In this Week's Market Rollup

The Merge is upon us. Following the successful completion of the Goerli testnet this week, the Ethereum Merge to PoS has finally been scheduled. News of this event saw investor capital flow into assets that may benefit from the Merge, with ETH rallying to its highest level in months. Altcoins have also gone barking mad, with dog-themed meme coins jumping in price. Despite Celsius’ bankruptcy troubles, the CEL token has been the hottest performer across the market, thanks to a major short squeeze.

Market Highlights

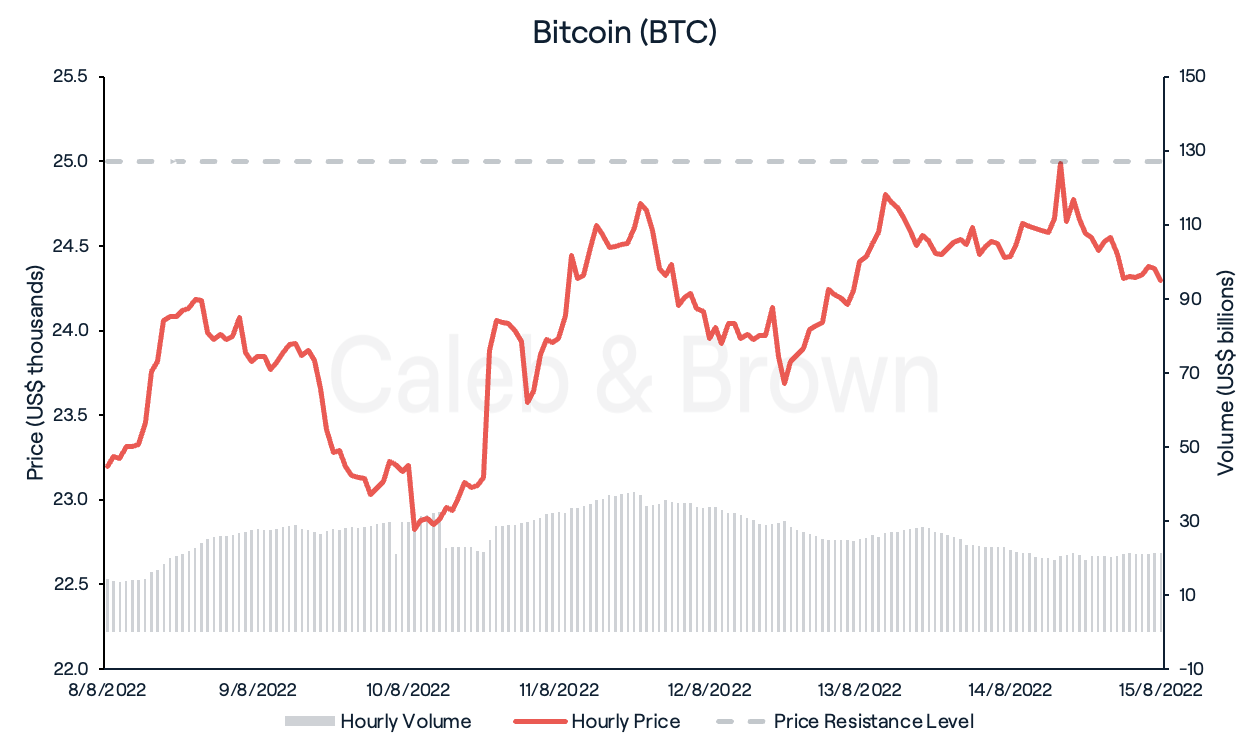

- Bitcoin (BTC) briefly traded above US$25,000 for the first time in nine weeks, as it continues to recover from May’s lows.

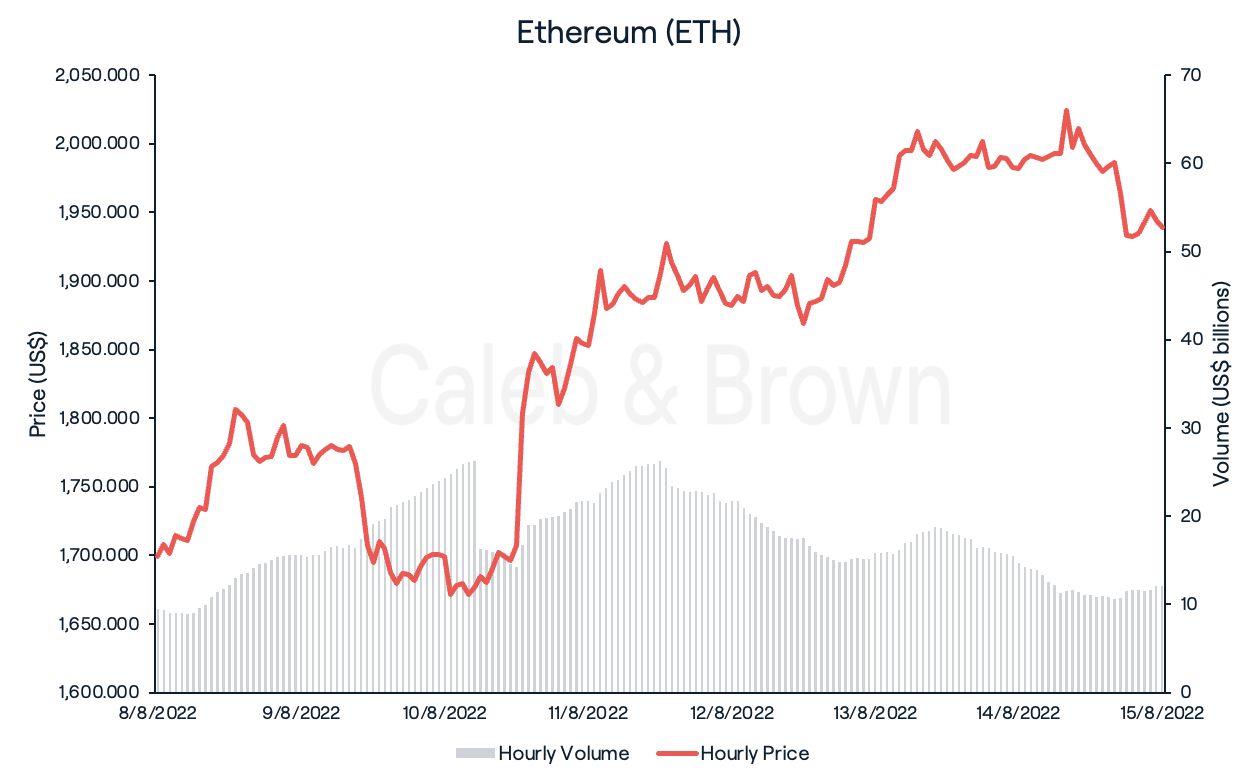

- Ethereum (ETH) price rallied to its highest level since early June 22, trading above US$2,000.

- Ethereum successfully completed its final testnet merge on the Goerli network this week, which officially scheduled the Merge to take place mid-September.

Price Movements

Bitcoin (BTC)

Following a relatively tame week, Bitcoin (BTC) successfully broke out of last week’s range (US$22,500 to US$23,500) to the upside, reaching a high of US$25,047 on August 14. This was the first time BTC traded above US$25,000 in over nine weeks. However, BTC was unable to sustain this move and quickly fell below this key level, closing the week up 5.9% at US$24,505.

BTC’s positive price performance this week could be partially attributed to the United States’ cooling inflation. The Consumer Price Index (CPI) report released on August 10 unveiled a July inflation rate of 8.5% which came below the market forecast of 8.7%. Energy and gasoline prices also fell by 4.6% and 7.7% respectively, perhaps contributing to the lower than expected CPI.

Blackrock, the world’s largest asset management firm, announced the launch of a spot BTC private trust on August 11. This would allow U.S.-based institutional investors direct exposure to the world’s largest digital asset. In the same press release, Blackrock also stated that it would be exploring “permissioned blockchains, stablecoins, cryptoassets, and tokenization,” further exposing institutional investors to the crypto market.

Ethereum (ETH)

Ethereum (ETH) continues to go from strength to strength, with a 14.1% gain this week. ETH briefly crossed the US$2,000 mark, before returning to $1,967 where it is currently trading. This is the highest price ETH has traded since the start of June, when the collapse of Three Arrows Capital and several high profile CeFi lenders sent the market into a panic.

The Merge continues to inch closer. Ethereum’s final testnet merge successfully took place on the Goerli Network on August 10. With this final test completed, the Merge has officially been scheduled for Ethereum’s mainnet. Ethereum’s co-founder, Vitalik Buterin, tweeted that the network has a fixed number of blocks to mine, predicting the Merge to occur around September 15, though this may vary depending on hash rate.

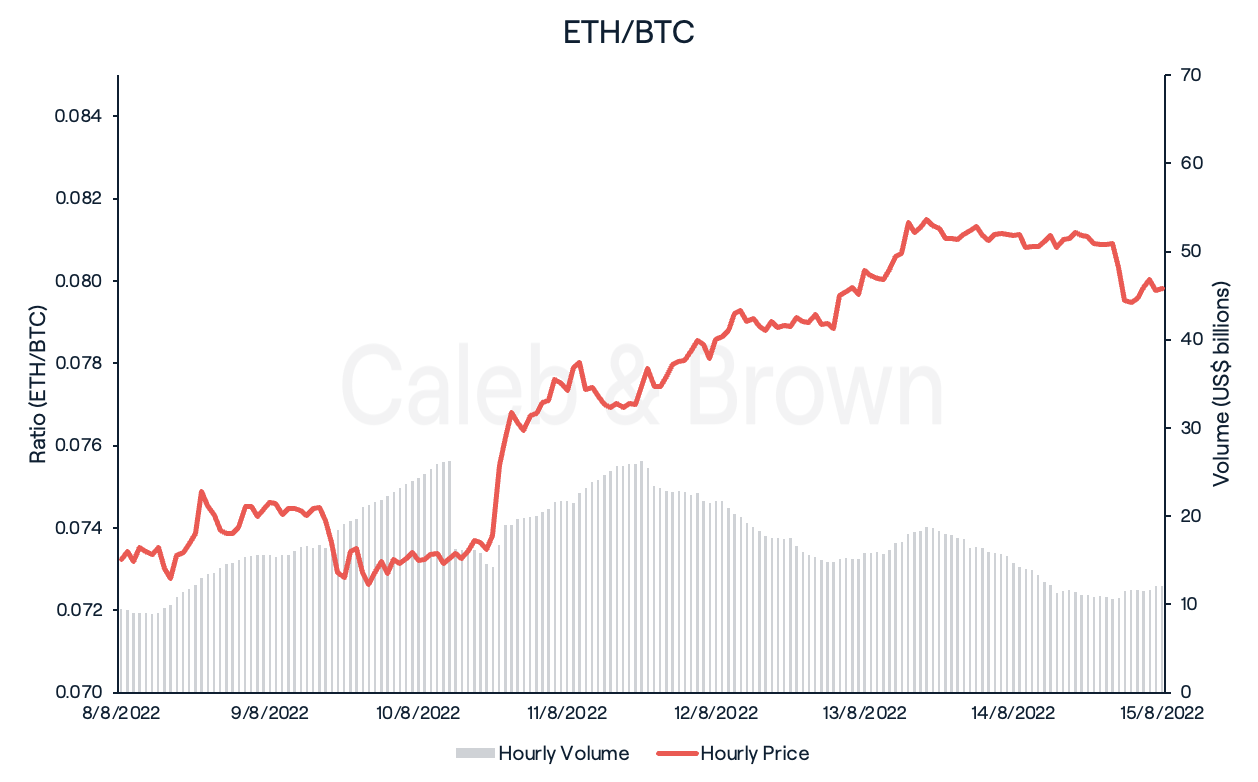

Consequently, with the Merge consuming the attention of the crypto market at present, it is unsurprising that ETH was amongst the strongest performers over the past seven days. ETH captured an impressive 9.57% relative market share against BTC.

Altcoins

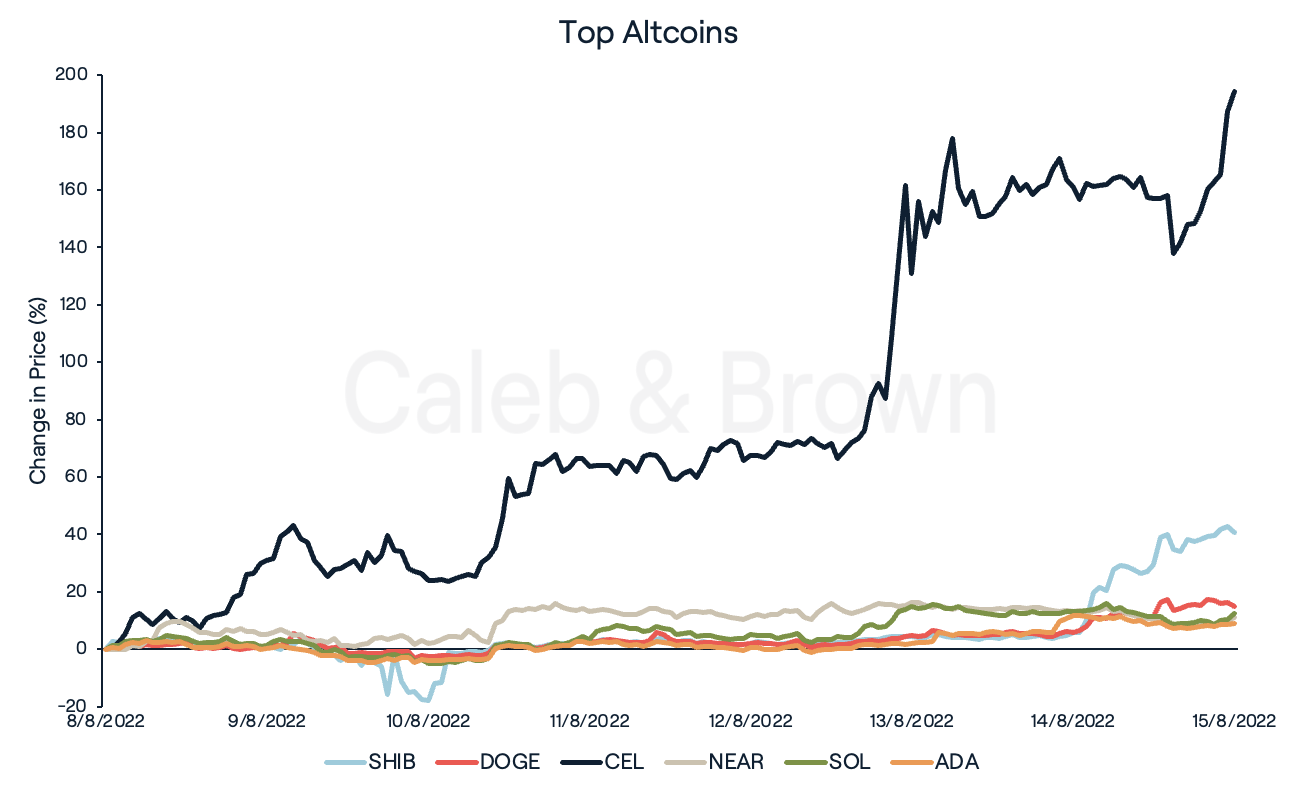

Altcoins have gone barking mad once again, with capital flowing into dog-themed meme coins to start the week. Shiba Inu (SHIB) was among the strongest performing assets, trading 39.8% higher over the last seven days. Speculators have traded US$4.47 billion of SHIB in just the last 24 hours. Dogecoin (DOGE) trailed SHIB’s sharp move and has managed to increase 17.9% over the same period of time.

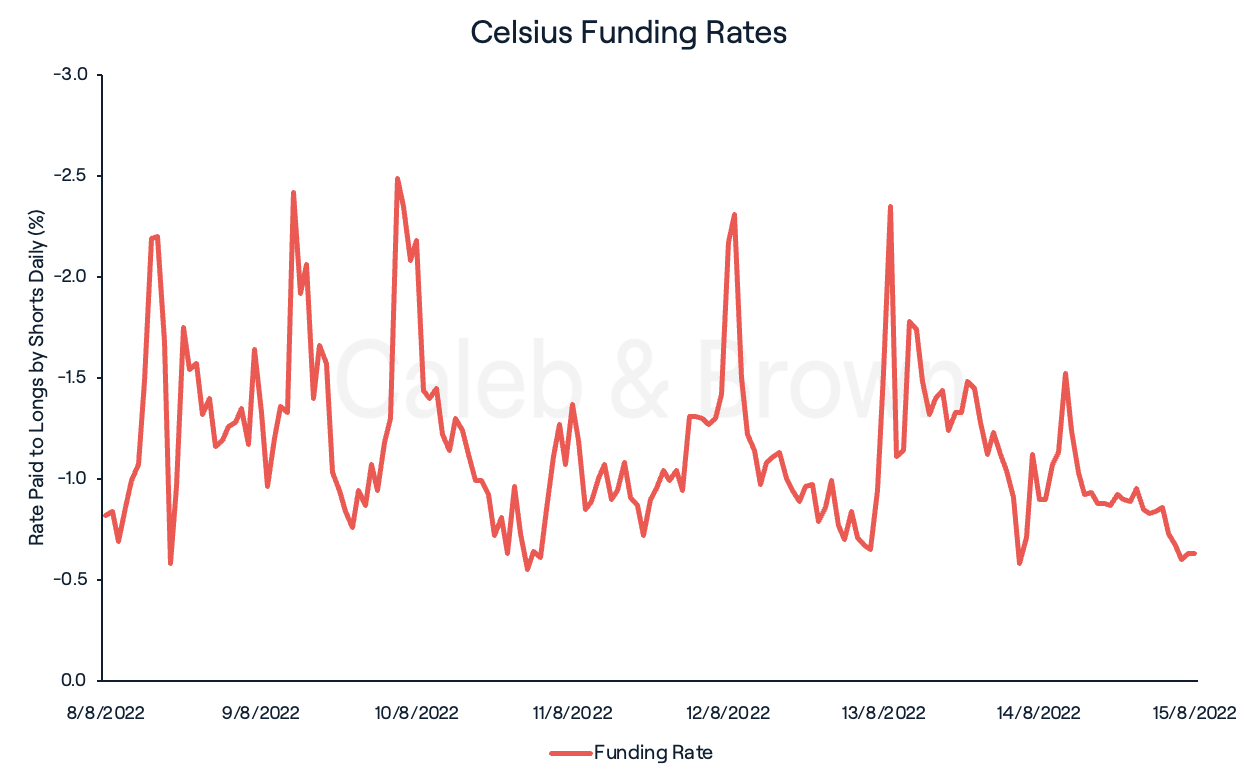

Celsius Network (CEL) has been the hottest asset across the market this week, increasing by a scorching 174%. Despite filing for bankruptcy in June due to a US$2 billion hole in its balance sheet, the embattled lender’s token has rallied in price due to a major short squeeze. With the majority of CEL’s supply held by Celsius and therefore unable to be moved, withdrawn, or sold because of their bankruptcy proceedings, the conditions for a short squeeze were set. Moreover, traders were forced to pay 0.5-2.5% a day to short the token. Speculators saw around 863,000 CEL in short liquidations in throughout, worth around US$2.15 million.

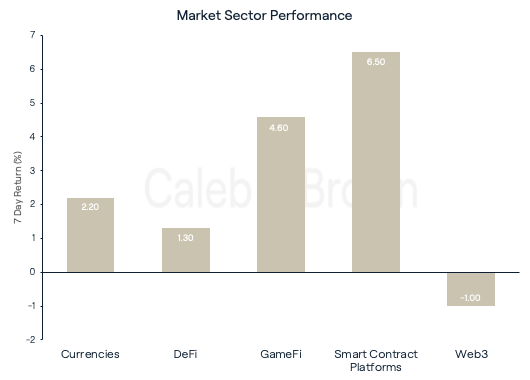

Smart contract platforms were the strongest performing sector over the week. They returned 6.5% on average in the last seven days, led by Near (NEAR), Solana (SOL), and Cardano (ADA). These tokens increased by 12.4%, 10.5%, and 8.4% respectively. The GameFi sector returned 4.6%, while the currencies and DeFi sectors returned 2.2% and 1.3% respectively. The Web3 sector struggled this week and posted a negative return of 1%.

Regulatory

The US Treasury department sanctioned Tornado Cash, alongside several wallet addresses tied to the mixing service. Tornado Cash is a service that allows users to obfuscate where their funds have come from and where they’re going. This service has been linked to money laundering on several occasions, including the infamous Lazarus Group, a hacking group with ties to North Korea that were responsible for the US$600mil hack of Axie Infinity. Several Decentralised Finance (DeFI) projects (including AAVE and DYDX) have responded to these sanctions through blacklisting wallets that have directly interacted with Tornado Cash.

Recommended reading: What is Ethereum? A Beginner's Guide

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)