Market Highlights

- Ethereum (ETH) surpassed US$3,000 for the first time since April 2022.

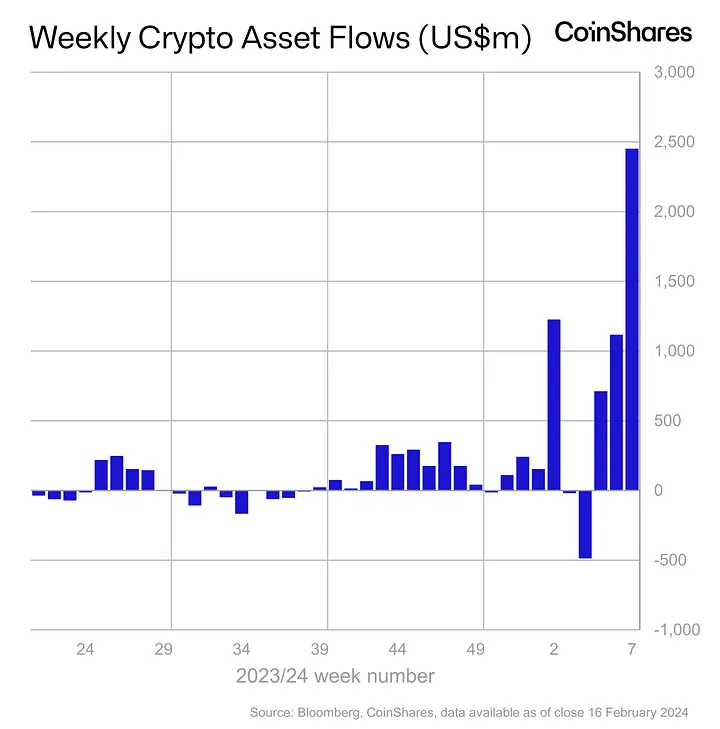

- Institutional funds saw record inflows this week as US$2.45 billion entered the space.

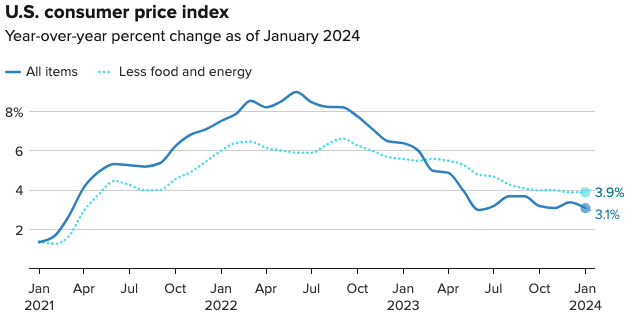

- The U.S. Labor Department revealed inflation was higher than expected last month, having risen 3.1% relative to a year earlier.

- Bankrupt crypto trading desk and lender, Genesis, was approved to liquidate US$1.6 billion worth of its Grayscale Bitcoin Trust (GBTC) shares.

Bitcoin

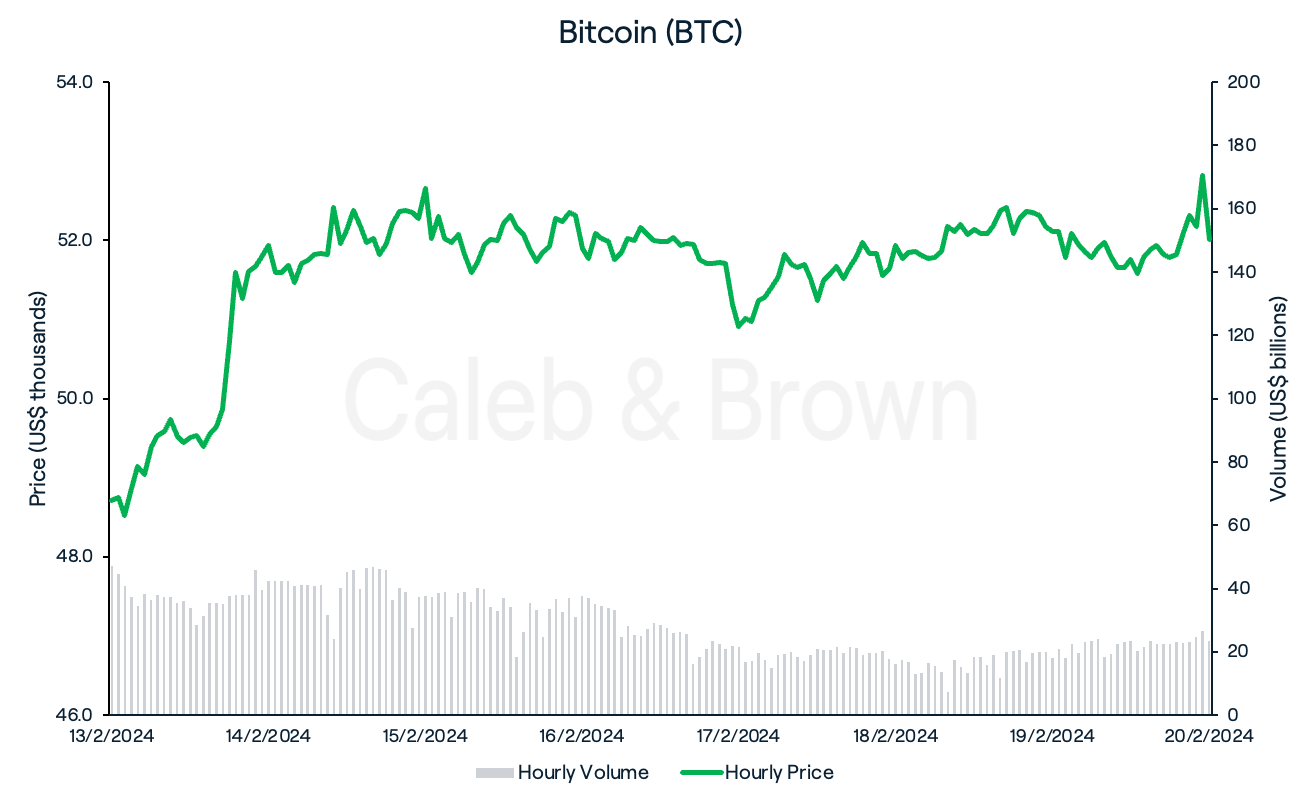

Since hitting US$50,000 last week, Bitcoin (BTC) has held the line, trading tightly between US$51,000 to US$52,400 for majority of the week.

Contributing to this effort has been a mammoth shift in investor focus to the fast-approaching halving event which will cut issuance in half in April. New BTC created each day will be reduced from 900 to approximately 450 BTC. As it stands, Bitcoin ETF’s are taking 10x the amount of BTC off the market than is being minted daily. This is set to potentially double after the halving, hinting at the possibility of a supply shock, or shortage.

Furthermore, institutional interest in the newly approved ETFs has flooded capital into the space with digital asset investment products seeing record weekly inflows of US$2.45 billion, bringing the total inflows this year to US$5.2 billion. For comparison, it took almost two years for $GLD just to reach US$3 billion of inflows, as recently highlighted by Bloomberg ETF analyst, Eric Balchunas.

As such, BTC closed the week at US$52,013, up 6.8% over the last seven days.

Ethereum

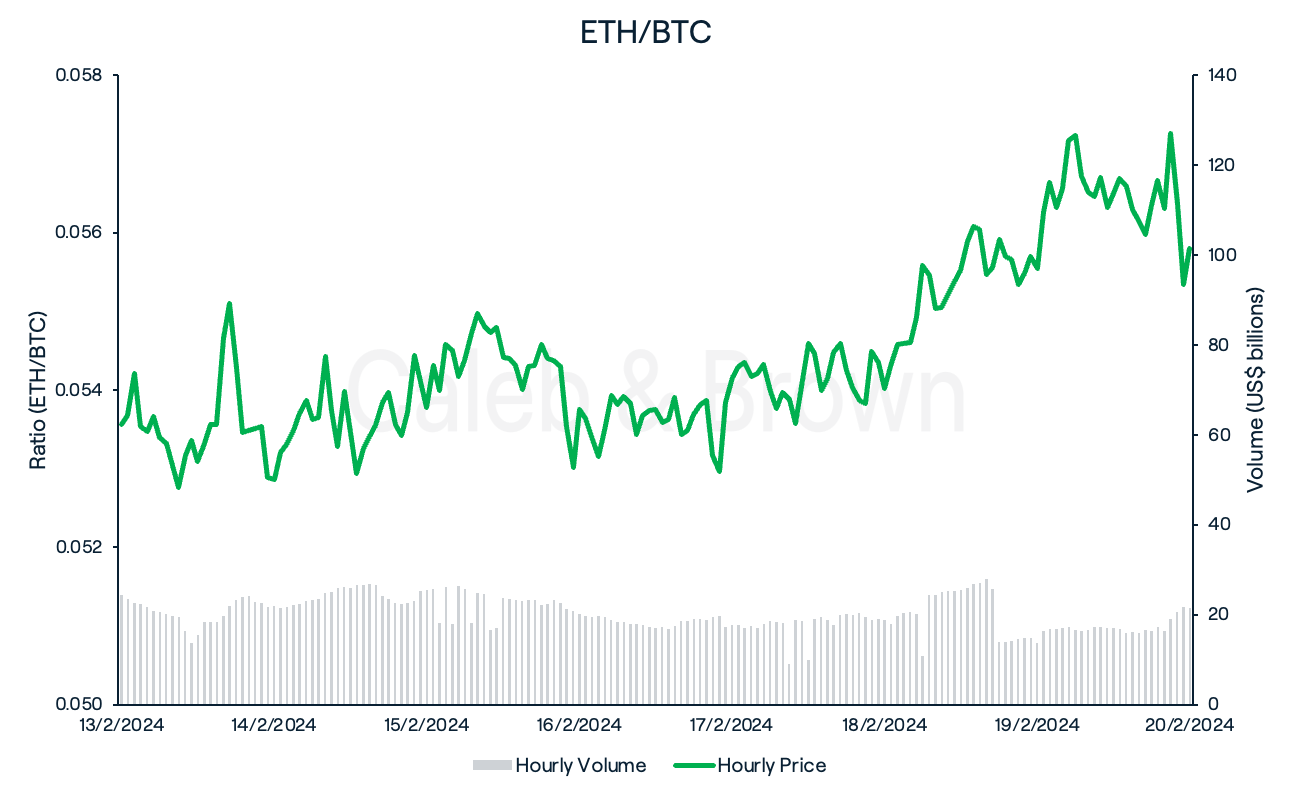

Ethereum (ETH) picked up the pace from last week, pushing ahead of BTC for weekly gains as it crossed US$3,000 for the first time since April 2022.

The ETH/BTC pair successfully bounced off its key support level this week as ETH gained 4.2% relative market share against the market leader over the past week.

Altcoins

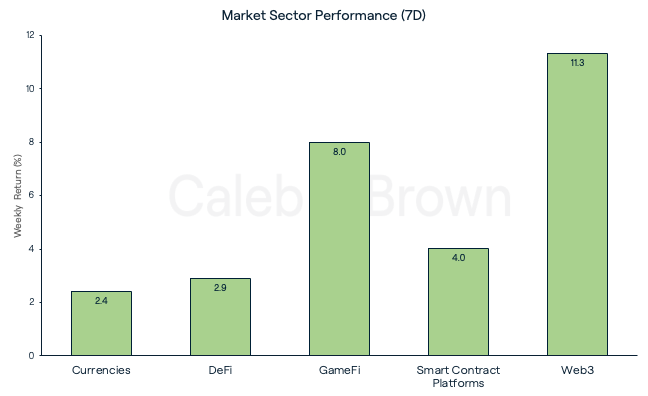

Market sector performance was green across the board once again this week with Web3 taking top position after it gained 11.3%. GameFi and Smart Contract Platforms followed, surging another 8.0% and 4.0%, respectively.

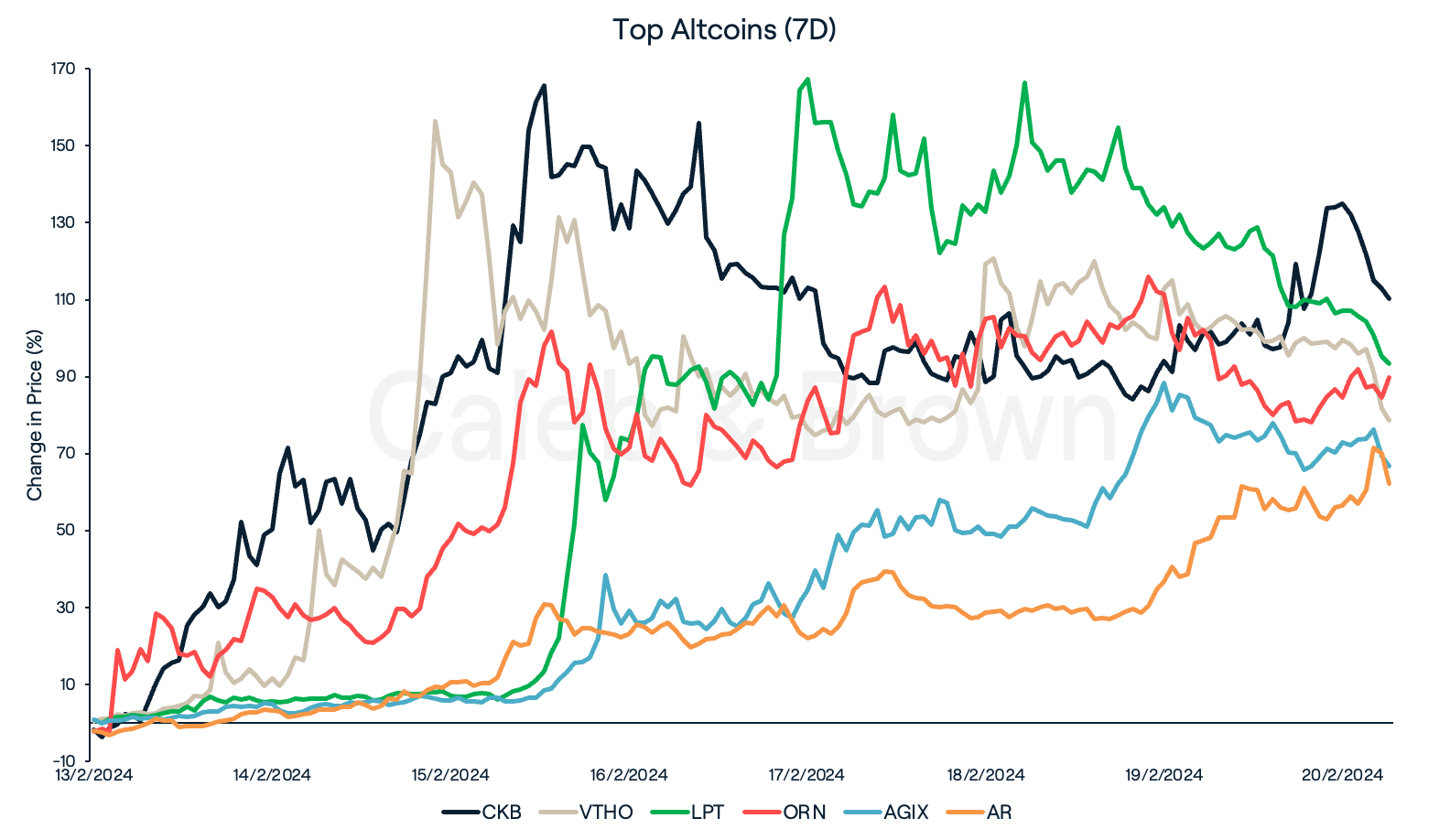

A number of smaller cap altcoins maintained last week’s velocity after surging immensely this week. These included layer-1 protocols, Nervos Network (CKB) and VeThor (VTHO) which rallied a staggering 110.2% and 78.7%, respectively. Decentralised streaming protocol, Livepeer (LPT) and DeFi player, Orion (ORN) also matched the pace, adding 93.4% and 89.7%, respectively. CKB jumped in price after the announcement of RGB++ Protocol which will link the network to BTC, while LPT’s surge can be largely attributed to its recent collaboration with OpenAI on the Sora generative video AI model.

Other notable runs this week include AI protocol, SingularityNET (AGIX) and data storage network, Arweave (AR) which each rallied 66.8% and 62.1%, respectively.

In Other News

A report from the U.S. Labor Department showed that inflation was higher than expected last month, having risen 3.1% for the 12 months ending January, down from 3.4% last month.

-

MicroStrategy (MSTR), who holds over $US10 billion worth of BTC, have made significant gains this year, positioning itself closely for inclusion in the S&P 500 Index. The S&P 500 Index, a widely-followed benchmark tracking the performance of the U.S. large-cap equity market through 500 companies, mandates that its constituents maintain a market capitalisation of at least US$15.8 billion. MicroStrategy, listed on the NASDAQ, currently boasts a market capitalisation of approximately US$12.4 billion.

-

Analysts suggest that inclusion in the S&P 500 could generate substantial new demand in BTC from passive investors in SPY, even those who are not actively seeking exposure to Bitcoin.

Regulatory

-

A U.S. bankruptcy judge has authorised the bankrupt crypto trading desk and lender Genesis to liquidate US$1.6 billion worth of its Grayscale Bitcoin Trust (GBTC) shares, as stated in a court filing.

-

In addition to the GBTC shares, Genesis will also be divesting its holdings in Grayscale Ethereum Trust (ETHE) and Grayscale Ethereum Classic Trust (ETCG) as part of the company's strategy to settle its outstanding debts with creditors.

-

On Friday, VanEck Associates Corporation agreed to pay a fine of US$1.75 million to settle charges brought by the U.S. Securities and Exchange Commission concerning the launch of its social media-centric ETF, in 2021. The registered investment adviser failed to disclose the involvement of a social media influencer, David Portnoy in promoting the ETF, according to the SEC’s statement.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F4xhm2KC9pmRbyg3LdHuOFN%2F00912ad427050b5be4fa4adee0e082b7%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-02-21T23%3A31%3A54.192Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)