Market Highlights

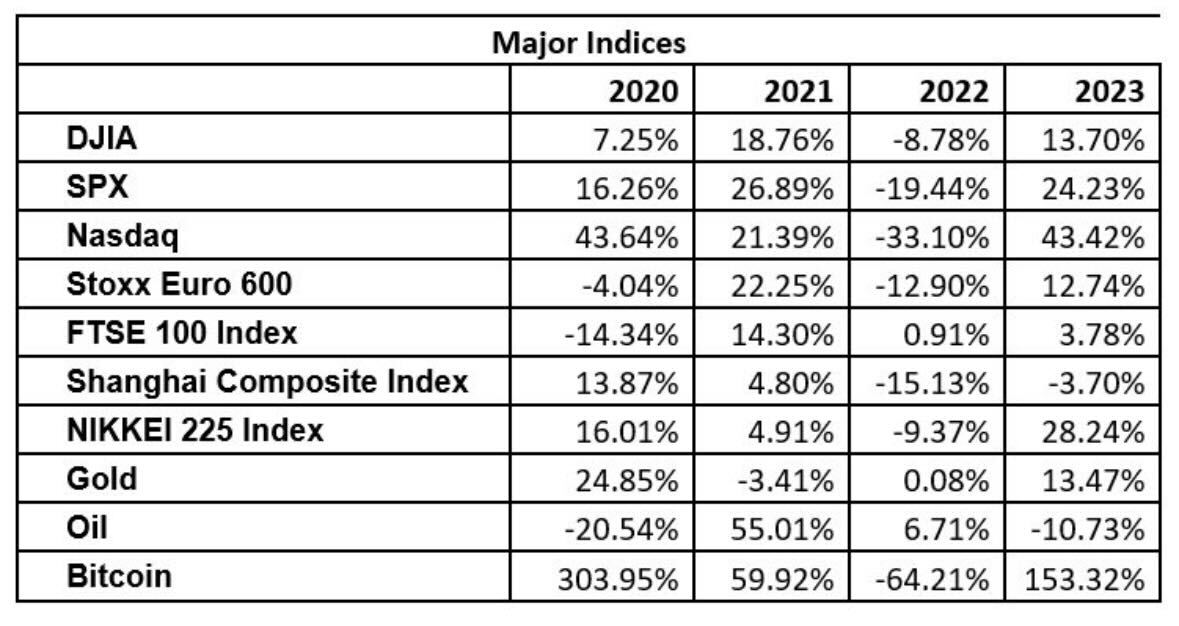

- Bitcoin (BTC) had a remarkable 2023, surpassing all major indices with a price increase of over 150%, and bringing the total crypto market cap past US$1.8 trillion!

- Digital asset investment products experienced outflows of $16 million, concluding an 11-week streak of inflows.

- BlackRock and Nasdaq met with the SEC's Division of Trading and Markets to discuss BlackRock's proposal for a spot Bitcoin ETF.

Bitcoin

After gaining over 150% in price last year, 2023 marked a great year for Bitcoin (BTC), outperforming all major indices by several-fold.

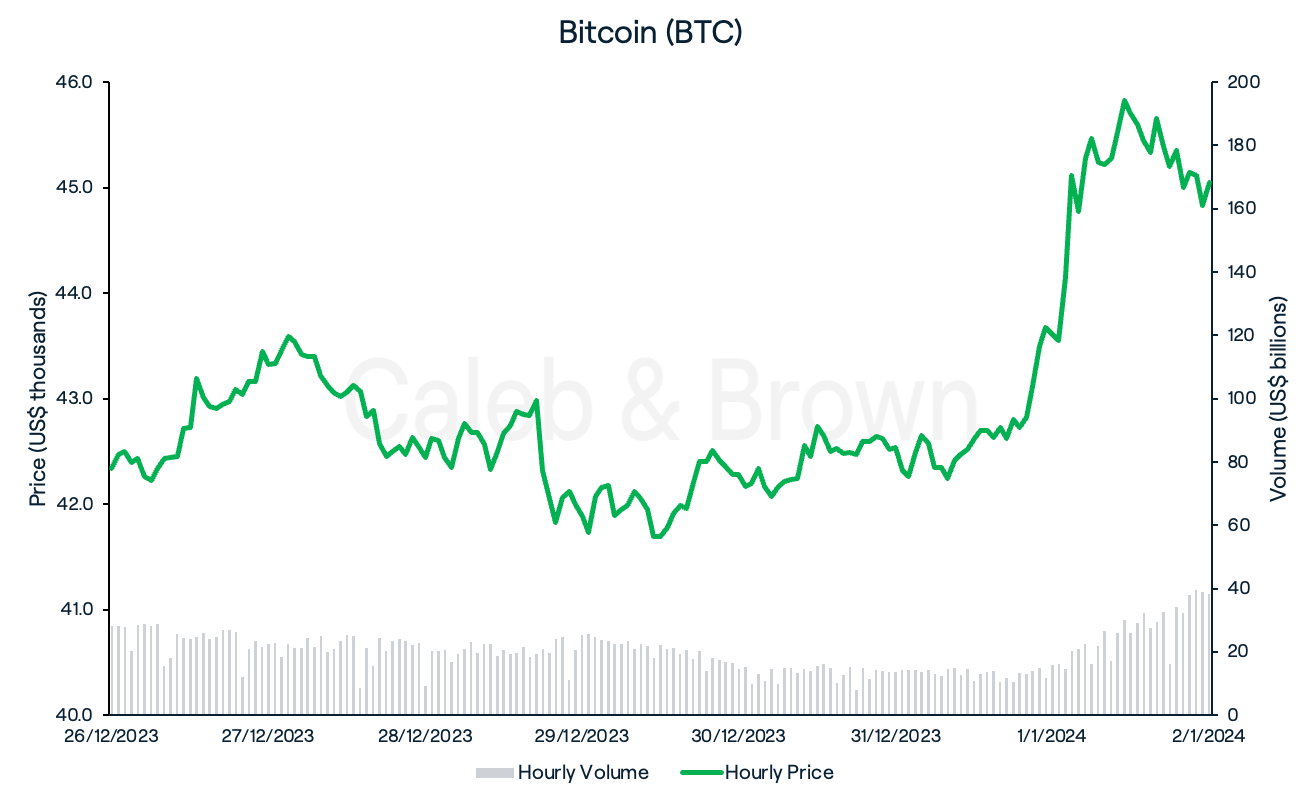

While BTC’s price trended down over the past week, 2024 has provided a great start to the year as BTC surged past $45,000 Tuesday morning. This move may have been spurred by a recent Reuters report which claimed that the U.S. Securities and Exchange Commission (SEC) may notify spot Bitcoin ETF issuers as soon as Wednesday this week, and be cleared to launch next week.

BTC closed the week at US$45,051, up 6.4% over the last seven days.

Ethereum

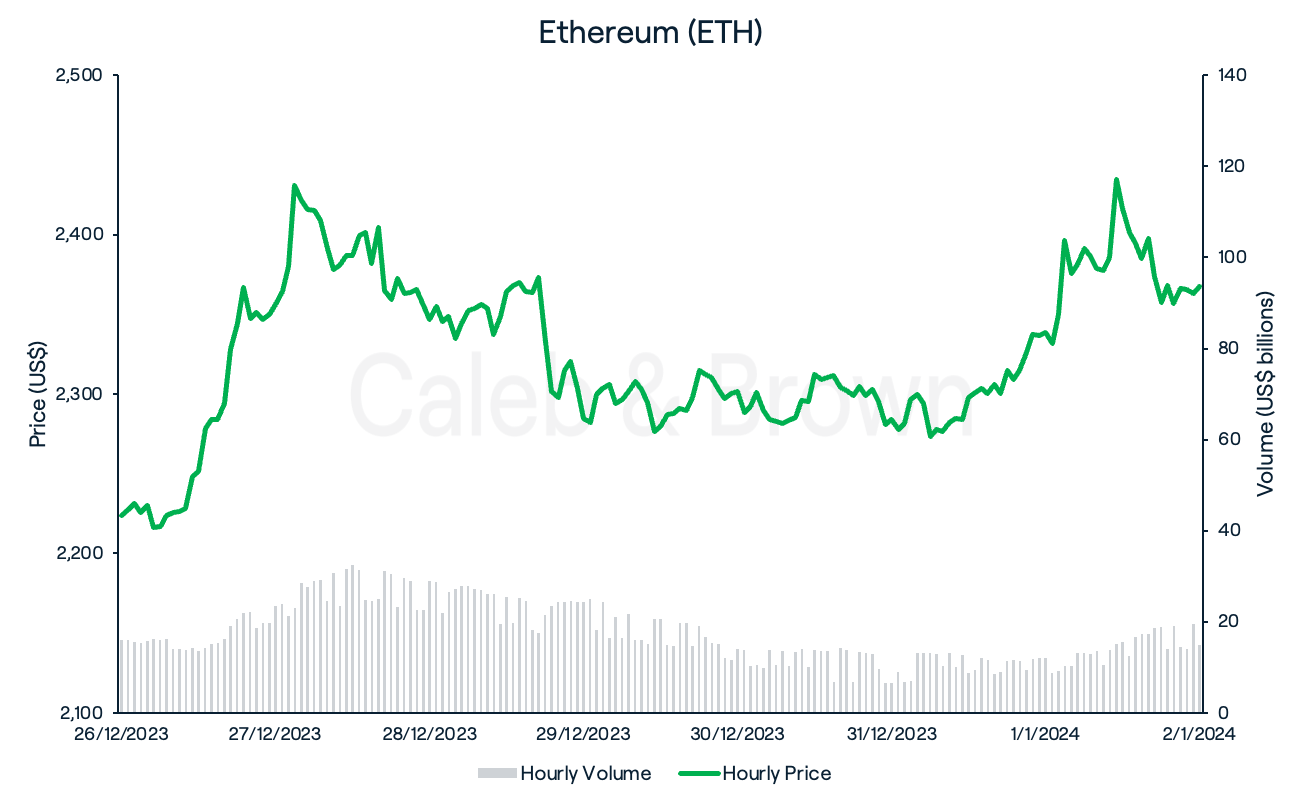

Ethereum (ETH) on the other hand was heavily outperformed by BTC last year. However, ETH also outperformed all other major indices returning an annual gain of 92.0%. A final push in the last week of 2023 saw ETH close the week at US$2,367 for a weekly gain of 6.4%.

Altcoins

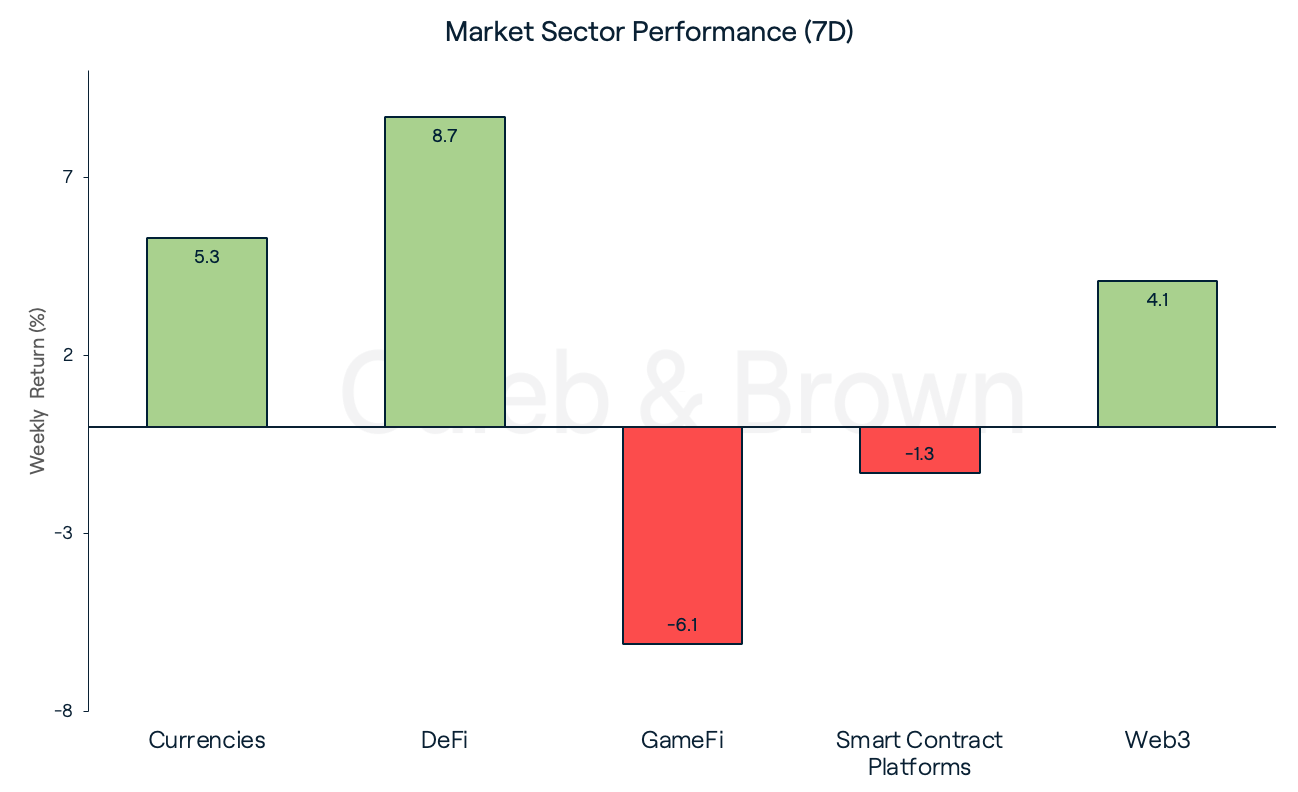

Market sector performance was mostly positive this week with DeFi and Currencies returning 8.7% and 5.3%, respectively. GameFi was the hardest hit sector, losing 6.1% over the last seven days.

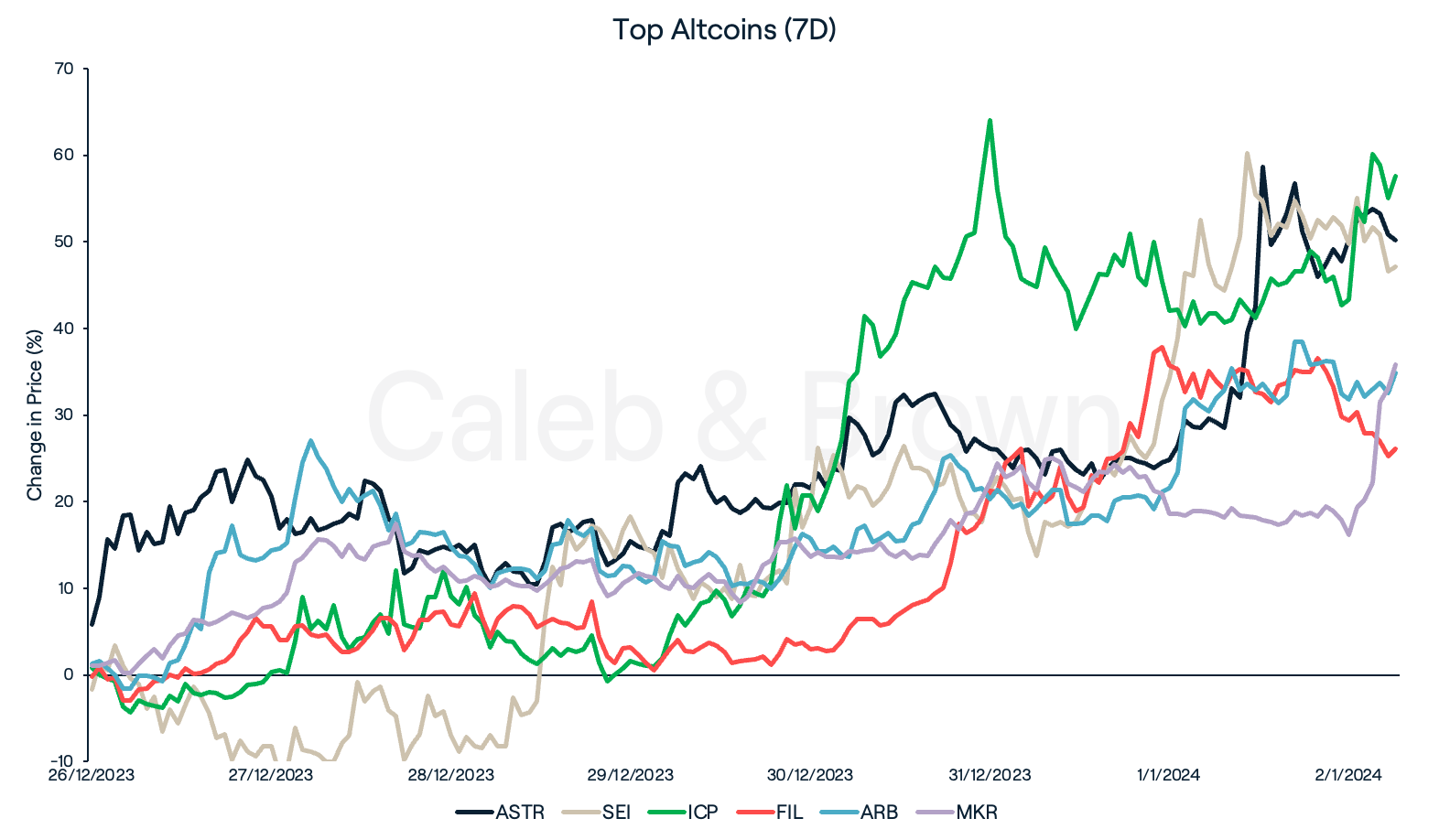

Despite the sectors performance this week Smart Contract Platforms, Astar (ASTR) and Sei (SEI) were this week’s top performers with each gaining 50.2% and 47.2%, respectively. SEI recently crossed 1 billion transactions and hit an all-time-high while ASTR raised US$7.1 million in a crypto presale round last week.

Web3 protocols, Internet Computer (ICP), and Filecoin (FIL) also rallied this week increasing 57.6% and 26.1%, respectively. ICP extended last week’s large surge and is up 200% over the last 30 days.

Lastly, layer-2 protocol Arbitrum (ARB) and DeFi player Maker (MKR) each surged 34.8% and 35.8%, respectively.

In Other News

-

Digital asset investment products concluded an 11-week streak of inflows after experiencing outflows of US$16 million this week. Despite this, trading activity remained significantly higher than the yearly average, reaching a total of US$3.6 billion for the week.

-

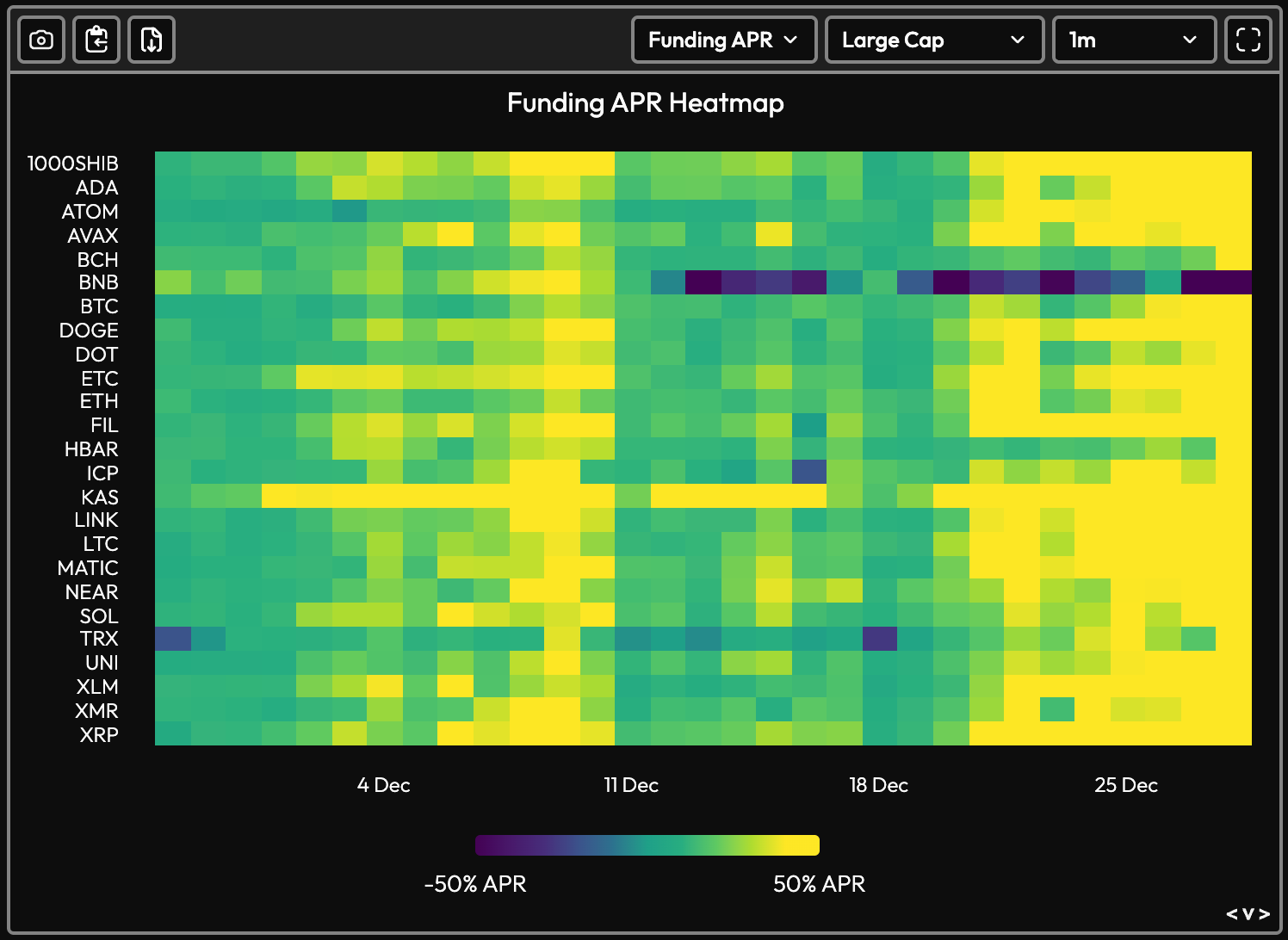

Funding rates for a number of altcoins have increased sharply over the past month, rising as high as 50% APR (annual percentage rate), and implying a large amount of new positions being longed with leverage rather than spot.

Regulatory

- On Tuesday, BlackRock and Nasdaq convened with the U.S. Securities and Exchange Commission's (SEC) Division of Trading and Markets to engage in discussions regarding the asset manager's proposal to introduce a spot Bitcoin ETF.

Specifically, changes to NASDAQ Rule 5711(d) were discussed, which involves guidelines for the listing of Commodity-Based Trust Shares, and specifying criteria for both initial and ongoing listing, which encompass compliance requirements.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F2KosWprK7DPP8NwkyRr3Bx%2F852906df10de2abf95d72731fd61d44c%2FWeekly_Rollup_Tiles__29_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-01-03T01%3A19%3A41.944Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)