In this week's Market Rollup

Crypto markets enjoyed a brief relief rally with BTC and ETH breaking their tight trading ranges for the first time in almost a month. However, the market was unable to sustain this positive momentum with both major assets retracing back their moves. Altcoins also showed strong performance, with DeFi assets leading the way across market sectors following weeks of adversity.

Market Highlights

- Bitcoin rallied 17.9% from its lows last week, crossing US$22,000 for the first time since the middle of June.

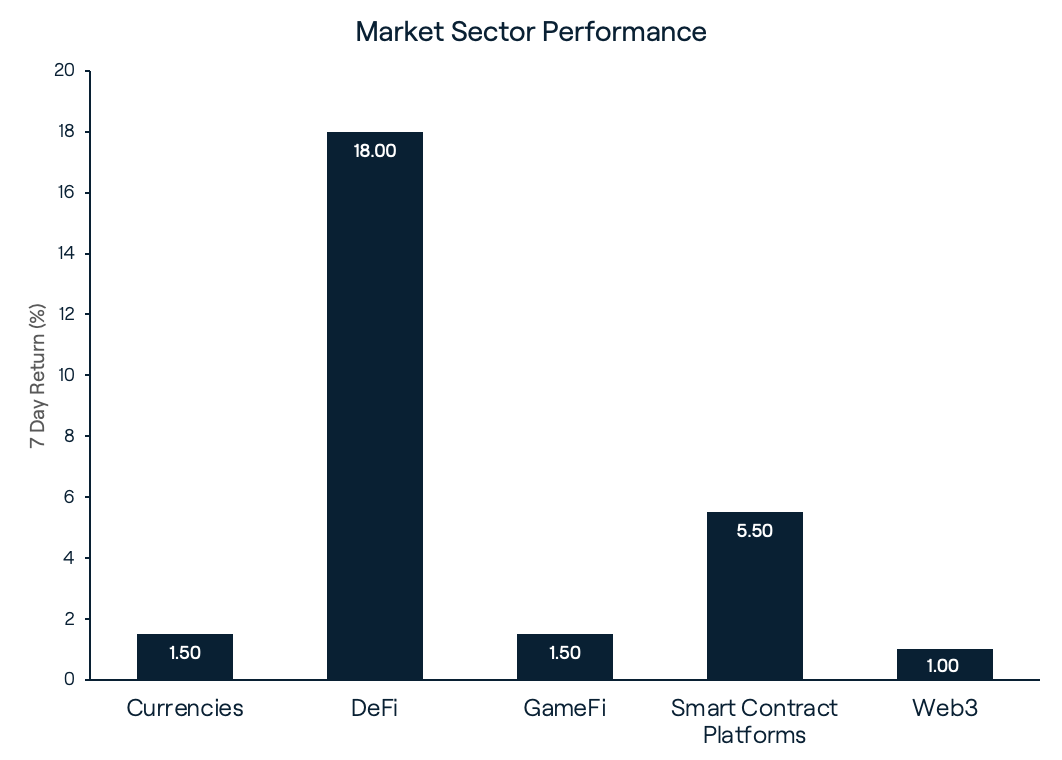

- DeFi was the strongest performing market sector this week with an impressive 18% return. This sector rally was led by Aave (AAVE) and Lido DAO (LDO), trading up 31% and 28% respectively.

- Crypto lending platform Aave (AAVE) is set to vote on a proposed decentralised, collateral-backed stablecoin, GHO.

Price Movements

Bitcoin (BTC)

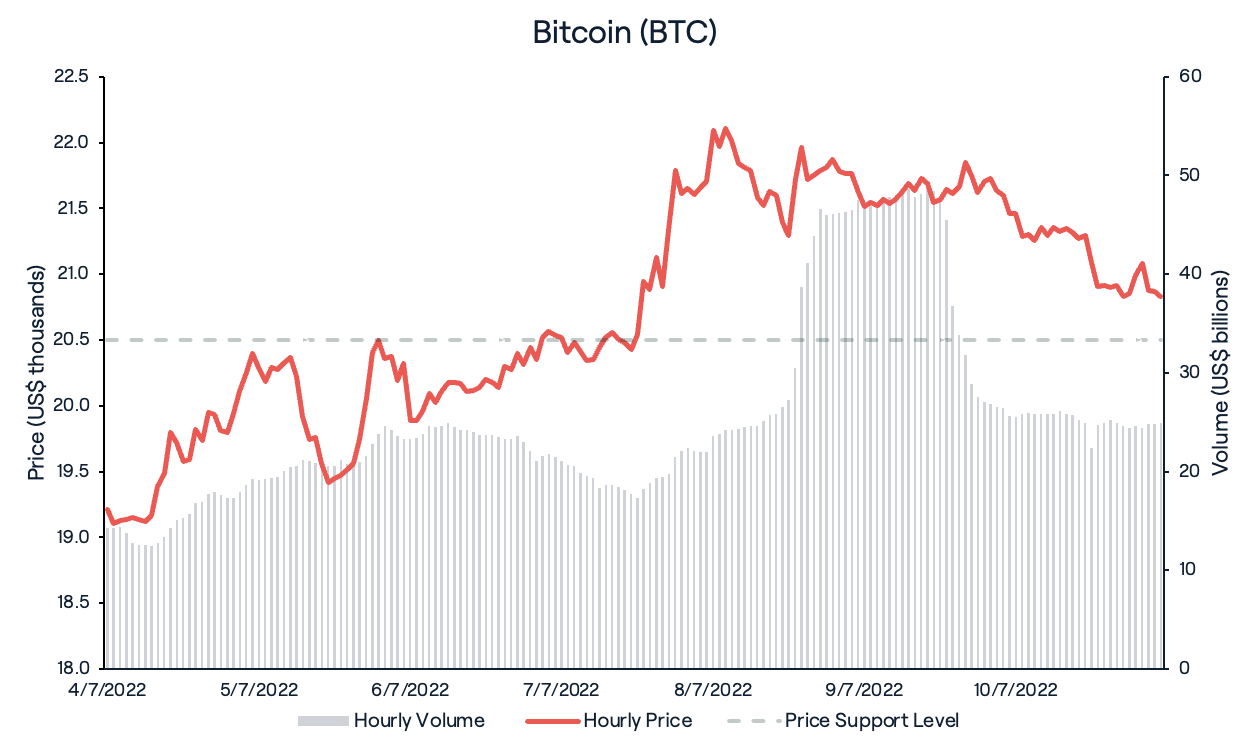

BTC has increased by 17.9% and crossed US$22,000 for the first time in almost a month, breaking out of the tight trading range of US$19,000 to US$21,000. After hitting a high of US$22,527 on 8/7/2022, BTC has since retraced to a key level of support at US$20,500.

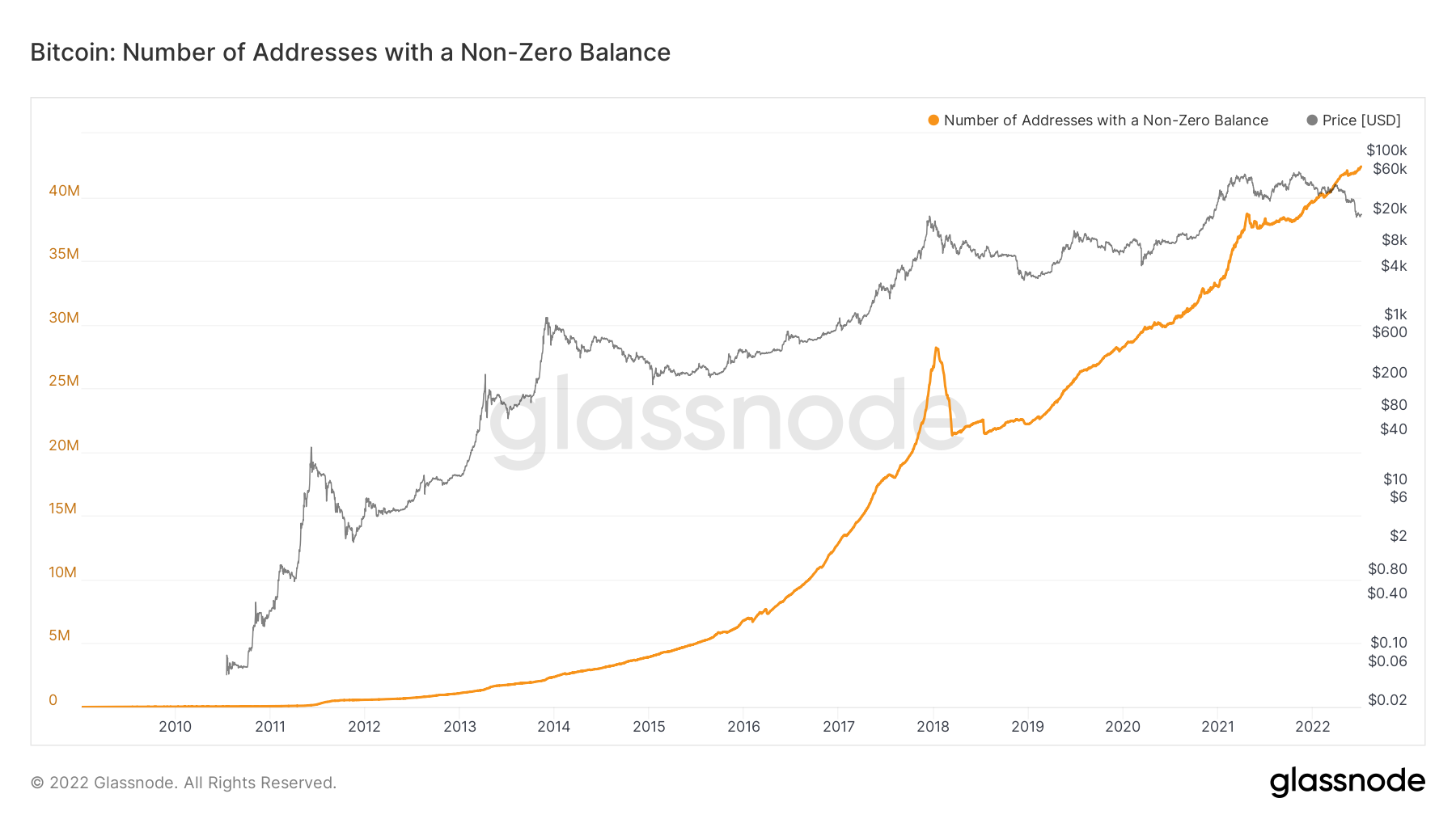

In stark contrast to BTC’s negative price performance throughout 2022, global interest in Bitcoin has actually been on the rise. As of July 7th, the number of new Bitcoin addresses with a non-zero balance reached a new all time high of 42,171,167. This number has continued to trend up since October 2021, indicating Bitcoin adoption is continuing to increase. This trend is common after crypto bull markets, as speculative price action and hype attracts more new investors into Bitcoin.

Ethereum (ETH)

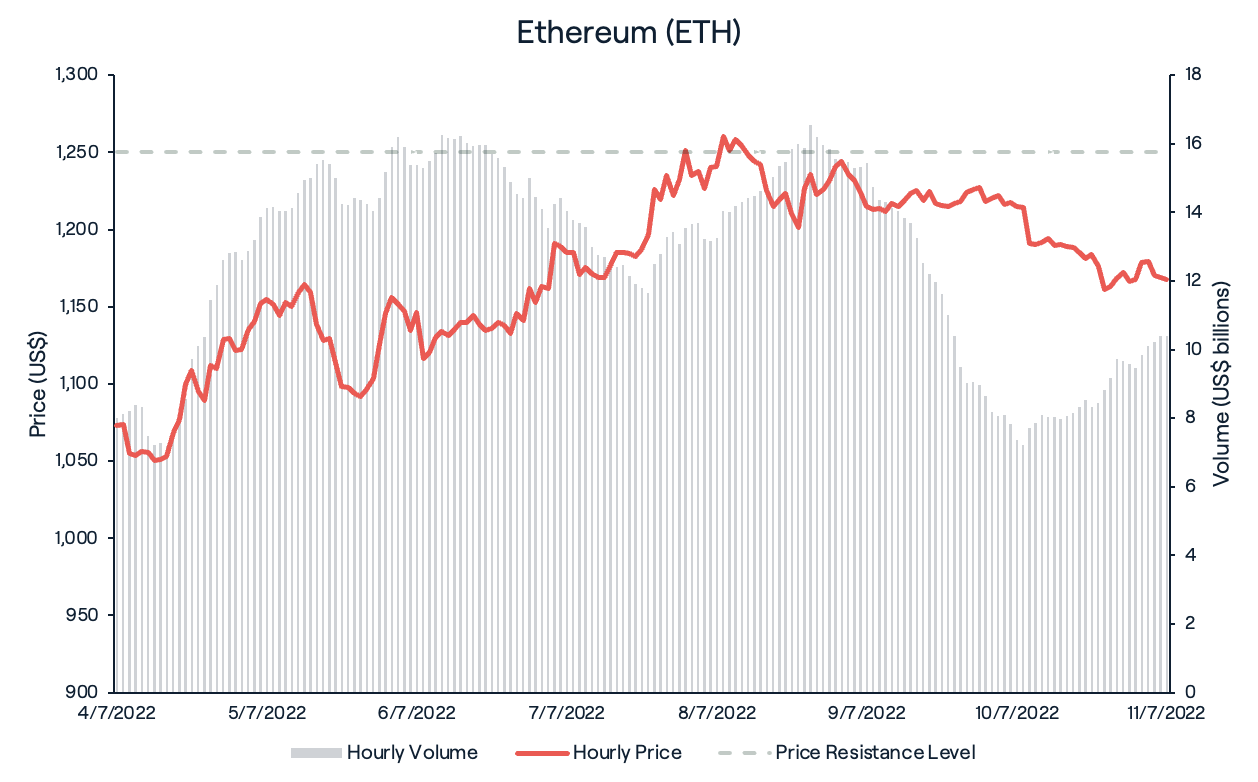

Ethereum (ETH) has followed similar price movement to BTC this week, rallying to a high of US$1,276 on July 8th. After falling below US$2,000 at the start of June, US$1,250 has served as a key level of resistance for ETH. This resistance level was tested for the fourth time in the last 30 days where buyers were again rejected and unable to overcome the level, pushing the price back to its current trading price of US$1,150. ETH continues to trade steadily between the price range of US$1,000 to US$1,250.

Ethereum has continued to steadily progress towards the Merge with a major update this week. The Merge is the process of Ethereum transitioning its consensus mechanism from the environmentally costly proof of work (PoW) to the more sustainable proof of stake (PoS). In order to change this mechanism, Ethereum developers introduced the PoS network called the beacon chain. They aim to complete the Merge through transferring Ethereum’s current blockchain data across to the beacon chain. In order to safely complete the Merge, Ethereum’s developers have completed a series of test merges. The latest test involved transitioning Ethereum’s Sepolia testnet across to PoS. This test was successfully completed on July 7th, leaving only one final test run before the Merge can take place on Ethereum’s main chain. While there is no specific date for the Merge, it is expected to take place later this year.

Altcoins

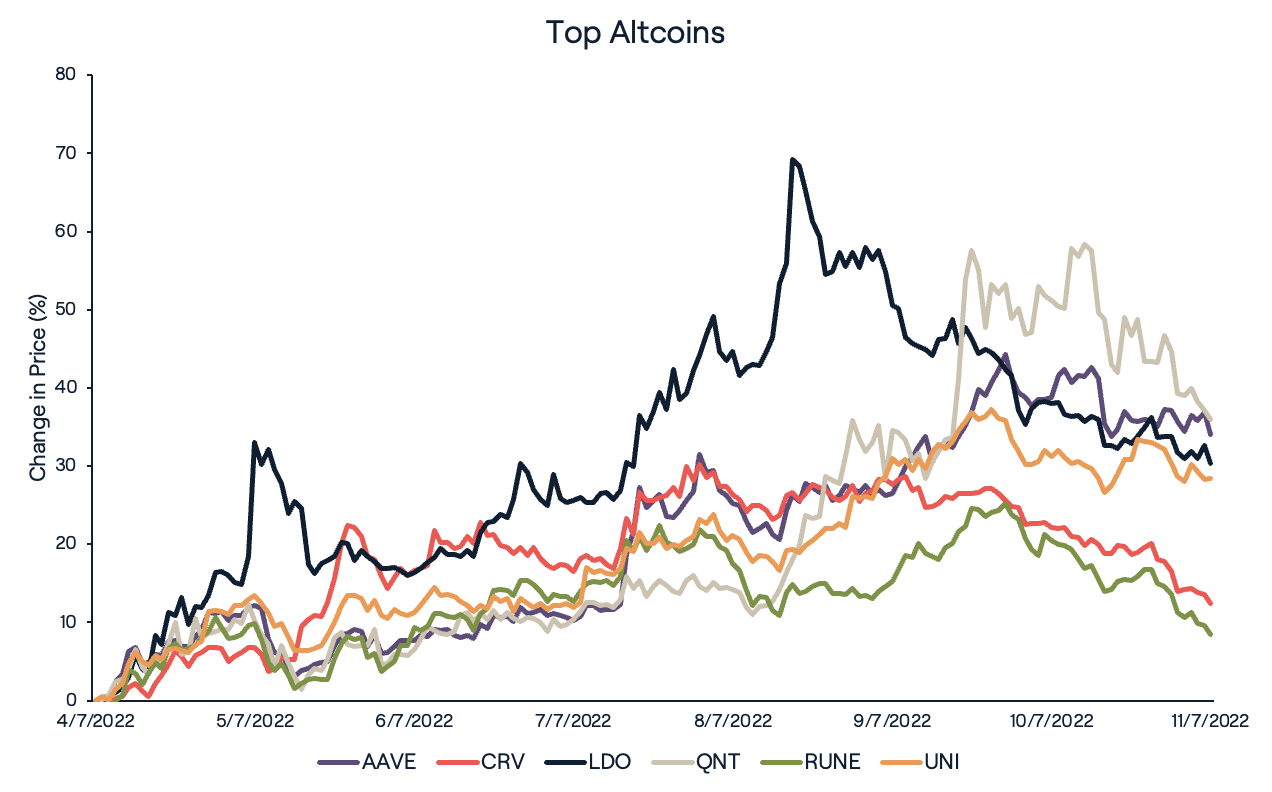

Altcoins have enjoyed a strong week, with almost all major assets posting positive weekly returns. Despite recent controversies surrounding CeFi lender Celsius, the DeFi sector has shown strength in the face of adversity, with no major protocols affected. Subsequently, the DeFi sector enjoyed the highest returns over the last seven days, with assets returning close to 18% on average. Indeed, following recent market events and changing narrative shifts, crypto investors have moved away from highly speculative assets and into more traditional DeFi assets with established cashflows.

The DeFi sector returns this week were led by Aave (AAVE) and Lido DAO (LDO). Following a recent governance proposal to introduce its own collaterised and decentralised stablecoin (GHO), AAVE traded 31% higher this week. LDO’s strong return of 28% is likely related to the recent stabilisation of the stETH/ETH trading pair which has returned closer in price to its 1:1 ratio. Other notable DeFi performers include Uniswap (UNI), Curve (CRV) and Thorchain (RUNE), which all posted impressive returns in this period, appreciating by 25%, 16% and 12% respectively.

Quant (QNT) was the strongest individual altcoin performer this week, increasing by 43%. This follows rumours of Quant looking to partner with global payment services provider, Visa, however no offical statement has been released and there is little evidence to substantiate these rumours.

Recommended reading: Zero Degrees Celsius: A Deep Dive into the Celsius Liquidity Crisis

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)