Market Highlights

- Another round of re-filings and amendments for a spot Bitcoin ETF, including BlackRock and Fidelity saw Bitcoin (BTC) reclaim the US$30,000 mark.

- On Friday, the SEC voluntarily dismissed charges against Ripple CEO Brad Garlinghouse and Executive Chairman Chris Larsen.

- Sam Bankman-Fried's trial is approaching the later stages, scheduled to end on October 26.

- Maker's (MKR) annualised revenue reached an all-time high of US$213 million.

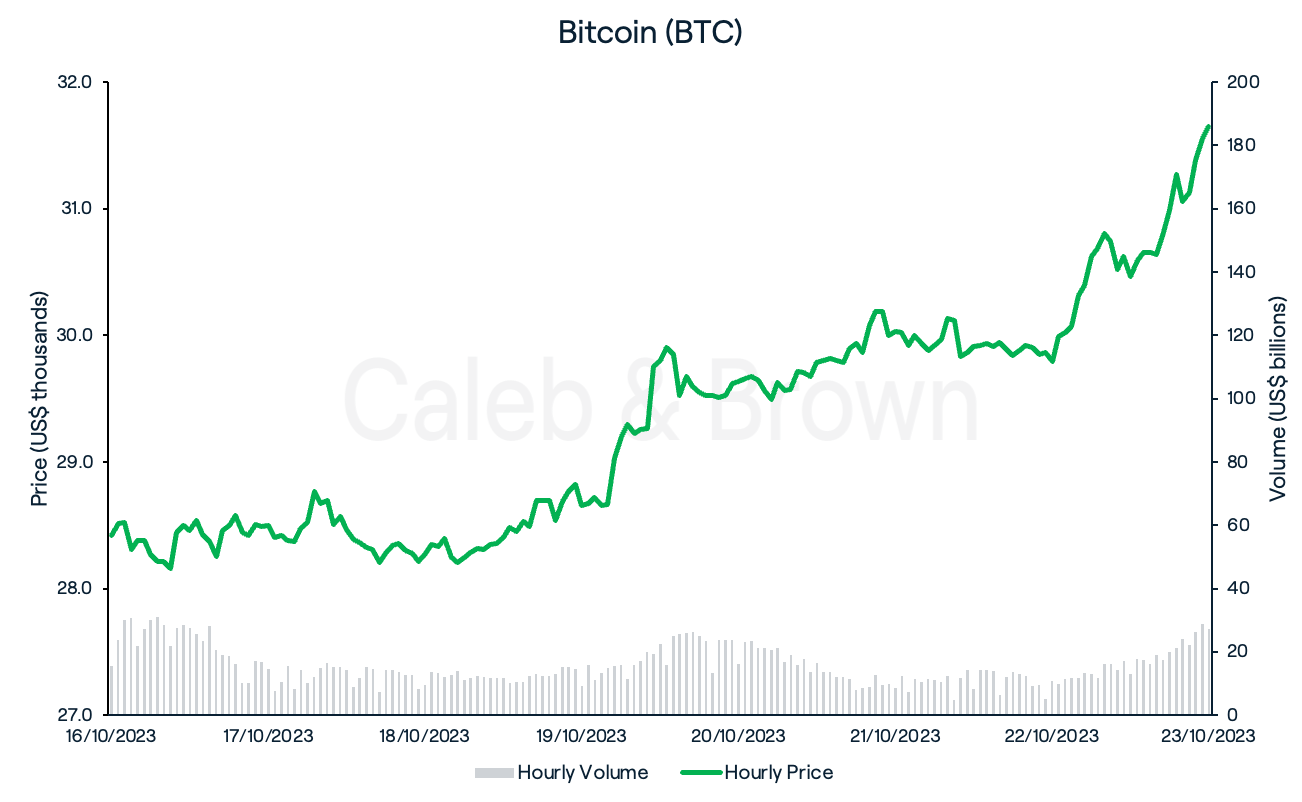

Bitcoin

It was a great week for crypto as Bitcoin (BTC) managed to reclaim the US$30,000 mark after last week’s fake ETF approval news.

The positive performance comes amid a raft of re-filings and amendments from finance's biggest players, as the race for a spot Bitcoin ETF heats up, with JP Morgan expecting a decision to be made by January next year.

Then on Monday the U.S. Court of Appeals issued a mandate for the Securities and Exchange (SEC) to review Grayscale’s spot Bitcoin ETF application, after failing to present an appeal before October 13.

BTC closed the week in a positive light at US$31,650, adding on a generous 11.4%.

Additionally, a recent CoinShares report has shown institutional crypto investments to be positive for the fourth consecutive week, with BTC representing 83.7% of last week’s US$66 million in inflows.

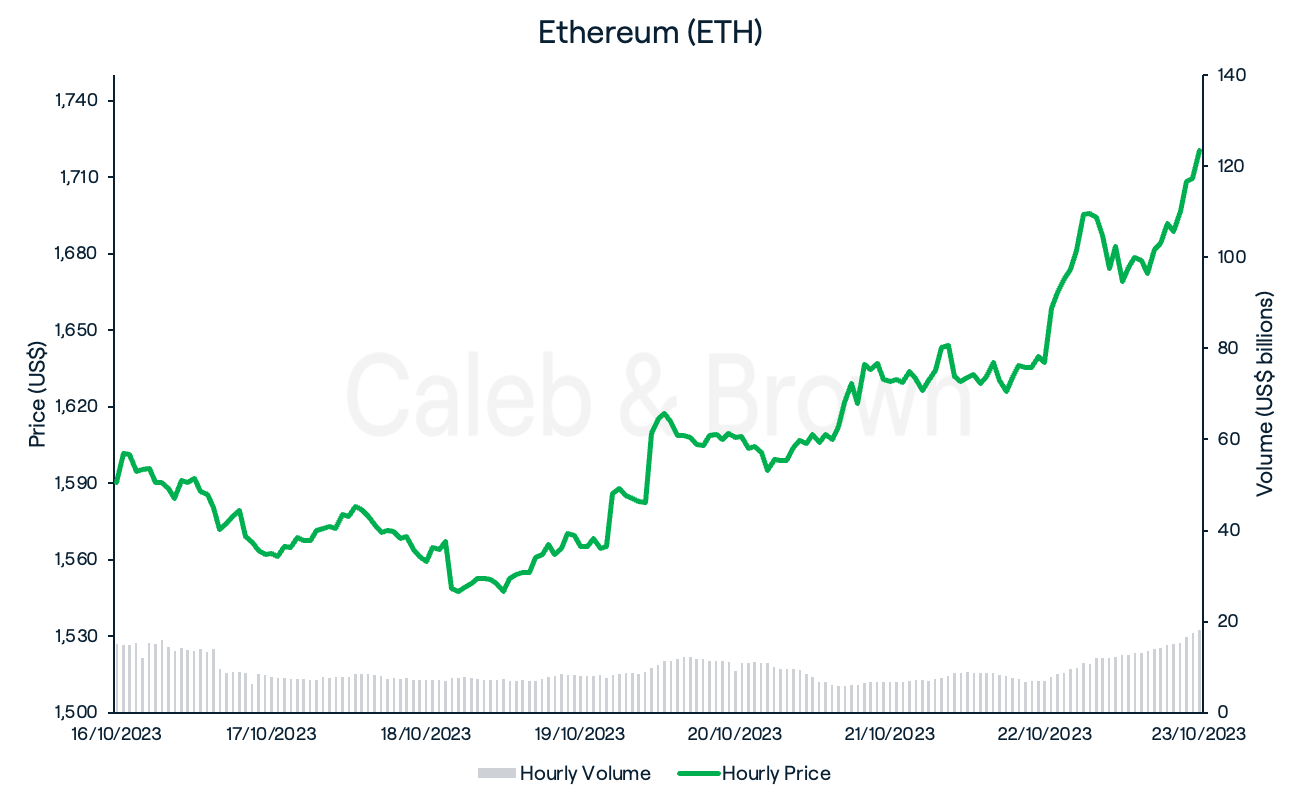

Ethereum

Ethereum (ETH) also rallied this week, however due to lingering Bitcoin ETF approval news, ETH has underperformed BTC this entire month, losing 13.8% against BTC in October.

ETH closed the week at US$1,720, up 8.2% over the last seven days.

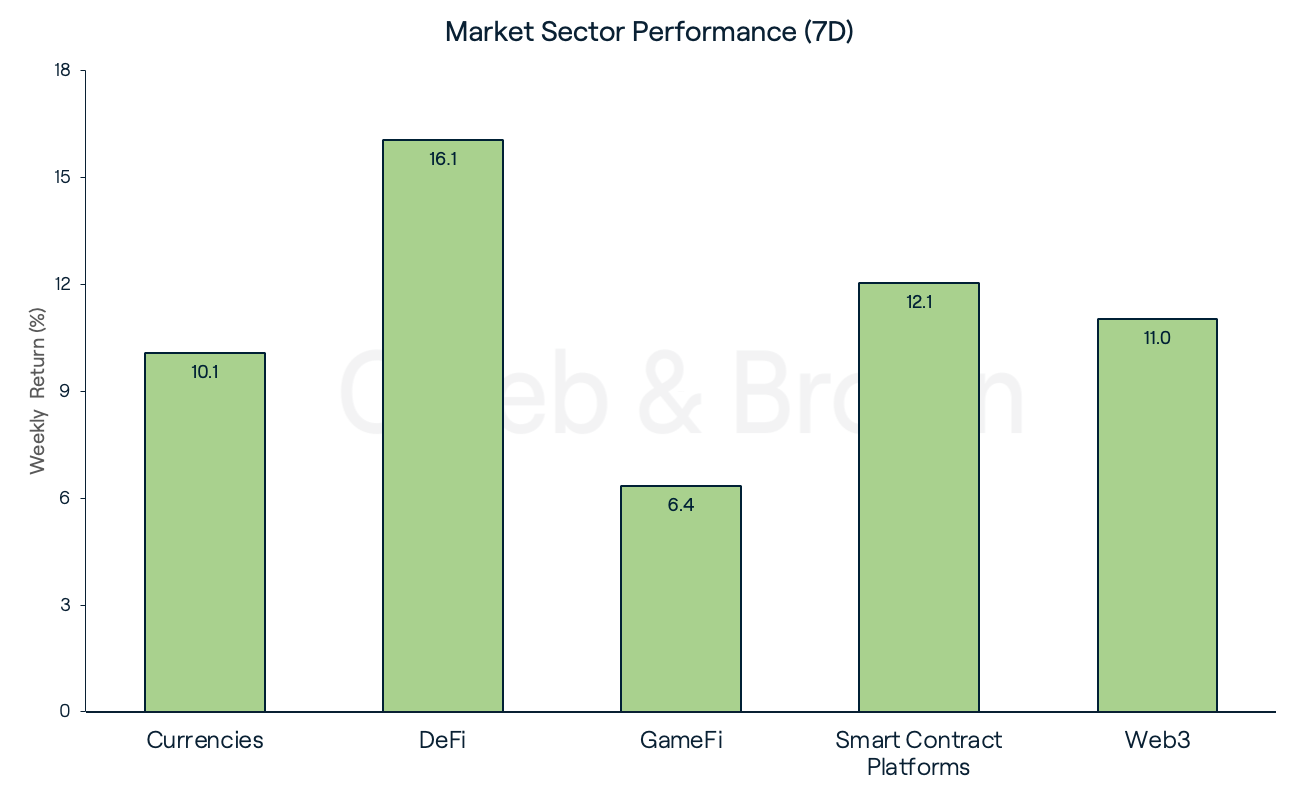

Altcoins

It was a great week for all market sectors with DeFi securing top spot this week, adding on 16.1% while GameFi trailed the pack, increasing 6.4%.

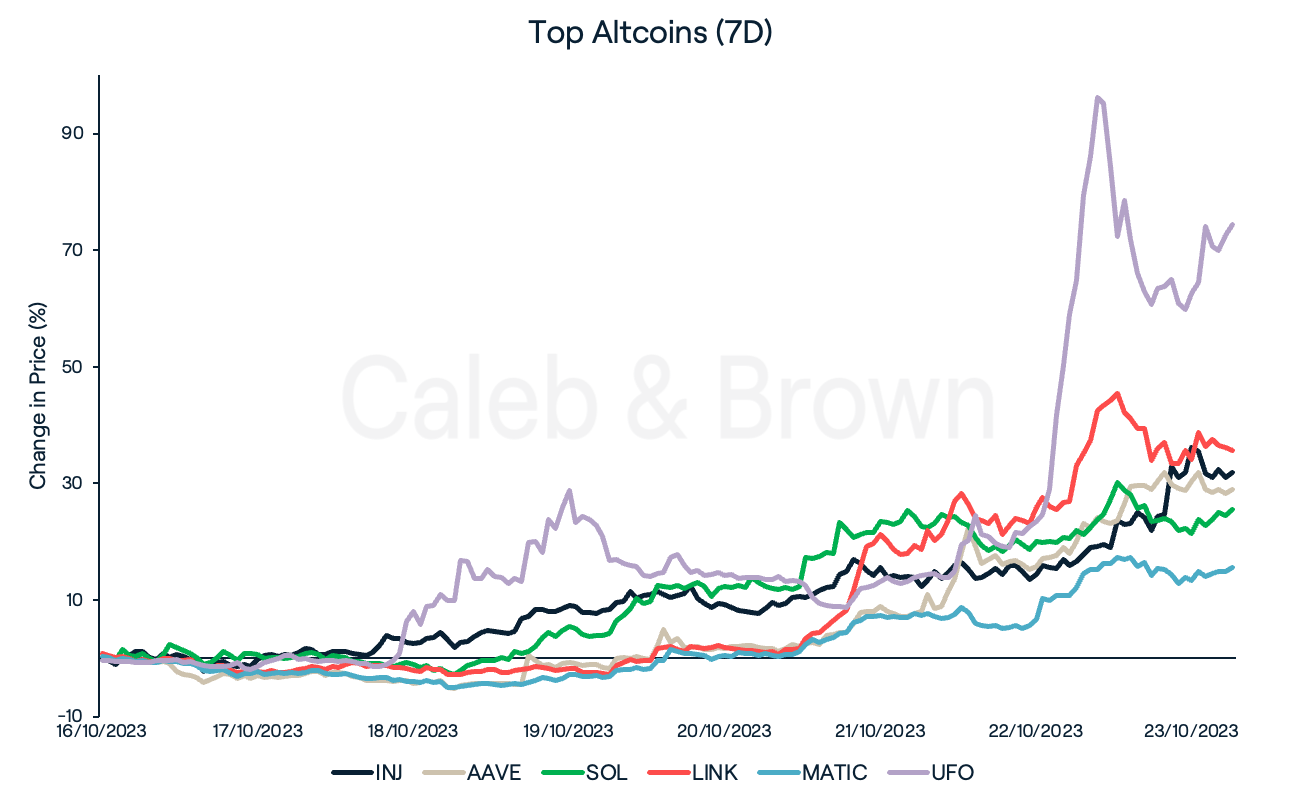

Injective (INJ), Aave (AAVE), and Solana (SOL) each gained 32.0%, 29.0%, and 25.5%, respectively. INJ surged after it launched Helix, a new product on its DeFi application which allows users to speculate on unreleased tokens before their official launch.

Decentralised oracle Chainlink (LINK) and layer-2 protocol Polygon (MATIC), also jumped double-digits this week with each securing a respective 35.6% and 15.6% gain. LINK’s rally followed its announcement of the Chainlink Staking v0.2 upgrade while MATIC is surging ahead of its highly anticipated Polygon 2.0 update.

The top performer this week was crypto gaming protocol, UFO Gaming (UFO) which surged an impressive 74.5%.

In Other News

Stablecoin issuer, Maker’s (MKR) annualised revenue has grown steadily this year, with it now at an all-time-high of US$213 million. The surge in revenue can be attributed to US$3 billion in deposits of tokenised real-world assets (RWAs) this year, in addition to its US$1.73 billion T-Bill stash that is earning them 5% p/a.

Sam Bankman-Fried’s trial is approaching the later stages, with prosecution set to rest its case on 26 October after nearly twenty testimonies were heard. Bankman-Fried faces seven criminal charges, including securities fraud, wire fraud, and conspiracy to launder money.

Regulatory

In a huge win for Ripple, the U.S. Securities and Exchange Commission (SEC) have voluntarily dismissed charges against Ripple CEO Brad Garlinghouse, and Executive Chairman Chris Larsen. The SEC sued them alongside the company in December 2020 for allegedly violating securities laws with sales of the XRP token.

It is unclear what specifically led the SEC to drop charges against Garlinghouse and Larsen as individuals, however the SEC will still continue to pursue Ripple over securities violations, particularly over sales of XRP to institutional investors.

Learn with Caleb & Brown

Crypto Portfolio Basics: The Key to a Well-Balanced Portfolio A well-balanced crypto portfolio could help you maximise your returns while mitigating risk. Learn how to build a balanced and diversified portfolio here.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3TxSk9wvE1CytmT2GiH6wf%2F263bf333d3a26ebb7b191b36e7af3497%2FWeekly_Rollup_Tiles__20_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-10-24T03%3A15%3A33.568Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)