Market highlights

- US$1.3 billion in crypto positions liquidated amid December rate cut uncertainty.

- Balancer suffered an exploit, losing approximately US$128 million across multiple chains.

- The Ethereum Fusaka upgrade will go live on December 3.

- Grayscale and Bitwise’s Solana ETFs launched.

- Ro Khanna (D-Calif.) introduced legislation to ban U.S. policymakers from owning crypto.

Markets Overview

The recent bullish momentum across risk assets waned this week on hawkish commentary from U.S. Federal Reserve Governors following the Federal Open Market Committee’s (FOMC) 25-basis-point rate cut on October 29. The Federal Funds rate now sits at 3.75% to 4%. In addition to the rate cut, Federal Reserve Chair Jerome Powell said the central bank is ending its quantitative tightening program on December 1.

With the U.S. labour market weakening in the lead-up to the government shutdown, the Fed’s statement following the October FOMC meeting stated that “downside risks to employment rose in recent months” and outlined division amongst the committee on whether another 25-basis-point cut will be delivered at its December 10 meeting. On Powell’s comments that a further rate cut isn’t a “forgone conclusion,” risk assets declined. The odds of a December rate cut have since dropped from 90% to 70.1%. The U.S. Dollar gained on the news, while gold continued to retreat from its recent all-time high, settling around US$3,900 an ounce at the time of writing.

Developments in U.S.-China trade progressed this week. President Trump and Xi Jinping met in South Korea on October 30. The fact sheet released following the meeting detailed the key points of the agreement, including the resumption of U.S. soybean and other agricultural sales to China and the removal of China’s export controls on rare earths. Throughout this week, market participants will presumably be watching for whether U.S. non-farm employment data is released and any further indications on the Fed’s rate-cut trajectory.

Weekly performance: S&P 500 0%, Dow Jones -0.2%, Nasdaq +1.6%.

Looking ahead:

- Reserve Bank of Australia rate decision - November 4

- U.S. ADP non-farm employment change - November 5

- Bank of England rate decision - November 6

- U.S. non-farm employment change - November 7 (tentative)

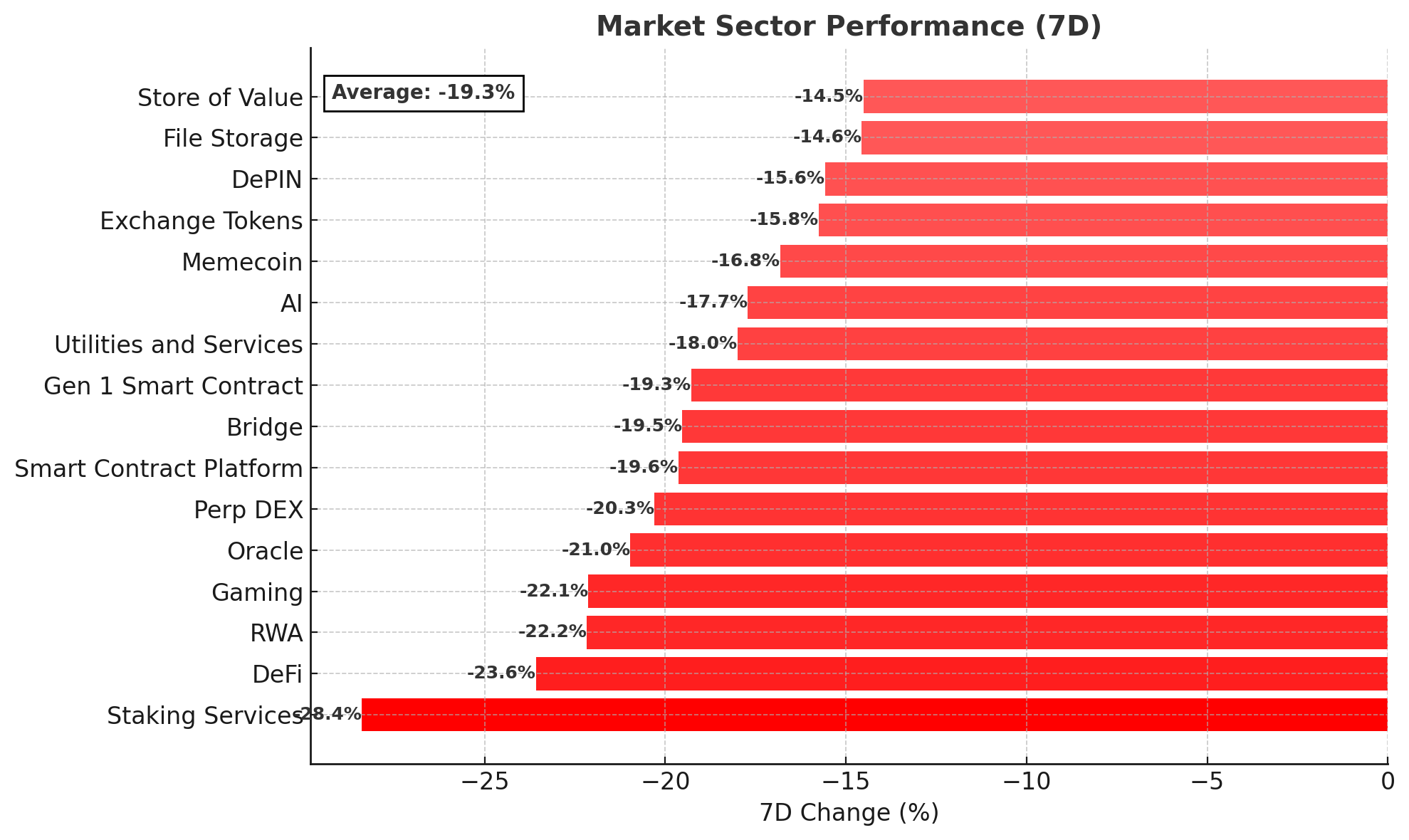

Crypto Market Sector Performance

All crypto sectors saw declines in the last week due to macro headwinds. The market sold off last week on uncertainty over whether the U.S. Federal Reserve will cut interest rates at its December 10 meeting. In this most recent sell-off, US$1.3 billion in positions have been liquidated. Most of these liquidations are long trades, with bitcoin and Ethereum positions accounting for US$298 million and US$273 million of liquidations, respectively. Sentiment is currently bearish across the market, with the fear and greed indicator at 27 (“fear”) as bitcoin and other crypto assets continue to sell off.

Biggest loser

- Staking services: EigenCloud (-31.1%) declined, presumably as staking services saw positions unwind in the sell-off. The news of SharpLink investing US$200 million in Ethereum via Linea, EtherFi, and EigenCloud (more on that below) wasn’t enough to provide upward momentum.

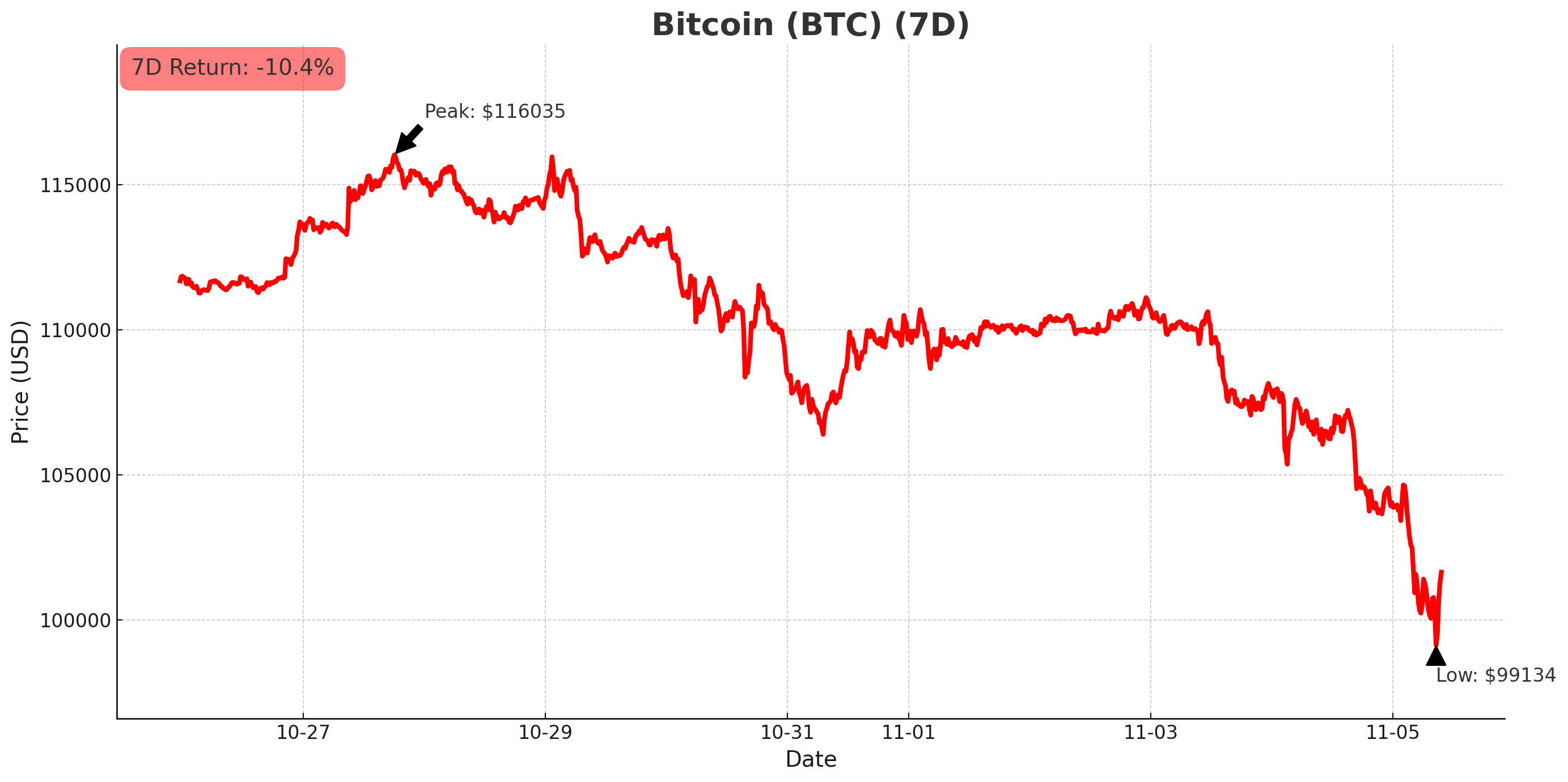

Bitcoin (BTC)

- Opened the week at US$114,561 and declined to US$106,279 on uncertainty over whether the FOMC will deliver a rate cut at its December 10 meeting. Bitcoin’s weakness has continued into the new week, currently trading around US$99,700. Total liquidations in this most recent sell-off total over US$1.3 billion, with US$1.2 billion accounting for long positions (-11.9% 7D).

- BTC dominance hovered around 59.6% and 60.7% this week.

- Bitcoin investment products saw US$946 million of outflows this week.

Elon Musk’s SpaceX moved more of its bitcoin holdings this week. The company moved 281 BTC, worth over US$31 million, from Coinbase Prime custody to a new wallet. It’s not yet clear if the company is changing its storage scheme, getting organised to sell its holdings or using its bitcoin in another way.

In bitcoin buying news:

- Strategy bought 397 BTC, bringing its total holdings to 641,205 BTC at an average purchase price of US$74,057 per bitcoin.

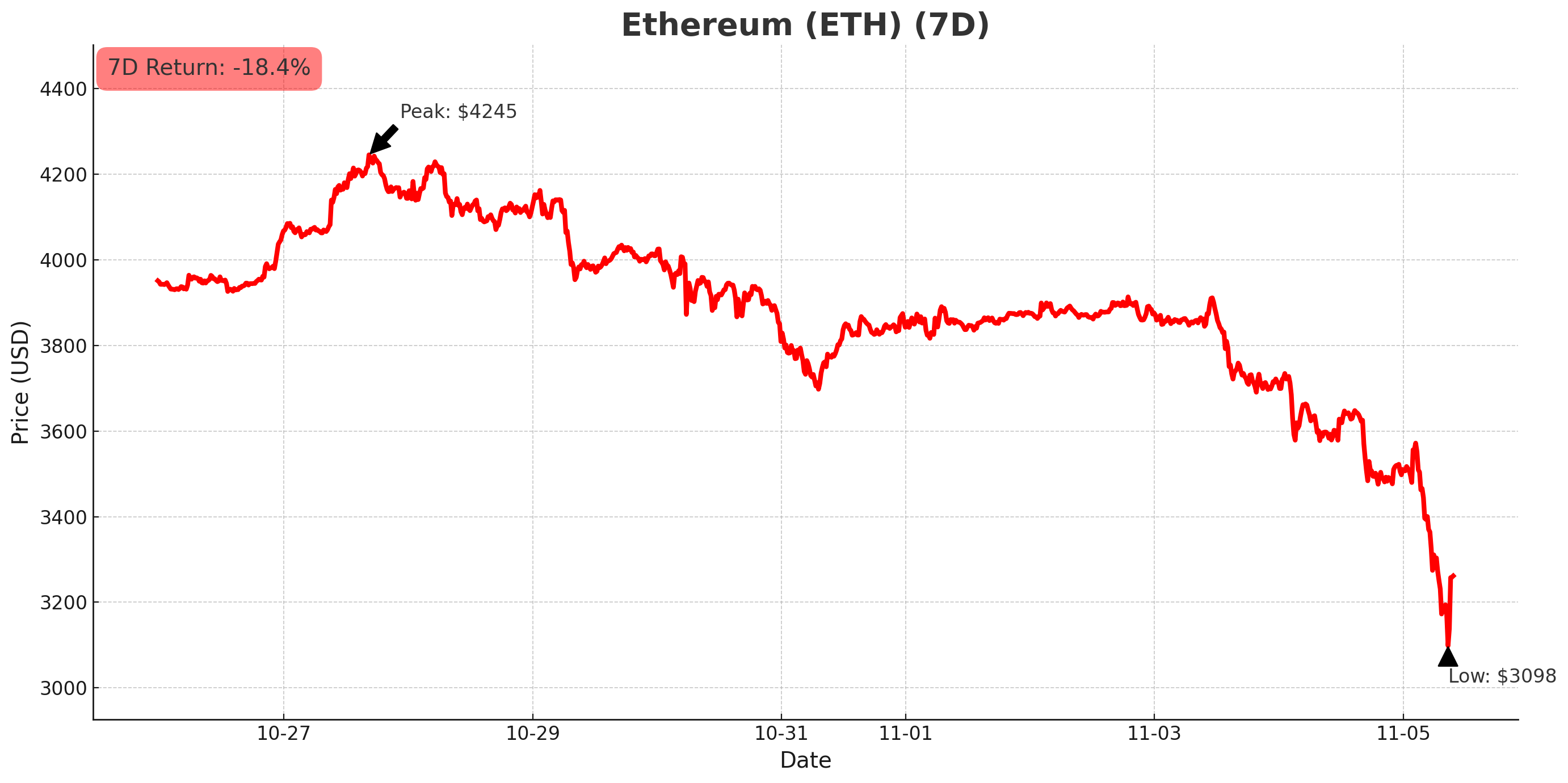

Ethereum (ETH)

- Opened the week at US$4,159 and sold off on U.S. interest rate uncertainty, reaching a low of US$3,552 on Monday, November 3. The declines have continued into the new week, with ETH trading around US$3,150 (-21.4% 7D).

- Ethereum dominance started the week around 13% and declined to 12.5%.

- Ethereum-focused funds saw inflows of US$57.6 million this week.

The Ethereum Fusaka upgrade is scheduled to go live on December 3. The upgrade introduces PeerDAS, which is “the key to layer-2 scaling,” driving Ethereum into its next stage for mass, low-cost adoption. Layer-2 scaling will be improved by building on the introduction of “blobs” in the 2024 Dencun upgrade, which allows layer-2 data to be stored in Ethereum blocks, reducing gas fees and processing time.

SharpLink Gaming will deploy US$200 million from its ETH treasury to the Linea layer-2 network. The funds will be released over multiple years to generate higher yields from staking, restaking and DeFi rewards.

In Ethereum buying news:

- BitMine added US$294 million worth of ETH to its treasury, bringing its total holdings to almost 3.4 million ETH, worth US$12.5 billion worth of ETH and 2.8% of the total supply.

Altcoins

The altcoin season index is currently at 39 as bearish sentiment dominates.

Computer says yes (and no)

- Internet computer (ICP) gained 104.6%. The outsized gains, compared to the rest of the market, came due to an announcement from Dfinity Foundation, a non-profit that backs ICP. In October, the foundation launched Caffeine, a new AI product that can build applications from scratch, while this week it announced the DFINITY 2.0 vision, which aims to cut ICP inflation by 70%.

Sell the news

- Ethena (ENA) declined by 34.2%. The synthetic dollar protocol built on Ethereum, saw declines following Terminal Finance’s successful pre-launch. Ethena backed the new decentralised exchange (DEX), which saw a spike on the announcement followed by profit-taking. Token unlocks on November 5 and December 5, equating to 2.3% of supply is also presumably adding to bearish pressure.

Tell me a story

- Story (IP) declined by 27.9%. After hitting a new all-time high of US$14.89 on September 22, the blockchain that tokenises IP has seen sharp declines, presumably as tokenising IP is a new frontier in real world asset tokenisation and the market is searching for certainty.

Network effects

- Aptos (APT) declined by 27.3%. The layer-1 proof-of-stake blockchain saw declines despite strong recent network growth, including 1.4 million active addresses per day, making it the one of the fifth largest layer-1 chains behind BNB Chain and Solana.

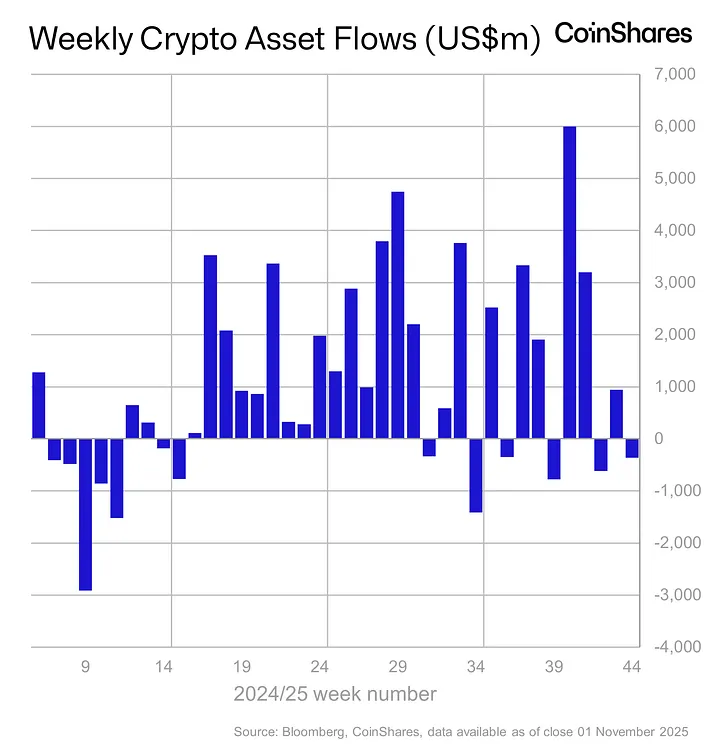

Crypto ETF News

Digital asset investment products saw outflows of US$360 million this week, driven by Federal Reserve Chair Jerome Powell’s hawkish commentary on a potential December 10 rate cut. The comments increased uncertainty, leading to a sell-off across risk assets and outflows from digital asset exchange-traded funds (ETFs).

Solana was the outlier amongst crypto ETFs this week, seeing US$421.1 million of inflows on the launch of Bitwise and Grayscale’s new U.S. Solana ETFs. Canary Capital’s Litecoin and Hedera funds also launched this week. Also this week, Bitwise and Grayscale announced management fees for their upcoming XRP and Dogecoin ETFs without official U.S. Securities and Exchange Commission (SEC) approval, as firms grow impatient amid the protracted government shutdown.

REX Shares launched a new ETF, the REX IncomeMax Option Strategy ETF. The product follows a hedge-fund-style strategy that aims to generate income from price movements in volatile U.S. stocks and crypto-focused companies.

21Shares applied for a Hyperliquid ETF. It follows Bitwise’s September application to launch a HYPE ETF. The U.S. SEC is currently assessing over 90 crypto-focused ETF applications.

Other crypto news

- Balancer, a multi-chain automated market maker, suffered a major exploit, losing approximately US$128 million across multiple chains due to a precision-error vulnerability in its liquidity pools. Berachain, built on the same codebase, halted its network and announced an emergency hard fork to recover funds and isolate compromised contracts. SUI dropped 9.2% on the news as investors minimised their exposure to riskier layer-1 tokens.

- Ro Khanna (D-Calif.), a U.S. Representative, has proposed legislation to ban elected officials from owning or trading cryptocurrencies. He cited Binance founder CZ’s recent presidential pardon as “blatant corruption” and argues unrestricted crypto access for politicians fosters conflicts of interest.

- Western Union filed trademarks for “WUUSD,” signalling its expansion into crypto-services a day after announcing its own stablecoin, USDPT. The stablecoin will be built on Solana and is expected to launch in early 2026 through a partnership with Anchorage Digital Bank.

- Nasdaq has issued a formal reprimand to TON Strategy after the company raised US$558 million in a private placement and used an estimated US$273 million to acquire its native token without obtaining required shareholder approval. The exchange noted the violation seemed unintentional and stopped short of delisting the stock.

- Animoca Brands, a Hong Kong-based blockchain gaming and investment firm, is planning a Nasdaq listing via reverse merger with Currenc Group, giving Animoca shareholders approximately 95% of the combined entity. The merger is expected to close in 2026, subject to regulatory and shareholder approval.

- A U.S. appeals court affirmed the denial of Custodia Bank’s request for a master account with the Federal Reserve, ruling the Fed retains discretion to reject crypto-focused firms on safety-and-soundness grounds. The 2-1 decision closes Custodia’s banking access battle unless the company files for a rehearing and it is granted.

- The European Central Bank (ECB) has officially moved to the next phase of its digital euro project, targeting potential issuance of a central bank digital currency (CBDC) in 2029, with a 2027 pilot contingent on legislation. The initiative aims to modernise the eurozone’s payments system and strengthen monetary sovereignty. Critics of CBDCs cite concerns around privacy, centralisation and the potential for issuing authorities to freeze funds.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. Past performance is not a reliable indicator of future results. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

from Caleb & Brown Cryptocurrency Brokerage.