In this Week's Market Rollup

Crypto market prices were sent tumbling on Friday following news that the Fed plans to keep raising interest rates to combat ‘transitory’ inflation in the US economy. Major assets classes hit monthly lows, surrendering most of the gains from July and August. Meanwhile, altcoins continued their bearish price action with all market sectors in the red over the past seven days.

Market Highlights

- News that the Fed will keep raising interest rates to combat inflation sent stocks and crypto prices tumbling on Friday, August 26.

- This surprise news triggered over US$250 million in liquidations in under 24 hours, sending Bitcoin (BTC) prices below the key US$20,000 support level for the first time since July 12.

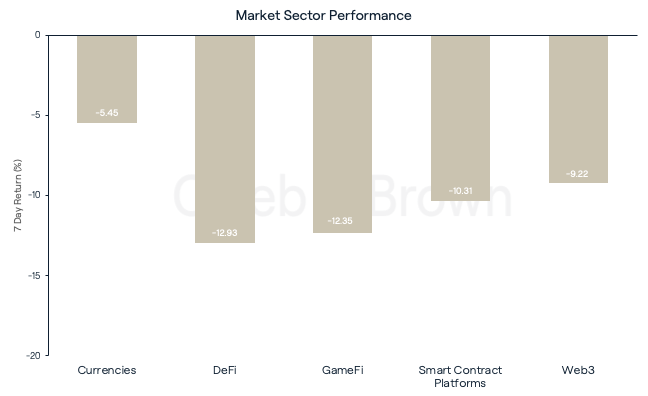

- All major assets and market sectors are at a net loss over the past seven days, with DeFi taking the heaviest hit, down nearly 13%.

Price Movements

Bitcoin (BTC)

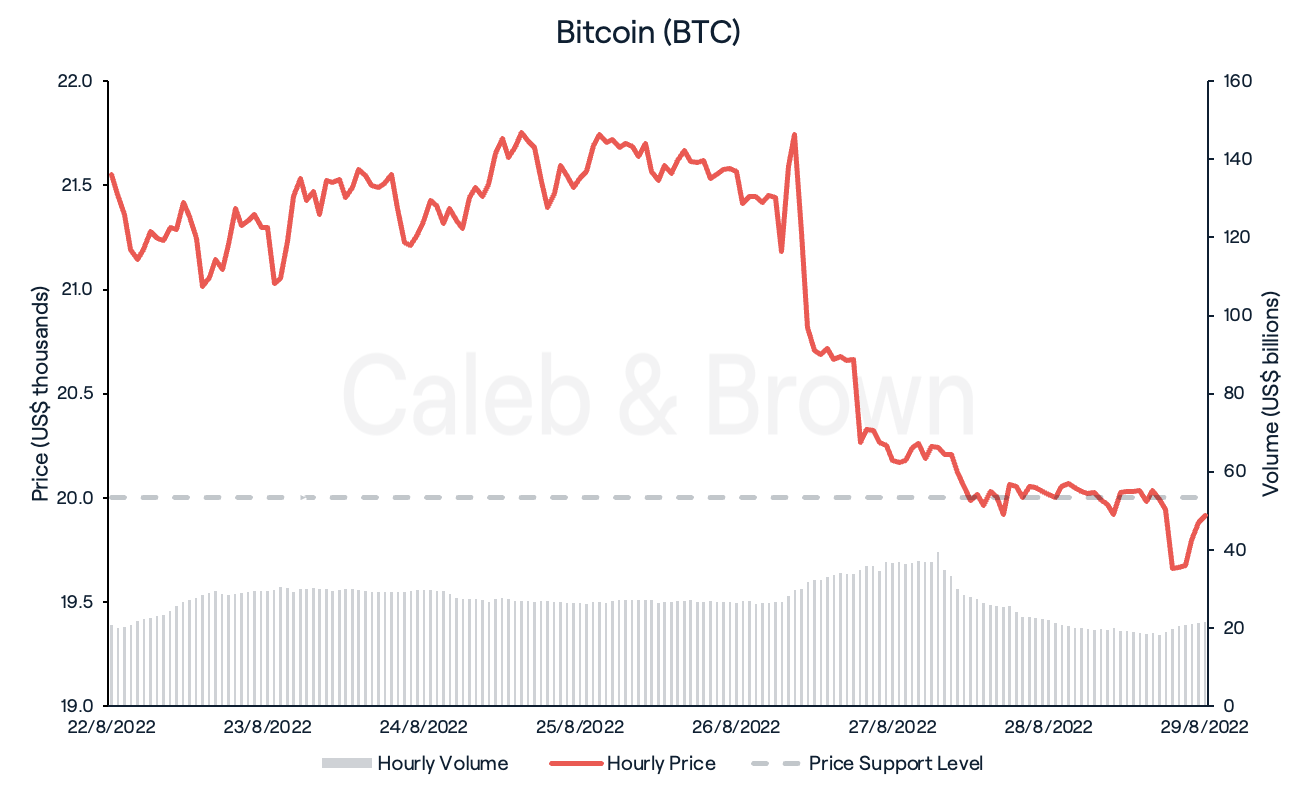

What started out as a relatively uneventful week in the crypto market turned into a dramatic one on Friday 26, as Bitcoin (BTC) dropped 4% in under 24 hours. This negative price action continued through the weekend, with BTC’s price slipping below the key US$20,000 support level to US$19,700 as of time of writing. This seven day loss of 8.9% represents a monthly low for August and the first time BTC has fallen below US$20,000 since July 12.

This price plummet was likely triggered by Federal Reserve Chair Jay Powell’s remarks that the Fed will continue to raise interest rates for as long as it takes to combat inflation. The comments likely affected both stock and crypto prices, sending both tumbling. The Dow, Nasdaq, and S&P 500 each closed down more than 3% on Friday. According to Insider, a 75 basis-point hike will be expected when the Federal Open Market Committee (FOMC) meets next month, making it the fifth rate increase of 2022.

Ethereum (ETH)

Ethereum (ETH) began the week making up ground from last week’s fall to US$1,600, however, it was unable to hold the line after the Fed’s announcement on August 26. ETH fell sharply to US$1,475, a level not seen since July 26 and closed the week down 8.87%. Amidst the sharp decline, over US$250 million in liquidations took place, with ETH alone suffering over US$160 million worth of liquidations in a 24-hour period.

While Ethereum supporters still have high hopes for the upcoming Merge, this week ETH deposits sent for staking on the Beacon Chain hit an all-time low. In a similarly interesting trend, ETH whales have also been consistently moving their holdings onto exchanges over the past three months. The inflow of assets onto exchange addresses generally indicates bearish sentiment where traders look to take profits by selling their holdings.

Altcoins

The declines continue for altcoins this week with negative returns posted across the board. Currencies faired best over the last 7 days, only falling by 5.45% while DeFi, GameFi, and Smart Contract Platforms all suffered double digit losses, as shown in the chart below.

Celsius Network’s (CEL) hot streak has come to a scorching end after its August rally of 344% completely retraced, shedding 60% over the past seven days alone.

Total value locked (TVL) across DeFi platforms on all blockchains has fallen over 5.5% this week suggesting dwindling user interest in the DeFi space. Lido (LDO) took the brunt of the TVL loss, declining by 10.88% the past 7 days. The DeFi market leader, MakerDAO (MKR), also lost 4.56% during the same timeframe.

The major outlier to the markets this week has been Chiliz (CHZ), the sports industry fintech platform. It continued its recent strong performance, rallying another 19.6%—its second week in a row of double-digit growth. Chiliz provides sports and entertainment entities with blockchain-based tools to help them engage and monetize their audiences. With the 2022 FIFA World Cup fast approaching, investors may be speculating on the ‘sports currency’ gaining increased relevance.

Web3 News

Cardano founder, Charles Hoskinson, revealed on August 26 that the ‘Vasil hard fork’ will go ahead “sometime in September.” The fork will act as a major system upgrade that will address a number of bugs currently found on the Cardano (ADA) network. While the fork itself should not pose any issues, major exchanges will need to accept and allow the newly forked coin to be traded on its platforms.

Avalanche (AVAX) also recently hit the spotlight after Binance founder, Changpeng Zhao shared a cryptoleaks article accusing Avalanche (AVAX) founder, Emin Gün Sirer, of harming competitors and distracting regulators only to promote his own protocol. Sirer was quick to respond on Twitter completely denying these accusations as “conspiracy theory nonsense.” AVAX fell 9.7% in response to the article in less than 24 hours.

Regulatory

On the regulatory front, the Australian Treasury said in a statement on Monday that it has a multi-step plan in place to establish a crypto regulatory framework based on market research that it claims will be more thorough and informed than those previously established anywhere else in the world. The market research will include token-mapping, which will "assist in determining how crypto assets and related services should be regulated." The Treasury says it will have a timeline for changes to legislation and regulations once the preliminary work is completed. The Australian Treasury also stated that a public consultation paper on token-mapping will be released "soon.”

Meanwhile, American investors looking for an SEC-approved Bitcoin exchange-traded fund (ETF) will have to wait a little longer, as the SEC postponed its decision on VanEck's Bitcoin ETF application for another 45 days. This means that the agency has until October 11 to "either approve or disapprove the proposed rule change, or institute proceedings to determine whether to disapprove it.”

Recommended reading: Crypto vs Stocks: What's the Difference?

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)