Market Highlights

- Stablecoin giant, Tether (USDT), bought US$380m worth of BTC, bringing its total holdings of the digital asset to over US$2.8 billion.

- The U.S. Securities and Exchange Commission’s (SEC) extended the deadline for Fidelity’s proposed spot Ethereum ETF to March 5.

- DYdX (DYDX) has secured the position of the largest DEX by daily trading volume, surpassing Uniswap v3 (UNI).

- The now-inactive cryptocurrency exchange FTX has reportedly divested nearly $1 billion in shares from Grayscale's GTBC fund since the fund transformed into a spot Bitcoin ETF.

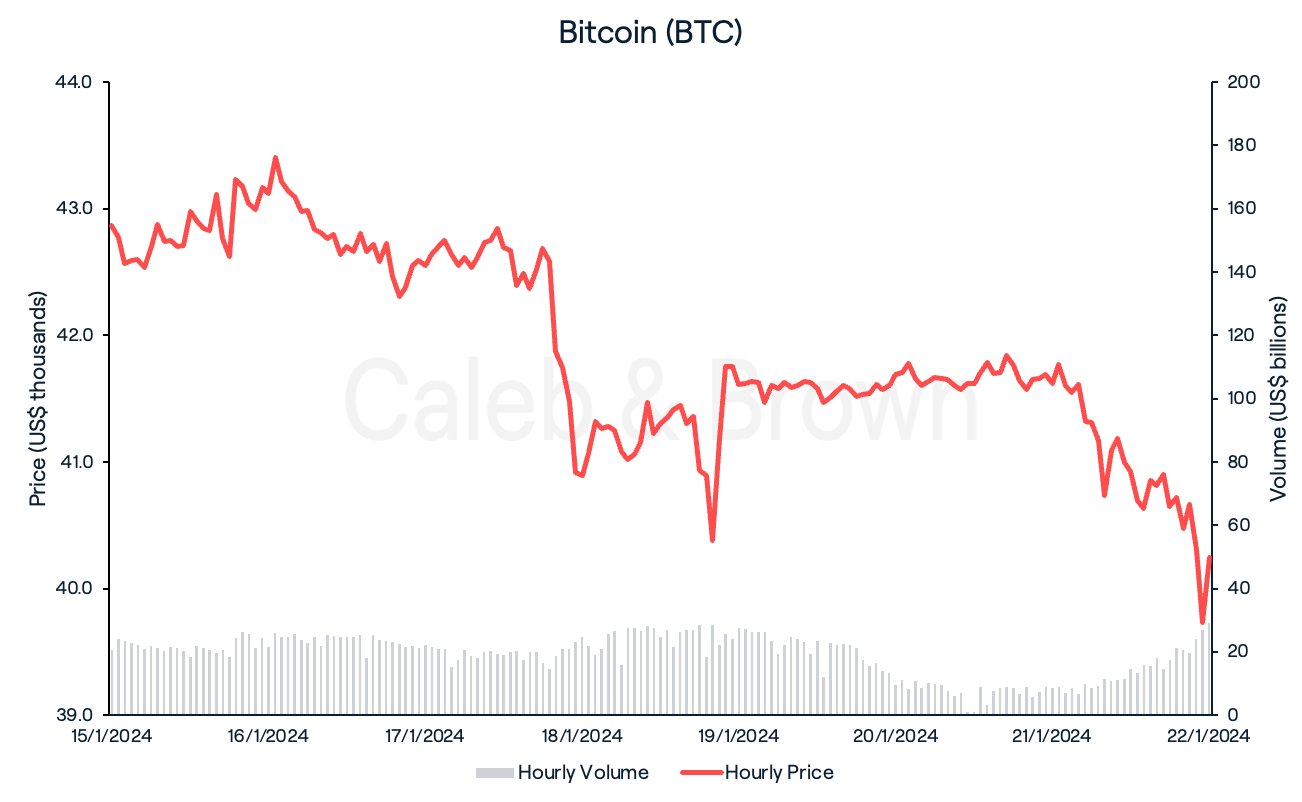

Bitcoin

Following the intense culmination of the prolonged Bitcoin ETF saga last week, the crypto markets have taken a downturn. Over the past week, Bitcoin (BTC) has seen a decrease of 6.1% in price, briefly dipping below US$40,000 before closing the week at US$40,247.

The decline in price is likely attributed to investors capitalising on their profits from the initial ETF excitement, marking a conventional "sell the news" event.

On a positive note, stablecoin giant, Tether (USDT), has bought more BTC, bringing its total holdings of the digital asset to over US$2.8 billion.

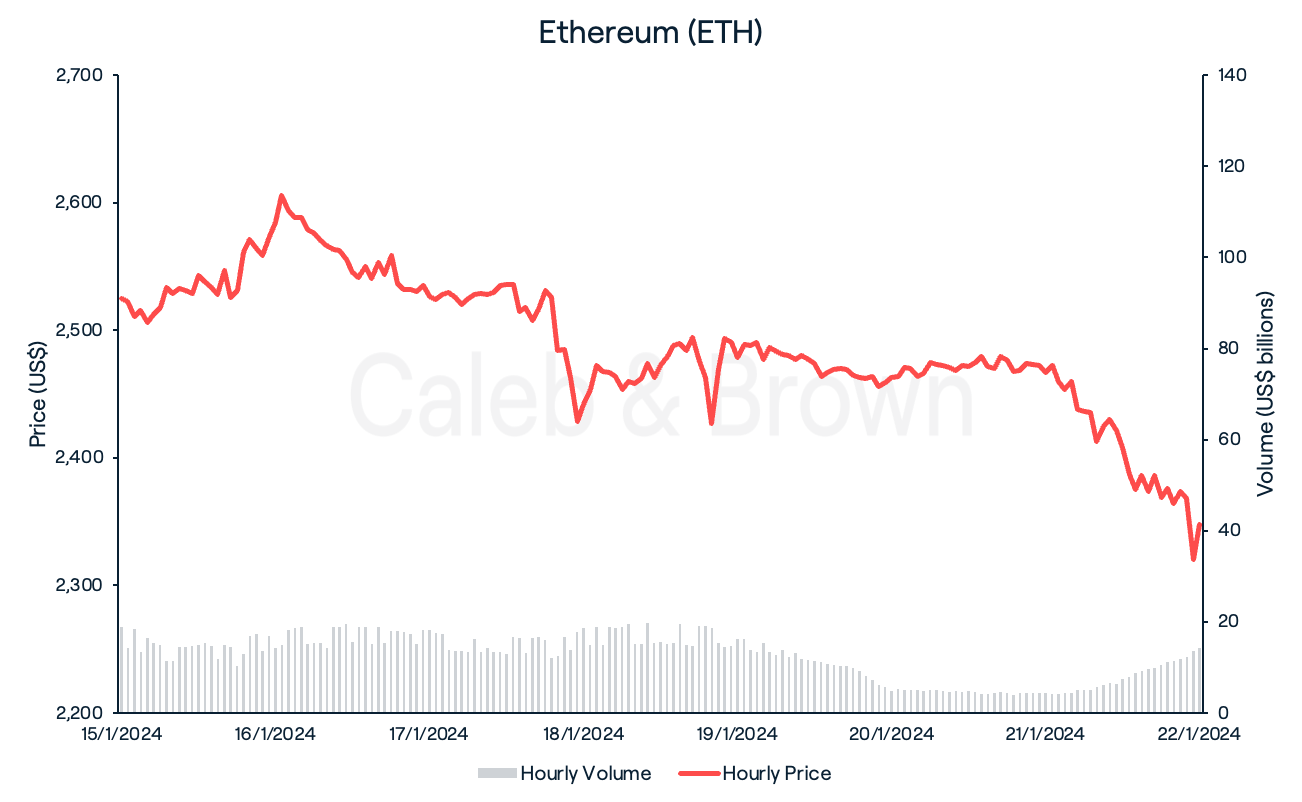

Ethereum

Ethereum (ETH) also stumbled this week, following in Bitcoin’s footsteps. After soaring to yearly highs, ETH fell 7.0% this week to a low of US$2,303. The price action perhaps perpetuated by the U.S. Securities and Exchange Commission’s (SEC) decision to extend the deadline for Fidelity’s proposed spot Ethereum ETF to March 5.

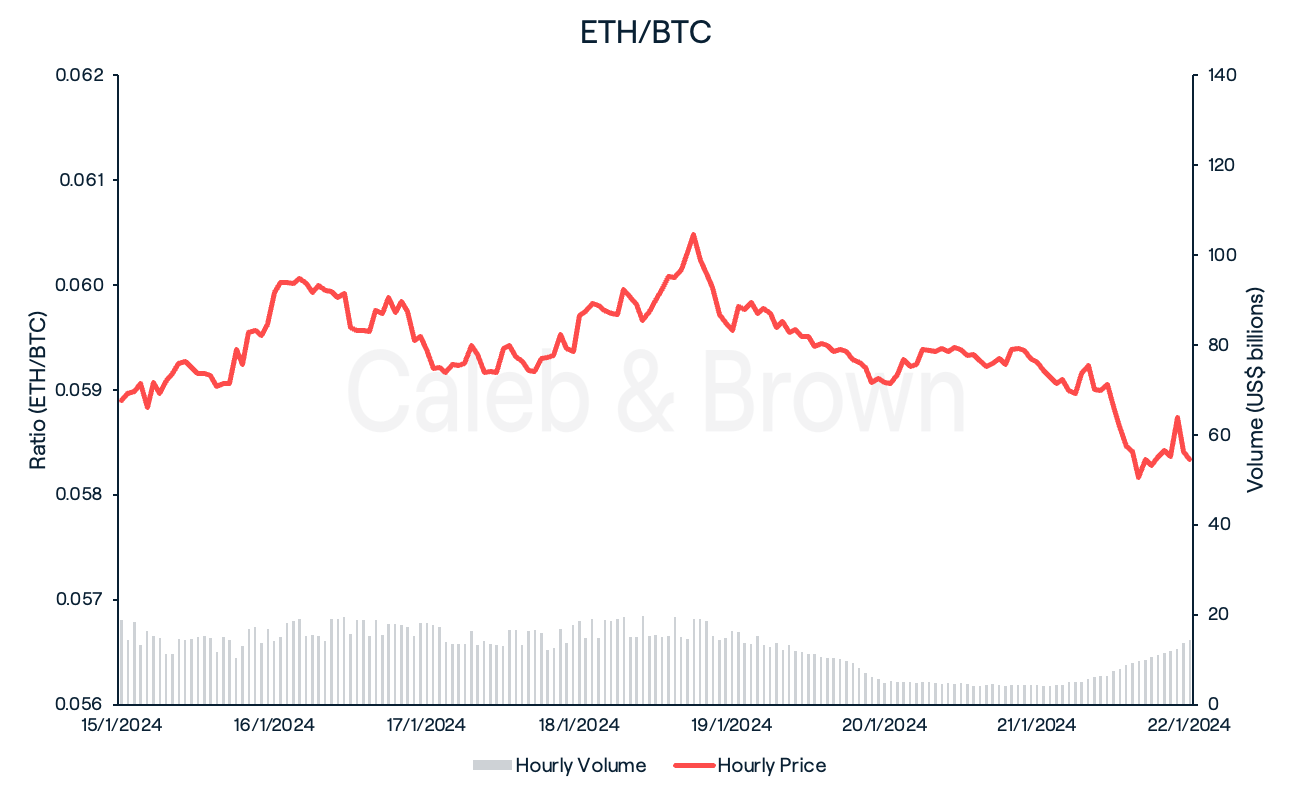

Despite the sharp fall in price, the ETH/BTC ratio remained relatively flat throughout the week, falling just 0.9%.

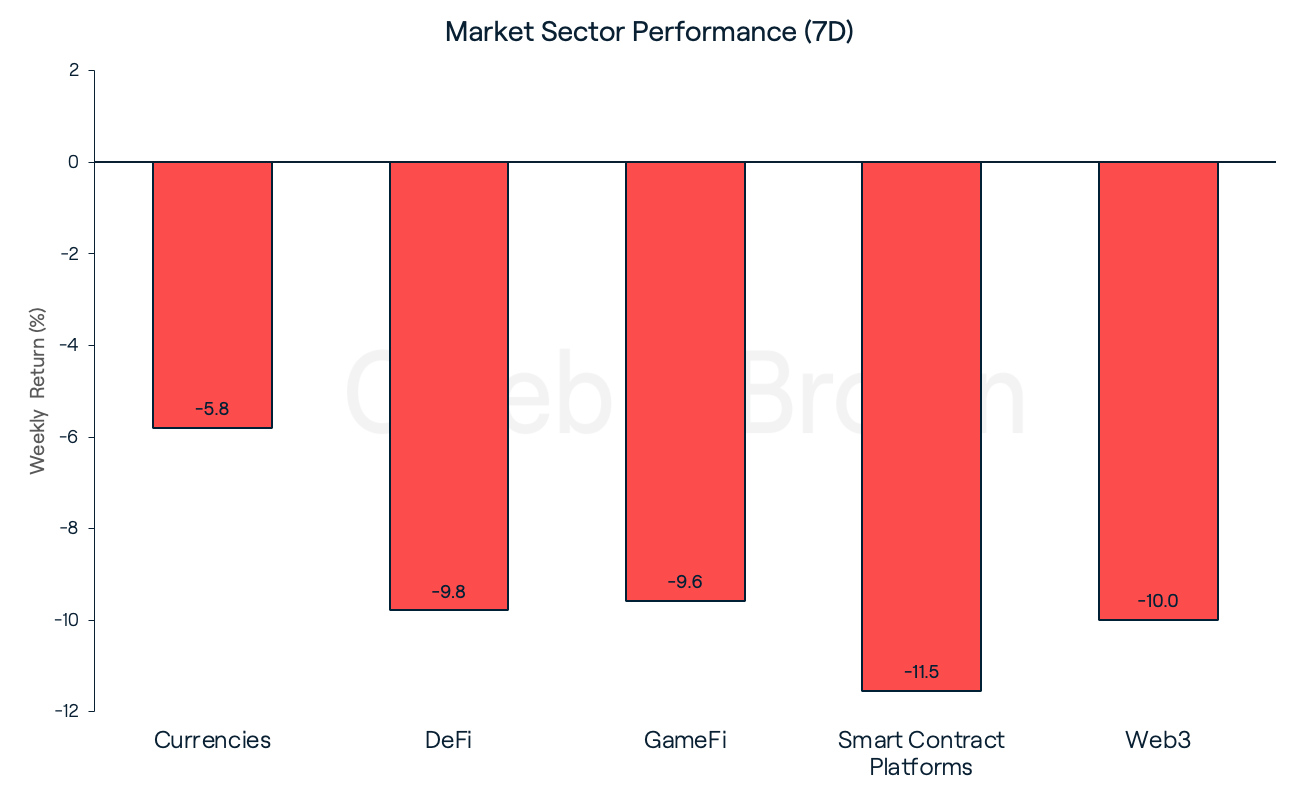

Altcoins

Market sector performance reflected that of BTC and ETH this week, with no sectors producing a gain. As usual, Currencies managed to hold on the strongest, losing 5.8% in value. Smart Contract Platforms was the largest hit, falling 11.5% over the last seven days.

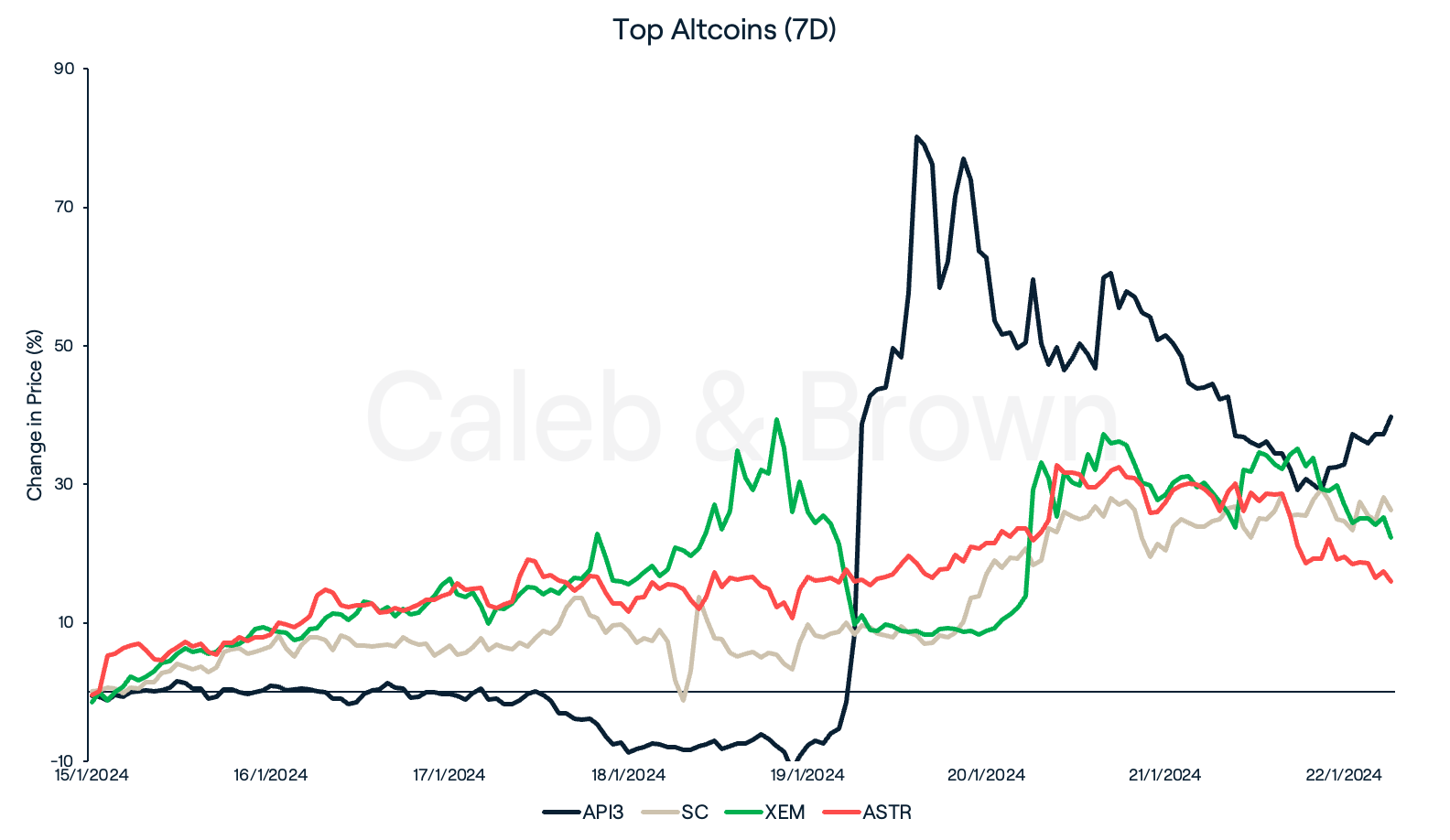

Similarly, only a handful of tokens swam above water this week. Decentralised oracle, API3 (API3) and the cloud storage protocol Siacoin (SC) gained 39.8% and 26.3%, respectively. API3’s pump is likely linked to the extreme negative funding rate, attracting investors to hold long positions while SC recently launched Renterd v1.0.

NEM (XEM) and Astar (ASTR) added on 22.3% and 15.9%, respectively. Astar’s rise can be attributed to its recent strategic partnerships with Polygon and Polkadot.

In Other News

- The Dencun upgrade of Ethereum (ETH) reached a testnet milestone on Thursday, marking the latest advancement in the decentralised network's development. This testnet launch signifies that Ethereum is progressing toward the completion of its upgrade. Once fully implemented, Dencun will resolve Ethereum's scalability issues, enhancing the performance of the underlying blockchain supporting ETH.

- In another milestone, this time for decentralised exchanges (DEX), dYdX (DYDX) has secured the position of the largest DEX by daily trading volume, surpassing Uniswap v3 (UNI). This accomplishment comes after a strategic transition from Ethereum to Cosmos and the subsequent full activation of trading under the new infrastructure. The DEX now holds 10.7% of all the crypto market share.

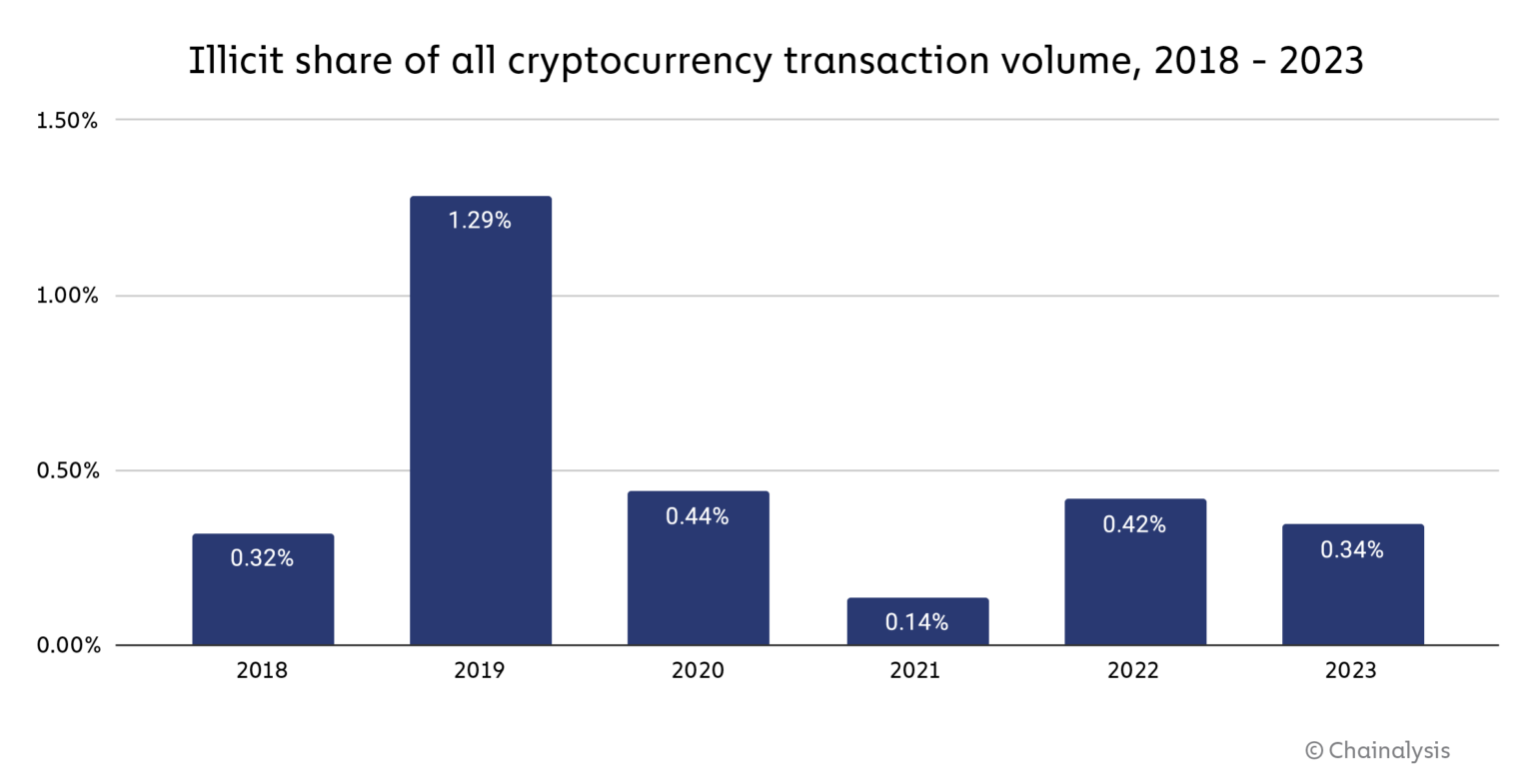

- The quantity of cryptocurrency pilfered through scams in the previous year decreased by almost one-third compared to 2022, as revealed in preliminary extracts from a Chainalysis report. The blockchain analysis company indicates that overall illicit revenue witnessed a decline of more than 54%. Alongside the reduction in the absolute value of illicit activities, the estimated portion of all cryptocurrency transaction volume linked to illicit activity also decreased, dropping from 0.42% in 2022 to 0.34%.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)