Market Highlights

-

Bitcoin (BTC) and Ethereum (ETH) prices sink as major U.S. exchange Kraken settles with SEC.

-

All altcoin sectors decline as they mimic price action of the majors.

-

PayPal reveals its HUGE bag of crypto held for millions of customers.

Price Movements

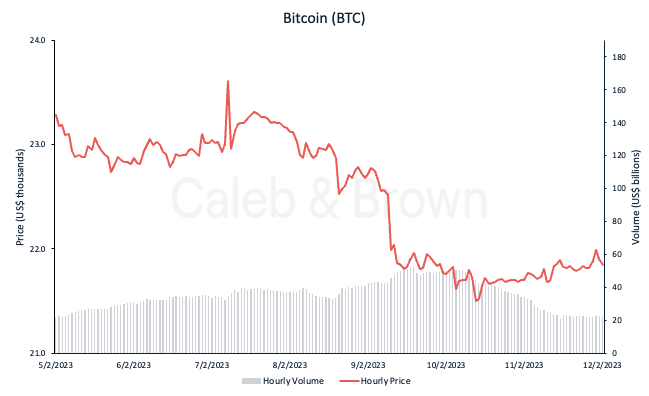

Bitcoin (BTC)

BTC took its biggest weekly loss of the year so far, sinking 7.2% over the last seven days to $21,730. The bearish sentiment stems from U.Ss regulators, who have been keeping a close eye on crypto in the wake of several high-profile bankruptcies last year from firms like Celsius, Three Arrow Capitals, and FTX. Last Friday, the SEC announced it hit Kraken with a $30 million fine and to cease its staking service.

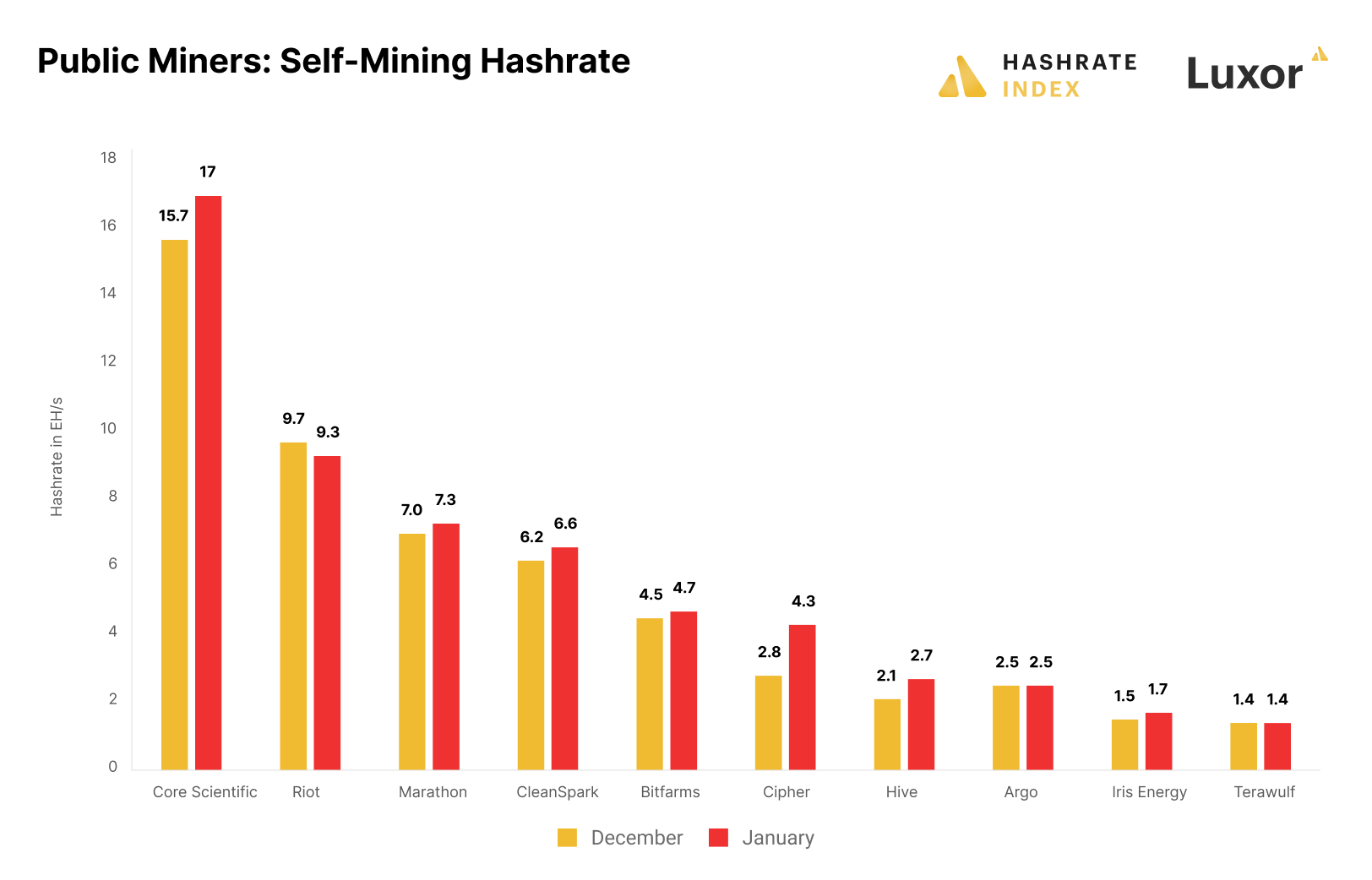

Moving over to Bitcoin mining companies: according to Hashrate Index, the first production update of 2023 shows a steady increase in hash rate and a surge in BTC production compared to previous months.

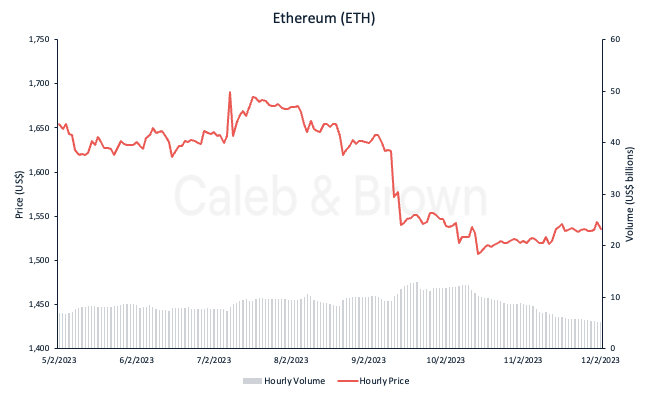

Ethereum (ETH)

ETH followed BTC’s action, sinking 8% over the past week to $1,545 at the time of writing. The ETH/BTC ratio started the week at ~ 0.071 and has stayed fairly consistent this week with it holding a current ratio of ~ 0.070, reflecting a slight fall.

According to an Ethereum Foundation blog post on Feb 10, the team announced another milestone on the road to the Shanghai upgrade, with the Shapella fork on the Zhejiang testnet moving into the final pre-launch sequence.

The Shapella refers to two Ethereum upgrades — “Shanghai” and “Capella” — allowing withdrawals on the execution layer and enhancing the Beacon Chain consensus layer. This move is especially welcomed by ETH stakers interested in understanding how withdrawals will work.

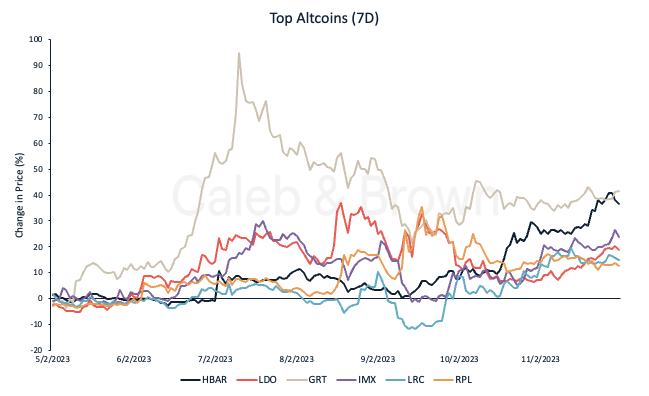

Altcoins

As for the rest of the crypto market, performance mimicked the market leaders, dropping in value over the past seven days. Despite performing well recently, the GameFi sector has been the worst performing sector in the last 7 days, with a 12.1% pullback.

The headline top performers for the week were Hedera (HBAR) and Lido DAO (LIDO), netting a positive return of 21.2% and 20.7% respectively. HBAR’s price performance was fuelled by one of the biggest technology companies in the world, Dell, joining their expanding governance council. Other well-known companies in the council are Ubisoft, IBM, Google, Boeing, and Deutsche Telekom.

GRT’s nearly 100% price rally from US$0.1266 to US$0.232 this past month may be attributed to Artificial Intelligence (AI) related tokens, which have been surging recently due to the OpenAI ChatGPT effect. Data from Messari’s February report showed that in the fourth quarter of 2022, The Graph witnessed a 66% quarter-over-quarter increase in GRT revenue from query fees (In USD terms this amounts to a 5% QoQ increase and a 265% year-over-year rise.) The report also noted that query fees “should continue to increase as more subgraphs are migrated to mainnet in the coming quarters.” This rally did not persists and GRT’s price action corrected over the past seven days, coming up 18.6% at the end of the period.

In Other News

Microsoft Culls Metaverse Team It Created 4 Months Ago

Software giant Microsoft has disbanded its newly formed Industrial Metaverse Core Team. The team was formed only four months prior, in October, with the purpose of constructing industrial networks and providing support to users in their metaverse operations. Microsoft unfortunately had to let go of the estimated 100 employees that comprised the team as part of the company's larger 10,000-person job cut in January.

Paypal’s Huge Bag

PayPal, a global payment giant, held a total of $604 million in cryptocurrencies for its customers at the end of 2022. The majority of this amount was comprised of Bitcoin and Ethereum, which accounted for almost 90% of the total, with PayPal holding $291 million in BTC and $250 million in ETH. The remaining $63 million was held in Litecoin and Bitcoin Cash, according to the company's annual report.

NFTs

France’s top modern art museum to display CryptoPunks, Autoglyphs NFTs

Paris’s leading contemporary art museum, the Centre Pompidou, announced on Feb. 10 an upcoming permanent exhibition targeting the intersection between art and the blockchain represented by non-fungible tokens.

Cool Japan

Japanese prime minister says DAOs and NFTs help support government’s ‘Cool Japan’ strategy. Fumio Kishida, the prime minister of Japan, has come out in support of blockchain as a potential solution for technological issues facing the country.

Regulatory

Crackin’ Down on Kraken

SEC chair issues warning to crypto firms after action on Kraken staking: Gensler’s statement followed the SEC announcing it had reached a settlement with Kraken in which the exchange agreed to shut down its staking services and programs for U.S. customers as well as pay $30 million in disgorgement, prejudgment interest and civil penalties.

Recommended reading: Bitcoin Lightning Network Explained

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F4if00GJWoqIL5Rqmbfx28a%2F8a121eb4acd7585e0ba1ff4437e3a89d%2FBlog-Cover__11_.png&a=w%3D400%26h%3D225%26fm%3Dpng%26q%3D80&cd=2023-02-13T12%3A20%3A39.719Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)