In this Week's Market Rollup

It’s been another unforgiving week across the crypto market as news of the Fed’s interest rate hike on Wednesday scared off investors and sent prices tumbling in the days that followed. Bitcoin (BTC) and Ethereum (ETH) posted losses for the second week running as investors once again rotated out of risk-on assets. However, there were some exceptions amongst the top assets by market cap, with XRP soaring as news broke that the SEC’s lawsuit against Ripple may soon come to a conclusion.

Market Highlights

- Crypto markets dipped on Wednesday following news that the United States Federal Reserve would raise interest rates by another 75bps to combat inflation.

- Despite bearish price action, ETH’s supply dynamics continue to improve post-merge, removing over $160 million worth of selling pressure from markets in just over 10 days.

- XRP surged over 36% as investor speculation grows following news the SEC’s lawsuit against Ripple may be coming to a close after both parties filed motions for summary judgment.

Price Movements

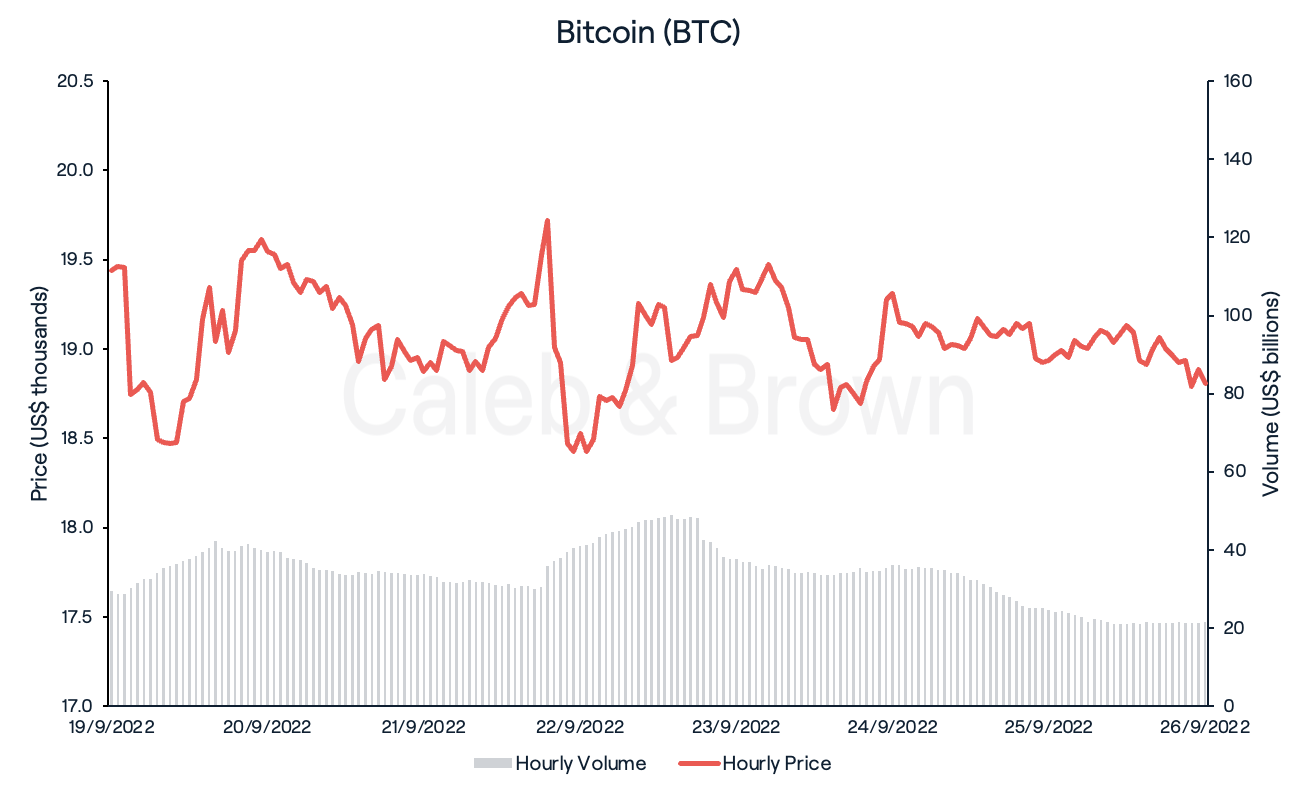

Bitcoin (BTC)

It has been a tumultuous week for Bitcoin (BTC) as its price dipped below US$19,000 for the second time this month on September 19. A potential price reversal was then quashed on September 21 when Federal Reserve Chairman, Jerome Powell, announced plans to hike interest rates by another 75 basis points (bps), the third consecutive hike of its kind this year. Investors responded aggressively to the news, with BTC’s price falling 7% in the hours that followed. BTC proceeded to trade the remainder of the week in a range of US$18,600 to US$19,500, closing the week down 2.87% at US$18,870.

Despite Michael Saylor’s departure as CEO, Microstrategy continues on its Bitcoin buying spree. The software company purchased another 301 BTC between August 2 and September 19, spending roughly US$6 million in total, according to its SEC filing. This brings its total holdings to nearly 130,000 BTC which has been acquired at an average price of US$30,639 per BTC.

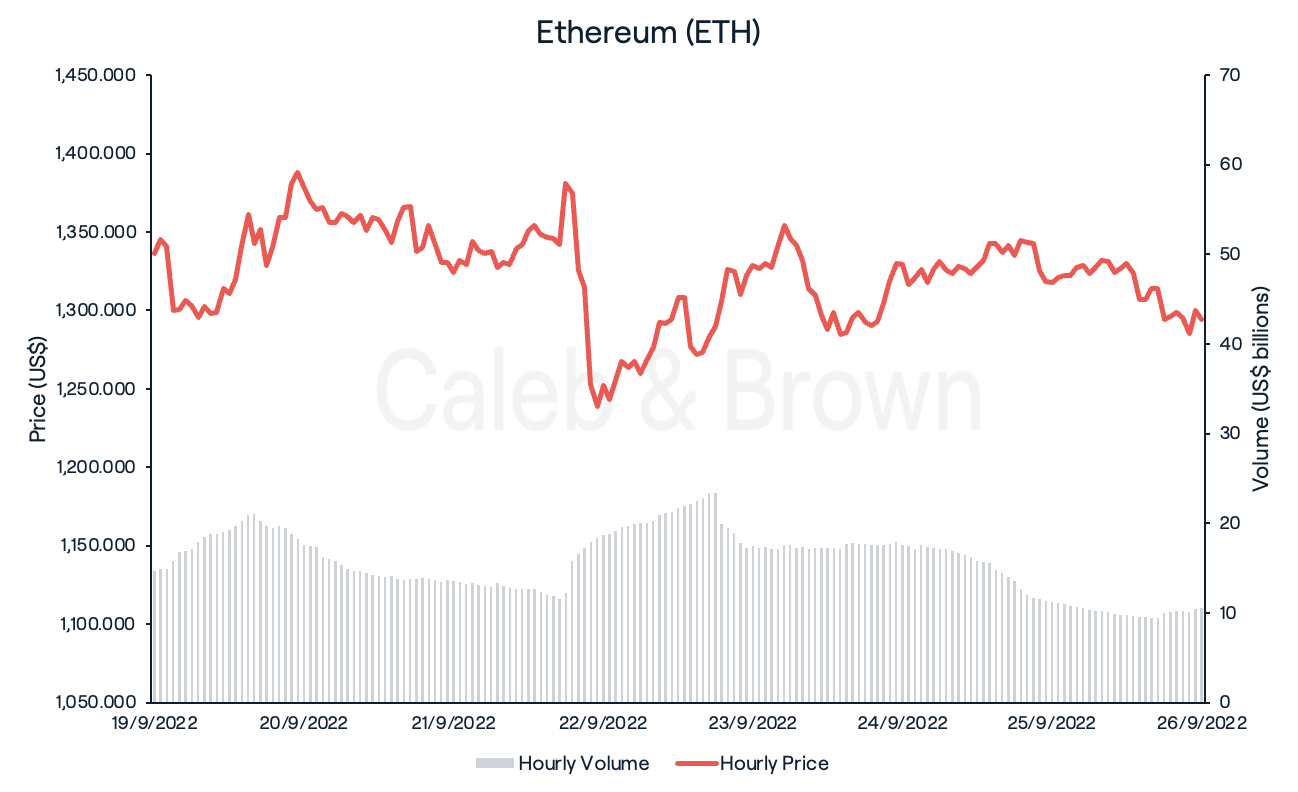

Ethereum (ETH)

News of the Fed’s rate hike had a similar impact on Ethereum’s (ETH) performance over the last seven days, as the price of ETH fell below US$1,300 for the first time since July 17. ETH found its local bottom for the week on September 22 at US$1,238. Price has since consolidated back to US$1,309 at the time of writing, down 2.77% for the week.

Although ETH’s recent price action has been relatively bearish post-merge, Ethereum on-chain statistics paint a vastly different picture. Ethereum’s transition to a Proof-of-Stake (PoS) network following the Merge has drastically changed the supply mechanics of ETH. Since September 15, the supply-inflation of ETH has dropped to 7,900 ETH (US$10million) under the new PoS model. On the contrary, supply inflation would have increased by over 134,000 ETH (US$176million) on the old Proof-of-Work (PoW) system. This represents a 94.4% decrease in supply-inflation, and is equivalent to removing US$160 million worth of selling pressure from the market in just over 10 days.

Pair this decrease in supply-inflation with the 230,000 ETH that has been locked up in staking contracts since the Merge, and the net liquid ETH in circulating supply is actually down by 222,100 ETH. So, despite the less than favourable price action, Ethereum’s fundamentals are getting stronger.

Altcoins

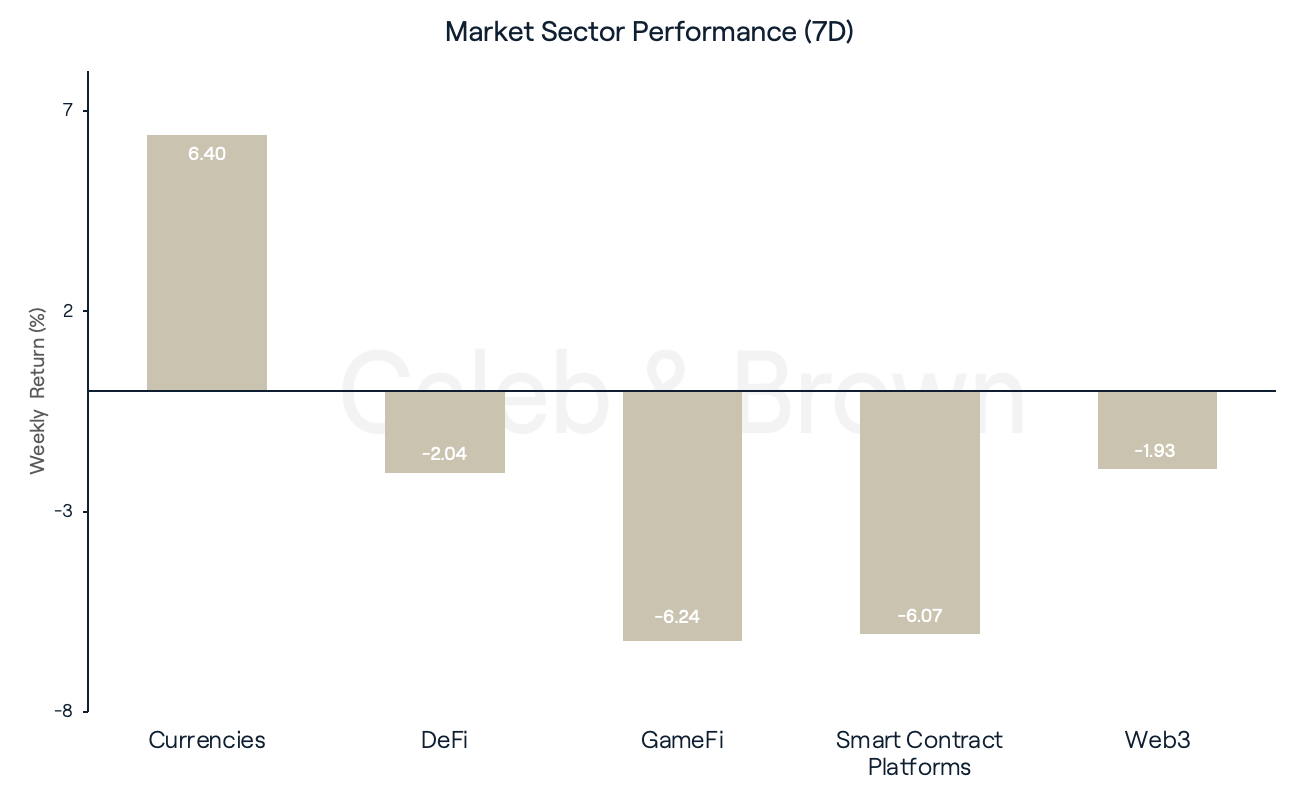

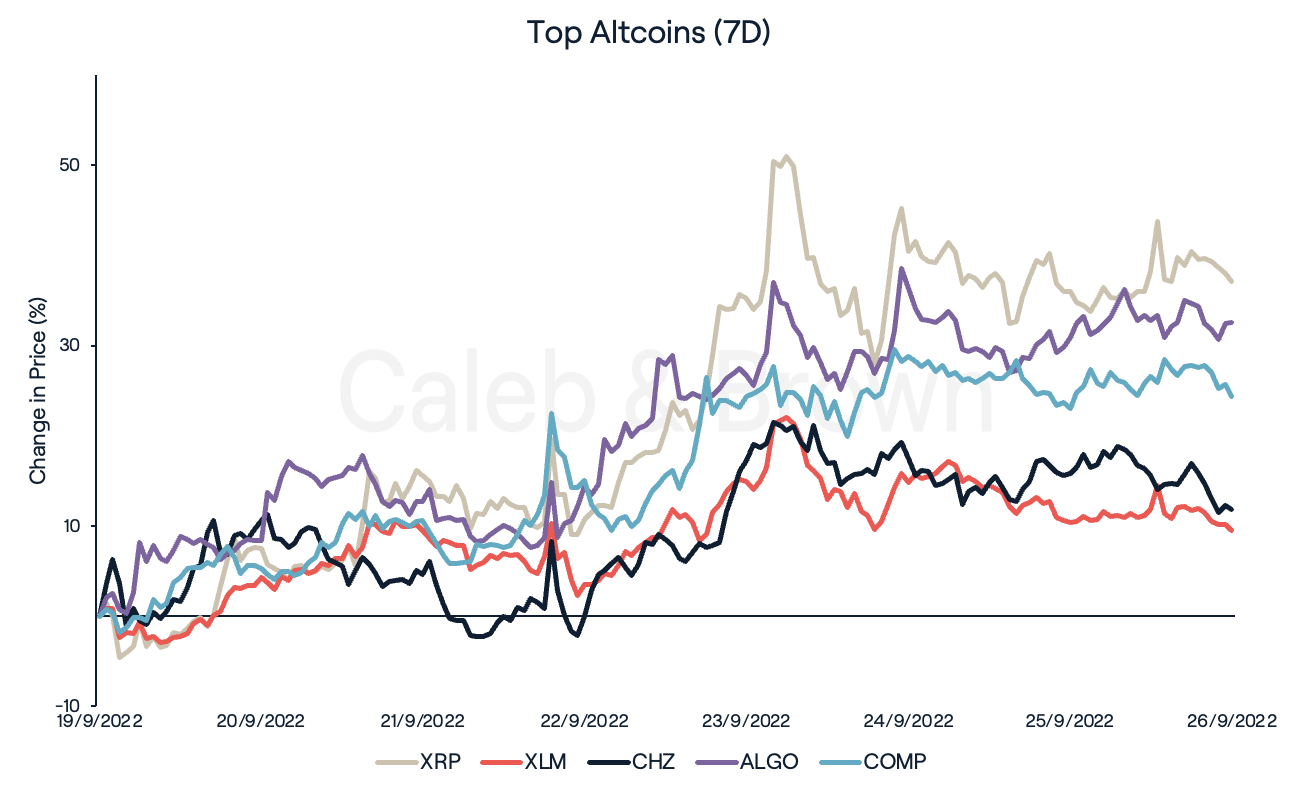

While most crypto market sectors traded in line with major assets over the past seven days, one sector went against the grain, with Currencies coming out on top this week, gaining 6.4%. This was led by XRP (XRP), which rallied an impressive 45% during the middle of the week, settling at a price of US$0.4922, a 36.7% jump in week-on-week price. Web3 and DeFi sectors held on the strongest after Currencies, losing only 1.93% and 2.04% respectively in value last week.

The XRP price surge follows news of both Ripple and the SEC filing motions for summary judgement, in their $1.3 billion lawsuit, each manoeuvring to dismiss the lawsuit before trial. The SEC filed charges against Ripple in December 2020 for allegedly conducting an unregistered securities sale of XRP. With the case becoming one of the most noteworthy cases in the crypto space, leaving investors to speculate on XRP’s price.

Another token which responded positively to the XRP news is Stellar (XLM), which is up 7% over the week. Stellar was founded by Jed McCaleb in 2014, who also co-founded XRP the prior year. XLM also shares similar functionality with XRP, which could explain the recent correlated price-action.

Algorand (ALGO), Compound (COMP), and Chiliz (CHZ) have had a great week, each returning 31.1%, 26.6%, and 12.5% respectively. ALGO’s pump coincided with news of a FIFA partnership, in addition to positive growth in its user base and total value locked (TVL).

Web3 News

Cardano’s (ADA) five-day Vasil hard-fork commenced on September 23. Co-founder, Charles Hoskinson described it as the hardest update for the developers since its inception in 2017. The upgrade will see accelerated transaction times and cheaper transaction costs.

The crypto wireless network token, Helium (HNT), revealed its plan to transition to the Solana network from their very own, after a community proposal on September 22 voted 81% in favour of the migration. Founder, Amir Haleem, explained that this migration looks to address scaling as more users adopt the network.

Recommended reading: What is BnB? A Beginner's Guide

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)