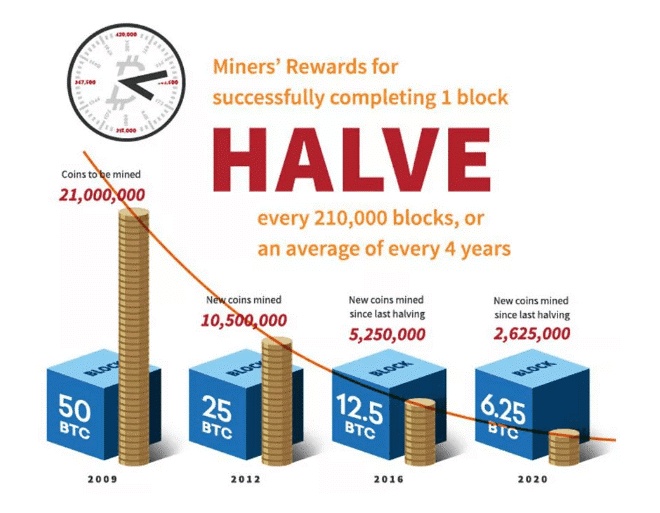

The Halving

Within the next two weeks the block reward for mining a new Bitcoin will be cut in half. Whenever a block of Bitcoin is successfully mined, the miner receives a payment in Bitcoin. This process is a fundamental part of the underlying technology which enables the coin to function.

The following link details the countdown as to when this event will occur - https://www.bitcoinblockhalf.com/

The last Halving event happened 4 years ago in 2016, please see below a chart detailing Bitcoins performance in the months leading up to and after the event took place.

BTC/USD - March to December 2016

In the months either side of the Bitcoin Halving in 2016 we can see increased volatility. Bitcoin jumped slightly in price after the event and then bounced between $620 and $680 for a short while before quickly diving 30% in price on the 2nd of August 2016. Bitcoin then quickly recovered and climbed in price for the remaining months of the year where it reached prices 20% higher than the Halving price before moving into 2017.

The Bullish and Bearish Arguments

Please see below two Bullish and two Bearish arguments for how the highly anticipated 2020 Bitcoin Halving may play out:

Bull - BTC Economic Theory

There is a finite supply of Bitcoin and thus halving the reward given to Bitcoin miners reduces the supply side of the asset by 50%.

The rationality behind this argument is that with a reduced overall supply, Bitcoin in time will become deflationary. Should the demand for Bitcoin continue to increase, then the limited supply side will ensure that the cost of Bitcoin will increase over time. This simple economic argument of supply and demand has made many investors optimistic about the Halving event.

Bull - Incentives for miners

The Halving event will mean that miners will need to do twice as much work to earn the same amount of Bitcoin reward. Mining Bitcoin can involve a variety of costs such as electricity, hardware costs and maintenance. With the reward for these labors decreasing by 50%, there is an argument that those who invest in mining will simply buy Bitcoin as opposed to mining it. This will of course increase the buying pressure on the Market, thus causing the price to increase.

Bear – A lack of historical evidence

It has only been a little over a decade since Bitcoin was first created. Trading volume in the coin has increased year on year but we are still in the early days. As such, any historical evidence is difficult to rely on. First of all, there is only one decade worth of information. This does not give investors much depth of knowledge in terms of previous scenarios and precedent. Bitcoin did experience a Halving event in 2016, so we do have something to look at. However, trading volume in Bitcoin was only reported at $180 million USD per day back then, while today, reported daily trading volume exceeded $37 billion USD.

With a growing Market and developing infrastructure surrounding the coin, the performance of the 2016 Halving event by many is not seen as a fair indication of how things may play out going forward. Additionally, the estimated number of Terahashes per second (A measure of how much power the network is consuming to function) dedicated to the Bitcoin Network has increased by almost a factor of 100 from July 2016 to present day.

Bear – “Buy the rumor sell the news”

This phenomenon has been seen across financial markets all around the world. The premise behind this saying is that asset prices move in anticipation of rumors but then fall in price once the news itself is released. Now, the Bitcoin Halving is not a rumor, it is a fundamental event embedded into Bitcoins algorithm. However, the assertion here still has a lot of merit. With so much anticipation leading up to the Halving event, the price of Bitcoin could increase as investor optimism grows. Once the Halving date strikes though, investors may take profits and the price of Bitcoin may in turn fall.

The Litecoin Halving event in 2019 can provide some insight to this argument. As seen in the graph below, the price of Litecoin rose dramatically in the weeks leading up to the event. However, after the Halving, Litecoin fell in price over the coming months. We of course cannot assume that Bitcoin will follow the performance of Litecoin as there are numerous other variables and market conditions at play. This does however give merit to this bearish argument for how the Market may treat Bitcoin leading up to and immediately after the Halving event takes place.

LTC/USD - March to December 2019

These are just a few of the many arguments regarding the impending results of the Bitcoin Halving. The Market has been extremely volatile this year and the greater economic climate is experiencing unprecedented circumstances.

Should you have any questions or thoughts here, please do not hesitate to contact us.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7meVnT2vnQelBrt6W5yw73%2F8469fbdea8168e404fff363b35dd65a4%2FBitcoin_Halving-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-01-10T02%3A22%3A06.649Z)

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FuIaUbUNRbO1LdljRWKvoI%2Fd93965ff275cd47f8c19fcc71edcd42e%2FBitcoins_Market_Cycle_V3-01__1_.jpg&a=w%3D480%26h%3D270%26fm%3Djpg%26q%3D80&cd=2023-02-21T06%3A17%3A39.793Z)