The Current Climate

Following Facebook's rebranding as 'Meta', interest in virtual environments and the metaverse boomed. As a result, the Metaverse has made inroads into mainstream media, been a hot topic on crypto Twitter and, crucially, seen investor attention, particularly during the 2021 bull market.. Metaverse-related cryptocurrenciesSandbox (SAND) and Decentraland (MANA) have led the way as investors traded more than $500 million USD worth of digital land (a claim to a piece of land within a digital environment) across various games in the30 days following December 6th 2021, with sales reaching highs of over $2 million for a single plot of LAND, according to data from Opensea.

So, why all the hype? Multinational corporations native to crypto and those beyond are staking a claim in the metaverse for fear of missing out – even JP Morgan, which opened a lounge on the Decetraland protocol. The metaverse is no longer a concept only seen in science fiction (think Steven Spielberg's Ready Player One), but a real developing vision of the future. In the current technological age, where our digital identity is highly integrated with our real identity, providing a virtual environment for immersion and interaction is now more important than ever.

Catch up on part 1 of our metaverse deep dive here: The Cyber Big Bang: What is the Metaverse?

Blockchain technology already underpins the metaverse, providing the same settlement and security mechanisms that prop up cryptocurrencies.. Once investors caught wind of the powerful marriage of the virtual world and blockchain technology, metaverse became a dominant crypto narrative that brought investment inflows similar to those enjoyed by Layer 1 altcoins, such as Solana (SOL) and Avalanche (AVAX), in early 2021.

As a result, The Sandbox (SAND) and Decentraland (MANA) rallied strongly along with the rest of crypto market While the metaverse buzz has tapered off since, the security that blockchain technology provides, the rapid growth of digital assets, and the fact that digital interactions are becoming more prominent in a post-COVID world, there’s a sense the metaverse is inevitable.

Why Use Blockchain Technology?

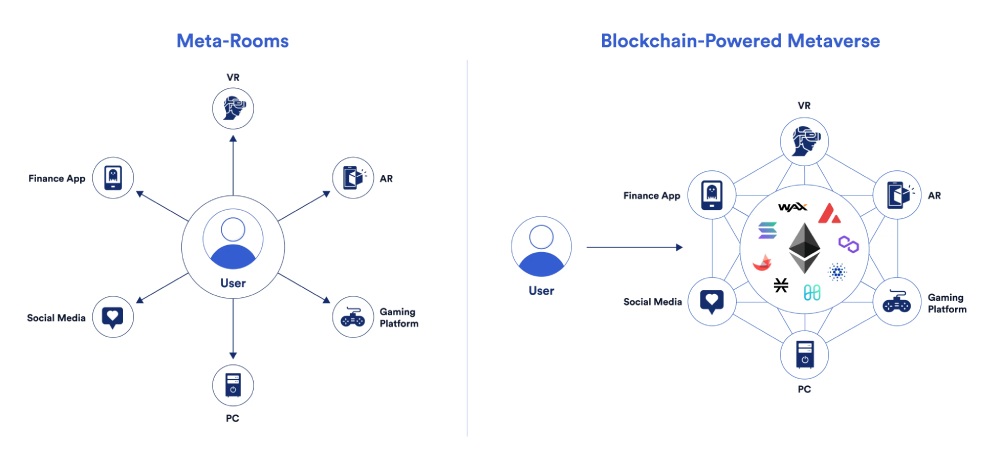

If you take the view that the metaverse will play a large role in our lives, it’s important that the technology behind it is secure. This is achieved through blockchain’s consensus mechanisms that allows users to confirm transactions and avoid spending errors, greatly reducing the likelihood of cyber-threats or hacks, thereby protecting ownership of the digital assets stored in the virtual environment.

More importantly, blockchain technology can facilitate governance of the metaverse by its users, making for a more democratic model. In practice users would vote on a change or improvement proposals that would impact the way the metaverse runs. This puts the interests of users and the ecosystem at the forefront rather than the interest of some centralised authority, such as Facebook, whose main incentive is profit. This point on governance is important as it provides confidence in the longevity of the metaverse, which in turn increases its value and utility.

Blockchain technology also enables the tokenisation of assets, which subsequently the ownership of can be publicly verified on a distributed ledger (aka a blockchain), which crucially is immutable. As a result, t transactions of assets are absolute and irreversible, with no party bearing the power to alter a transaction to serve their own interests. Blockchains are also home to NFTs, which the properties of spawned the possibility of the metaverse. As previously stated, NFTs allow parties to verifiably own unique digital assets and provide the infrastructure for users to interact within the metaverse.

Major Players in the Metaverse

Currently, the most notable players in the metaverse include The Sandbox (SAND) and Decentraland (MANA). The former, whose native token SAND rallied more than 1000% between October & November 2021,operates as a community-driven platform where users can create, share, and monetize their own gaming experiences and assets.

The SAND utility token allows players to purchase services, trade in-game and govern the chain. The virtual universe is built on the Ethereum blockchain and consists of over 160,000 ‘LAND’ blocks, which are digital real-estate plots that users can populate with assets and/or develop their own games on. Multiple LANDs combine to form estates and within the Sandbox multiverse; you can visit those estates and play different people’s games, develop, trade or operate a virtual world governed by other users. At the time of writing, he the average value of a LAND plot is around $1,000, although it’s ranged between $10,000 to $15,000 in stronger markets, when the total value of LAND on the platform hovered around $2 billion. Similarly, SAND accommodated 1000s of unique active users, however the number has dropped off significantly into the 100s, recently. Driving the period of strong performance wasthe play-to-earn model that The Sandbox employs, which was novel in crypto at the time.

Decentraland is similar to The Sandbox in that land plots can be bought using the native token MANA and itoperates on the Ethereum chain. However, unlike SAND it is a 3D virtual world which users navigate using their avatars to interact with the different features or assets that other users have built on the land. The land market in Decentraland has run extremely hot in the past.

One plot sold for a record $2.43 million in November 2021 — almost five times the average US house price at the time. Within Decentraland, different users can do as they would in the real world, such as meeting with friends or attending concerts.

Like The Sandbox, Decentraland saw plenty of users in 2021, but activity on the platform has come down from those levels to which they’ve not returned. Furthermore,a large portion of current users have typically traded assets related with the metaverse, rather than playing the game itself.

Despite the first metaverse wave running out of steam, along with the rest of the crypto market in 2022, the potential for growth remains. Statista projects revenue in the metaverse industry, including activity beyond crypto, to climb from $44.1 billion in 2022 to nearly $500 billion by 2030 as adoption and interest in the space increase.

Supporting Metaverse projects are platforms like Ultra (UOS), a game publishing platform that supports blockchain games such as The Sandbox and Decentraland, allowing users to distribute and re-sell games and items on their secondary marketplace. With Ultra as the centre of the ecosystem, the platform aims to be the ‘Steam’ equivalent of blockchain games. Steam, for context, is the ultimate destination for online game distribution, hosting more than 62 million daily active players with a current valuation of $12 billion.

The Future Climate

While The Sandbox and Decentraland are providing an interesting view on the future of the metaverse, blockchain natives are not the only organisations looking to exist in this area. A metaverse land grab played out in 2021 and 2022 between giants such as Apple, Amazon, and Microsoft, which sought to capture market share in the metaverse, by investing significantly. Even companies like Nike and Adidas are partaking in the meta-revolution. Nike has already acquired an NFT studio and has since launched various projects, while Adidas has worked with established NFT players including the Bored Ape Yacht Club.

Each of these companies provide an interesting view on how to protect their property during the digitisation of assets. The question seems to be: will the resources and power of the centralised bodies, or the technology and security seen in the decentralised world prevail in the metaverse?

Check out part 3 of our metaverse deep dive here: Centralised and Decentralised Metaverse

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3spEQl01aQfHVCQ7XGfue1%2F0872b77f75dde50c04bc1203ac893485%2FUntitled_design__13_.png&a=w%3D439%26h%3D250%26fm%3Dpng%26q%3D80&cd=2023-05-08T07%3A27%3A00.249Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F2cOywdhYZ4EhUXb2JdAbru%2Fd144a2c5f45d3b90fa237d1698899a5c%2FUntitled_design__15_.png&a=w%3D439%26h%3D250%26fm%3Dpng%26q%3D80&cd=2023-05-09T05%3A29%3A07.895Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1zNRsIeweJesyMCND3fJkK%2F6b37dbce46e92fc1c51ce41fcebc6117%2FUntitled_design__12_.png&a=w%3D439%26h%3D250%26fm%3Dpng%26q%3D80&cd=2023-05-08T07%3A06%3A45.484Z)