Market Highlights

- Bitcoin (BTC) and Ethereum (ETH) experience moderate price increases, while altcoins see significant gains.

- HSBC Hong Kong offers trading of BTC and ETH futures ETFs through mobile app.

- Warner Music Group and Polygon collaborate to establish a music accelerator program.

- The UK acknowledges crypto trading as a regulated financial activity.

Price Movements

Bitcoin

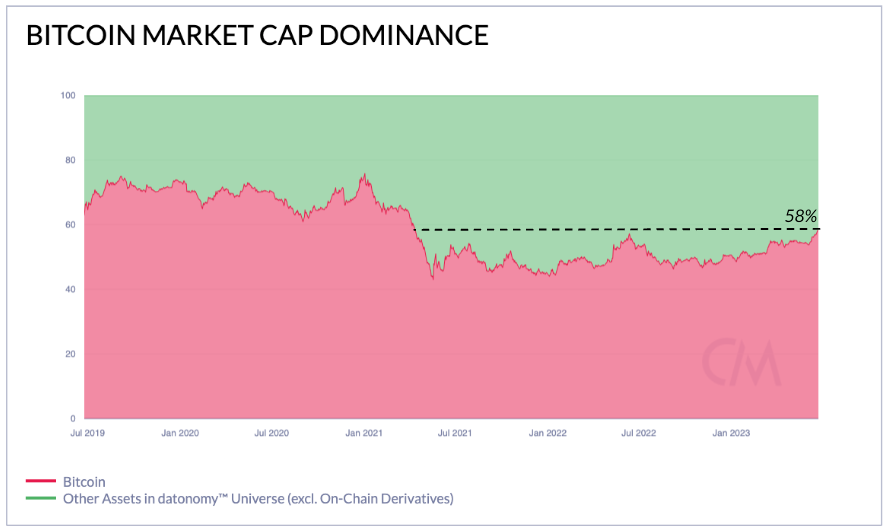

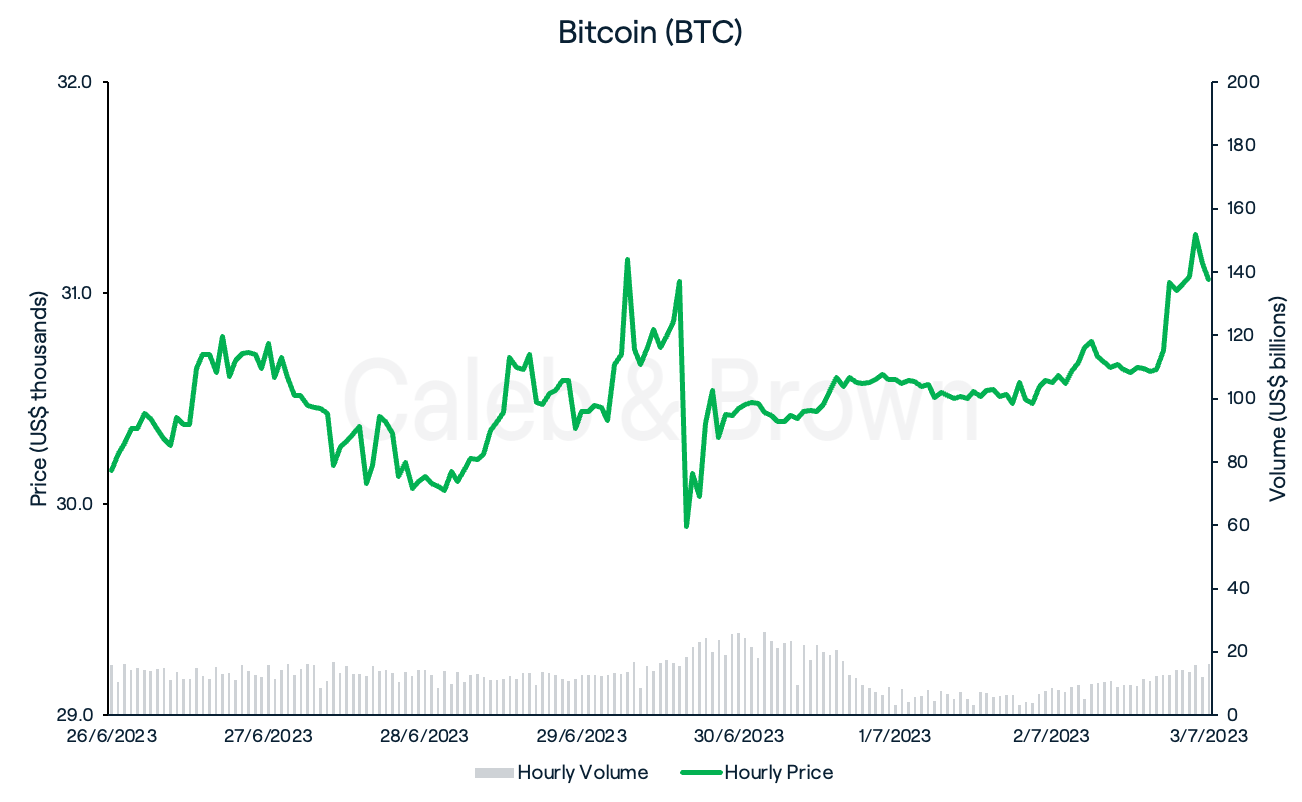

Since soaring past US$31,000 last week, Bitcoin (BTC) has stagnated slightly, trading the majority of the week rangebound between US$29,900 and US$30,900. While BTC price remained relatively unmoved, BTC dominance— its relative percentage of total crypto market cap, reached 58% for the first time since April 2021, as reported by Coin Metrics.

This can mostly be attributed to BTC’s surge in price last week in conjunction with the number of tokens recently listed as securities by the U.S. Securities and Exchange Commission (SEC), resulting in plummeting prices.

Meanwhile, prominent BTC-bull Michael Saylor announced MicroStrategy’s purchase of an additional 12,333 BTC for US$347 million, bringing the company’s total stack to 152,333 BTC.

With the help of a small rally Sunday night, BTC closed the week at US$31,065, up 3.0% over the last seven days.

Ethereum

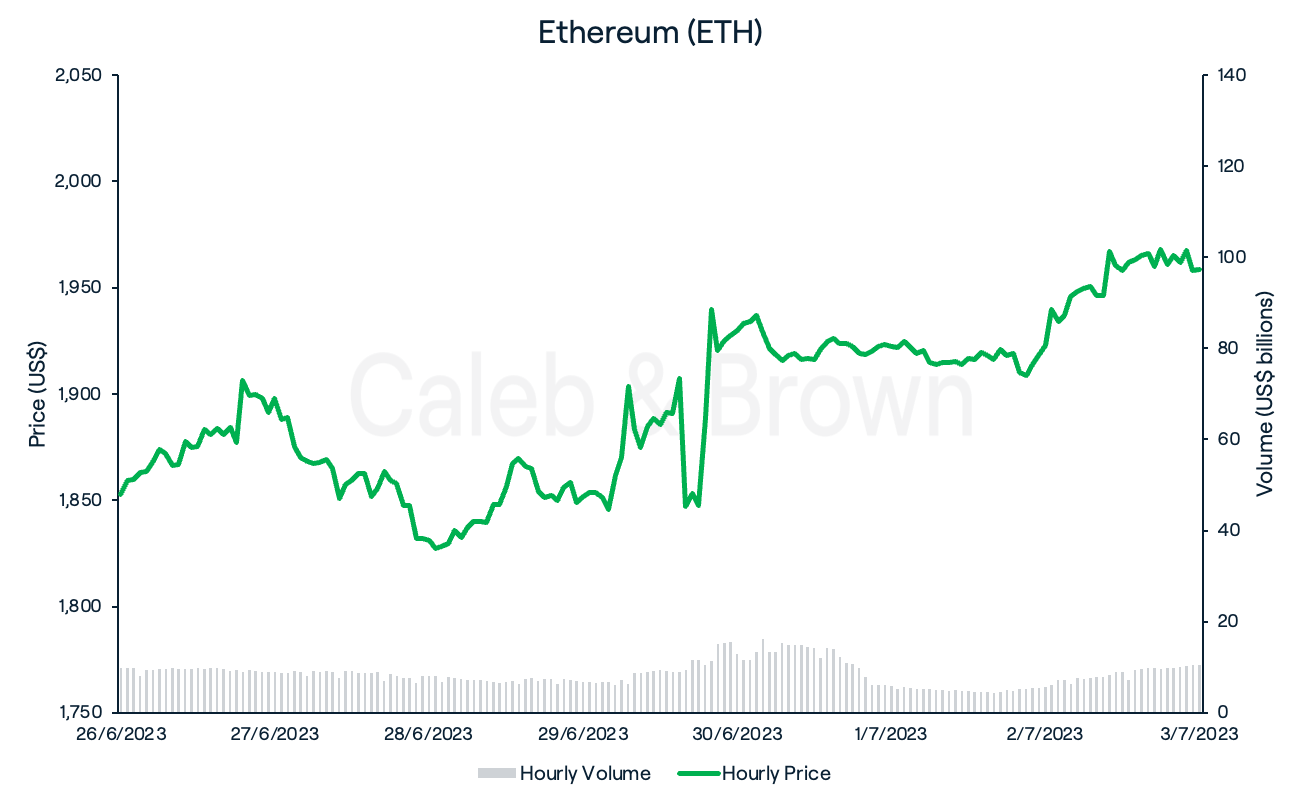

Ethereum (ETH) saw similar price action to BTC for the start of the week but a 5.5% surge on Friday helped bring its price back well above US$1,900. As such, ETH was able to close the week at US$1,958, up 5.7%.

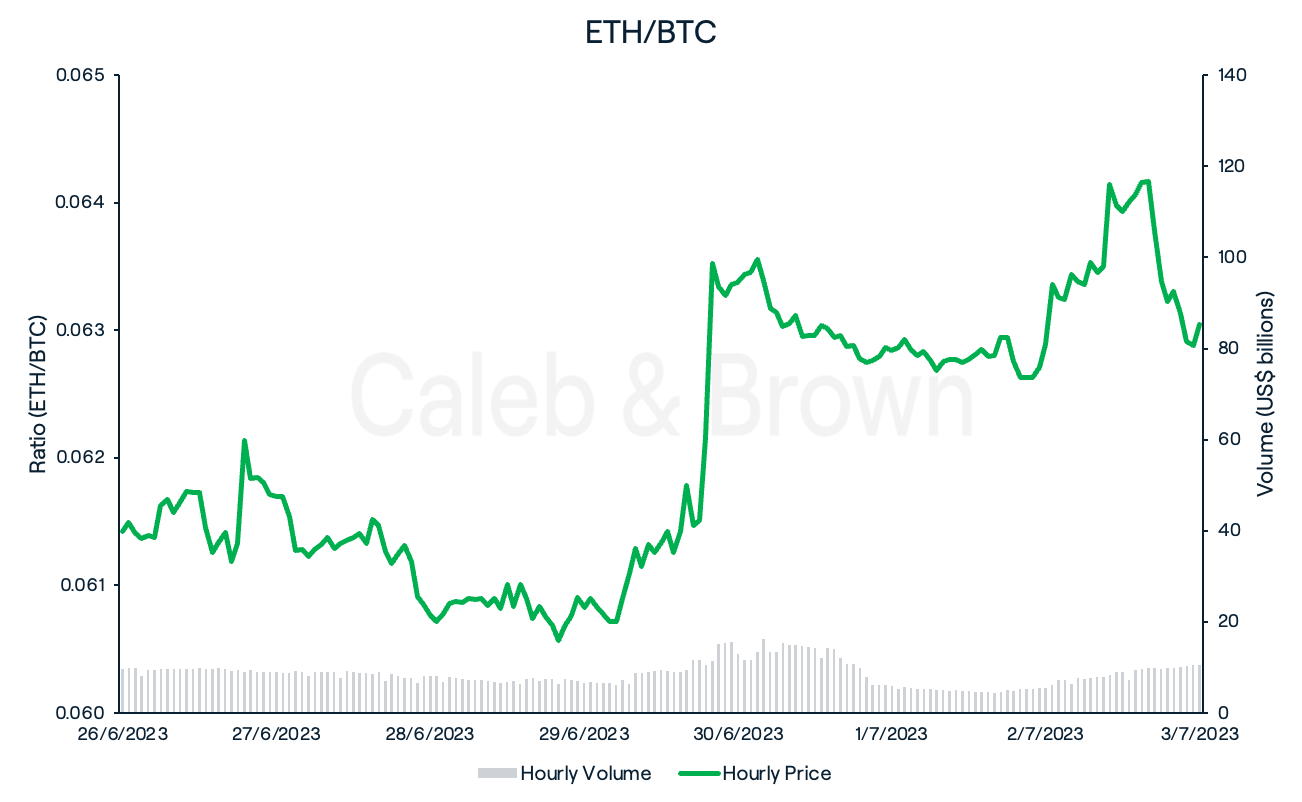

This also saw the ETH/BTC ratio break a three-week downtrend and close the week at ~0.0630, up 2.6% week-on-week.

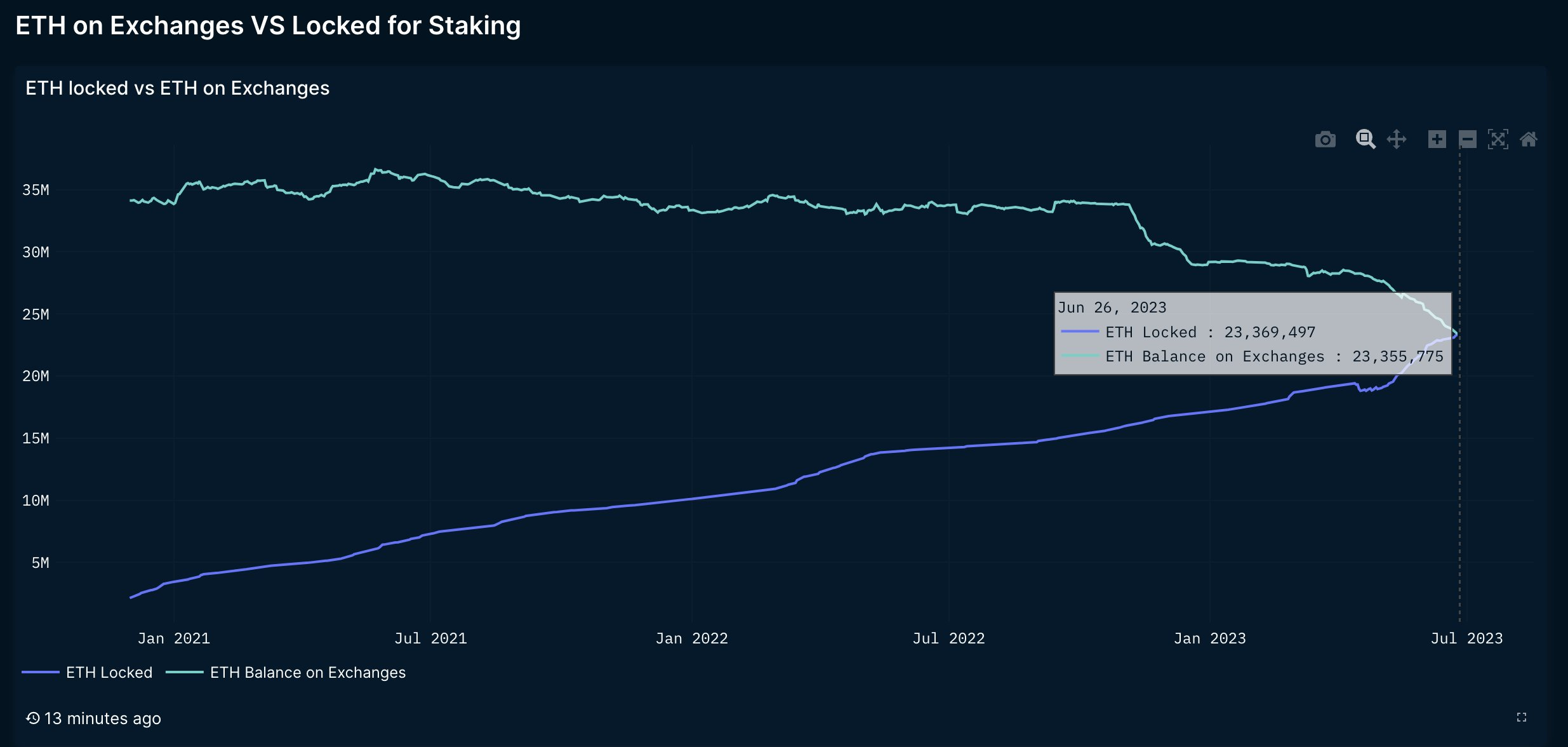

Additionally, data from Nansen revealed that staked ETH had surpassed ETH on exchanges for the first time ever. Since FTX’s implosion late last year, ETH supply on centralised exchanges has fallen quickly while the number of staked ETH has risen steadily, with 19.4% of the total supply currently being staked. This could indicate increased user confidence in the Ethereum network and its staking products, and a decrease in centralised “hot” wallets.

Altcoins

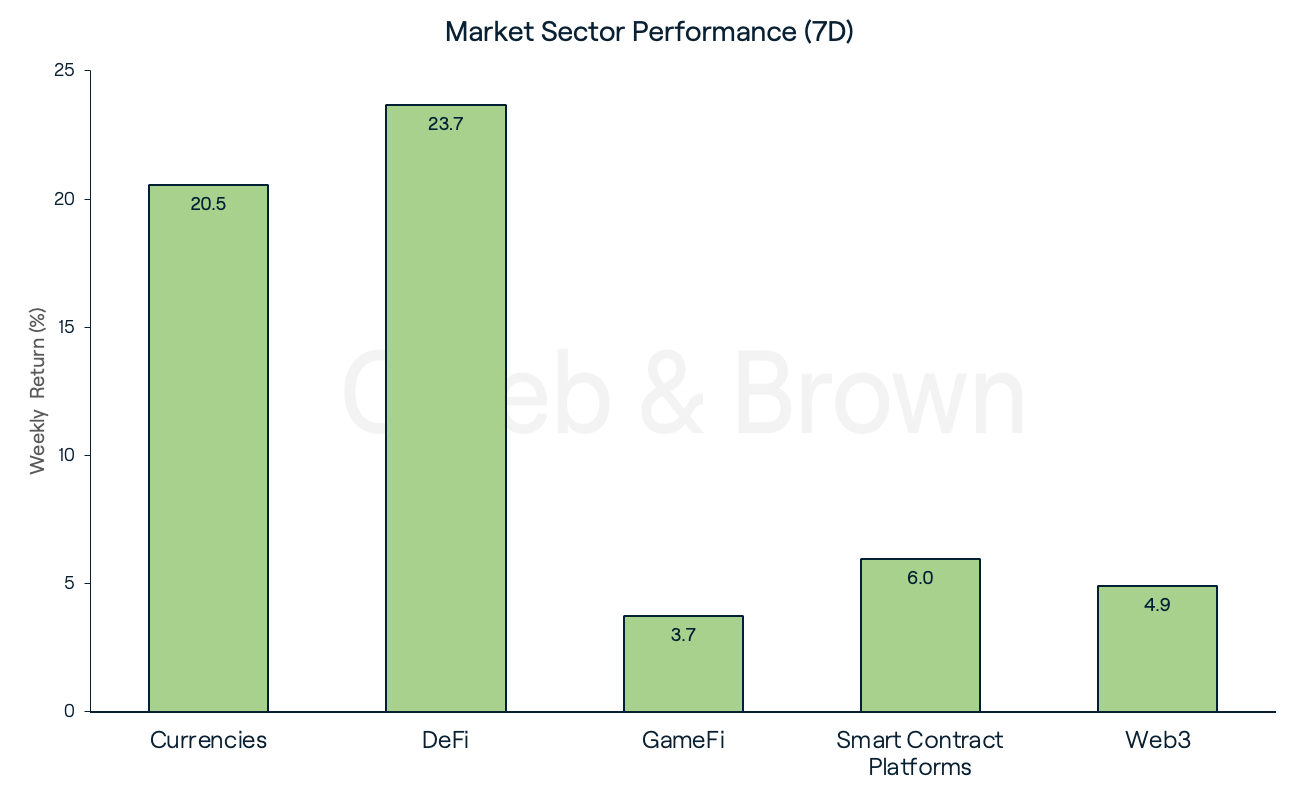

It was another green week across the board with the DeFi sector taking top spot, increasing by 23.7% over the last seven days. Currencies followed closely adding 20.5%, then Smart Contract Platforms, gaining 6.0%.

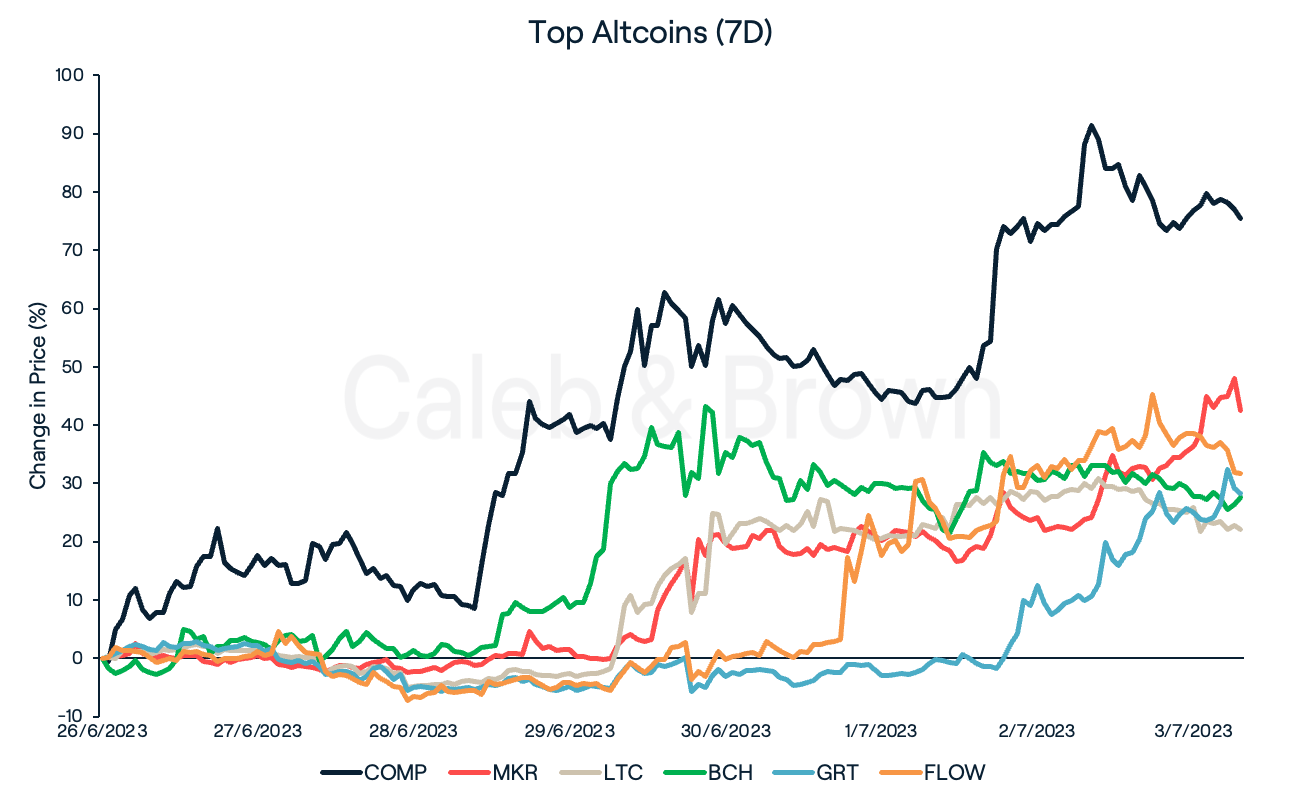

From the DeFi Sector Compound (COMP) and Maker (MKR) were the top performers with each rallying 75.4% and 42.5%, respectively. COMP’s price surge can be attributed to whale activity, with one whale withdrawing 170,000 COMP (approx. US$9.7 million) from Binance, representing 1.7% of the total supply, and greatly reducing the supply left on the exchange.

Currencies also exploding this week were Bitcoin Cash (BCH) and Litecoin (LTC), increasing by 27.5% and 22.1%, respectively. BCH and LTC have continued to benefit from last week’s launch of EDX Markets which currently lists BTC, ETH, BCH, and LTC for trading. LTC also has its halving event scheduled next month which typically sees a “pre-halving” rally.

Finally, also securing double-digit gains this week were The Graph (GRT) and Flow (FLOW) with each adding 28.3% and 31.7%, respectively. The Graph, a decentralised oracle, which recently migrated to layer-2 protocol, Arbitrum (ARB) has gained attention this week after Twitter introduced a rate limit for unverified accounts.

In Other News

HSBC Hong Kong Offers Support for Bitcoin and Ethereum ETFs

In a move to expand the availability of digital asset derivatives in the growing Asian crypto hub, Hong Kong’s largest bank HSBC, has introduced the ability for its customers to trade BTC and ETH futures Exchange Traded Funds (ETFs).

On Monday, these ETFs, classified as securities, have been added to HSBC’s mobile app called "Easy Invest." They provide traders with the opportunity to gain exposure to BTC and ETH futures through derivatives contracts traded on commodity exchanges. The available ETF options include the CSOP Bitcoin Futures ETF, CSOP Ethereum Futures ETF, and Samsung Bitcoin Futures Active ETF.

Warner Music Group Launches Music Accelerator Program with Polygon

Warner Music Group has recently made a significant commitment to blockchain-based endeavours by announcing its collaboration with Polygon Labs to establish a groundbreaking music accelerator program. The primary objective of this program is to empower and enhance decentralised music applications and projects developed on the Polygon network.

Key areas of focus for Warner Music Group and Polygon include companies striving to create innovative methods for decentralised music distribution, initiatives dedicated to cultivating artist-fan communities, endeavours that offer on-chain ticketing solutions, and ventures exploring music-related collectible merchandise.

Regulatory

UK Adopts Crypto as Regulated Financial Activity

After the British House of Lords (upper house of parliament) successfully endorsed the Financial Services and Markets Bill last week, the bill was granted Royal Assent from King Charles on Thursday, officially making it law.

With the implementation of this legislation, crypto trading is now acknowledged as a regulated financial activity. The revised Financial Services and Markets Act provides a clear definition of crypto assets as "digital representations of value or contractual rights secured through cryptography." It categorises these assets as regulated financial instruments, products, or investments.

Prime Trust Faces Closure as Nevada Regulators Take Action

Prime Trust, a cryptocurrency custodian, is on the verge of closure as Nevada regulators took steps to shut down the troubled firm. The regulatory intervention comes in light of Prime Trust's significant financial liabilities, owing millions of dollars to its customers, and being deemed in an "unsound financial condition and/or insolvent" according to the Nevada Financial Institutions Division (FID) filing.

The issues for Prime Trust originated when it reintroduced "legacy wallets" to its customers, only to discover that it was unable to access them, including the cryptocurrencies held within. Faced with the challenge of meeting withdrawal requests, Prime Trust resorted to utilising customer funds to purchase cryptocurrencies that could be subsequently withdrawn. Consequently, the company accrued debts up to US$85 million in fiat currency.

Recommended reading: What Is the Crypto Fear and Greed Index?

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7fRHF4QqSrqLiNbadSuApk%2F261a1434cdaa5c5121c0121de5e2e1c1%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-07-04T01%3A51%3A07.763Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)