Market Highlights

- The U.S. Securities and Exchange Commission (SEC) approved the country's first wave of spot Bitcoin (BTC) ETFs.

- Ethereum (ETH) experienced a steady rally throughout the week, driven by growing optimism that a spot ETH ETF might be realised in the coming months.

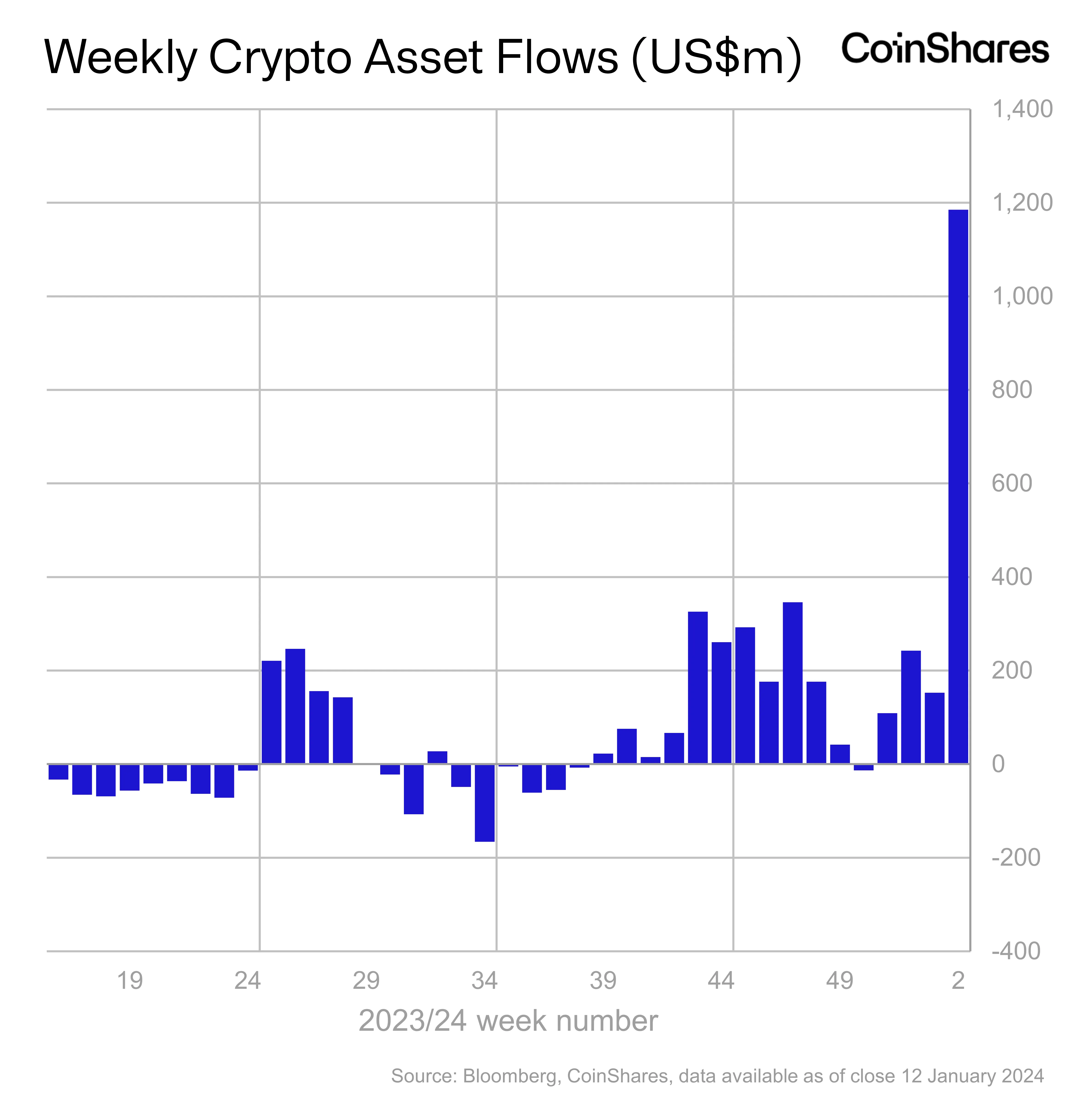

- Digital asset investment products experienced inflows of US$1.18 billion last week.

- CoinShares, the European asset manager, exercised its option to acquire Valkyrie Funds, a division of Valkyrie Investments based in Nashville.

Bitcoin

What a week it was for crypto!

After months of escalating anticipation, the U.S. Securities and Exchange Commission (SEC) had finally approved the country’s very first wave of spot Bitcoin (BTC) ETFs, however not without hiccups along the way.

A day prior to the official announcement, the SEC’s verified X (formerly Twitter) account was compromised, leading to an unauthorised approval post which briefly shot BTC up 3.0% in price. This move quickly corrected itself after SEC Chair, Gary Gensler confirmed in another post that “The SEC [had] not approved the listing and trading of spot bitcoin exchange-traded products.”

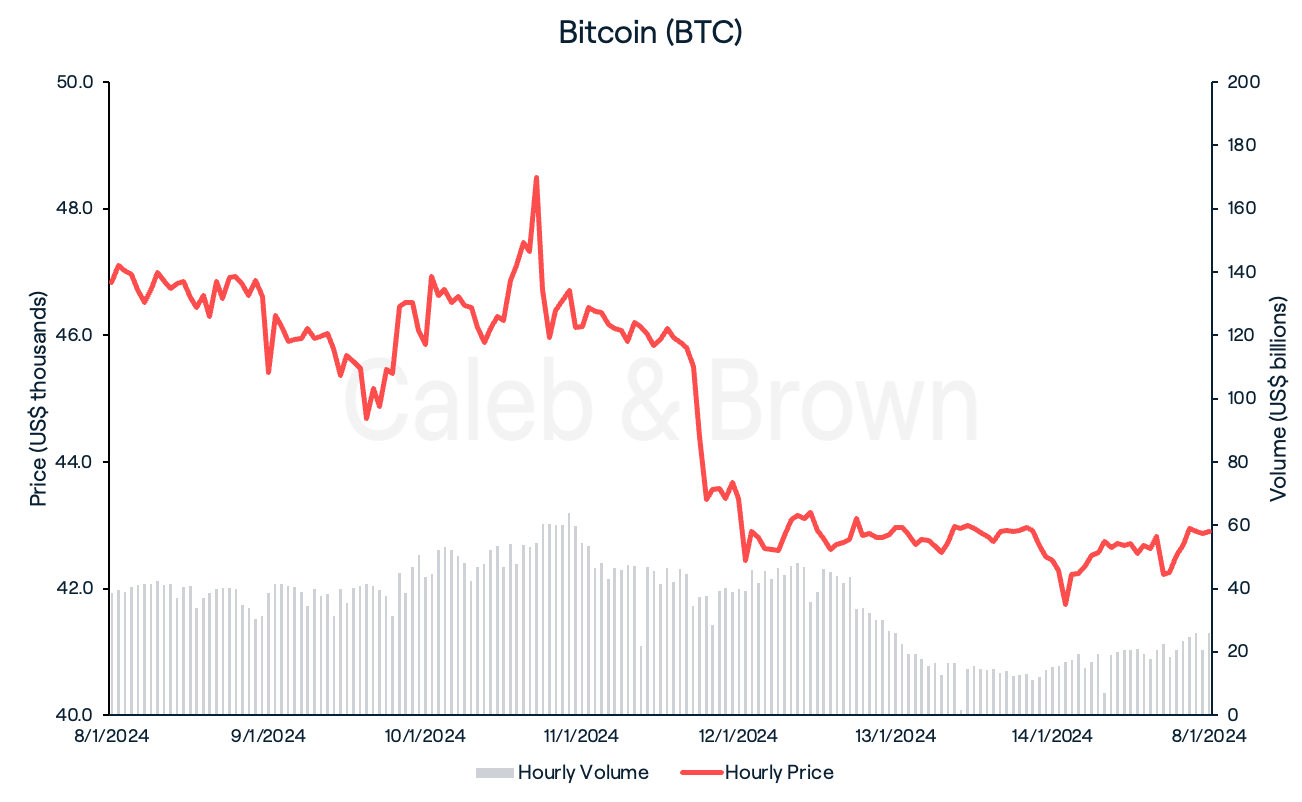

Despite the turbulence, BTC proceeded to surge to a high of US$48,970 the following day, a price not seen since 2021, before over US$110 million worth of BTC liquidations brought the price back crumbling down. BTC closed the week at US$42,905, down 8.4% over the last seven days.

Ethereum

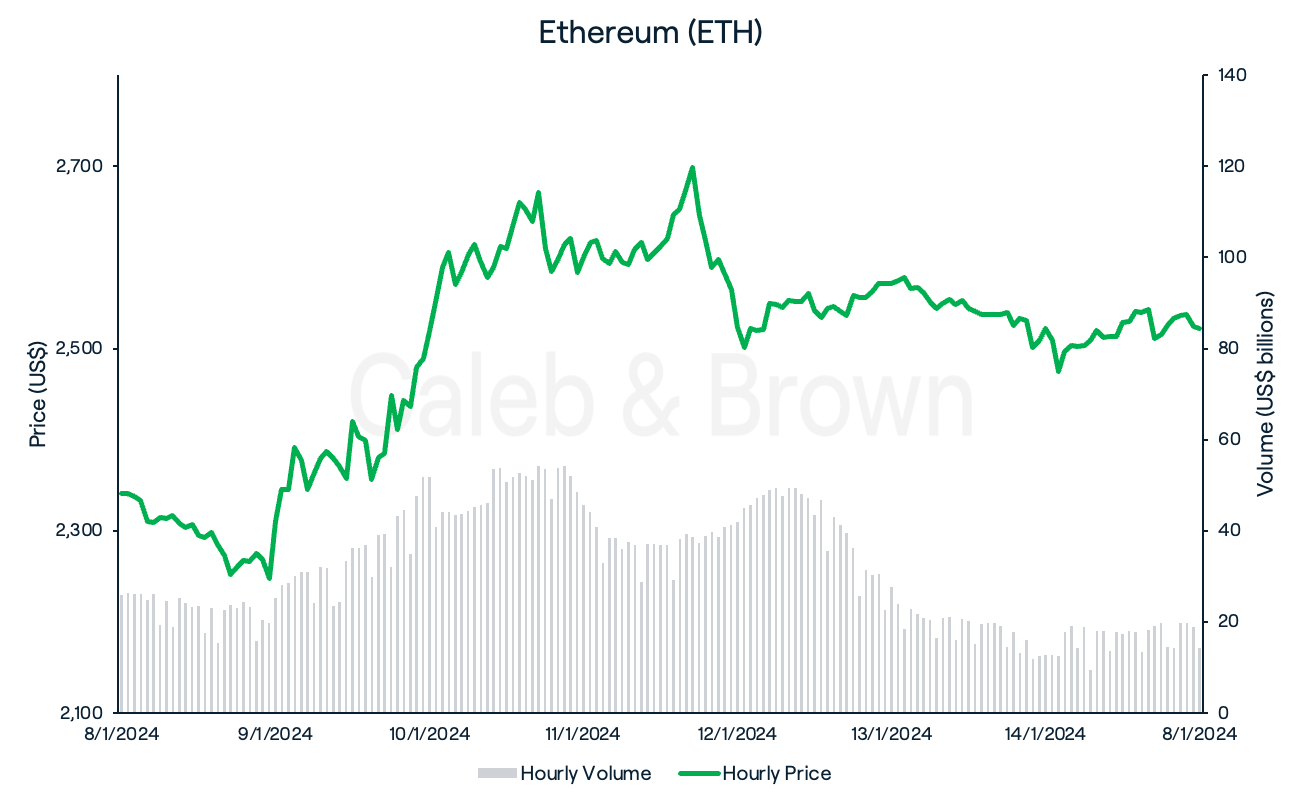

As BTC glimmered in the spotlight, Ethereum (ETH) lurked in the shadows, rallying steadily throughout the week, and reaching a high of US$2,717 Friday night. The majority of that growth could be attributed to growing optimism that a spot ETH ETF might become a reality in the coming months, thanks to Bitcoin paving the way.

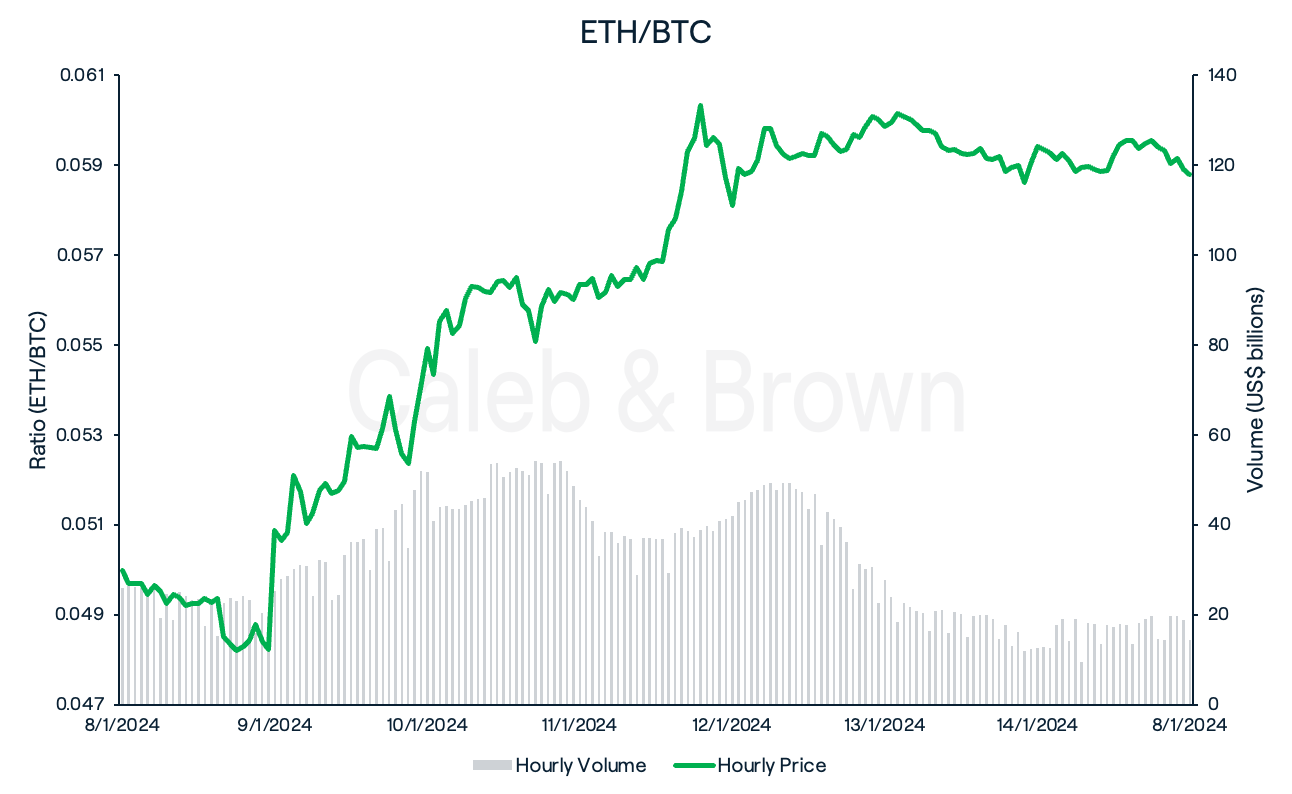

The rotation of funds from BTC to ETH can be clearly depicted in the ETCBTC ratio which bounced from monthly lows, giving way to a weekly rise of 17.6%.

ETH sold-off slightly over the weekend and closed the week at US$2,522, up 7.4%.

Altcoins

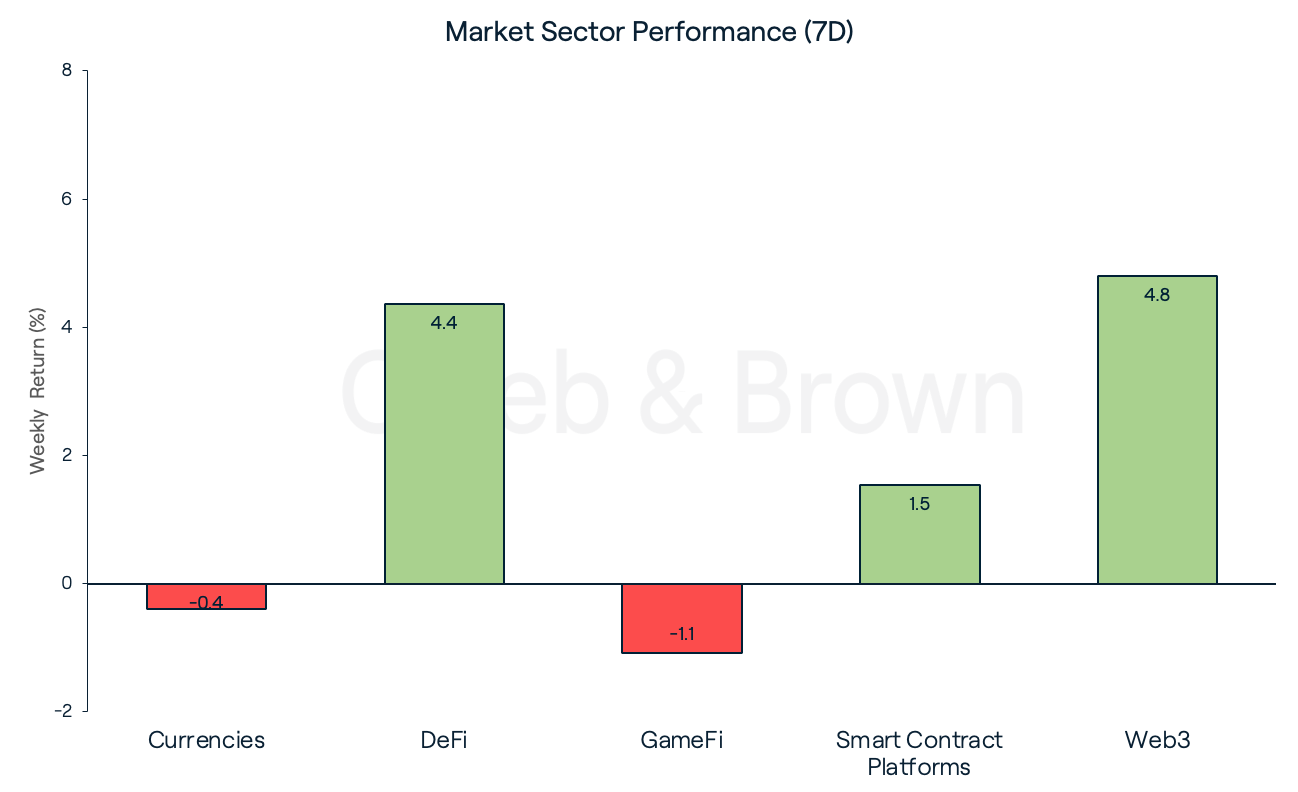

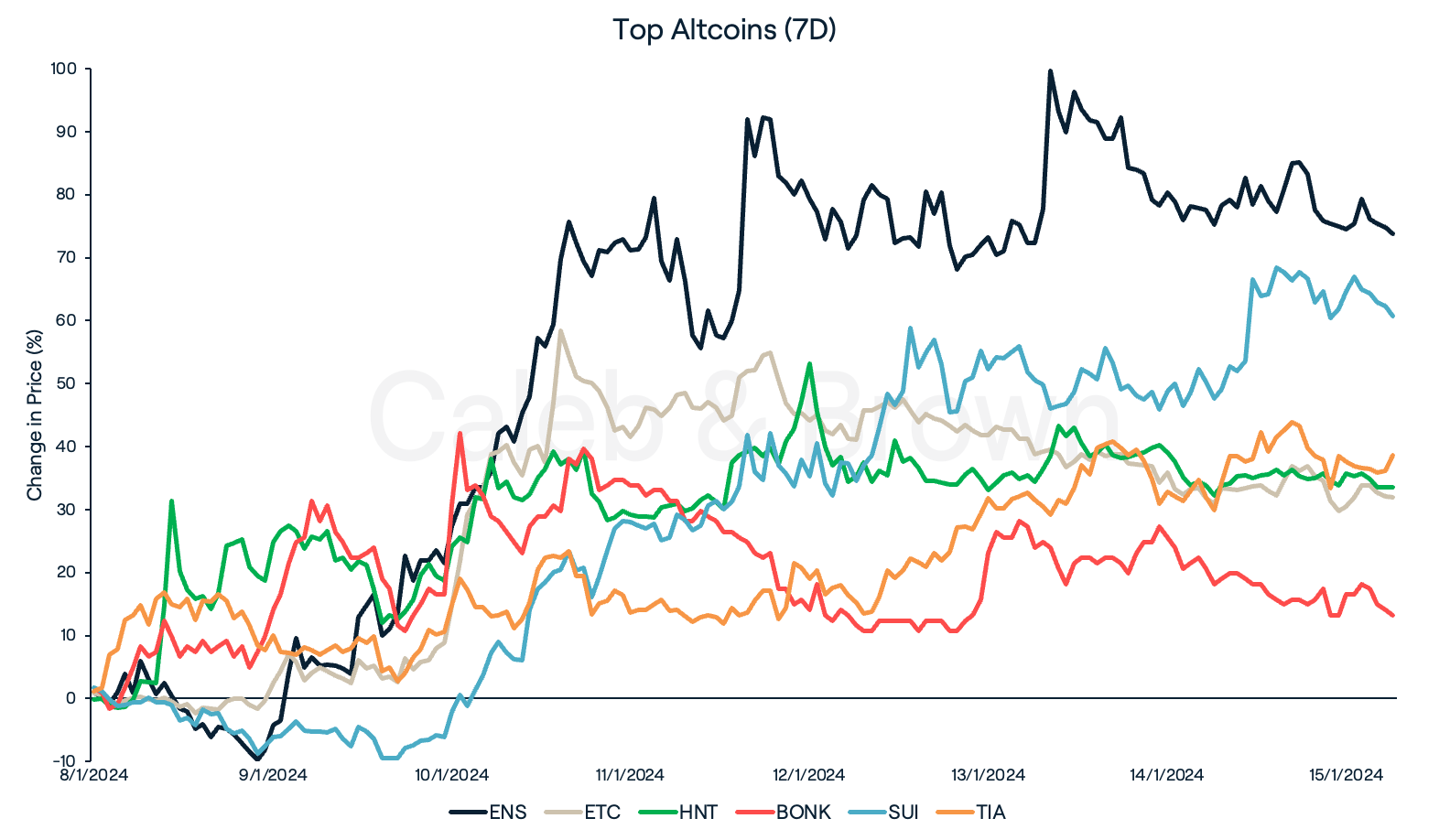

Thanks to the positive BTC news the majority of sector performance secured gains this week with Web3 and DeFi taking top spot after adding on 4.8% and 4.4%, respectively. GameFi and Currencies lagged behind the pack and lost 1.1% and 0.4%, respectively.

Investors were quick to jump on Ethereum-related coins, taking advantage of ETH’s price pump this week. The two biggest benefactors being Ethereum Name Service (ENS) and Ethereum Classic (ETC) which rallied 73.8% and 31.9%, respectively.

Decentralised wireless network, Helium (HNT) as well as Solana-based memecoin Bonk (BONK), were quick to recover this week, gaining 33.5% and 13.2%, respectively. BONK recently released a new feature which allows users to quickly funnel unwanted assets into BONK, decluttering wallets and saving time selling assets.

Amongst Smart Contract Platforms, Sui (SUI) and Celestia (TA) were the top performers, adding on 60.7% and 38.6%, respectively. SUI’s price growth has matched its huge spike in TVL (total value locked) recently, growing 85% in the last month.

In Other News

Last week, digital asset investment products witnessed inflows of US$1.18 billion (pending T+2 settlement), falling short of the record established during the introduction of futures-based Bitcoin ETFs. Notably, trading volumes reached a record high of US$17.5 billion, a significant increase compared to the 2022 weekly average of US$2 billion.

The first full day of trading following the SEC’s approval of the newly listed spot Bitcoin ETFs marked a huge success, with the funds seeing over US$4.6 billion in trade volume. BlackRock’s iShares Bitcoin Trust (IBIT), nearly cleared US$1 billion worth of volume by itself, accounting for 22% of the total volume. Grayscale also notched an impressive milestone after the company's Grayscale Bitcoin Trust saw an all-time high daily volume of 56 million shares on Thursday. This is likely attributed to outflows as well as inflows as long time holders cash in with EFT news.

Regulatory

CoinShares, the European asset manager, has chosen to exercise its option to acquire Valkyrie Funds, a division of Valkyrie Investments based in Nashville. This decision comes after Valkyrie Funds recently launched a spot Bitcoin ETF, trading under the name The Valkyrie Bitcoin Fund (BRRR). As per the initial agreement, the two entities had previously concluded a brand licensing arrangement, permitting Valkyrie Investments to utilise the "CoinShares" name in its S-1 filings with the SEC throughout the option period.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5PyjbKIeUsfgGmHEcjRsYk%2Fcaeaa65e370a8946081069eaf8a9158d%2FWeekly_Rollup_Tiles__31_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-01-17T11%3A11%3A33.409Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)