Market Highlights

-

Crypto and stock markets held strong despite the latest U.S. Consumer Price Index (CPI) report revealing that prices rose more than expected in January.

-

Bitcoin (BTC) rallied double-digits following the recent success of Ordinals, plus trader flight from stablecoins into the ‘safe haven’ flagship asset

-

BTC hash rate hits an all-time-high of 342 EH/s as miners regained profits and a positive sentiment towards mining.

-

The entire crypto market is up 12%, at US$1.19 trillion.

Price Movements

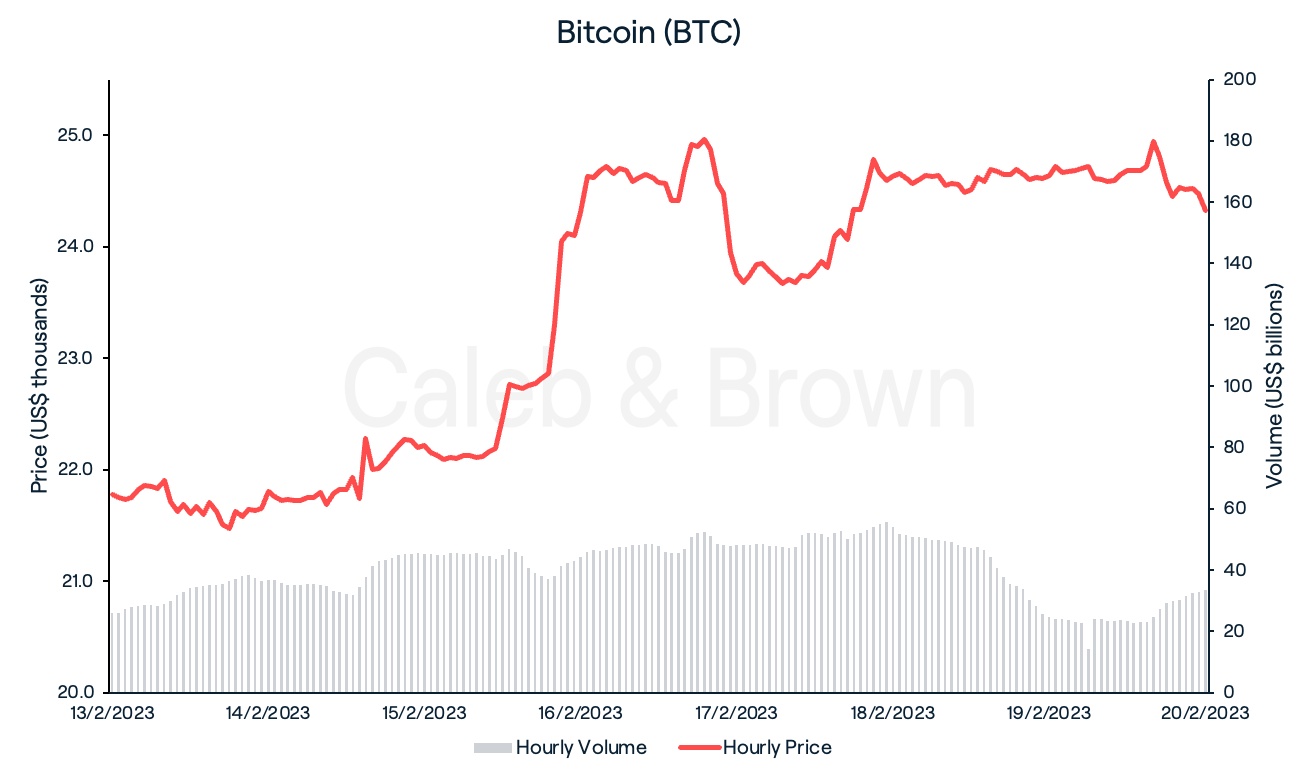

Bitcoin (BTC)

After two weeks of declining market prices - fuelled by the U.S. Securities and Exchange Commission’s (SEC) recent regulatory crackdown - BTC experienced some much awaited relief this week, closing at its highest price since early August 2022.

BTC, as well as major stock indices, held strong earlier in the week even though the Bureau of Labor Statistics revealed that consumer prices had risen more than expected in January. The report unveiled that Consumer Price Index (CPI), which tracks price changes across a broad range of goods and services, rose 6.4% in the twelve months through January, overshooting expectations of 6.2%.

Despite this, BTC rallied aggressively on Thursday to push past US$25,000 for the first time in eight months before falling slightly over the weekend. BTC closed the week at US$24,271, up an impressive 11.4% week-on-week.

Thursday’s surge could partially be attributed to the recent rise in popularity of Ordinals, a project which allows users to inscribe images and audio directly on to the Bitcoin blockchain, seeing major brands and NFT projects like Solana’s DeGods move part of its collection to the Bitcoin network.

Traders may also be turning away from stablecoins back to BTC as the SEC targets companies for issuing unregistered securities, with Binance USD (BUSD) issuer, Paxos, potentially next in line.

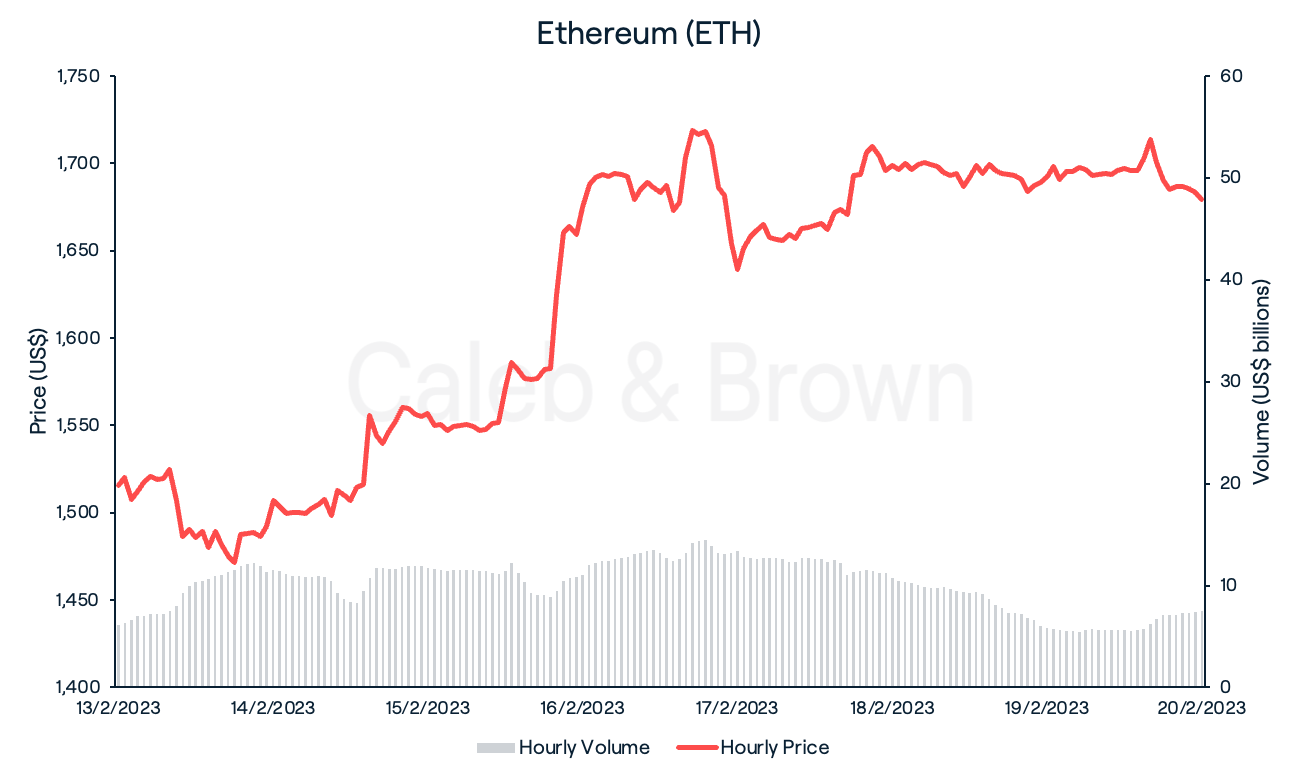

Ethereum (ETH)

ETH also experienced positive price action this week as it responded relatively well to Tuesday’s shaky CPI report. ETH surged aggressively on Thursday, trading above US$1,700 for the first time in five months.

However, ETH underperformed the market leader for the second consecutive week as the ETH/BTC ratio fell from ~0.070 to ~0.068 for a drop of 2.94% over the last seven days.

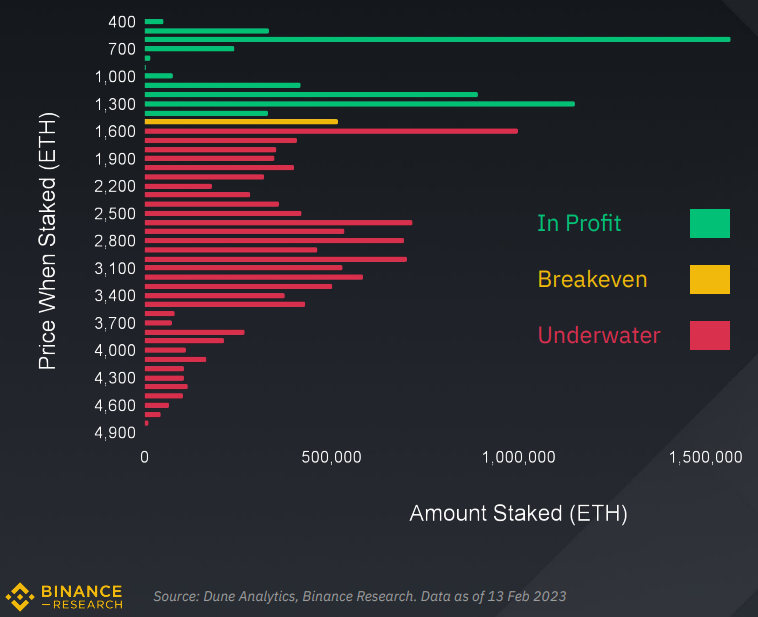

While the potential for increased ETH sell pressure remains a point of discussion for investors as staked ETH withdrawals now edge closer and closer - with early unlocks looking to potentially lock in profits. A recent Binance research report has shown that the majority of users that staked ETH are still under water (shown below), suggesting the ETH sell pressure to possibly be a non-event after the looming Shanghai upgrade.

Altcoins

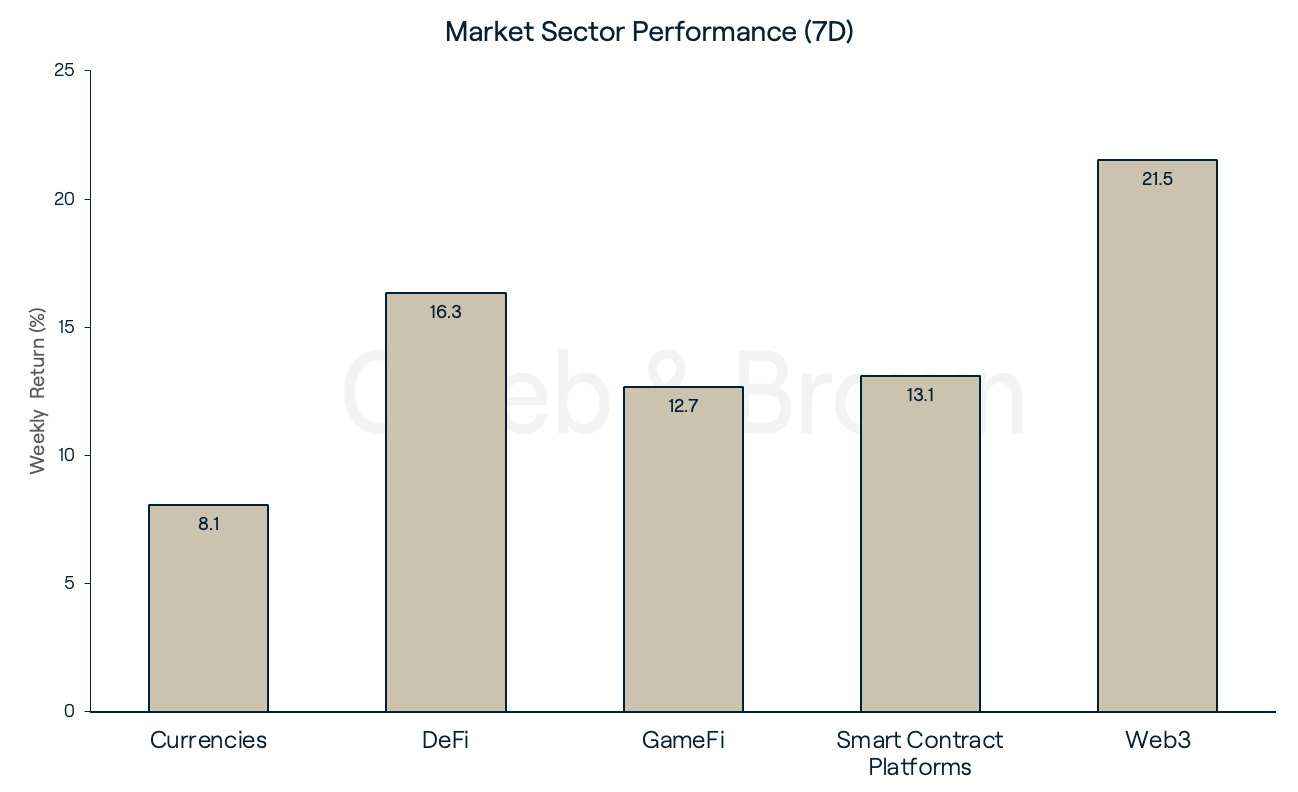

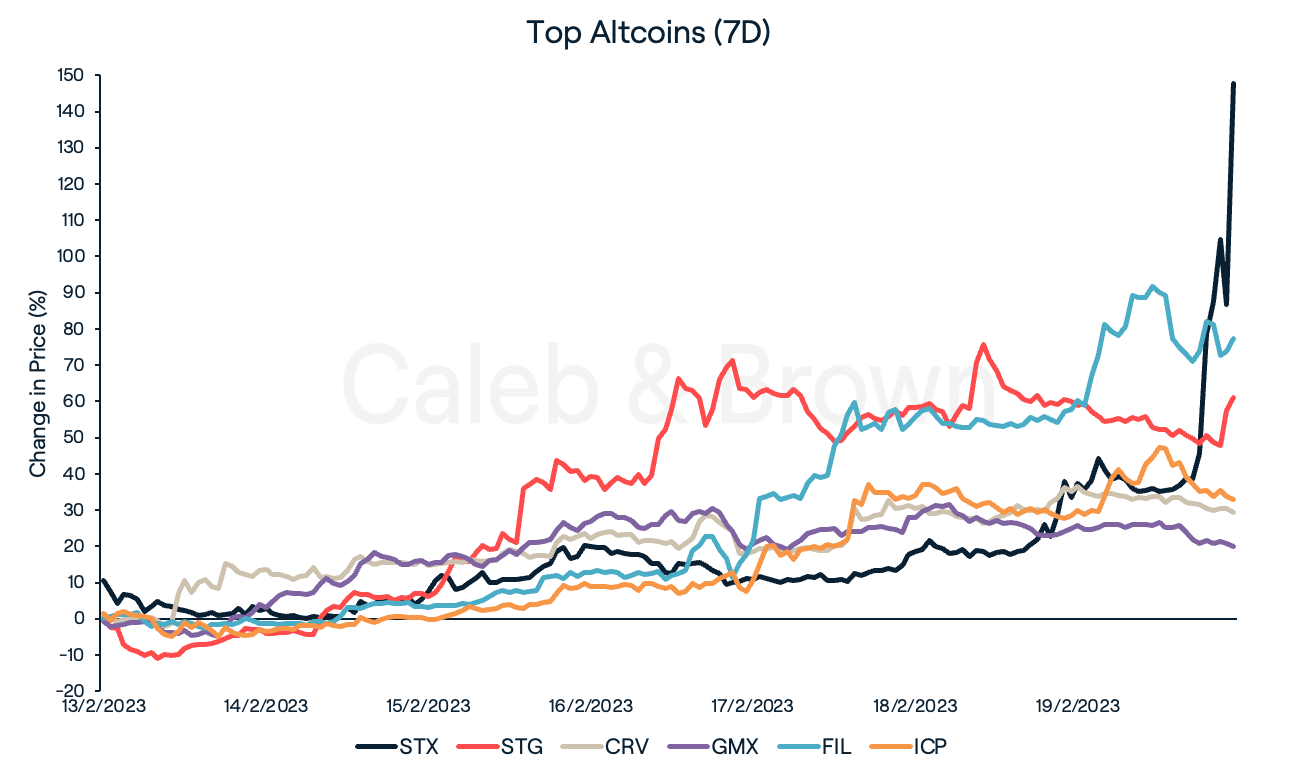

With BTC and ETH both pumping this week, almost all market sectors have made double-digit gains to recoup last week’s losses. Web3 led the pack netting a 21.5% gain over the last seven days. Following closely were DeFi, Smart Contract Platforms and GameFi which each rallied 16.3%, 13.1% and 12.7%, respectively. Currencies were the lagging sector and increased by a comparatively humble 8.1% week-on-week.

Web3’s performance was largely contributed to Filecoin (FIL) and Internet Computer (ICP) outperforming the market. With the launch of the Filecoin Virtual Machine (FVM) just around the corner, funds have rushed to the file storage solution allowing for a 77.5% weekly return.

The FVM launch will provide developers with tools to build applications on the network such as perpetual storage, storage replication and liquid staking applications. ICP returned 32.9% after its 2022 growth and 2023 roadmap were recently highlighted.

The SEC enforcement actions have again reinforced the DeFi narrative as traders pivot to decentralised solutions. Benefitting greatly from the current narrative were Stargate Finance (STG), Curve DAO (CRV), and GMX (GMX) which each grew by 61.1%, 29.3%, and 20.0% respectively.

The best performing asset this week was Stacks (STX), a Bitcoin layer for smart contracts which enables DeFi and NFT applications to interact with the Bitcoin network. STX surged a staggering 147.8% over the last seven days. While a direct event to the surge in price cannot be found, a correlation to BTCs pump and the recent success of Ordinals inscriptions is likely.

In Other News

Japan’s CBDC Pilot Set for Take-Off

The Bank of Japan has announced plans to roll out a new pilot for its central bank digital currency (CBDC) program in April. A CBDC is a digital version of a state’s fiat currency - like the U.S. dollar or the yen - backed by a central bank. Unlike current stablecoins such as USDT or USDC, a CBDC runs on a private network controlled by the government.

The bank does not expect any actual transactions to take place among participating users, instead only “simulated transactions” will be settled during the pilot.

Crypto Miners Turn Optimistic

After numerous filings for bankruptcies and operation shutdowns, the upward momentum seen in the market has begun to turn Bitcoin miners optimistic. One such firm, CleanSpark announced a purchase of 20,000 new ASIC machines on Thursday, after the asset rallied to nearly US$25,000 the day prior. The new rigs will add 2.44 exahashes per second (EH/s) to its existing computational force of 6.6 EH/s, and will represent roughly 2.8% of the entire Bitcoin network's hash rate.

The Bitcoin network’s current hash rate -the total computational power and therefore security contributing to the network - sits at 243 EH/s, an all-time-high.

Hunt for Axie Infinity Funds Continues

Norwegian authorities have seized almost US$5.9 million worth of stolen crypto, as part of an investigation into last year’s attack on Sky Mavis and his game Axie Infinity, making it one of Norway’s largest ever cash seizures. Investigators have now seized roughly 12% of the stolen crypto funds after investigators were able to recover about 10% last year.

While a large portion remains lost, the case highlights current investigative ability to track funds on-chain, even if criminals are using advanced methods.

Regulatory

SEC Chair, Gary Gensler, released a statement on 15 February proposing rules regarding investment adviser custody. In an attempt to expand and enhance the role of qualified custodians, the proposal aims to segregate investor asset accounts definitively as seen with other asset classes, require advisers and qualified custodians enter into written agreements with each, and enhance requirements for foreign financial institutions that serve either as qualified custodians or as sub-custodians to a qualified custodian.

The proposal however was not met without backlash as fellow SEC Commissioner, Hester Peirce, responded quickly with her own statement. The Commission “acknowledge(s) that an agreement between the custodian and the adviser would be a substantial departure from current industry practice,” Peirce wrote, going on to say the proposal would expand the reach of custody requirements to include crypto assets while also shrinking the ranks of qualified crypto custodians.

Peirce also went on to say that Gensler’s proposal runs the risk of “causing investors to remove their assets from an entity that has developed safeguarding procedures for those assets, possibly putting those assets at a greater risk of loss,” potentially leaving customer assets more vulnerable to theft or fraud.

Recommended reading: What Is the Crypto Fear and Greed Index?

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1hBL9sN3y2cl8OKUFs1u04%2Fd52e4bf4284d3c98a4369ba176c78502%2FBlog-Cover__12_.png&a=w%3D400%26h%3D225%26fm%3Dpng%26q%3D80&cd=2023-02-20T13%3A08%3A21.441Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)