Market Highlights

- BTC mining difficulty and whale addresses (wallets which hold over 10,000 BTC) have grown significantly since the 2021 market peak.

- Staked ETH has been on the rise with ~26.2 million ETH now staked on the beacon chain, representing 21.8% of the circulating supply.

- In 2022, the stablecoin market settled an eye-watering value of over US$11 trillion, drawing parallels to payments giant Visa's annual figure of US$11.6 trillion.

- Circle, issuer of USD Coin (USDC), will launch its stablecoin on six new blockchain ecosystems over the next two months.

- E-commerce giant Shopify has added Solana Pay to its pool of payment options

- Tornado Cash developers, Roman Storm and Roman Semenov were charged with money laundering and sanctions violations tied to their work with the privacy mixer.

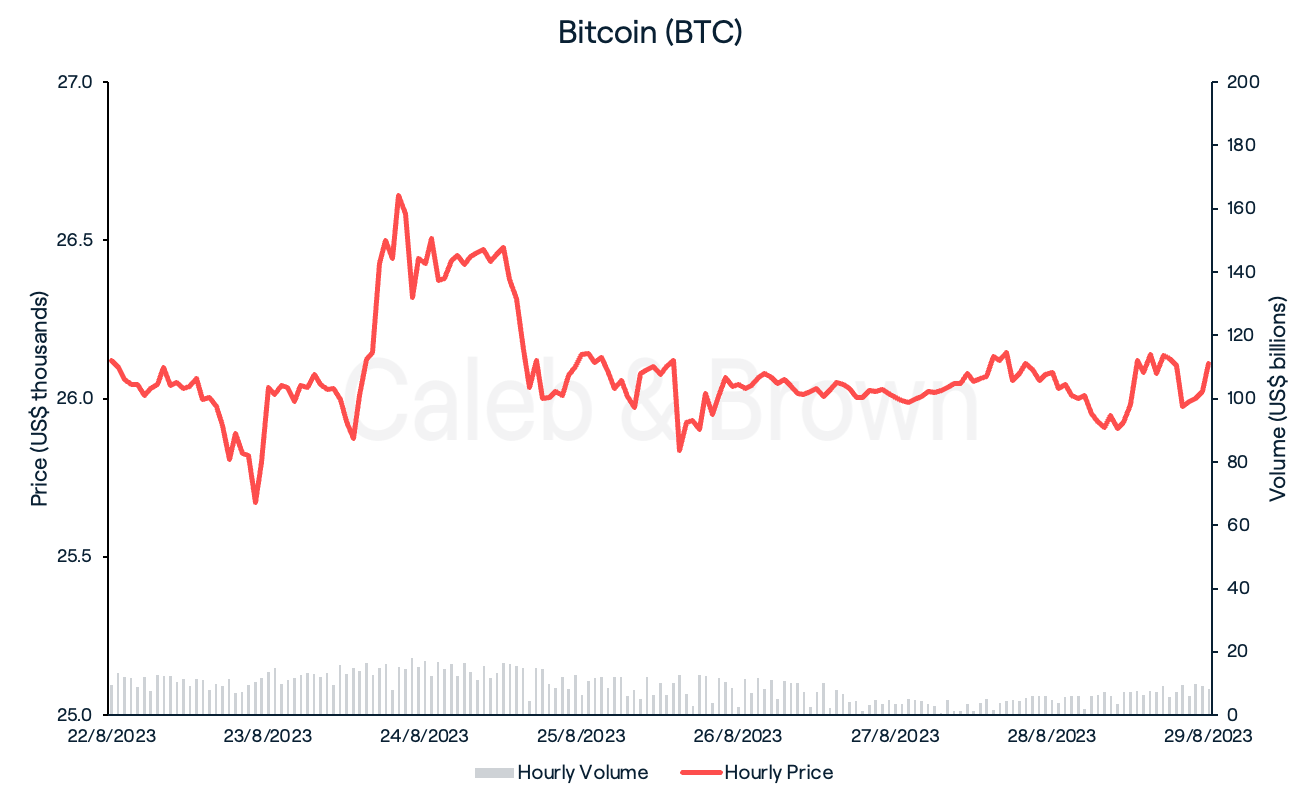

Bitcoin

Bitcoin (BTC) has fallen back into a slumber after last week’s flash-crash, holding steadily around the US$26,000 mark. No major stories unfolded this week, seeing BTC close near where it left off at US$26,109, down a very slight 0.04%.

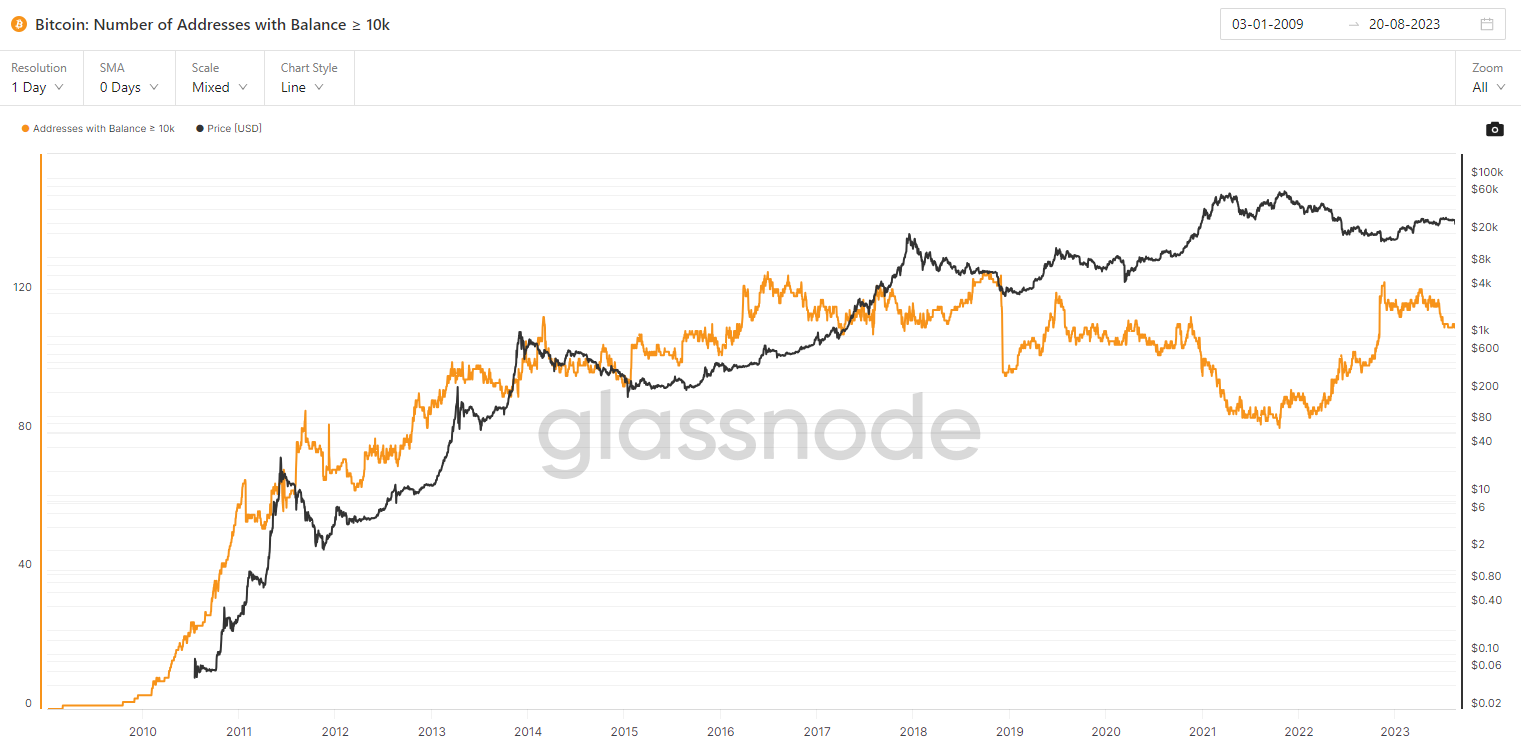

While BTC price continues to consolidate, both BTC mining difficulty and whale addresses (wallets which hold over 10,000 BTC) have grown significantly since the 2021 market peak.

BTC mining difficulty, or the degree of difficulty to mine new BTC, grew to 55.62 trillion hashes, an all-time-high, suggesting more miners are continuing to enter the market before the next halving, which will reduce mining rewards by half.

Bitcoin addresses with over 10,000 BTC grew 26.0% since the 2021 market peak, indicating that larger players, typically institutions, continue to accumulate or enter the market.

Meanwhile, BTC 30-day historical volatility just dipped below 20.0 for the first time since January of this year. This level has typically preceded huge price moves in the subsequent months, with the most recent being January 2023 (+85.0% in three months) and, July 2020 (+102.0% in four months).

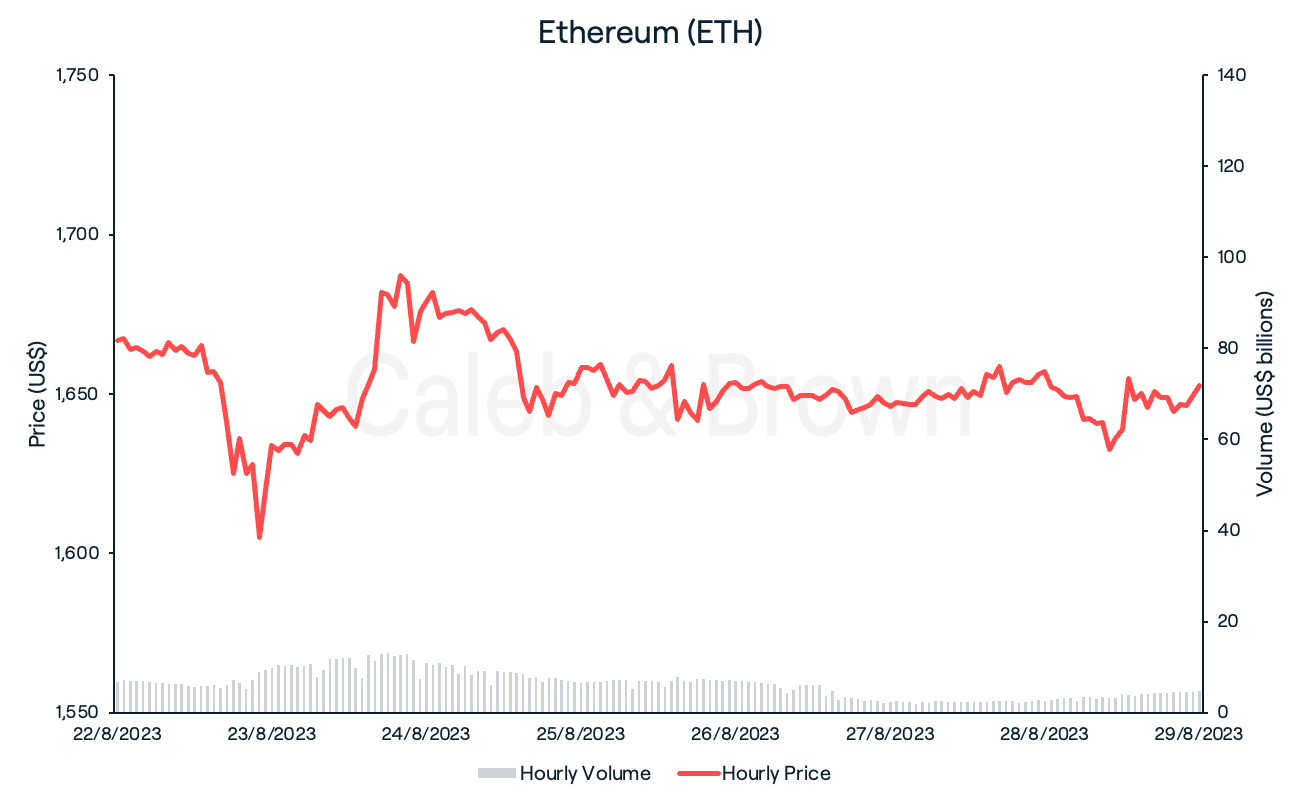

Ethereum

Ethereum (ETH) saw a bit of mid-week volatility, dipping below US$1,600 Tuesday before aggressively rebounding above US$1,700 shortly after. ETH traded flat for the remainder of the week where it closed at US$1,652, down 0.8% over the last seven days.

While ETH price has trended down in this second half of the year, staked ETH has been on the rise with ~26.2 million ETH now staked on the beacon chain, representing 21.8% of the circulating supply.

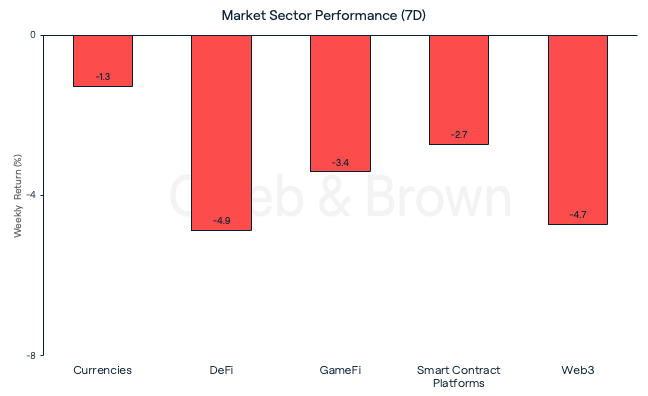

Altcoins

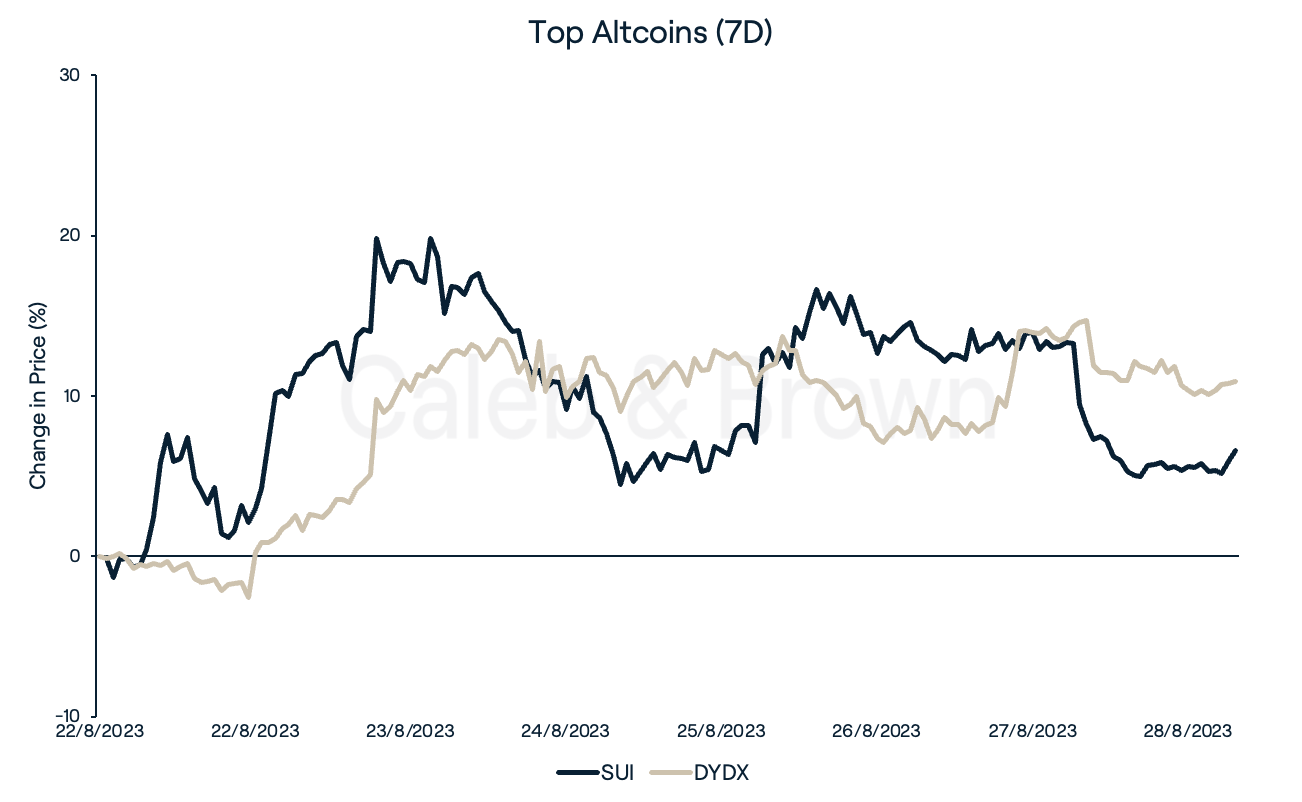

Although BTC and ETH found levels of support this week, majority of altcoins continued to bleed with DeFi and Web3 facing the brunt of it, losing 4.9% and 4.7%, respectively. Currencies held on strongest losing just 1.3% week-on-week.

With most of the market falling in price only a couple of tokens finished the week in the green. Sui (SUI) gained 20.0% after it announced a US$900,000 grant to fund 16 projects on its network this week, however has since retraced, closing the week with a 6.6% gain.

DyDx (DYDX), the crypto derivatives exchange, was this weeks best performer after rallying 10.9%, attributed largely to its successful network migration testing.

In other News

Stablecoins continue to make significant waves in the payments sphere according to a recent study by European hedge fund, Brevan Howard. In 2022, the stablecoin market settled an eye-watering value of over US$11 trillion, drawing parallels to payments giant Visa’s annual figure of US$11.6 trillion.

Circle, issuer of USD Coin (USDC), will launch its stablecoin on six new blockchain ecosystems over the next two months. This will include Base, Cosmos via Noble, NEAR, Optimism, Polkadot, and Polygon PoS, expanding USDC’s availability to a total of 15 blockchain networks. E-commerce giant Shopify, has added Solana Pay to its pool of payment options, enabling millions of merchants that use the platform to accept crypto transactions, kicking off with USD Coin (USDC).

On Wednesday, Tornado Cash developers Roman Storm and Roman Semenov, were charged with money laundering and sanctions violations tied to their work with the privacy mixer that "facilitated more than US$1 billion in money laundering", including "hundreds of millions" for North Korea's Lazarus Group. Storm has already been arrested while Semenov remains at large.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F10oXaTqfH1ogaOiWxVJ0Pz%2F87dd722e17c1c75667dd3b8468d1de76%2FWeekly_Rollup_Tiles__12_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-08-30T06%3A19%3A30.958Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)