Market Highlights

- The U.S. Federal Reserve suggested maintaining its hawkish stance in its press release on Wednesday, increasing expectations of another rate hike next month.

- Bitcoin’s (BTC’s) price nose-dived 10.0% following the news of Chinese property giant Evergrande filing for Chapter 15 bankruptcy protection.

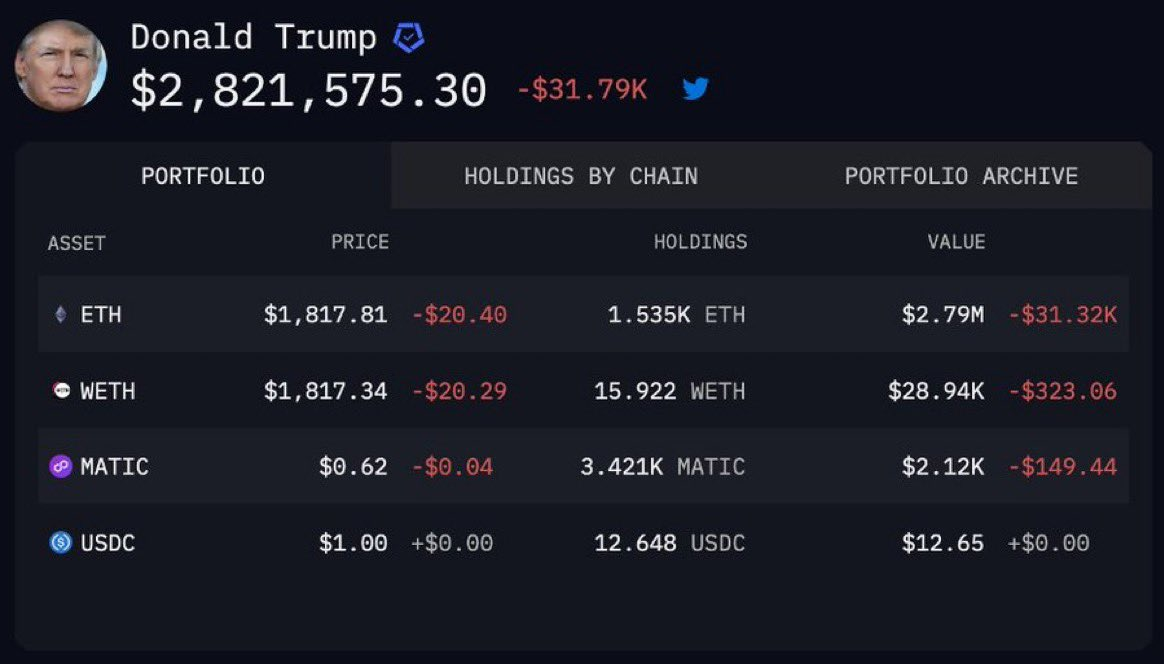

- Arkham revealed on Thursday that former U.S. president Donald Trump held more crypto than was initially believed with over 1,500 ETH sitting in his wallet.

- Jacobi Asset Management introduced Europe's first spot BTC ETF (exchange-traded fund) on Euronext Amsterdam.

- On Thursday, Judge Analisa Torres granted the SEC’s request to move for an interlocutory appeal regarding two of the July 13 decisions on XRP.

- The Federal Deposit Insurance Corporation (FDIC) dedicated a section to digital assets for the first time in its annual risk review report.

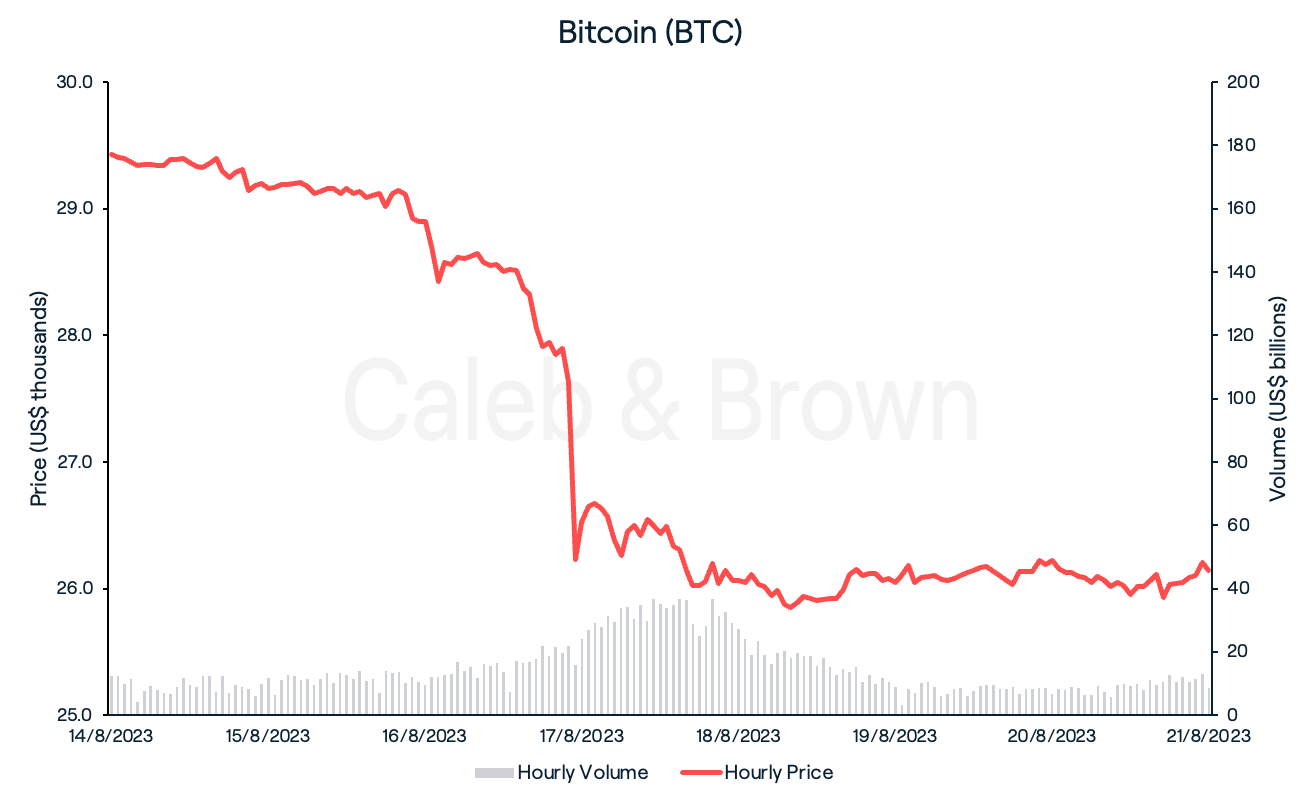

Bitcoin

After weeks of stagnant price action and record low volatility Bitcoin (BTC) has jolted awake with implied volatility returning to levels not seen since the meltdown of FTX. BTC first slumped 2.0% on Wednesday after U.S. Federal Reserve suggested maintaining its hawkish stance in its press release, causing next month’s rate hike expectations to increase from 10.0% to 13.5% shortly after.

The bearish move was further perpetuated when news of Chinese property giant Evergrande filing for Chapter 15 bankruptcy protection broke the next day. Fearful of broader market implications a major sell-off ensued, causing over US$850 million in long positions to be liquidated.

This saw BTC’s price nose dive over 10.0% in the following hours, falling below US$26,000 for the first time in two months. BTC closed the week at US$26,139, down 11.2% over the last seven days.

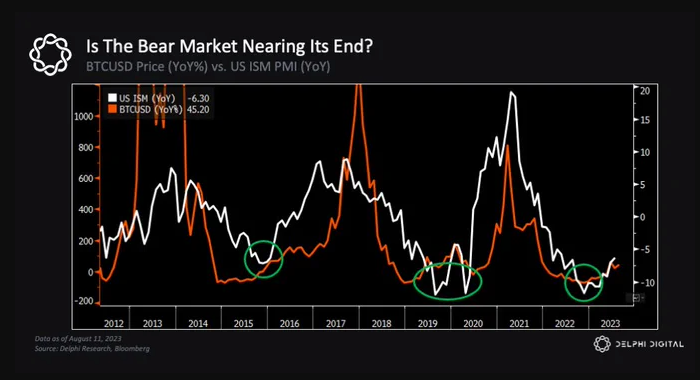

Despite the volatile week, Delphi Digital’s co-founder and Head of Research, Kevin Kelly, recently shed light on how the crypto market may be in the early stages of a new cycle. Other than the consistency of 4-year cycles witnessed over the last decade, Kelly explained how each of these cycles have lined up almost perfectly with cyclical changes in the business cycle i.e. Institute for Supply Management (ISM). Specifically, how BTC's YoY% change usually shows signs of a reversal near bottoms in the ISM YoY.

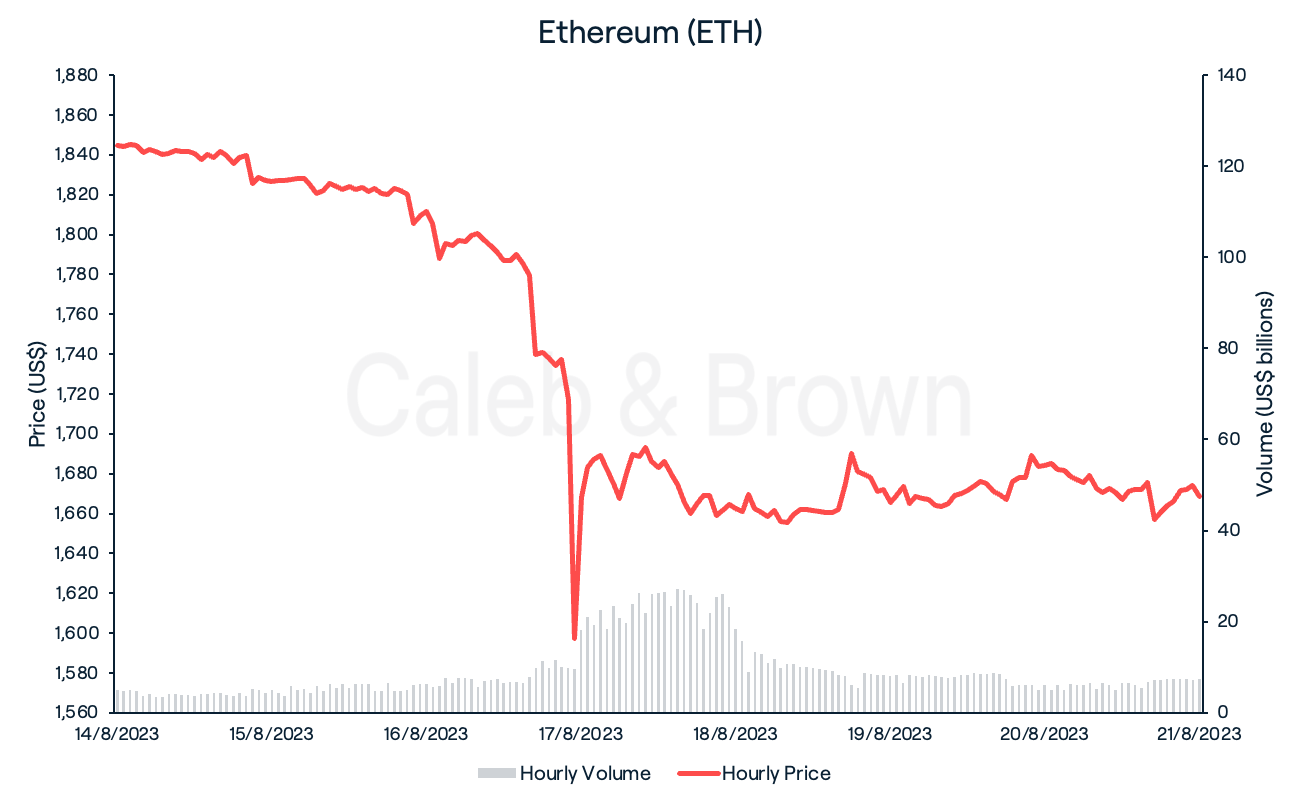

Ethereum

Ethereum (ETH) fared no better to the Evergrande news, falling over 12.0% after the bankruptcy was announced. This saw ETH dip below US$1,600 for the first time in five months, before recovering slightly throughout the week.

ETH closed the week at US$1,668, down 9.6%.

Meanwhile, the US Securities and Exchange Commission (SEC) is close to approving the first ETH futures ETF (exchange-traded fund) marking a significant victory for over a dozen firms that have filed to launch ETFs.

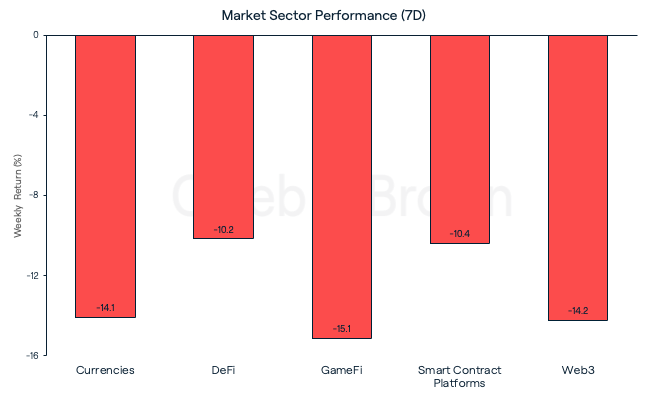

Altcoins

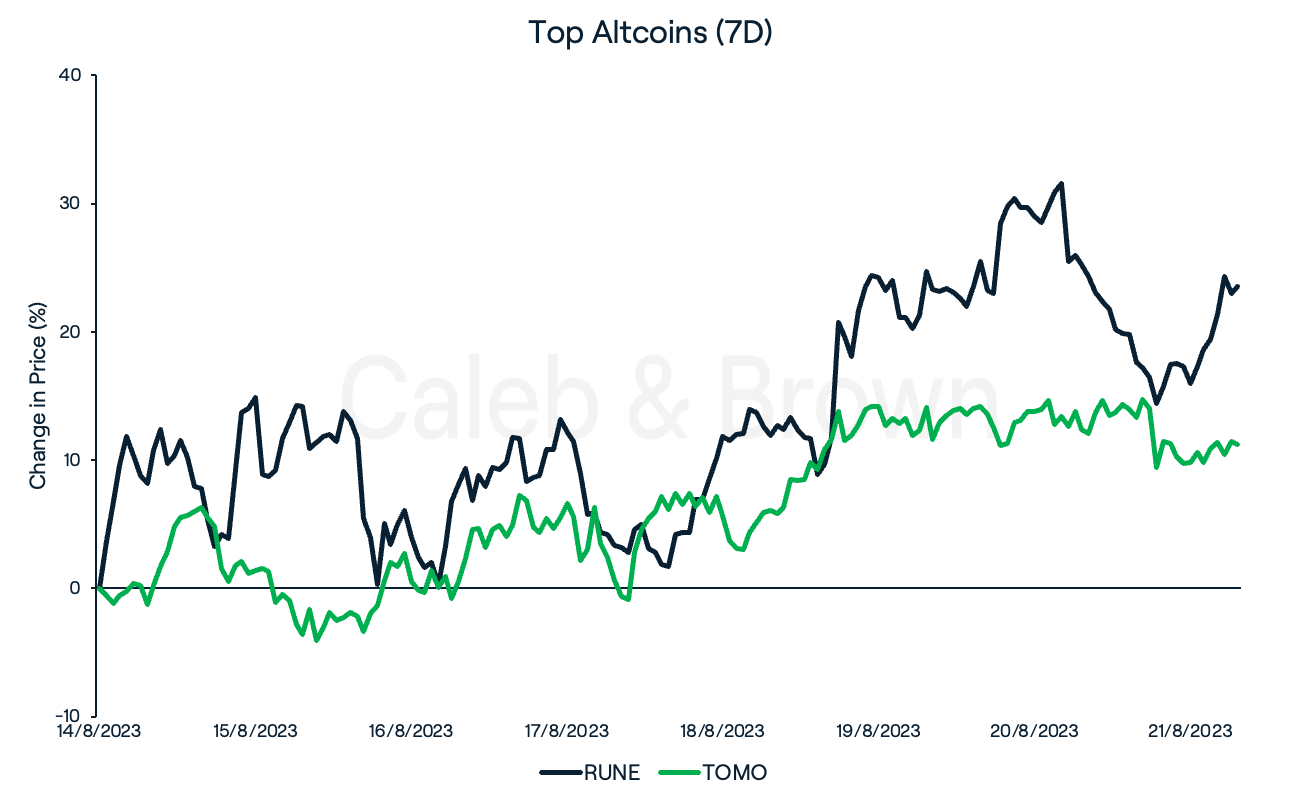

As the crypto market plunged over the past week all market sectors saw double-digit losses. DeFi and Smart Contract Platforms held on the strongest however, losing 10.2% and 10.4%, respectively.

Ignoring the market-wide sell-off and maintaining momentum from last week’s rally was THORChain (RUNE). RUNE surged 23.62% with a remarkable rally over the past week. The surge in price can be primarily attributed to the successful launch of its THORFi lending protocol, which allows users to lend native layer-1 assets to THORChain and borrow USD-denominated debt with no liquidations, no interest, and no expiration. The protocol also saw its highest trading volume day this week thanks to its new product, Streaming Swaps, allowing for highly efficient and permissionless cross-chain trades.

Tomochain (TOMO) also stood out as an exception as it rallied 11.2% week-on-week.

In Other News

- Crypto analytics firm, Arkham, revealed on Thursday that former U.S. president Donald Trump held more crypto than was initially believed. Trump currently holds over US$2.5 million in crypto assets, the majority of which Ethereum (ETH), which he likely received in royalty fees associated with his Collect Trump NFT collection.

- Jacobi Asset Management, headquartered in London, has introduced Europe's first spot BTC ETF (exchange-traded fund) on Euronext Amsterdam, almost 24 months after obtaining its initial approval.

- After experiencing a recent security breach on its platform, Curve Finance has managed to retrieve approximately 70% of the lost funds, worth about US$50 million. Regained funds were either directly given back by hackers involved or saved through the intervention of ethical operators.

- On Tuesday, open-source blockchain funding platform, Gitcoin announced a new partnership with fossil fuel giant Shell to accelerate open-source innovation in the energy sector.

Regulatory

- On Thursday, Judge Analisa Torres granted the SEC’s request to move for an interlocutory appeal regarding two primary decisions on XRP. Recent court records indicate that the SEC intends to lodge its appeal by August 18th, allowing Ripple Labs until September 1st to submit their responses against the SEC’s request for an interlocutory appeal.

- For the first time ever the Federal Deposit Insurance Corporation (FDIC) dedicated a section to digital assets in its annual risk review report. Albeit a two-page section, the bank regulator highlighted that digital assets present novel and complex risks that are difficult to fully assess.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F4NbJ88pjko0iIVMLgtyP74%2F22ec53da267d32050cafb82e4adf776d%2FWeekly_Rollup_Tiles__10_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-08-23T11%3A43%3A09.789Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)