In this Week's Market Rollup

It’s been another rough week across the crypto markets. The after effects of recent major liquidation events involving Celsius and 3AC continue to be felt, with immense sell pressure being placed on an already fragile market. Bitcoin finds itself struggling to hold on to 2017 all time high levels, while many altcoins and NFTs continue to get decimated in the process.

Macroeconomic Updates

- Major US indices have continued their six-month long down trend with the S&P500, Nasdaq, and Dow Jones down 3.35%, 5.3% and 2.3% respectively.

- As a response to current recessionary fears, the US 10 year treasury yields have declined 200bps to 2.9%.

- In the world of commodities, oil remained relatively flat with an increase of 0.9% to US$108.60 a barrel. Gold on the other hand is down 0.6% for the week, sitting at US$1,806.80/oz.

Crypto Market Updates

- Bitcoin (BTC) has posted its sharpest quarterly loss in 11 years as the price of the world’s largest digital asset has plummeted 56% between Q1 and Q2 of this year.

- The Commodity Futures Trading Commission (CFTC) has filed a lawsuit against Cornelius Steynberg and his company Mirror Trading International Proprietary Limited (MTI) in its largest fraud case to date. The CFTC has accused Steynberg of bringing in 29,421 BTC (US$12.7 billion) as part of a fraudulent multilevel marketing scheme.

- Meta has continued its development into crypto, with Facebook beginning to test Ethereum and Polygon NFTs on user profiles.

- BlockFi, one of crypto’s largest lenders, is on the verge of being purchased for US$240 million by FTX after being valued at US$5 billion only a year ago. This heavy devaluation is a result of the challenges currently faced by crypto lending platforms, specifically Celsius, as well as broader market price corrections.

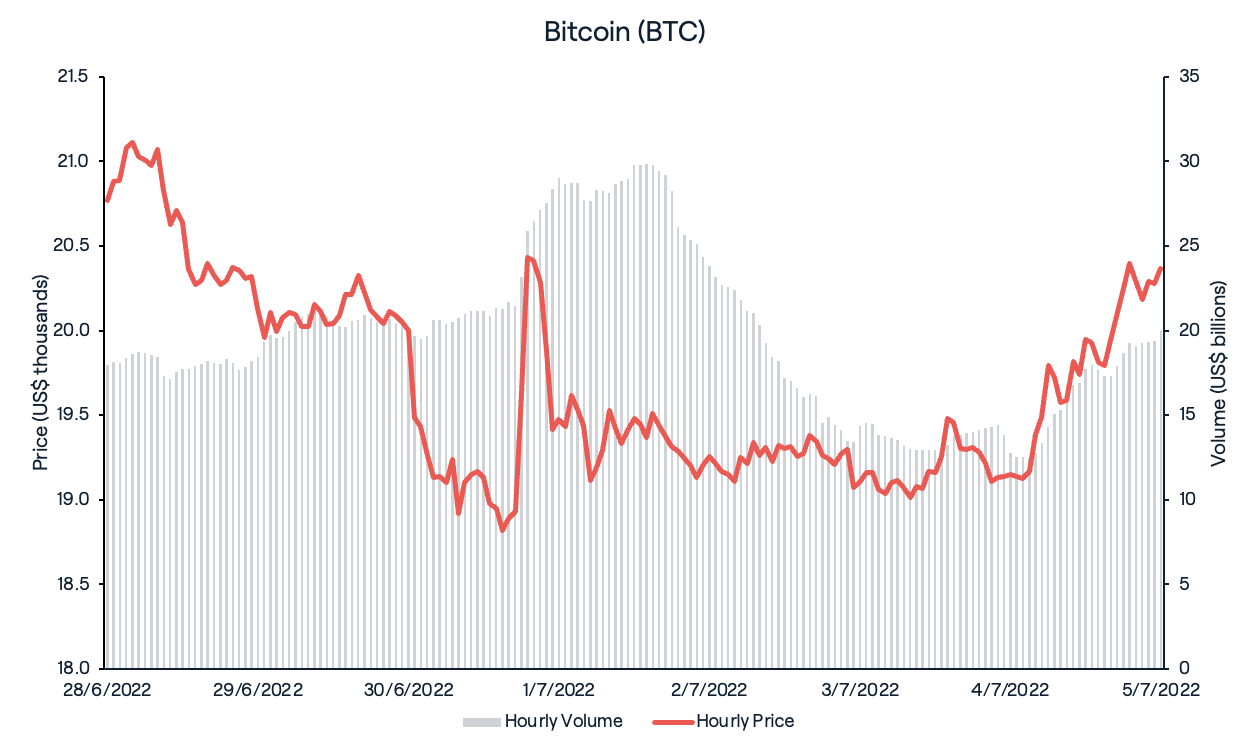

Bitcoin (BTC)

Over the past seven days, BTC has declined 6.5% from last week’s close of US$21,500 to US$19,200. This is consistent with BTC’s monthly downtrend, which is down 36.6% for the month. The tightening of BTC’s price range between US$19,000 to US$20,000 indicates volatility is also dropping, emphasising poor investor sentiment and lingering broader market fears.

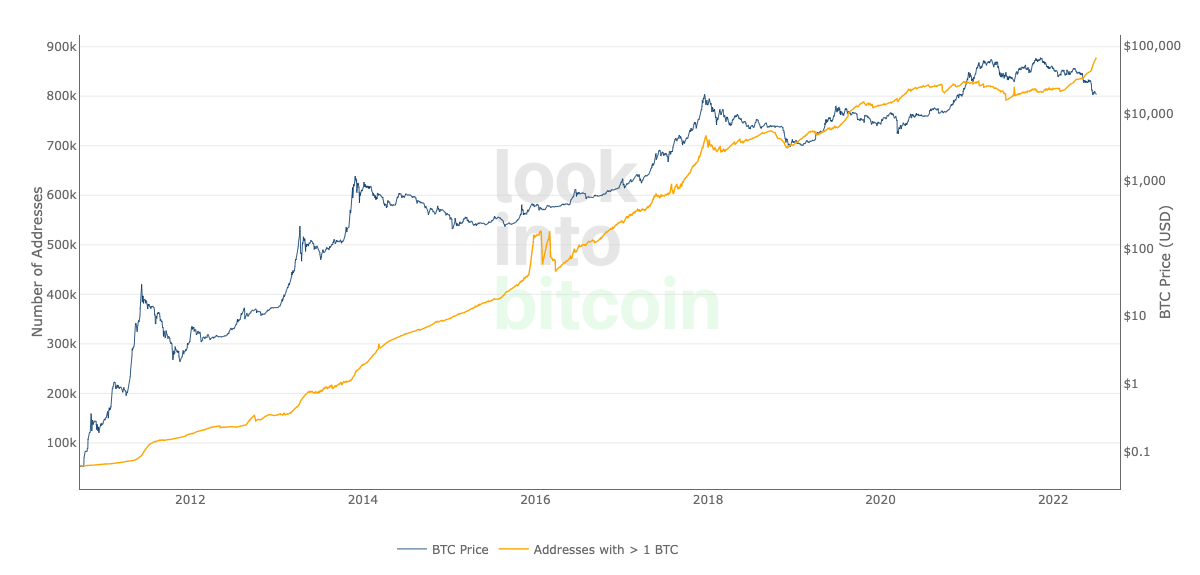

Interestingly, with prices continuing to fall, the number of BTC addresses accumulating BTC continues to rise. Addresses holding at least one BTC have reached a new all-time high of 877,501.

Major institutional investors also continue to buy the dip. Microstrategy’s Michael Saylor and El Salvador President Nayib Bukele both announced last week their BTC purchases of 480 (US$9.2 million) and 80 (US$1.5 million) coins, respectively. Saylor’s announcement, however, was met with backlash as he was accused of attempting to influence the market.

Brazil’s largest digital bank, “Nubank,” has introduced a new BTC trading service to their platform which will provide their 54 million users with the ability to buy and sell BTC directly, further expanding cryptocurrency accessibility to retail investors.

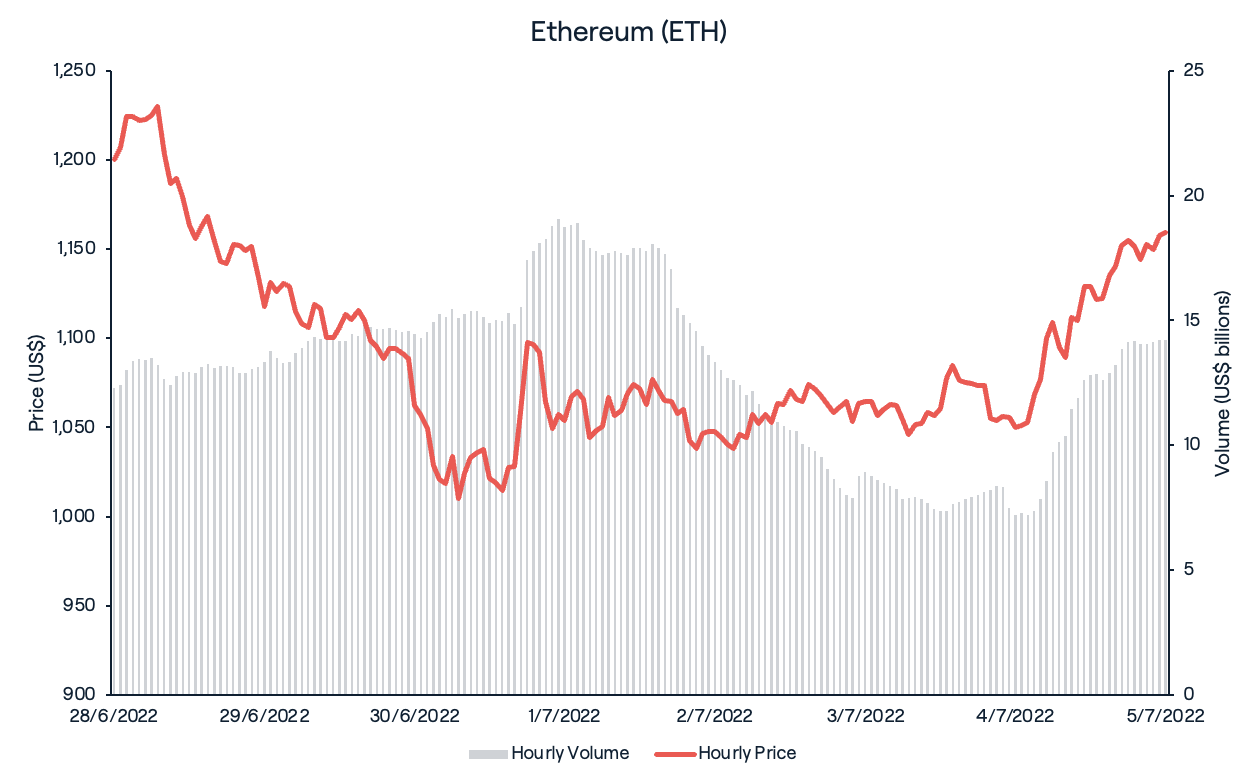

Ethereum (ETH)

ETH failed to hold the US$1,200-$1,300 price range seen last week, falling over 10.5% in the last seven days to US$1,070. Market participants are still grappling with recent market events concerning Celsius and anticipation of Ethereum’s major blockchain upgrade.

The Ethereum community received significant news this week following the announcement of another major blockchain update. Tim Beiko, an influential Ethereum developer, announced on Twitter that the update, known as "Gray Glacier," went live with the publication of block 15,050,000 on the network. The Gray Glacier update serves to delay the “difficulty bomb” by about 100 days to September, which is around the time that Ethereum developers predict the highly-anticipated “merge” upgrade will happen.

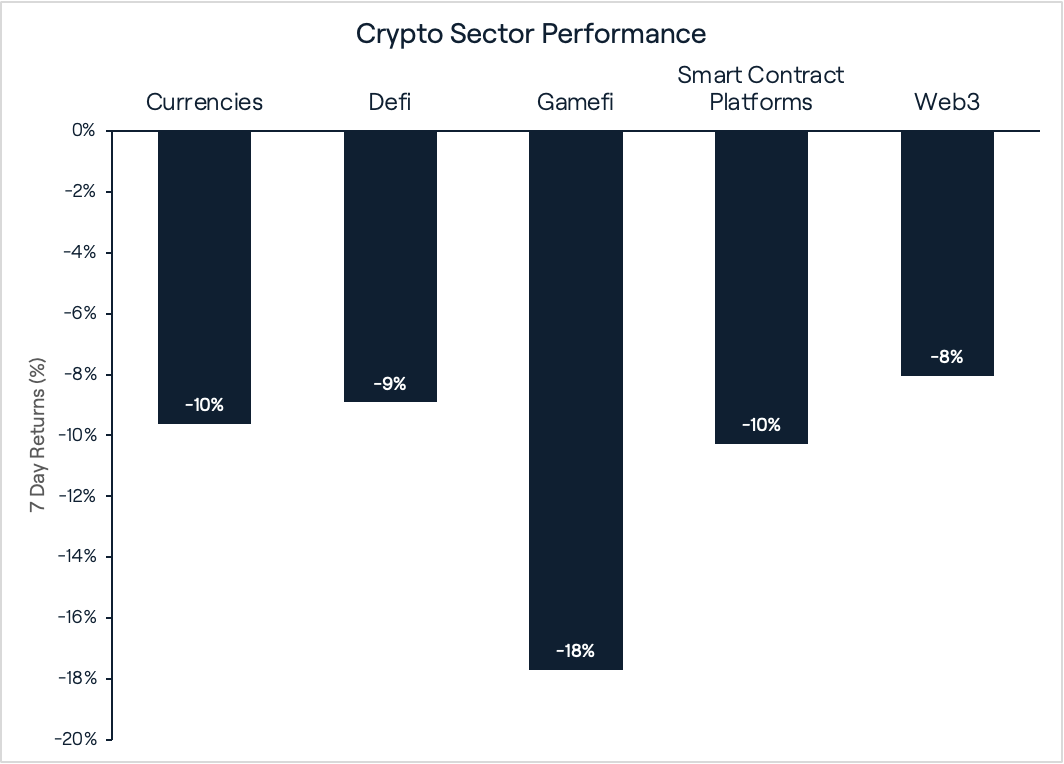

Market Sectors

Altcoins have continued their high correlation with major assets this week, trending down overall. The Web3, DeFi, Currencies, and Smart Contract Platform sectors have all seen declines between 8% and 10%. Notably, GameFi has performed the worst over the past seven days, decreasing by 18% with Illuvium (ILV) performing the poorest within the sector, trading down 36%.

The major outlier to altcoin performance this week was Arweave (AR). Arweave, the data storage blockchain protocol, has increased by 15% after the introduction of Arweave Name Systems (ArNS) was met with overwhelming demand. These domains make it easier for users to find data from a specific entity, which was limited to 200 places for its pilot program that were fully subscribed by willing participants. Tron (TRX), Nem (XEM) and Basic Attention Token (BAT) all had strong weeks. These assets all managed to post positive returns of 3.7%, 1.3% and 1% respectively.

NFTs

The NFT sector has arguably been the most successful cryptocurrency sector over the past year, with influencers, sports legends and a-list celebrities getting heavily involved. This resulted in a huge influx of initial engagement and interest in the ecosystem which was supported by healthy bullish momentum in the crypto ecosystem. In 2022, however, NFTs have been unable to escape the wider crypto bear market, with speculative interest falling off significantly this year. Total NFT sales for the month of June plunged to one-year lows, over 90% down from peak daily volume, experiencing roughly 19,000 transactions. This is in stark contrast to peak daily volume last year of nearly 250,000 sales.

Though investor interest has tapered off, the use case for NFTs is still being developed and experimented with. This is highlighted by news this week that Meta plans to integrate NFTs into Facebook and Instagram. Similarly, just days after announcing their NFT partnership with soccer icon Cristiano Ronaldo, Binance has also partnered with the world’s most followed Tik-Tok creator Khaby Lame, to increase awareness on Web3. As a brand ambassador, the influencer will educate his 142 million followers on all things crypto.

Recommended reading: Zero Degrees Celsius: A Deep Dive into the Celsius Liquidity Crisis

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)