Market Highlights

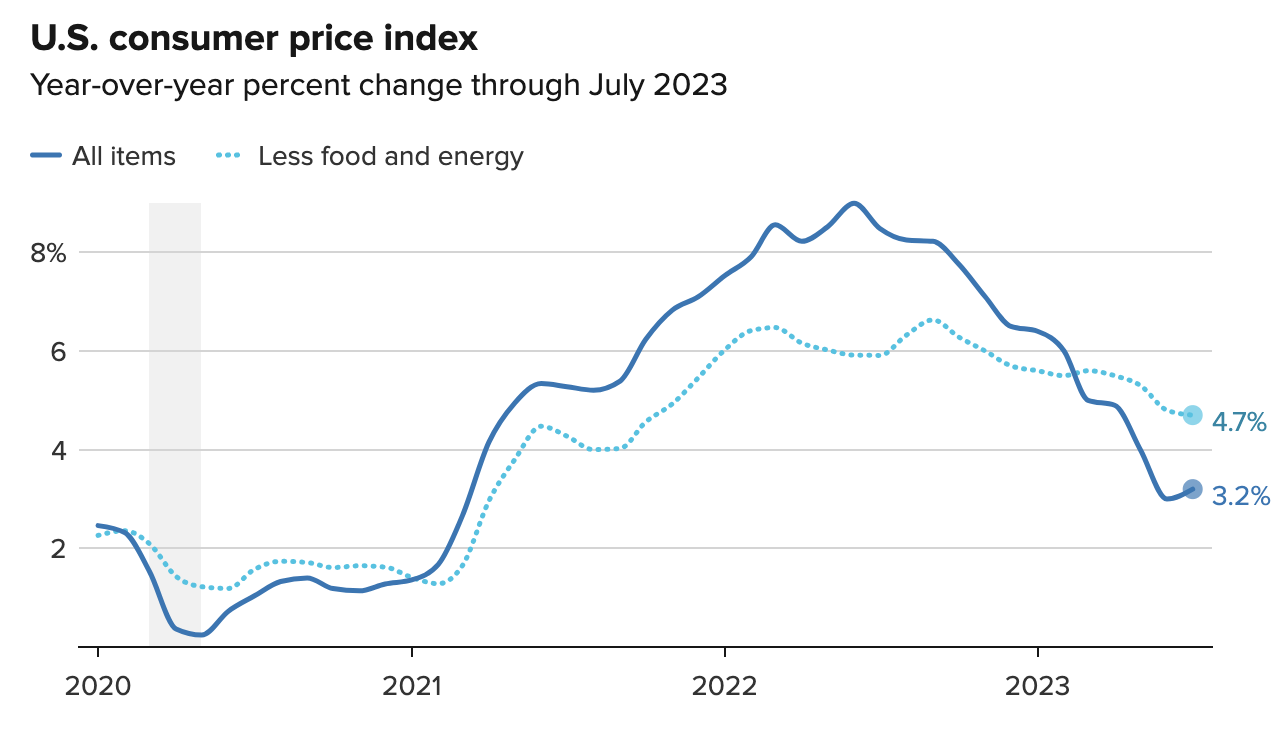

- CPI (consumer price index) rose 3.2% from a year ago in July, beating the estimated 3.3%.

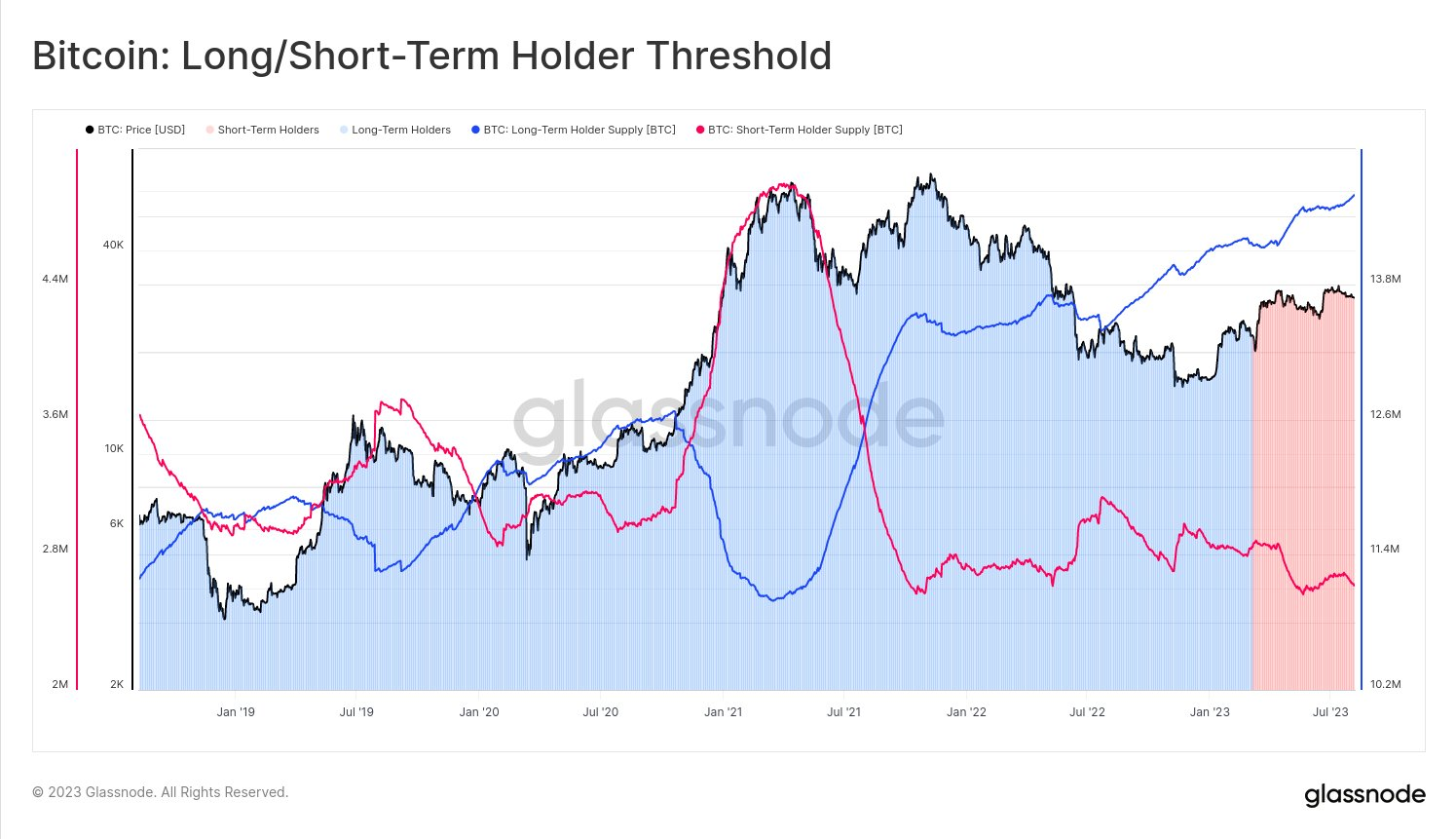

- Bitcoin (BTC) long-term holder supply hit a new all-time-high, representing 75% of the circulating supply.

- PayPal announced it would be releasing a regulated Ethereum-based, dollar-pegged stablecoin called PayPal USD (PYUSD).

- Visa introduced a pioneering experiment on the Ethereum blockchain that will allow users to cover gas fees using their Visa credit or debit cards.

- Sam Bankman-Fried was incarcerated on Friday after accusations of witness tampering against the FTX founder.

Bitcoin

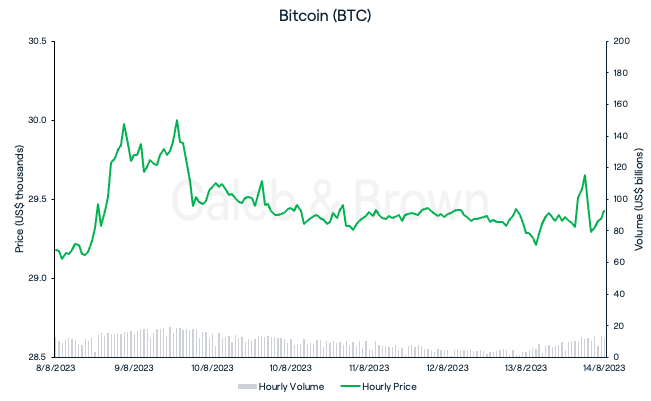

After six weeks of sideways trading, Bitcoin saw a breath of action as it climbed roughly 5.0% to a top of US$30,244 leading into Thursday’s July CPI reading.

The Bureau of Labor Statistics report revealed that CPI rose 3.2% from a year ago in July, beating the estimated 3.3%, however was higher than June’s 3.0%, and the first increase in more than a year.

This was short-lived, however, as prices quickly corrected and saw BTC close the week at US$29,424, hanging on to a 0.8% rise over the last seven days.

BTC long-term holder supply hit a new all-time-high this week as it crossed 14.599 million BTC, representing 75.0% of the circulating supply, and suggesting that investors are opting to hold onto their assets for extended periods of time.

Ethereum

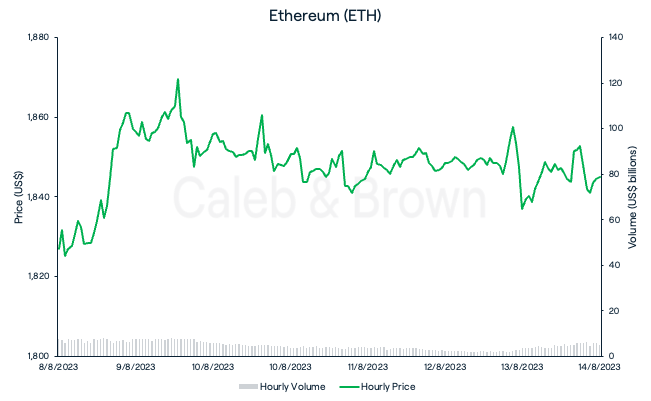

Ethereum (ETH) tracked very similarly to Bitcoin’s price action this week, hitting a high of US$1,876 on Wednesday before slowly bleeding for the remainder of the week. ETH eventually closed the week at US$1,844, up 1.0%.

Altcoins

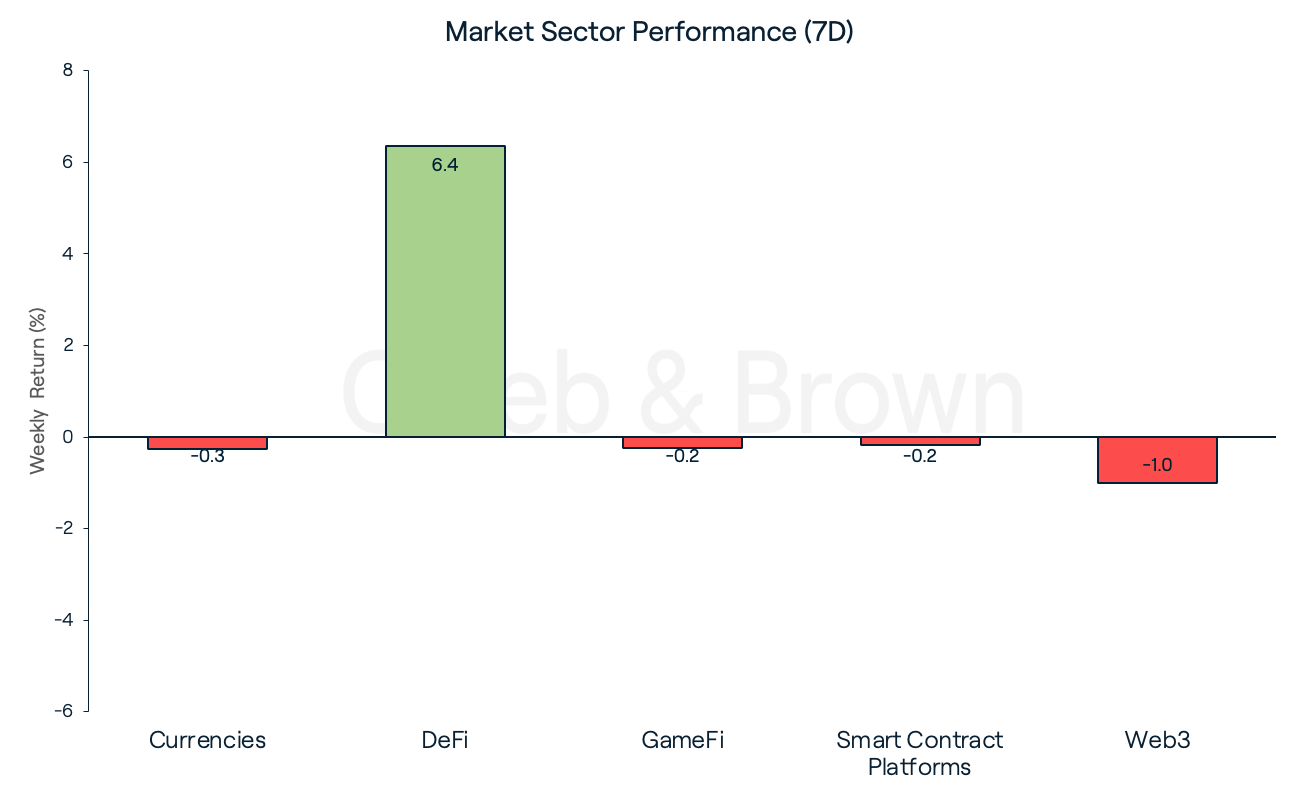

Market sector performance remained flat this week with the exception of DeFi which grew 6.4% over the last seven days. Web3 took the biggest hit losing 1.0%.

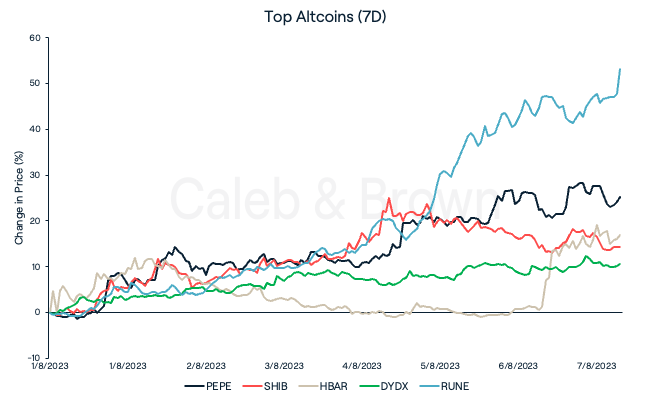

Pepe (PEPE) and Shiba Inu (SHIB) spearheaded a small memecoin rally this week with each adding on 25.1% and 14.3%, respectively. SHIB maintained momentum from last week’s rally after Binance recently added SHIB as a collateral asset - enabling loans to be taken out against the memecoin.

Hedera (HBAR) increased 17.0% after the Federal Reserve's payment service FedNow, added the Hedera-powered micropayments platform. Decentralised perpetual exchange, DyDx also enjoyed a 10.7% rally as the network moved to Phase 2 of network testing for its migration from Ethereum to Cosmos.

This week’s top spot went to THORChain (RUNE) which surged an impressive 53.1%. The rise in price comes ahead of the launch of its THORFi lending protocol which will allow users to create loans using native assets as collateral, without the risk of liquidation. The launch is expected next week.

In Other News

On Monday, payments giant PayPal announced it would be releasing a regulated Ethereum-based, dollar-pegged stablecoin called PayPal USD (PYUSD).

- The highly anticipated Coinbase Base mainnet officially launched to the broader public on Wednesday, showcasing a comprehensive array of more than 100 dApps and service providers within the Base ecosystem.

- Visa, the payment solutions giant, has introduced a pioneering experiment on the Ethereum blockchain that will allow users to cover gas fees thought the use of their Visa credit or debit cards.

- Over the past seven days, cryptocurrency exchange Huobi experienced net outflows exceeding US$73.3 million, following speculations of company executives being apprehended by Chinese police.

Regulatory

- On Wednesday, the Securities and Exchange Commission (SEC) indicated its intention to appeal the recent court ruling that determined XRP may not inherently qualify as a security.

- The U.S. Federal Reserve is set to supervise the crypto operations of banks, reinforcing its mandate, and emphasising that financial institutions within its jurisdiction must seek authorisation before participating in certain activities involving digital assets.

- Following a judge’s decision in favour of prosecution’s request to revoke bail, SBF was incarcerated on Friday. This is in addition a plea deal that federal prosecutors have in the works with Ryan Salame, the former CEO of FTX Digital Markets. The move to revoke bail stemmed from accusations of witness tampering against the FTX co-founder.

Learn with Caleb & Brown: Bitcoin Lightning Network Explained

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F2jkJED6K2BX9rlBrX3V21y%2Ff5daafcb0637e224e71e9357db8f1454%2FWeekly_Rollup_Tiles__9_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-08-15T02%3A07%3A33.086Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)