In this Week's Market Rollup

A modest gain from Bitcoin (BTC) over the past seven days wasn’t enough to bolster the market as negative price action across most major assets and market sectors dragged the total crypto market cap back below US$1 trillion. Ethereum (ETH) has once again performed poorly, posting its third consecutive week of losses since the Merge. Meanwhile, Terra Luna Classic continues to make headlines following a major announcement from Binance.

Market Highlights

- Bitcoin (BTC) global adoption continues as Telefónica, Spain’s largest telecommunications company, partnered with crypto exchange Bit2me to allow BTC payments on its platform.

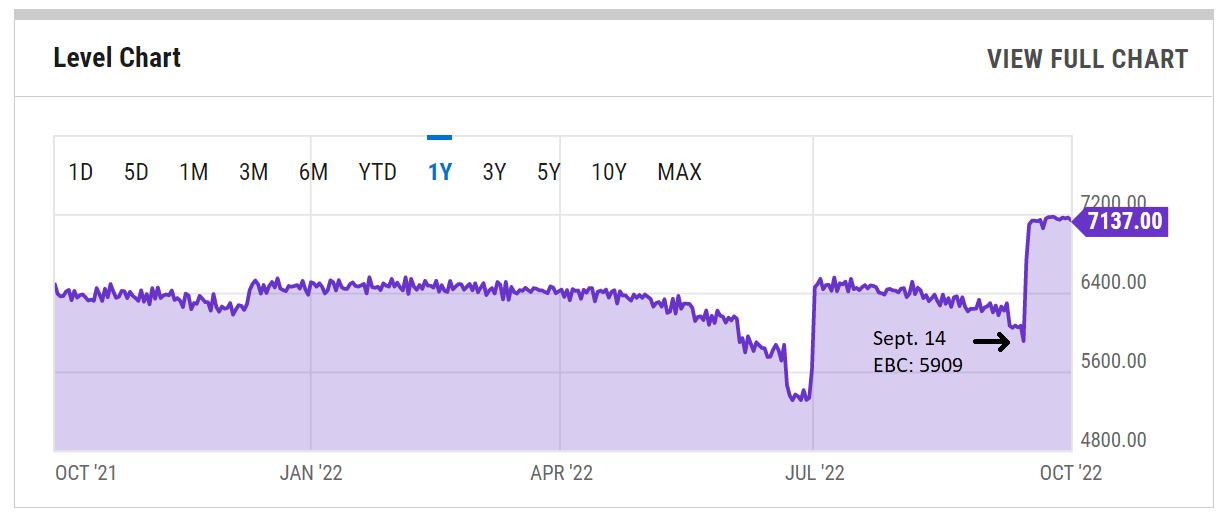

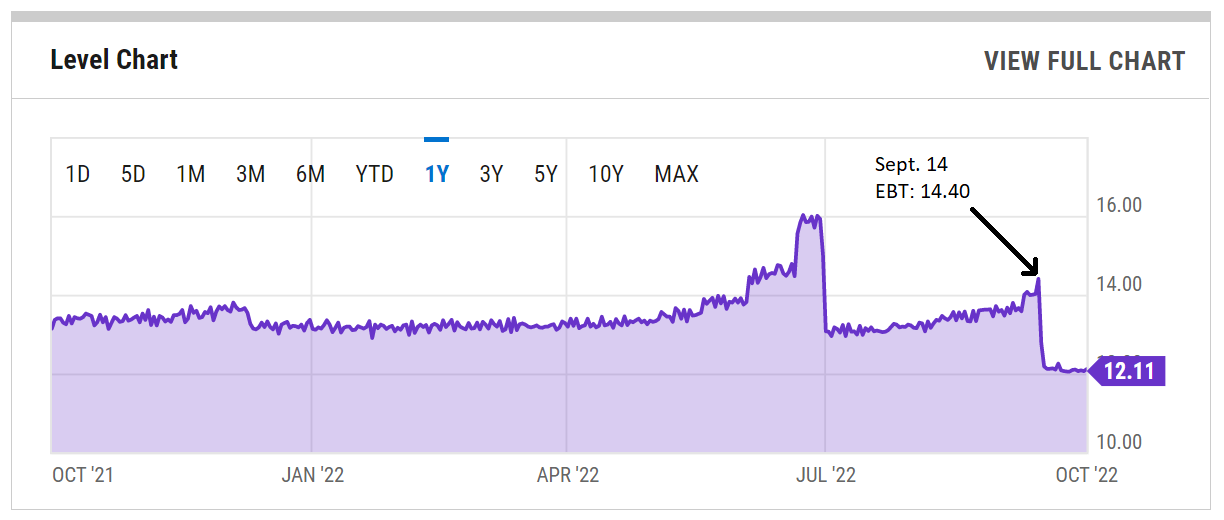

- Despite bearish post-Merge price action, the Ethereum network has seen notable improvements in both daily-blocks-produced and block-time since its transition to Proof-of-Stake.

- Terra Luna Classic (LUNC) rallied over 50% following an announcement by Binance to burn all LUNC spot and margin trading pairs.

Price Movements

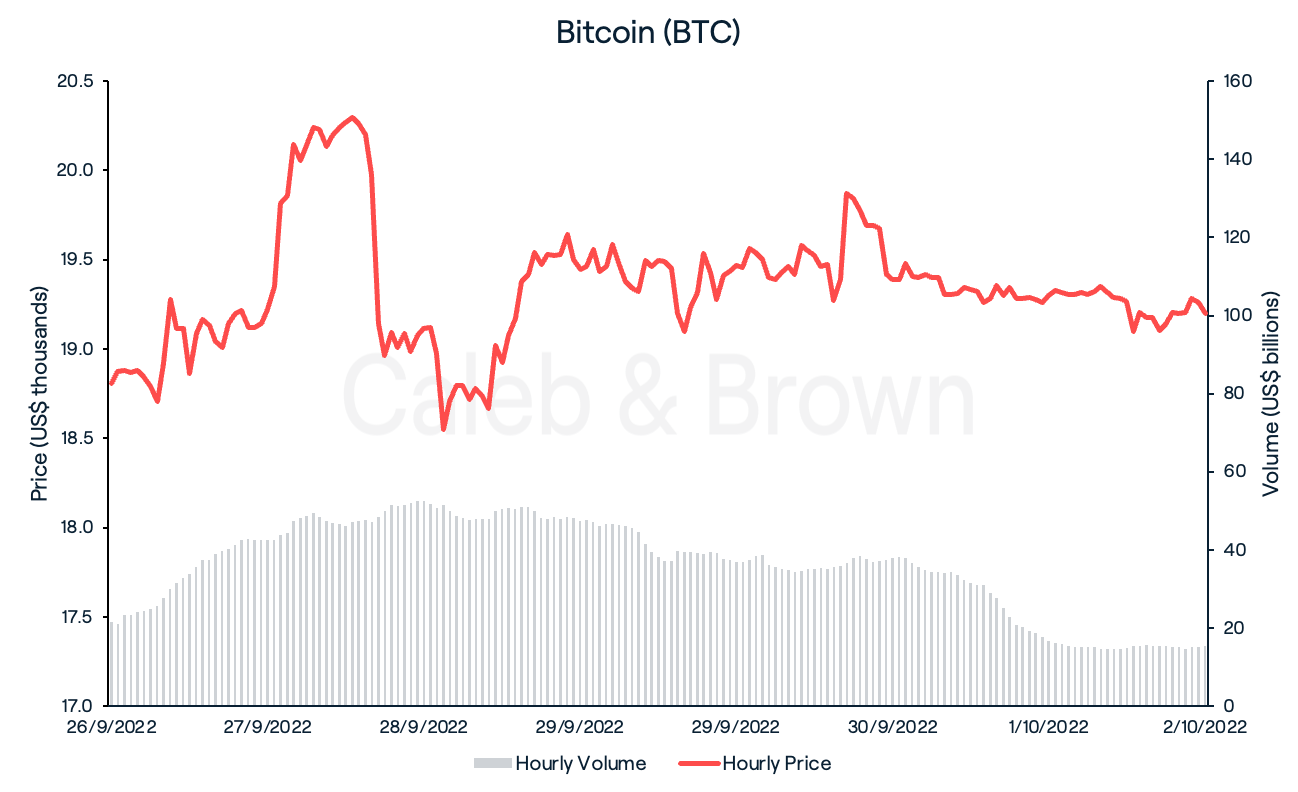

Bitcoin (BTC)

Bitcoin (BTC) experienced relatively flat price action this week, opening the week at US$18,809. A 6.61% rally on September 27 pushed BTC above US$20,000 which momentarily brought the total crypto market above the US$1 trillion mark. However, this move proved short-lived as BTC sold-off over 8% the following day. BTC continued to slowly appreciate for the remainder of the week, closing at US$19,200 for a modest 2.07% weekly gain.

Real-world crypto adoption continues in the face of the bear market with Spain’s largest telecommunications company, Telefónica, now accepting BTC as a payment method. Telefónica partnered with Spain’s largest bitcoin exchange, Bit2me, to facilitate the real-time conversion of BTC payments into euros. This follows Spanish airline Vueling’s announcement that it will also begin to accept BTC payments in early 2023.

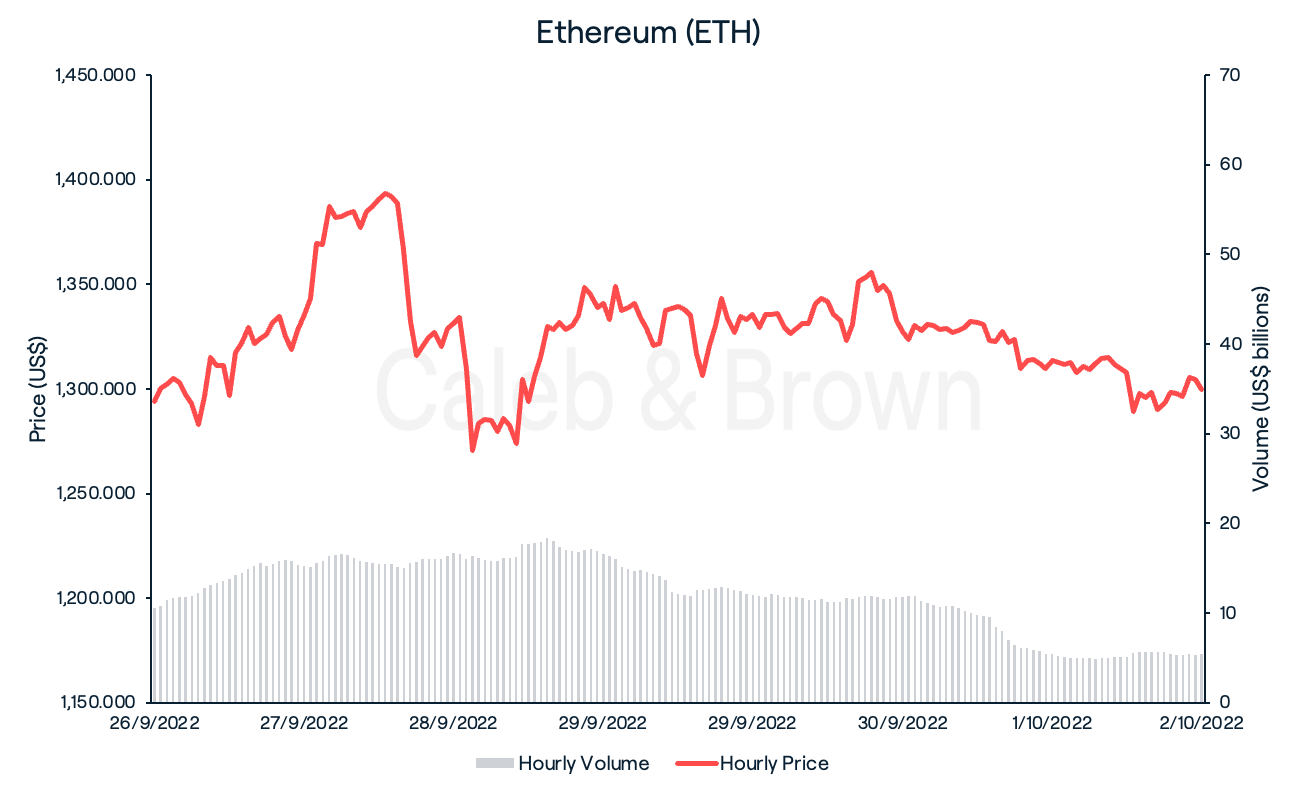

Ethereum (ETH)

Ethereum (ETH) trended in line with BTC for the first half of the week, rallying to a high of US$1,379 on September 27, but it could not break last week’s high of US$1,408. ETH proceeded to sell-off over 8% the following day. However, unlike BTC, it was unable to recover over the weekend and closed the week down 1.89% at US$1,276. This marks the third consecutive week of downwards price action since Ethereum transitioned to a Proof-of-Stake (PoS) consensus mechanism, having now lost 19.3% in value since the Merge occurred.

Despite negative price action, on-chain data continues to show improvements to the Ethereum network since transitioning to PoS. The new PoS chain has brought about an 18% increase in Ethereum blocks produced per day, as well as a 13% decrease in block time (the time it takes for miners to validate a block of transactions). An improvement in both blocks-produced and block-time could see total throughput and transaction speed increase on the network overall.

Altcoins

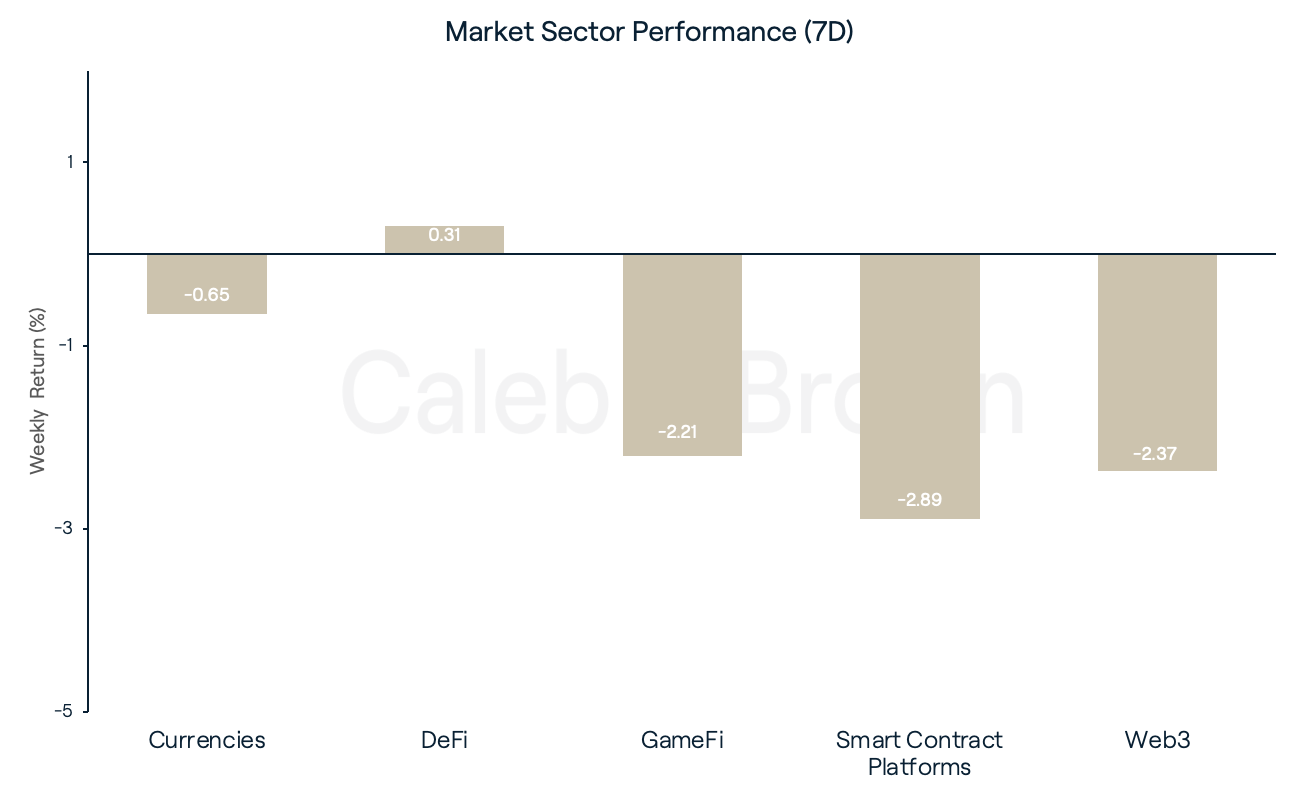

All market sectors traded lower over the past week, with the exception of DeFi which increased a meagre 0.31%. Following DeFi was Currencies, falling 0.65% this week, followed by GameFi and Web3, falling 2.21% and 2.37% respectively. Lastly, Smart Contract Platforms was the worst performing sector this week, losing 2.89% in value.

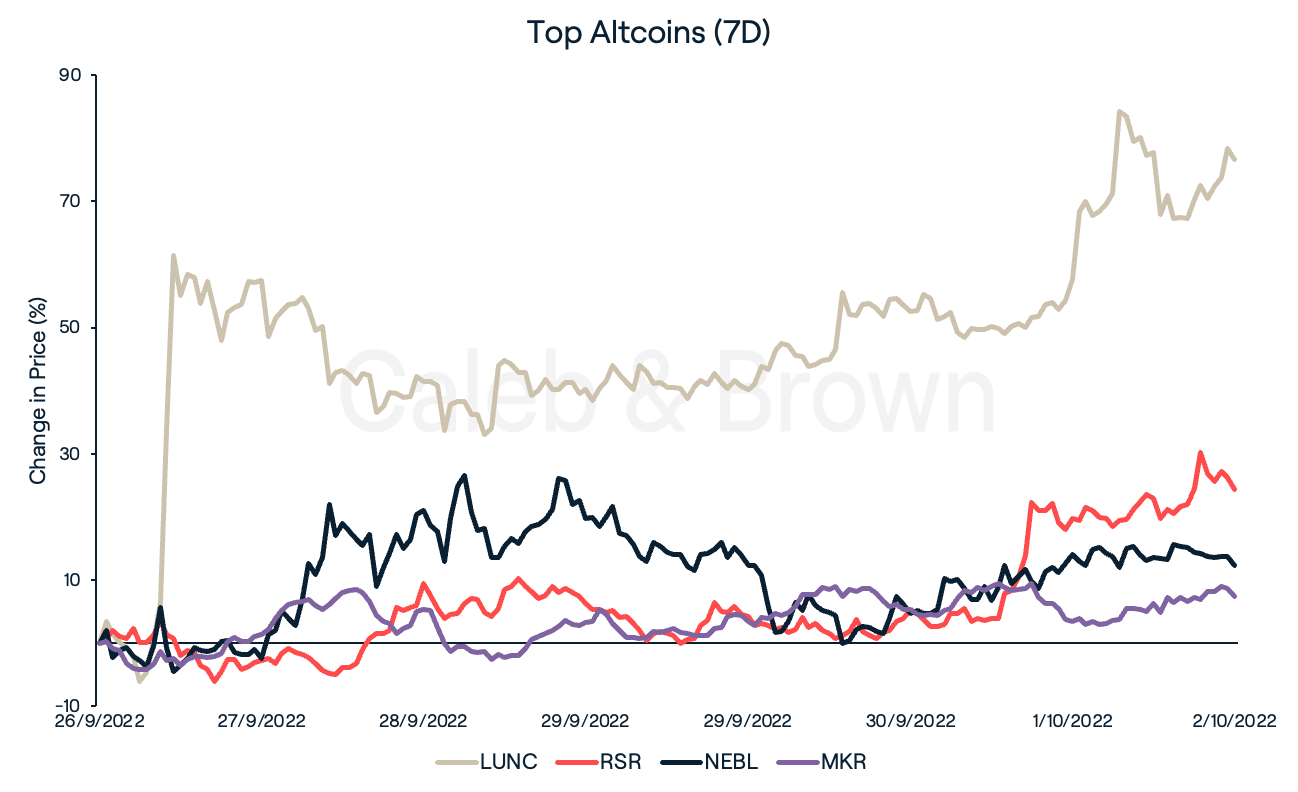

Leading the DeFi pack were Reserve Rights (RSR) and Maker DAO (MKR), which each gained 26.4% and 8.3% respectively. Reserve Rights announced the deployment of its full protocol will take place on October 10. Since the announcement, investors have speculated on the value of RSR, leading to the token rallying almost 100% over the last 10 days.

Although Smart Contract Platforms was the worst performing sector this week, Nelbio (NEBL) has outperformed the sector trend, gaining over 12%. NEBL has performed strongly week-over-week and is up an incredible 219% over the last 30 days.

The largest gainer this week and for the second time in a month was Terra Luna Classic (LUNC) which rallied 72% over the last seven days. This follows Binance’s announcement to burn trading fees accumulated on all LUNC spot and margin trading pairs as was proposed by the community in early September. As the burn may reduce the circulating supply of LUNC, speculators have been quick to jump into LUNC after the announcement.

Web3 News

A Uniswap user was exploited for 800 ETH (approx. US$1 million) while trying to sell US$1.8 million in cUSDC on its platform. Once the transaction was submitted by the user, a maximal extractable value (MEV) bot was able to front-run the transaction leaving the victim with just US$500 in cUSDC. Unfortunately for the hacker, the code of their bot was also exploited and the balance of the hacker’s wallet was drained for 1,101 ETH (approx. US$1.45 million) in the following transaction.

Solana (SOL) suffered its fourth major outage since January after a node was found to be misconfigured, causing an unrecoverable partition in the network. The network was rebooted on October 1 following a six hour hiatus. Solana has since been up-and-running at full capacity.

Meta announced on September 30 that all U.S.-based users will now have access to share their NFT collections on Facebook and Instagram. While a select few users were able to test the feature as early as May 2022, Meta has opened access to all of its U.S.-based users, further exposing Web3 technology to everyday users. The feature currently supports ETH, Polygon (MATIC), and Flow (FLOW) collections with a Solana integration also in the pipeline.

Recommended reading: Common Crypto Investing Strategies Every Investor Should Know

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)