In this Week's Market Rollup

The global crypto market cap is back above US$1 Trillion, Bitcoin's sharp gains cancel out months of losses, and altcoins go parabolic.

To learn how and why it happened, read on.

Market Highlights

-

A great start to the year sees Bitcoin (BTC) hit US$21,000 for the first time since November 2022, erasing all losses since FTX’s collapse.

-

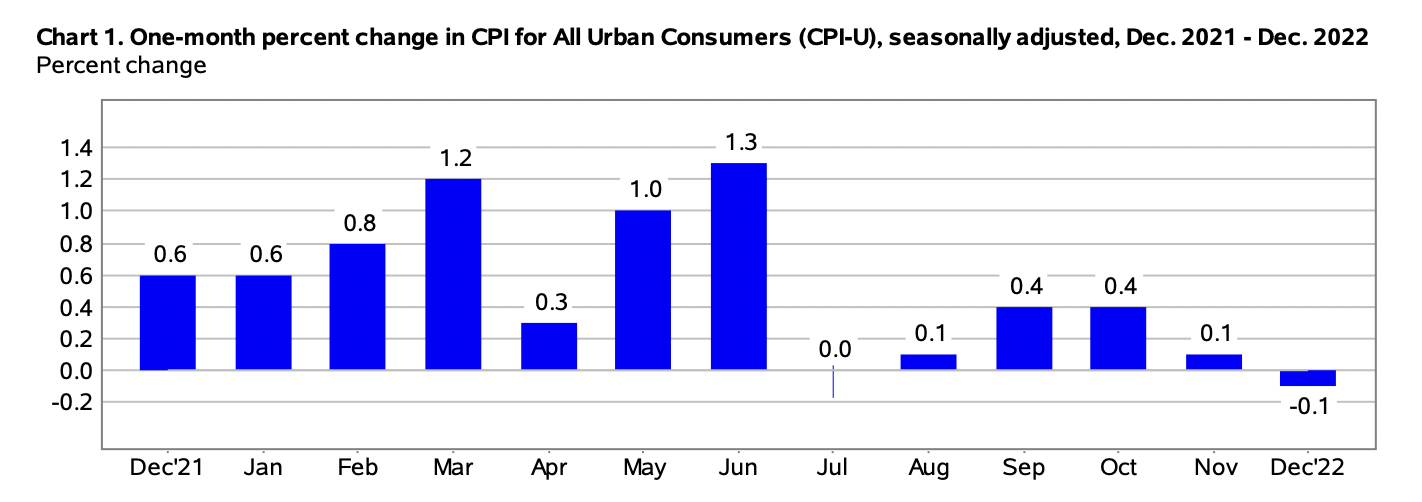

The U.S. Bureau of Labor and Statistics’ Consumer Price Index (CPI) report revealed that CPI fell 0.1% in December for the largest month-to-month drop since April 2020.

-

The FTX restructuring team was able to recover more than US$5 billion in cash and liquid crypto assets on Wednesday according to FTX's lead attorney, Adam Landis.

Price Movements

Bitcoin (BTC)

2023 continues to shine green as the crypto market rallied for the second consecutive week this year. Global cryptocurrency market cap grew by a staggering 19.2% to bring it back above US$1 trillion as the market responded positively to the U.S. Bureau of Labor and Statistics’ Consumer Price Index (CPI) report on Thursday.

The report revealed that CPI fell 0.1% in December for the largest month-to-month drop since April 2020.

On an annual basis, CPI rose 6.5% in December, lower than the previous month’s 7.1% figure. Both metrics met expectations, and could suggest smaller interest rate hikes from the Federal Reserve in the future. The fall of inflation rate seen in December could be largely attributed to the monthly decline in price of gasoline and fuel oil, which fell 9.4% and 16.6%, respectively.

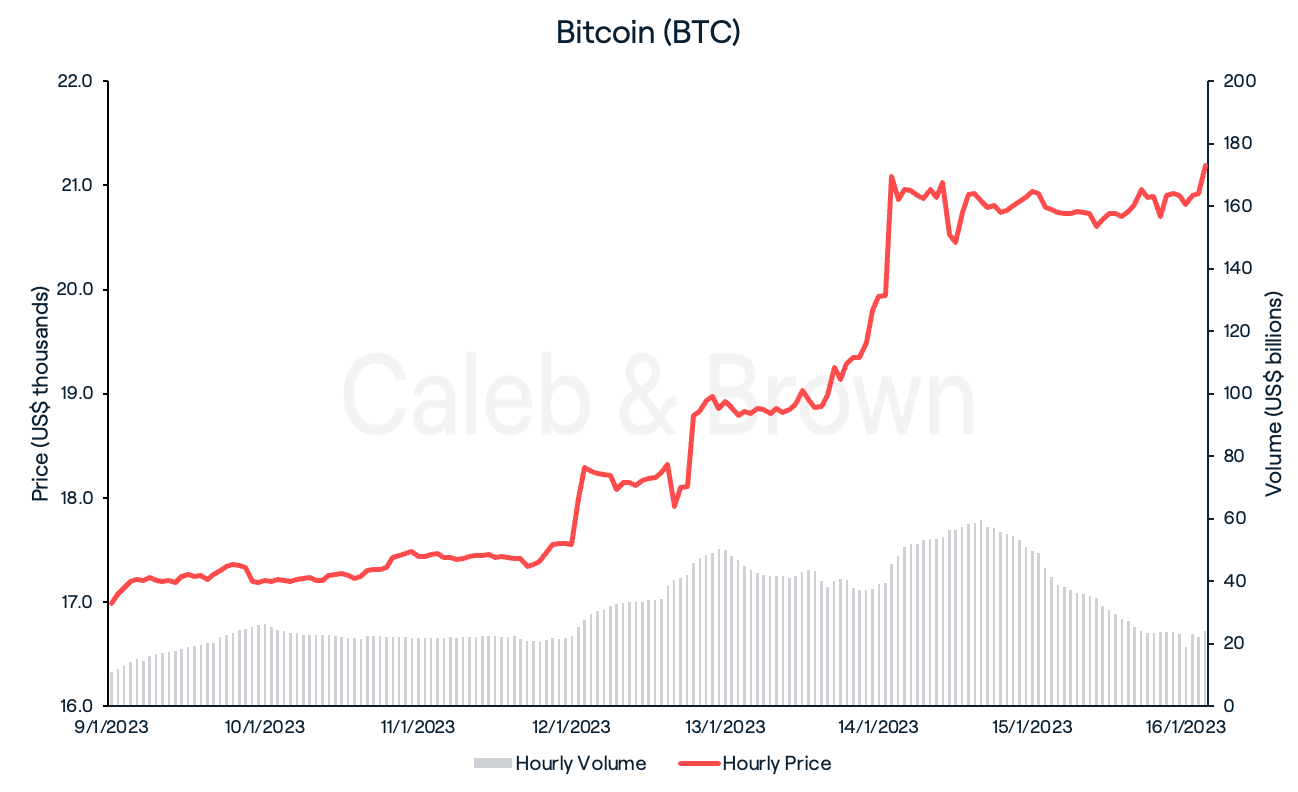

News of the report sent Bitcoin (BTC) past US$19,000 on Thursday for the first time since the fall of FTX in November, where it continued to rally into the weekend. BTC closed the week at US$21,182 for a 23.9% weekly gain, beating the market average and marking its best weekly performance since February 2021.

Ethereum (ETH)

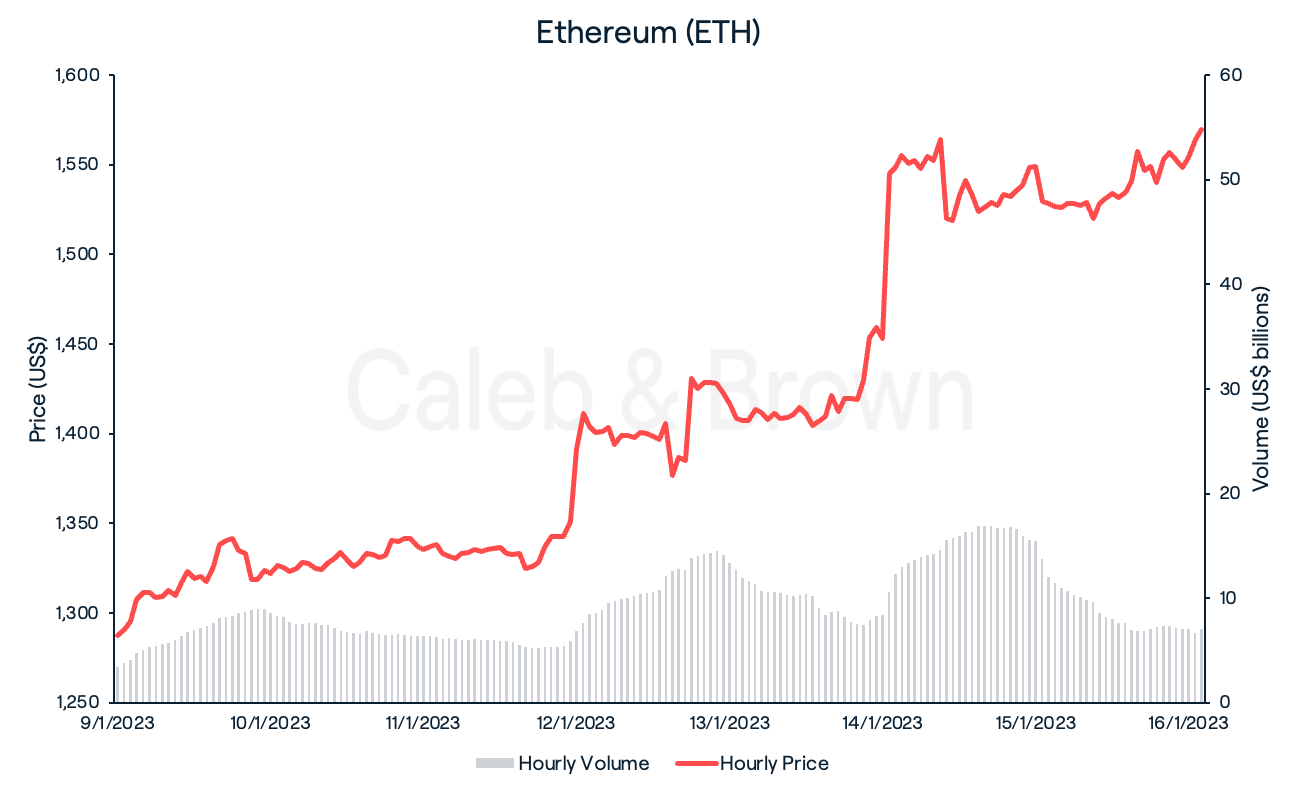

Etheruem (ETH) also enjoyed double-digit gains this week as the market continued its surge into 2023. ETH opened the week at US$1,295 and rallied 9.1% in anticipation for the CPI report on Thursday. Similarly to BTC, ETH responded positively to the report and reached a high of US$1,600 by Saturday. Overall, ETH closed the week at US$1,568 for a weekly gain of 21.8%.

Altcoins

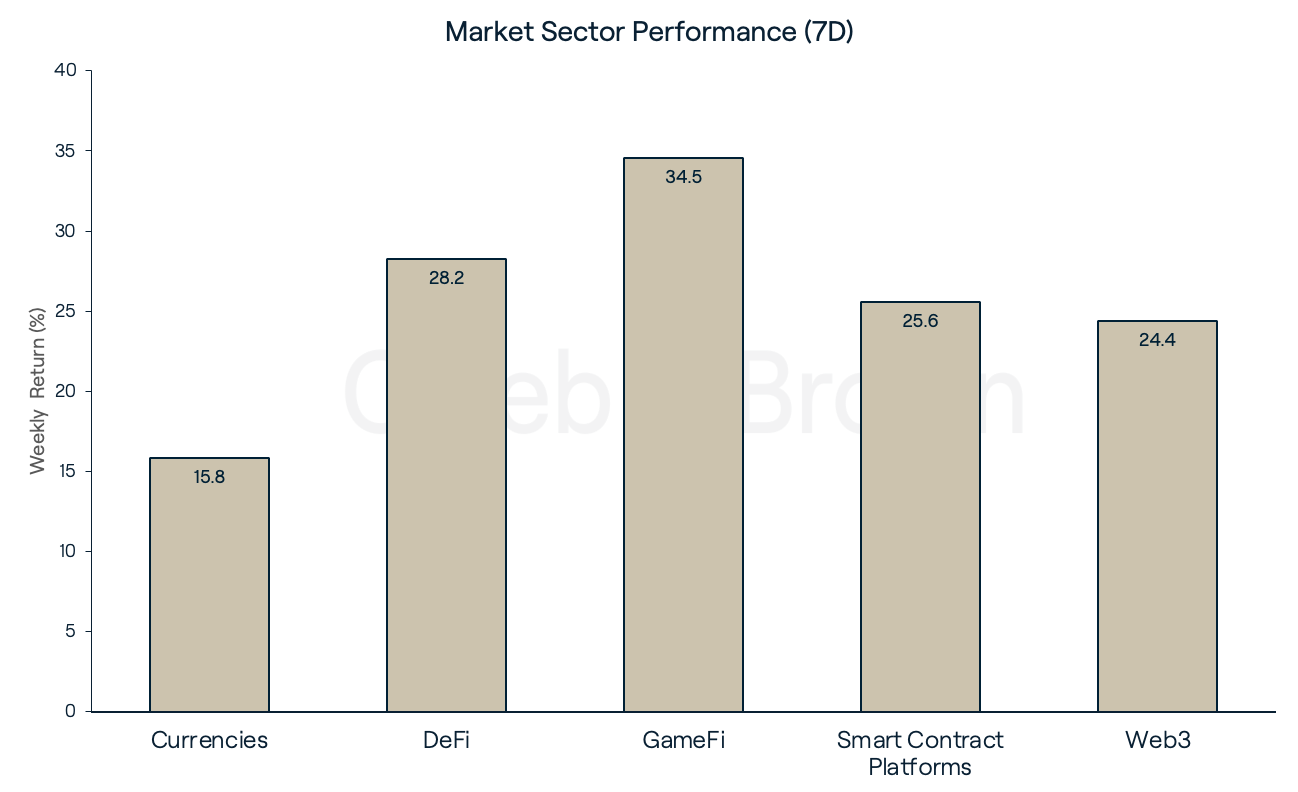

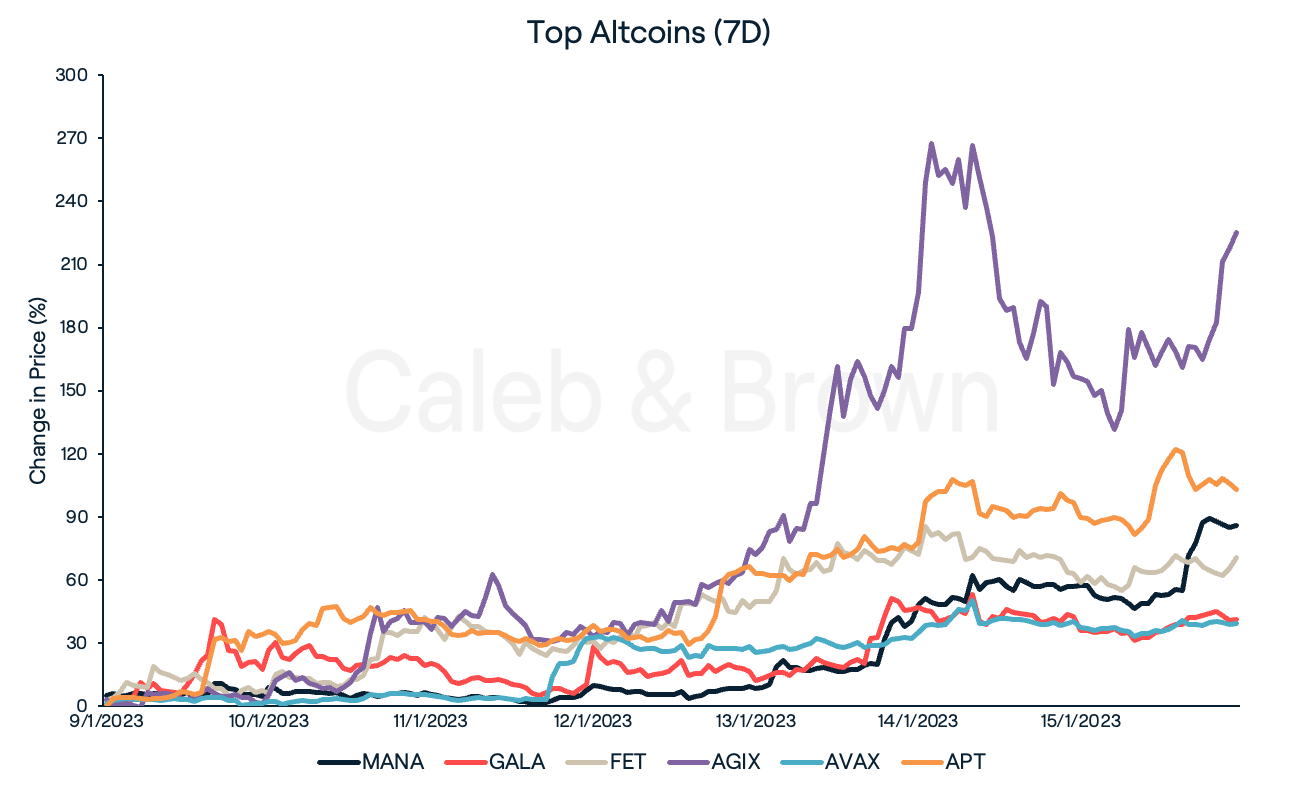

It was a huge week for altcoins with double-digit gains spanning all of the top 50 coins, however some sectors emerged above the rest. GameFi has continued to benefit from the current Metaverse narrative shift and secured the best performing sector for the second week in a row, gaining 34.5%.

Metaverse players, Decentraland (MANA) and Gala Games (GALA) rallied 89.1%, and 42.8% respectively, over the last seven days. MANA’s price jump came as it announced new features on Thursday, introducing new profile features and avatar functions. GALA was able to hold onto last week’s gains and is up 194.4% over the last 14 days.

Following closely was Smart Contract Platforms which gained 25.6% week-on-week. Avalanche (AVAX) grew by 40.8% after announcing its partnership with Amazon Web Services (AWS) on Thursday. The partnership will make it easier for more people to launch and manage nodes on Avalanche, giving the network even more strength and flexibility for developers.

Recently launched layer-1 protocol, Aptos (APT) surged 109.7%, securing its place as one of this week’s best performers. While no link can be directly attributed to its outperformance this week, APT traded up 41% on Tuesday after decentralised exchange, PancakeSwap voted to continue its multi-chain deployment on Aptos.

Thanks to the recent launch and success of ChatGPT, a chatbot tool driven by artificial intelligence (AI), the potential for AI as a technology has taken the forefront of the technology and crypto space. As such, investors begun speculating on AI tokens with two in particular significantly outperforming the market.

Fetch.ai (FET) and SingularityNET (AGIX) each rallied 66.6% and 233.3%, respectively over the last seven days. These projects both provide AI service integration with third-party decentralised apps (dApps) allowing users to utilise AI in their own dApps. Both have seen significant growth over the last month with FET adding 157.8% over the last 30 days, and AGIX adding 356.1%.

In Other News

US$5 Billion Recovered

The FTX saga sees a glimmer of hope as the FTX restructuring team was able to recover more than US$5 billion in cash and liquid crypto assets, FTX's lead attorney, Adam Landis said on Wednesday morning at a court hearing in Delaware. Landis also mentioned that FTX had identified more than 9 million customer accounts linked to roughly US$120 billion associated transactions. FTX are now attempting to evaluate positions “for every customer” as of November 11 for potential disbursement.

LSD High

Liquid Staking Derivatives (LSDs) continued to surge this week as Ethereum core developers confirmed that the Shanghai upgrade remains on track for March. The upgrade will enable staked ETH withdrawals, allowing users to remove their staked ETH from the beacon chain. With the major risk of not being able to withdraw your staked ETH almost gone, investors have continued to speculate on LSDs. Lido DAO (LDO) remains the market leading LSD, currently representing 88% marketshare.

Raid on Lender

After both of its main competitors Celsius and BlockFi filed for bankruptcy last year, the last remaining crypto lender, Nexo, has been hit with a wave of withdrawals after news broke that Bulgarian prosecutors raided its Sofia offices as part of a financial crimes investigation. Crypto intelligence firm Arkham was able to confirm a large amount of outflows from Nexo wallet addresses following the raid, however Nexo management denied all allegations by the Bulgarian Prosecutor’s Office and stated “it's business as usual”.

Recommended reading: What Is Bitcoin Halving?

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FZtVYSpeGjStxCr1tDgIh0%2Ff7f445955969e7f9dedfc1c434e55e52%2FBlog-Cover__7_.png&a=w%3D400%26h%3D225%26fm%3Dpng%26q%3D80&cd=2023-01-16T12%3A58%3A50.583Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)