Market Highlights

- Ripple (XRP) has a small triumph in the courtroom.

- Samsung partners with Bank of Korea to further research in offline CBDC (Central Bank Digital Currency) payments.

- Tether announced its plans to purchase BTC with up to 15% of its net realised operating profits, in order to “strengthen its surplus reserves”.

- Bitcoin (BTC) along with the rest of the market has traded flat for the third week in a row.

Price Movements

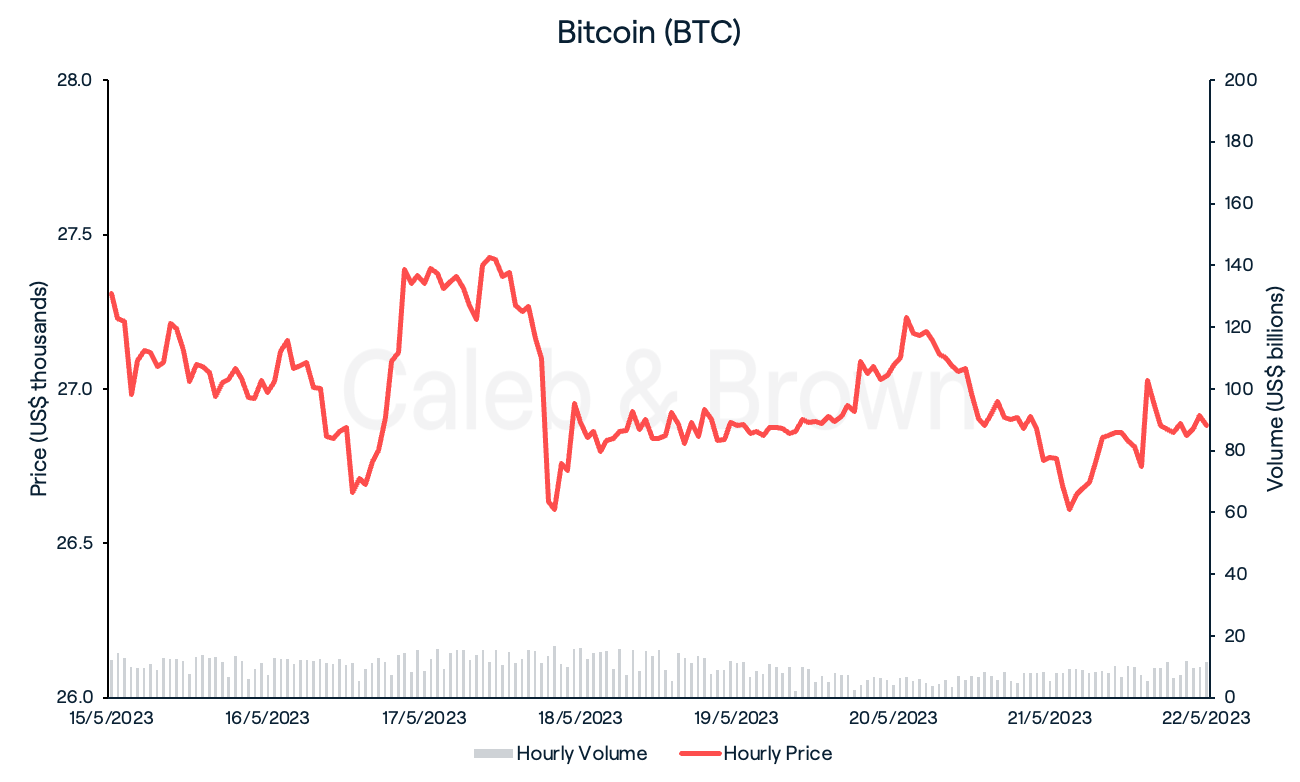

Bitcoin

Bitcoin (BTC) alongside the rest of the crypto market traded flat for the third week running, ranging between US$26,361 and US$27,500. Ordinals inscription activity remained relatively high this week, hitting nearly 250,000 daily inscriptions on Sunday, however has been trending down since its peak two weeks ago. BTC eventually closed the week at US$26,880, down 1.5% over the last seven days.

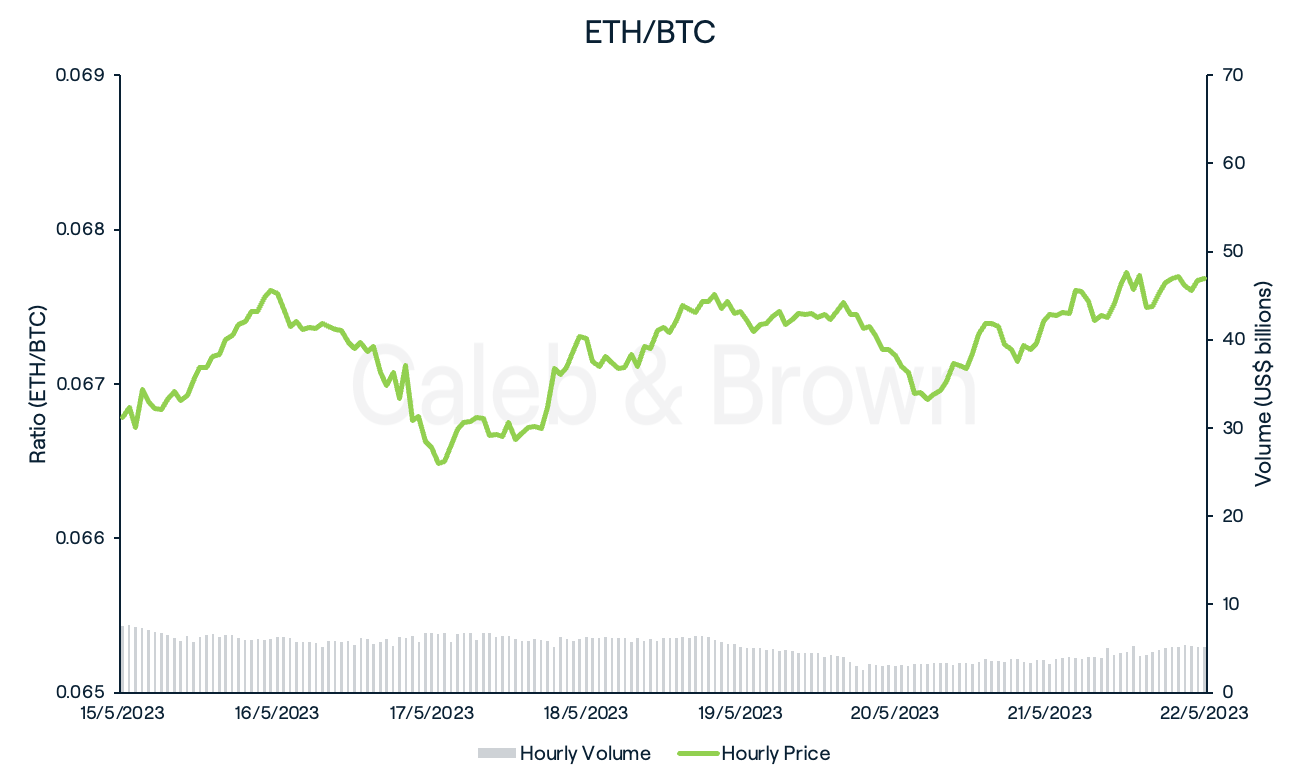

Ethereum

Ethereum (ETH) traded very similarly to BTC this week, hitting a high of US$1,846 on Monday night before bleeding slowly throughout the remainder of the week. A small push over the weekend kept ETH trading above US$1,800 and closed the week at US$1,819, down a slight 0.2% week-on-week.

Despite the modest losses, ETH has regained relative market share against BTC for the third consecutive week, pushing towards ~0.0677 for a weekly gain of 1.4%.

Altcoins

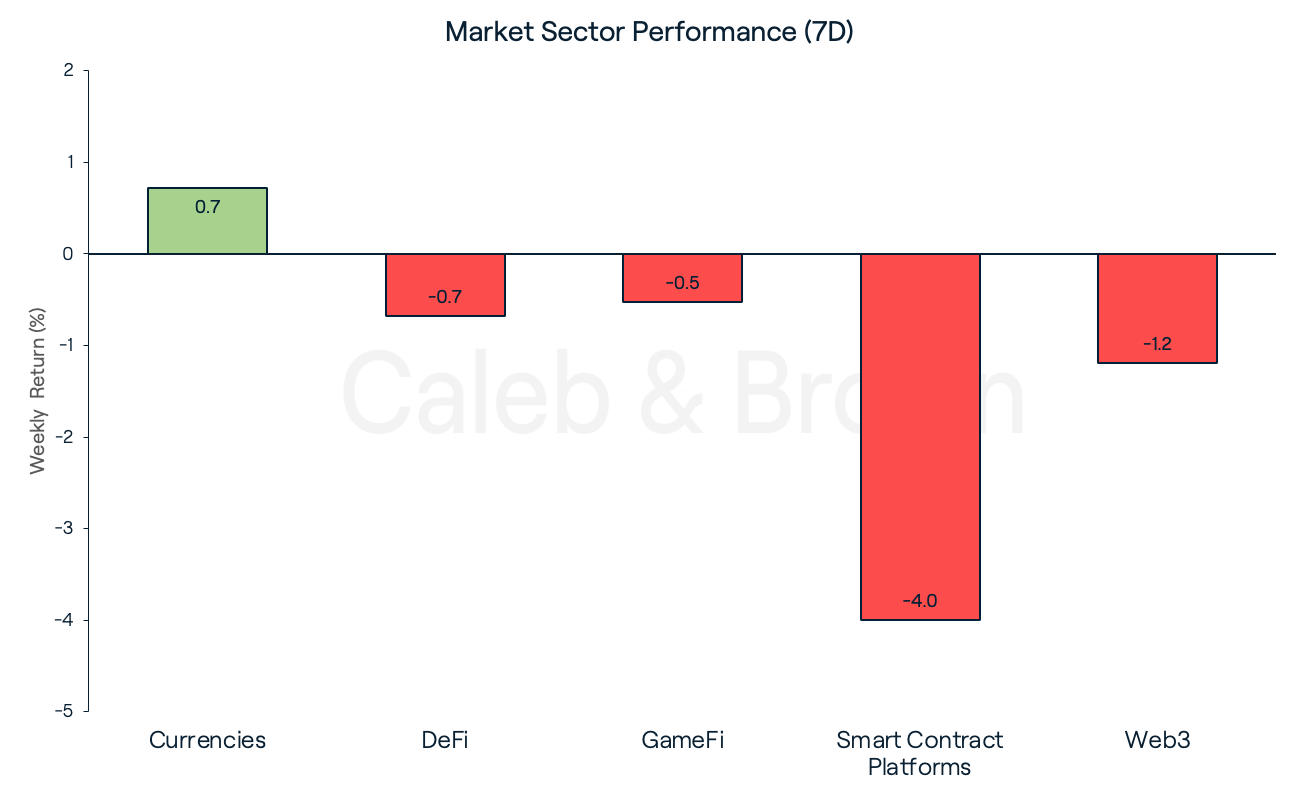

Market sectors also traded relatively flat with Currencies being the only sector to secure a gain, adding 0.7% week-on-week. Smart Contract Platforms took the biggest hit this week, losing 4.0% over the last seven days.

Recommended reading: 6 Types of Altcoins and Their Use Cases

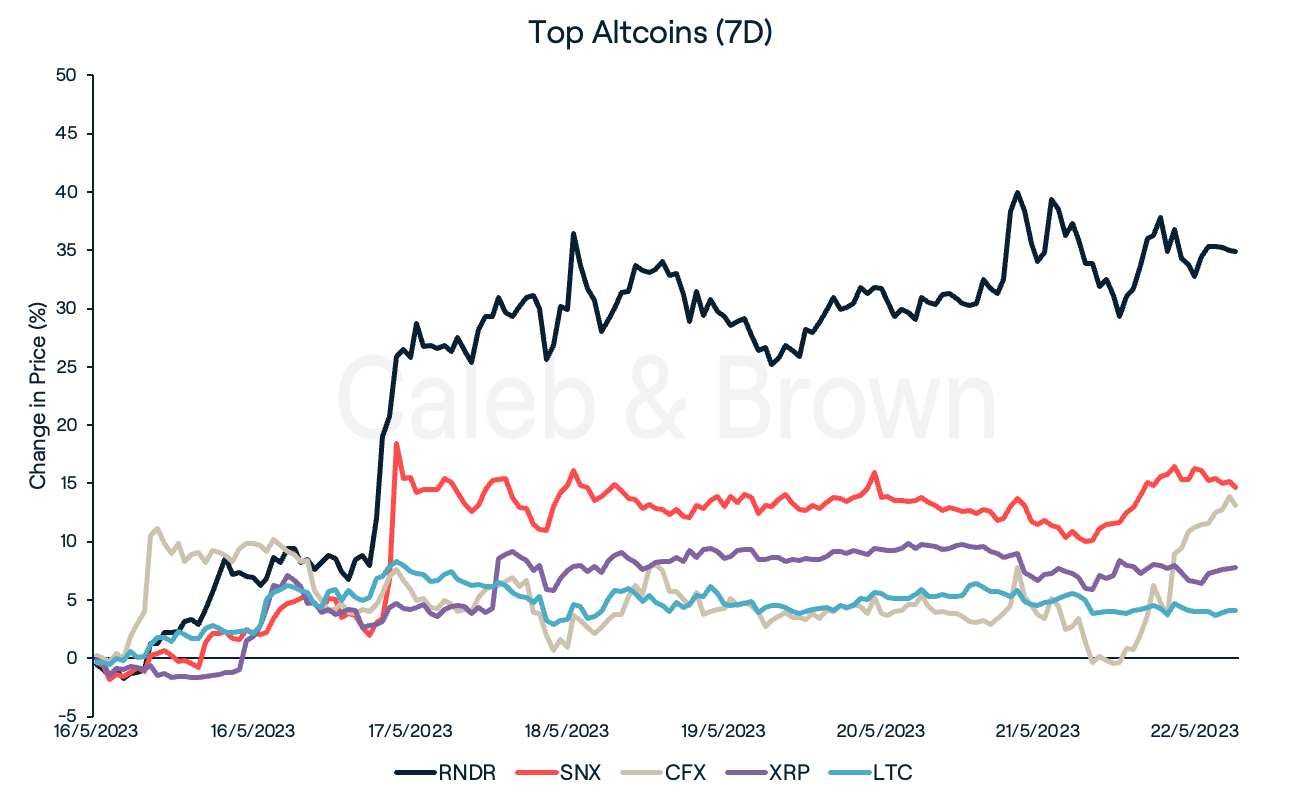

Despite the flat week a few tokens managed to run away with gains. Decentralised derivatives platform Synthetix Network (SNX), and layer-1 protocol Conflux (CFX) both rallied 14.6% and 13.1%, respectively. SNX jumped 10% when it proposed eight new markets, including most notably, memecoin Pepe (PEPE).

Leading the Currencies sector were XRP (XRP) and Litecoin (LTC) which added 7.8% and 4.0%, respectively.

In the ongoing lawsuit against XRP for selling the cryptocurrency as an unregistered security, the XRP team achieved a minor triumph in the courtroom. Judge Torres denied the SEC's request to keep documents related to a speech by former SEC director Bill Hinman, where he provided his then rationale for not categorising BTC and ETH as securities, under seal. This is a significant victory for XRP, as the documents could provide valuable evidence in their case against the SEC.

This week’s top performer was Render (RNDR), the peer-to-peer GPU marketplace, gaining 34.9% over the last seven days. Investors positioned themselves ahead of Apple’s upcoming virtual reality headset release which is speculated to utilise Render’s network based on Render recently launching a version of its app for iPads, however, this is yet to be confirmed.

In Other News

Samsung partners with Bank of Korea

According to a report from the Korea Herald, Samsung announced its partnership with the Bank of Korea (BOK) to collaboratively pursue research efforts in establishing an ecosystem for a Central Bank Digital Currencies (CBDC). Under a signed memorandum of understanding (MOU), the two entities will focus on advancing their research on offline CBDC payments.

The objective is to enable users to conduct transactions and payments using Samsung's Galaxy smartphones and Galaxy Watch, even in scenarios where online networks are unavailable, such as during disasters.

Tether to Purchase Bitcoin with Realised Net Operating Profits

After boasting tremendous Q1 net profits of US$1.48 billion, Tether revealed its plans to commence regular purchases of Bitcoin in order to strengthen its surplus reserves.

Starting from May, the stablecoin issuer intends to allocate a portion of up to 15% of its net realised operating profits towards acquiring BTC. Tether currently holds approximately US$1.5 billion worth of BTC in its reserves, as verified by an assurance report earlier this year.

Regulatory

Markets in Crypto Assets (MiCA) Passes Final Hurdle

With unanimous approval from European Union Finance Ministers on Tuesday, the Markets in Crypto Assets (MiCA) bill has been officially adopted by the bloc. This crucial development represents the final stage required for the legislation to take effect, providing the European Union with a comprehensive and consistent framework for regulating cryptocurrencies across all 27 member states.

With finance ministers now giving their approval, the regulation will be published in the EU's official journal and is set to become law this summer.

The SEC Labels Filecoin As Security

The SEC has set its sights on its next target, Greyscale Filecoin Trust, deeming its underlying token, Filecoin (FIL) a security. In a letter on Wednesday, Greyscale revealed that they received comment rom the SEC stating “that the Trust’s underlying asset, FIL, meets the definition of a security under the federal securities laws”.

Greyscale responded with “Grayscale does not believe that FIL is a security under the federal securities laws and intends to respond promptly to the SEC staff with an explanation of the legal basis for Grayscale’s position.”

Recommended reading: What is the Metaverse? Read part 1 (of 3) of our Metaverse Deep Dive

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F6KbiaLlIB8Tm3DJwtdfgDv%2Fd222d0acf493a72e192ac68ad237b66b%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-07T00%3A32%3A51.082Z)