Market Highlights

-

Inflation data released on Friday revealed that headline inflation increased 0.6% for the month, and 5.4% for the year, both up from the previous month.

-

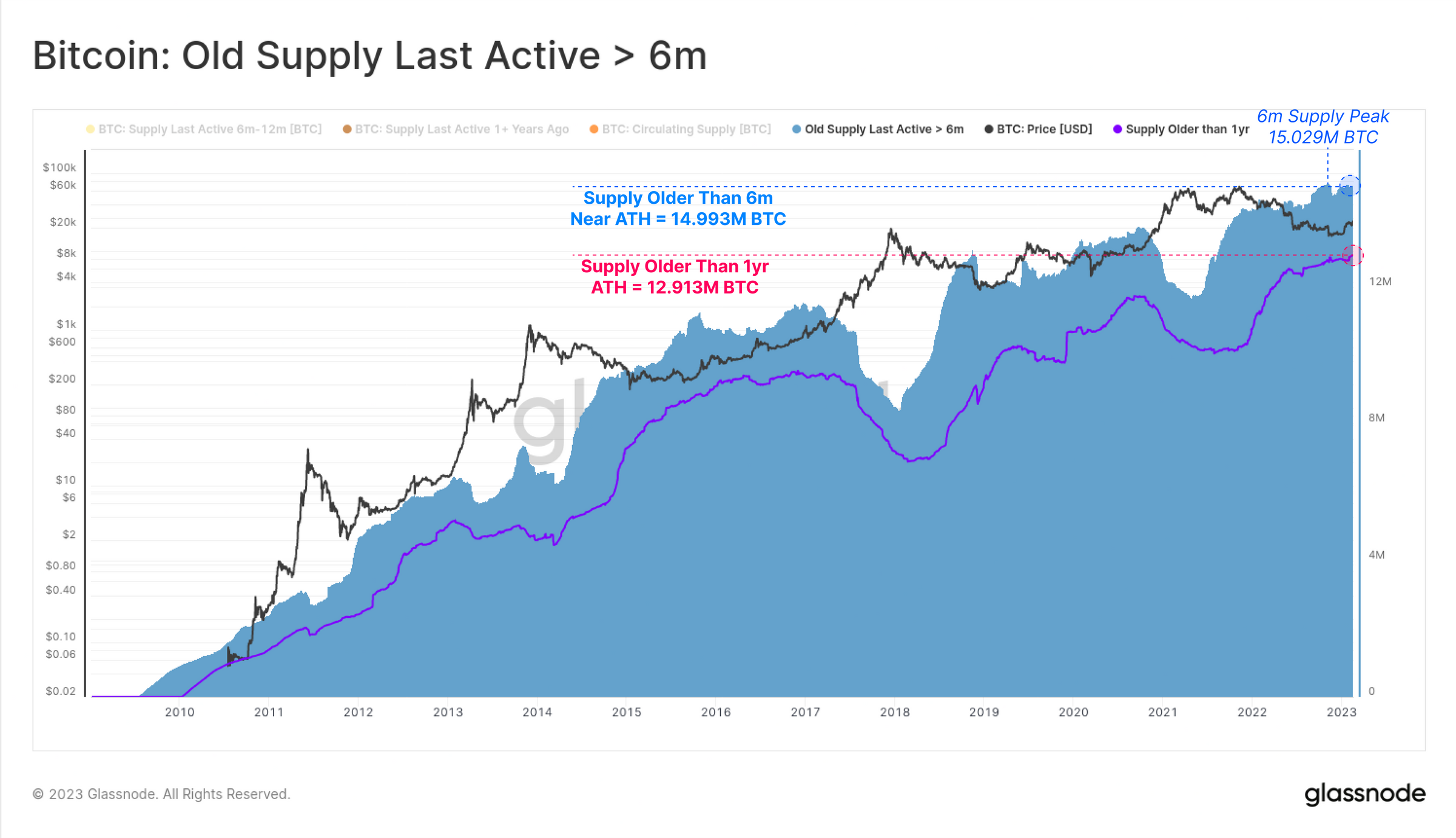

Dormant Bitcoin (BTC), or BTC that has not been active for the last six months nears an all-time-high, suggesting that BTC holders have possibly shifted focus to holding rather than trading.

-

Google Cloud further expands its Web3 reach by partnering with Tezos (XTZ) to become a block-producing validator on its network.

Price Movements

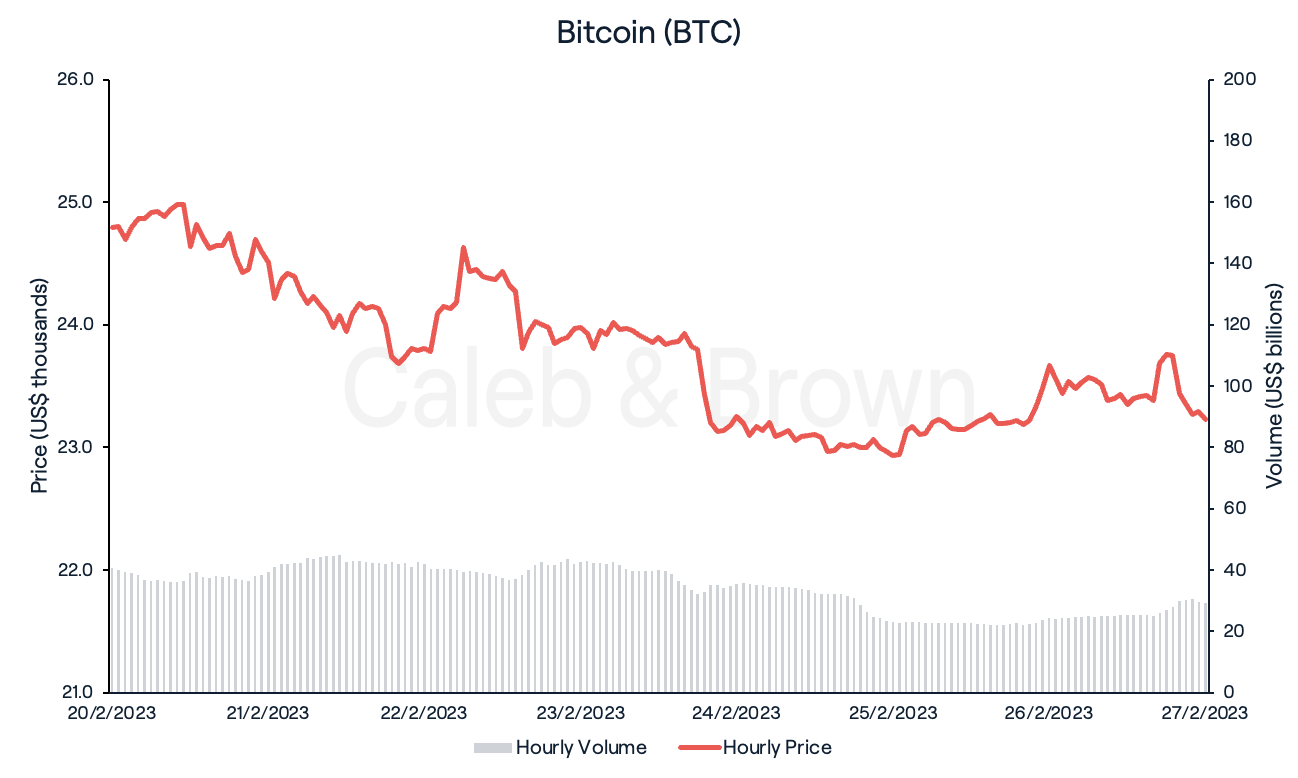

Bitcoin

Both crypto and U.S. equities markets tumbled this week as Bitcoin (BTC) gave back most of last week’s gains. BTC traded around US$25,000 until Tuesday afternoon when it slowly bled out for the remainder of the week. The price of BTC fell sharply on Friday after key inflation data rolled in, possibly indicating that further interest rate hikes by the U.S. Federal Reserve may be coming.

Friday’s report revealed that headline inflation increased 0.6% for the month, and was up 5.4% from a year ago, compared to 0.2% and 5.3% in December. The numbers could suggest that inflation accelerated during the first month of 2023, placing the Fed in a position where it will likely continue to raise interest rates. BTC fell nearly 2.0% in the hour following the report, taking the rest of the market with it.

BTC saw a small rally late into the weekend and closed the week at US$23,225, down 3.6% over the last seven days.

While the short-term macroeconomic environment remains shaky, the amount of dormant Bitcoin (Bitcoin that has not been traded within the last six months) is close to making a new all-time-high. Glassnode data showed that the number of “old supply” reached ~14.99 million units last week, worth approximately US$370 billion, just shy of its all-time-high of ~15.03 million. Supply older than one year marked a new all-time-high of ~12.91 million BTC. This could suggest that BTC holders have orientated to a more long-term outlook, shifting focus to holding rather than trading.

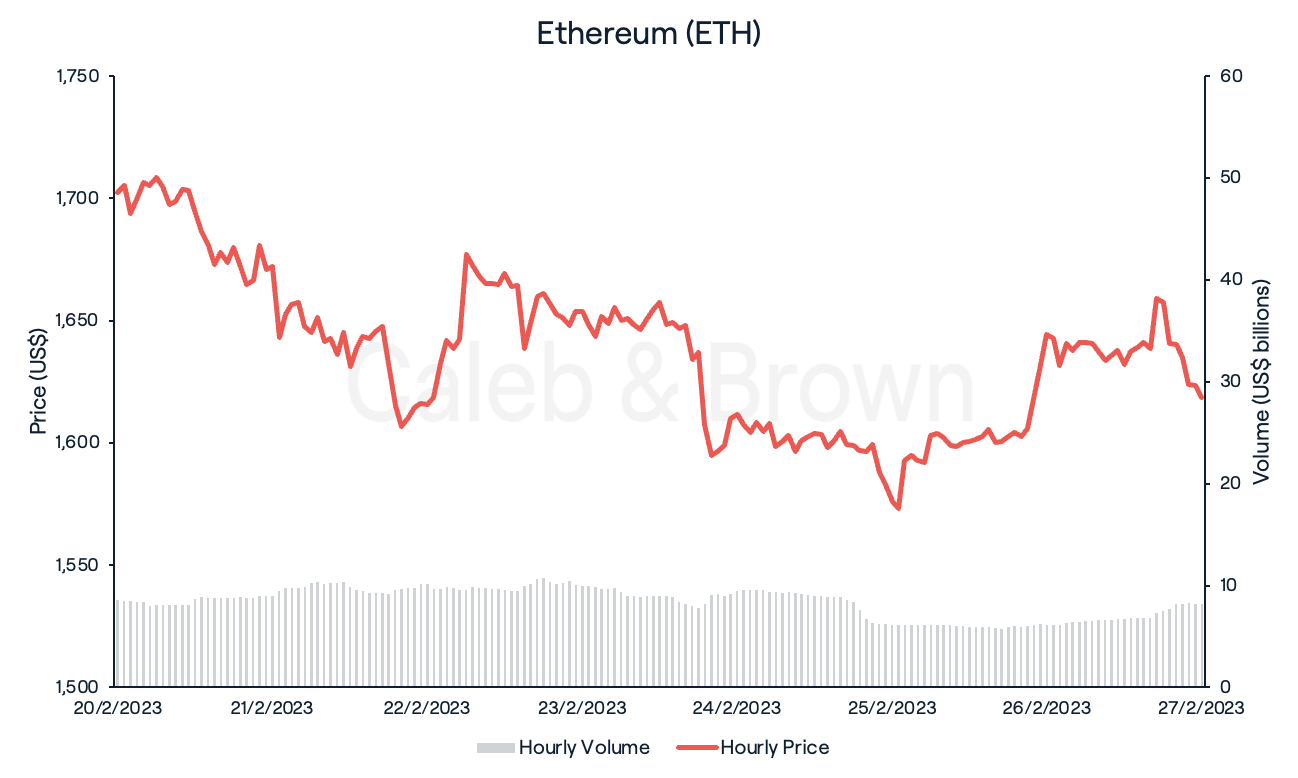

Ethereum

Ethereum (ETH) saw similar price action to BTC this week, dropping below US$1,600 in response to Friday’s inflation report before rising again late into the weekend.

Overall, ETH rebounded stronger than BTC did and closed the week at US$1,618, down 3.0%. The ETH/BTC ratio climbed to ~0.069, giving back 1.3% relative market share to ETH.

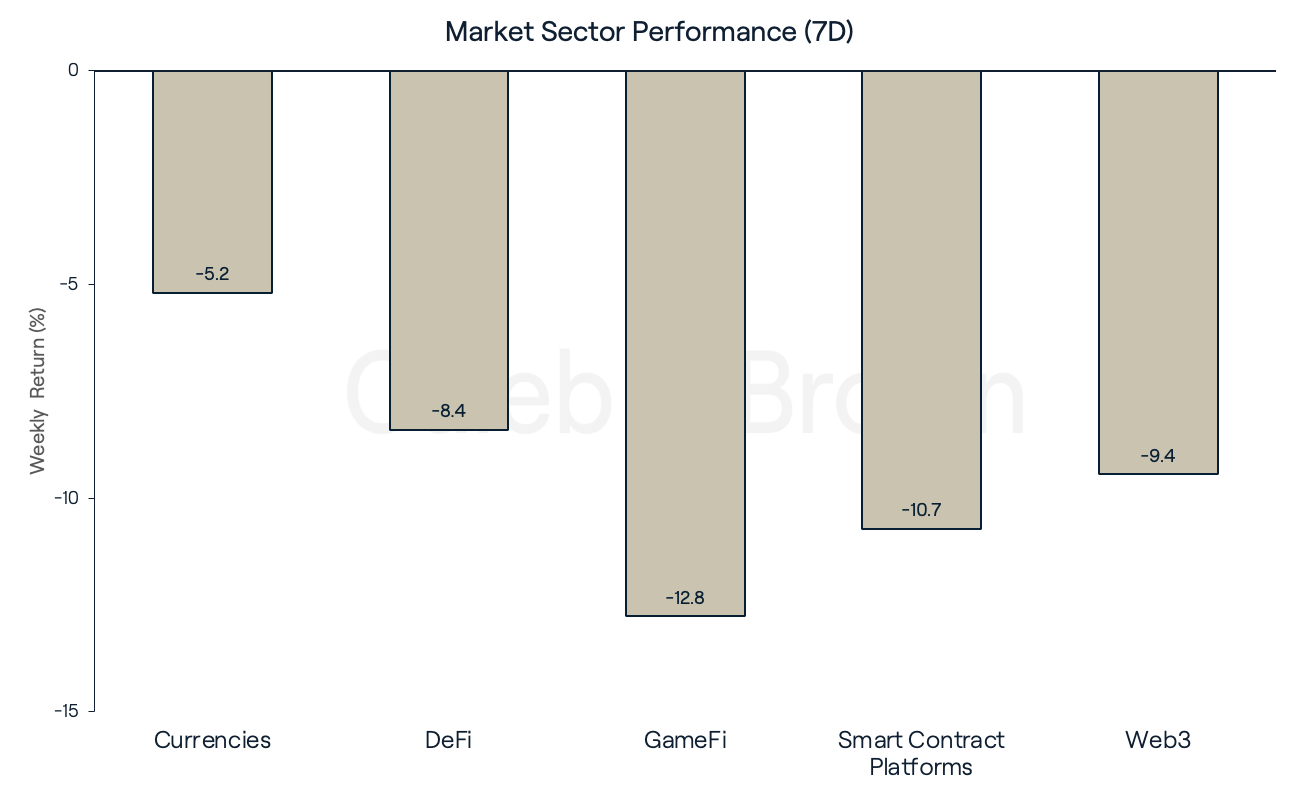

Altcoins

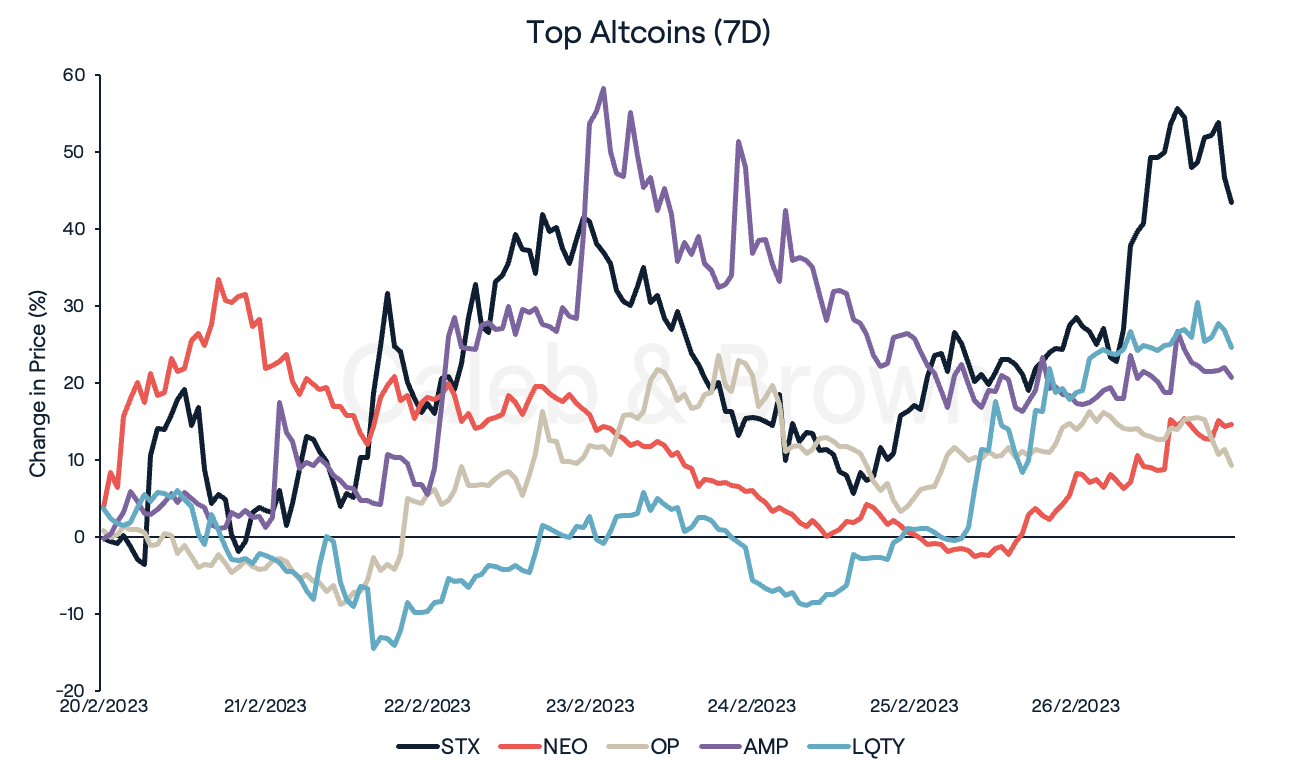

Market sectors were unsurprisingly down across the board this week with GameFi taking the biggest hit, losing 12.8% week-on-week. Currencies held up the best, falling 5.2% over the last seven days while DeFi fell 8.4%.

Despite the bearish price action seen across the market, a few tokens emerged with strong weekly performances.

Neo (NEO), a layer-1 blockchain protocol, and Optimism (OP), a layer-2 scaling solution, each returned 14.6% and 9.4%, respectively. NEO’s rally may be closely tied to Hong Kong’s recent announcement to re-establish crypto within its borders and allow retail investors to trade it. Speculators believe this could potentially lead to further developments in China, where NEO has its roots.

OP jumped 16% on the news of Coinbase’s announcement of its own layer-2 network called Base, stating Base will be “a rollup agnostic superchain powered by Optimism”.

DeFi has remained a relatively strong sector as the narrative continues to shift in its favour. Amp (AMP) and Liquity (LQTY) both saw success this week as they each returned 20.7% and 24.6%, respectively. AMP is a decentralised collateralisation protocol which enables instant settlement of digital asset transfers. Its most recent development was the launch of the Ampera Foundation, an organisation focused on the evolution of the AMP ecosystem.

Liquity is a decentralised borrowing protocol that allows users to draw interest-free (one-time payment) loans. LQTY has recently found popularity due to its high-yields offered on stablecoins, with a launch of stable pools attracting US$3.2 million of user deposits in 24 hours.

Stacks (STX) has remained the best performing asset for the second week in-a-row, taking full advantage of Ordinals’ rise to stardom. With now over 150,000 ordinals minted over the past three weeks, more apps built on Stacks are choosing to support and engage with ordinals inscriptions, seeing overall network activity skyrocket. STX is up 43.4% week-on-week and up nearly 200.0% over the last 30 days.

In Other News

SBF Makes It A Dozen

On Friday, Sam Bankman-Fried (SBF), the disgraced founder of crypto exchange FTX, faced fresh criminal charges following a superseding indictment. The indictment claimed that SBF had made more than 300 illegal political contributions in the United States with the aim of buying influence over cryptocurrency regulation in Washington, D.C. Prosecutors have now charged SBF with conspiracy to make unlawful political contributions and defraud the FEC (Federal Election Commission,) bringing the number of criminal counts made against SBF to twelve.

Google Expands Web3 Reach with Tezos Partnership

Similar to Aptos (APT) and Solana (SOL), the Tezos Foundation has endorsed Google Cloud as a block-producing validator on its network. As part of this arrangement, Google Cloud will offer enterprise-level support to developers building applications in the Tezos ecosystem, with the goal of fostering a fresh wave of app development within the network.

Electronic Arts Founder Makes the Move to Crypto

Trip Hawkins, the original founder and CEO of video game behemoth, Electronic Arts (EA) has made the switch to NFT games after Hawkins was announced as co-founder and chief strategy officer for Games for a Living, a web3 game studio startup. Hawkins said in a press announcement “We plan to do it in a way that helps enhance game performance and value for players, while keeping things fun.”

Regulatory

On Thursday, the U.S. Federal Reserve issued a fresh statement to remind banks about the risks associated with handling cryptocurrency and its related assets, as it continues its heightened examination of the cryptocurrency sector.

“Certain sources of funding from crypto-asset-related entities may pose heightened liquidity risks to banking organizations due to the unpredictability of the scale and timing of deposit inflows and outflows,” the statement said.

Additionally, the group cautioned banks to remain vigilant for crypto firms that misrepresent or provide inaccurate information about their deposit insurance status.

Recommended reading: Everything you need to know about Bitcoin's market cycle

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7kAXn6Mr6McAdVieTgQIxF%2F2fe3d70d4252c6e3369bd455871060f7%2FBlog-Cover__13_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-02-28T02%3A09%3A54.136Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)