In this week's Market Rollup

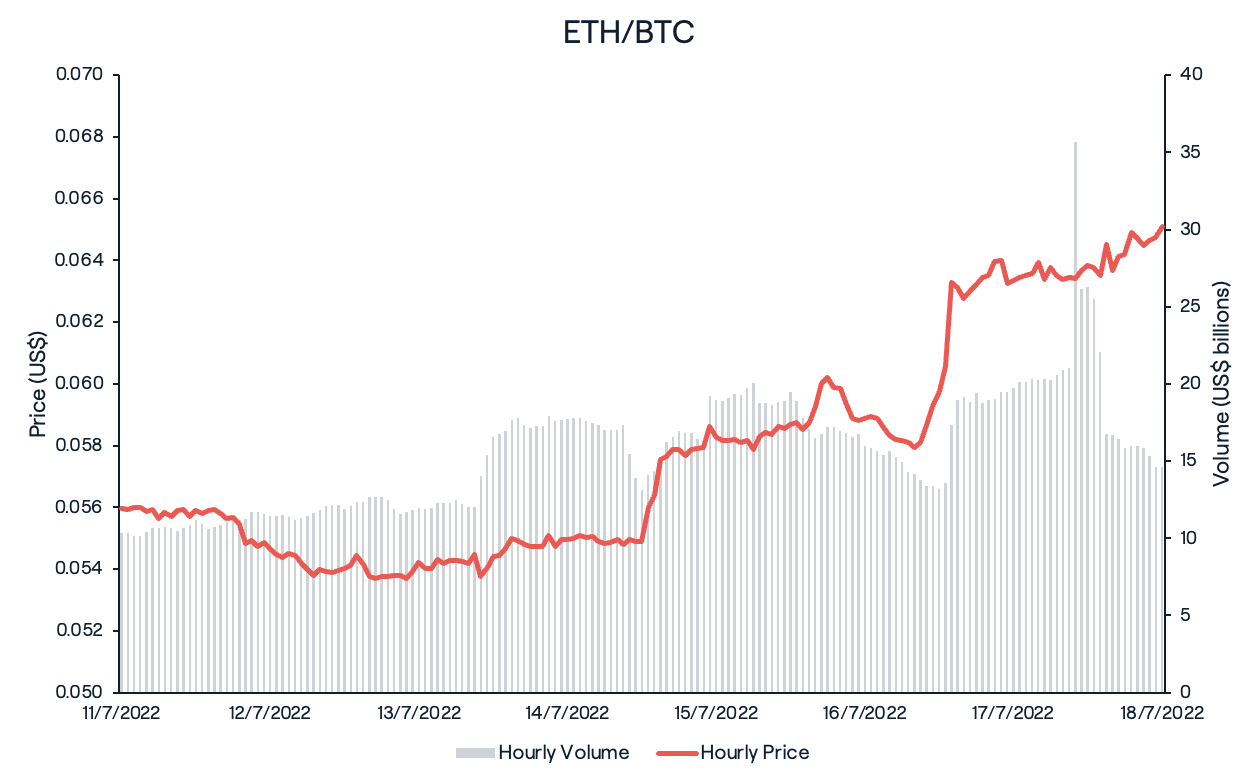

After weeks of frustration for investors, major assets finally enjoyed positive weekly returns, bringing some minor relief to what has been a dramatic crash in prices of late. News of a timeline for the Merge set markets in motion, with Ethereum and DeFi assets leading the way. This major update proved to be a key catalyst, with ETH having its strongest week since March. DeFi assets continued to dominate across market sectors, as investors rotate into assets that could potentially benefit from Ethereum’s transition to Proof of Stake (PoS).

Market Highlights

- Following a successful shadow fork on 16 July, the Ethereum developers announced a timeline for the Merge, expecting the protocol upgrade to take place on September 19, 2022.

- Inflation has dominated market headlines this week after inflation came in at a whopping 9.1%, topping most economist’s estimations by 0.3%.

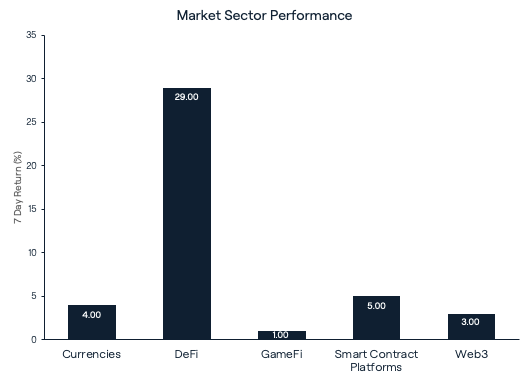

- The decentralised finance (DeFI) sector outperformed the market for the second consecutive week, gaining 29% over the last seven days.

Price Movements

Bitcoin (BTC)

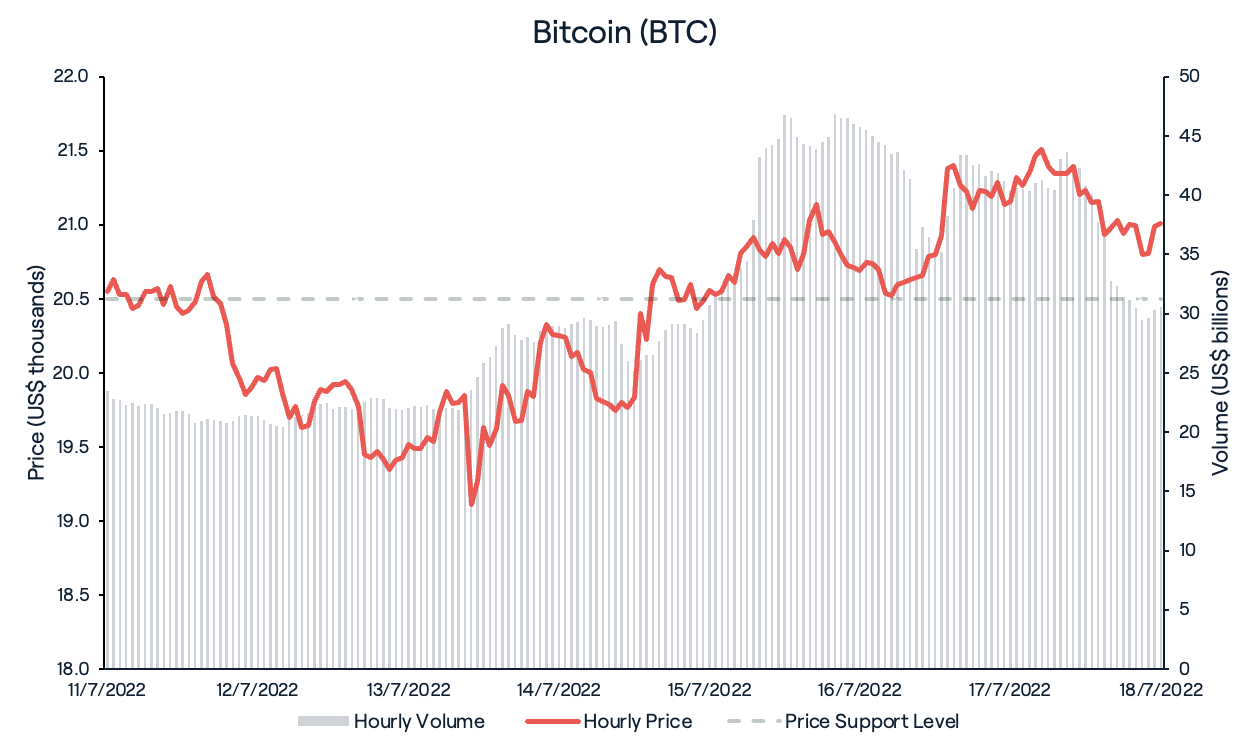

Bitcoin (BTC) was successfully able to hold its gains, closing the week 3.3% higher at US$21,150. Although BTC traded as low as US$19,100 during the week, its price has remained relatively stable as it continues to trade in the monthly range of US$19,000 to US$21,500. Meanwhile, Bitcoin dominance fell 3% over the past seven days as altcoins outperformed.

One of the heaviest blows to BTC’s price this week came from an inflation report by the U.S. Bureau of Labor Statistics released on July 13th, which noted that the Consumer Price Index (CPI) rose 9.1% in the 12 months up to June, 30 basis points higher than what was projected. That’s the largest 12-month increase in over 40 years. This led to a stock and crypto sell-off, as investors de-risked heavily, which coincided with BTC’s weekly lows. Two Federal Reserve officials have since indicated they favour a 75 basis point hike in the U.S. central bank’s upcoming July meeting.

Ethereum (ETH)

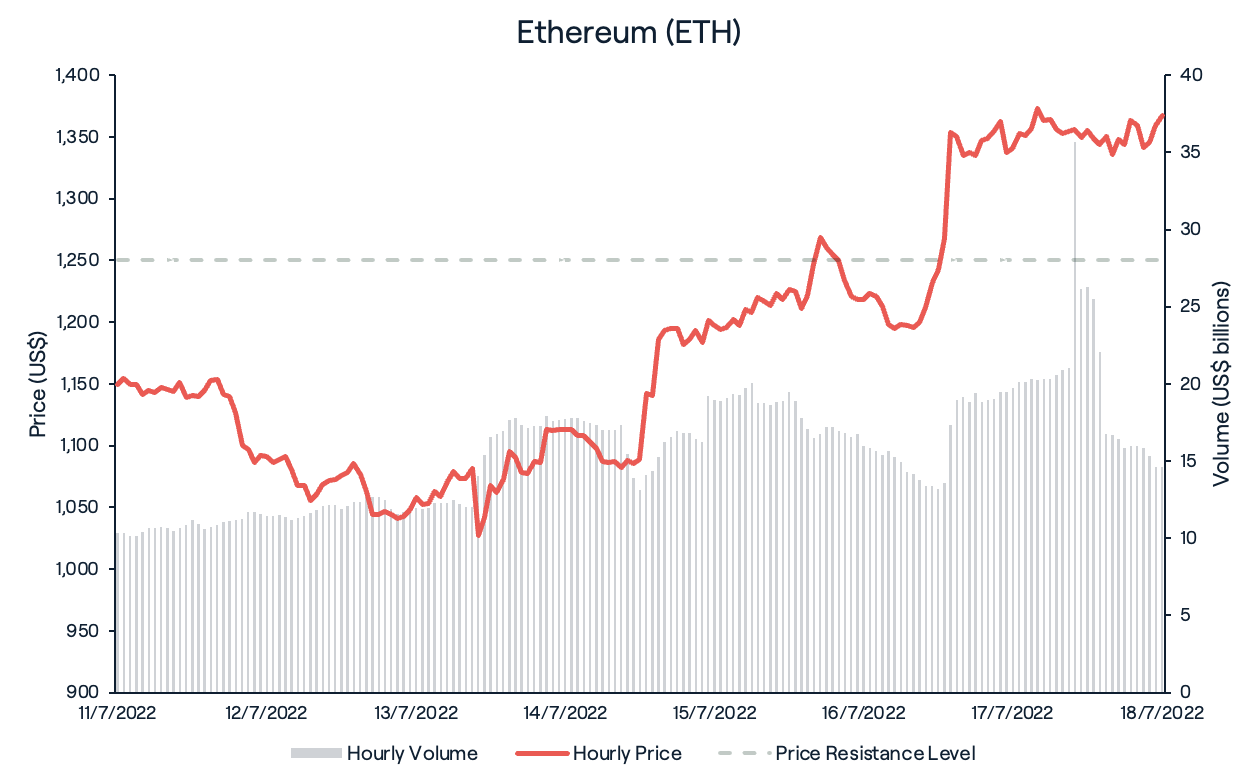

ETH enjoyed one of its best performing weeks since March, rallying 15% following major news from developers that the Merge is expected to take place on September 19, 2022. This news proved to be a key catalyst, pushing ETH above the US$1,250 resistance level.

News of this potential major milestone in the Ethereum roadmap saw ETH outperform BTC this week by 11.7%. The Merge is the most significant Ethereum upgrade and one of the most talked about events in the crypto space, as it will completely reshape how Ethereum functions going forward by shifting its consensus mechanism from Proof of Work (POW) to Proof of Stake (POS).

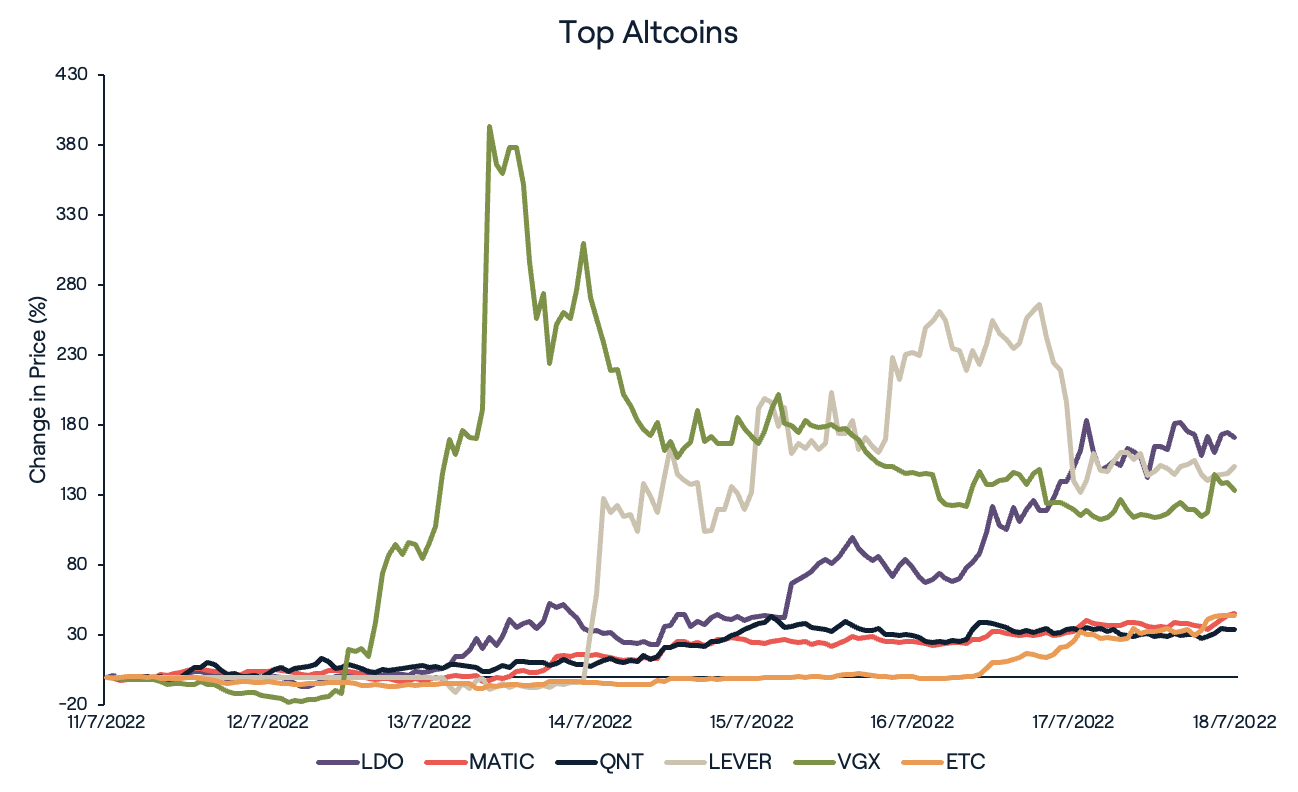

Altcoins

Altcoins enjoyed a second week of positive returns with all market sectors posting positive returns. DeFi led the way with 29% average returns this week, largely thanks to another strong week from Lido DAO (LDO). Following months of centralised finance (CeFi) making headlines due to negative press, investors have begun to reallocate into battle-tested DeFi protocols that have operated flawlessly during the recent downturn.

Lido DAO stole the show in DeFi this week, returning 163% over the last seven days. This significant move comes in conjunction with the announcement of the Merge timeline, as Lido is the largest liquid staking provider of ETH. The total value locked (TVL) on Lido increased by 55% since the planned launch date of the Merge was announced, from 3.66 million ETH (approx. US$4.5 billion) to 5.67 million ETH (approx. US$5.9 billion). This indicates that there is a potentially greater demand in the market for stETH. While stETH is currently worth 0.975 ETH, it will eventually trade at a ratio of 1:1 when users are able to withdraw their stETH from the Beacon Chain, following future updates on Ethereum after the Merge.

Voyager (VGX) and Ethereum Classic (ETC) also responded positively to the Merge date announcement, up 178.5% and 49.6% week-on-week respectively. VGX’s performance comes despite its recent Chapter 11 bankruptcy filing. Voyager is seeking the judge’s permission to honour its customers withdrawals. If granted permission, Voyager will look to release US$350 million from its custodian back to its customers.

Quant (QNT) has continued to perform well, up 31.4% for the week and 113.8% for the month. While this rally was initiated by rumours of a potential Visa partnership, an official announcement remains to be made by either party. Scaling solution Polygon (MATIC) rallied 40.8% this week after Polygon CEO, Ryan Wyatt announced that over 48 projects had moved over to Polygon from the Terra (LUNC) network. Disney also selected Polygon to take one of six spots in their Web3 accelerator program, cementing Polygon’s place as one of the leading scaling solutions built on Ethereum.

LeverFi (LEVER) was also among the strongest performing assets of the week, up 153%. This follows its recent re-denomination and rebrand from Ramp DeFI (RAMP). LeverFi announced a successful relaunch and that 72.2% of the RAMP total supply had already been burned.

Recommended reading: Ethereum: What is The Merge?

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)