Market Highlights

- CPI rose a seasonally adjusted 0.6% for August, and 3.7% from a year ago, the U.S. Department of Labor reported.

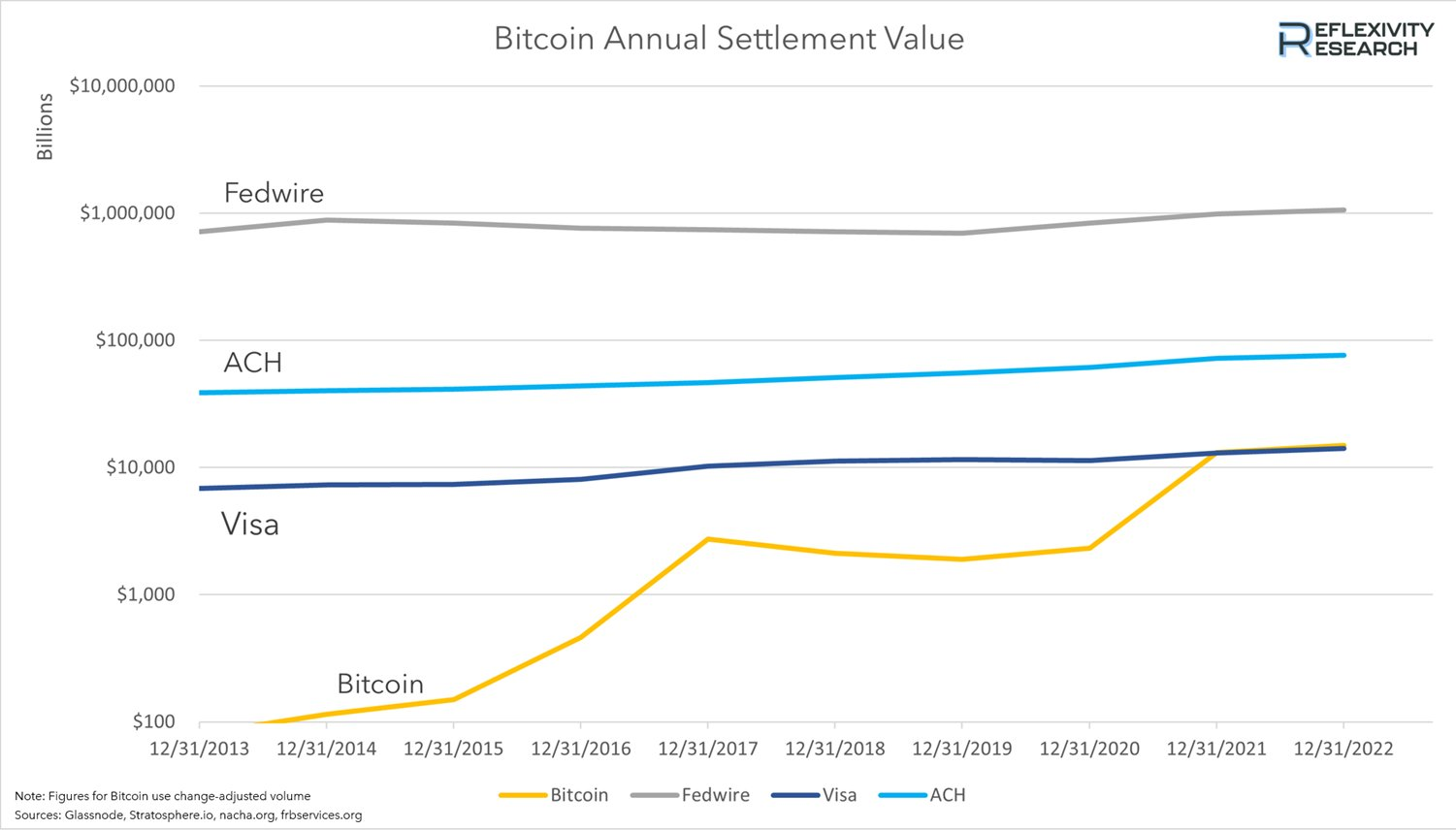

- Bitcoin recorded its largest daily transaction count ever, surpassing Visa's annual transactional volume.

- Sony announced the development of a blockchain network in collaboration with Startale Labs.

- FTX received court approval to liquidate its US$3.4 billion in crypto holdings.

- Amidst allegations of lack of transparency on Binance’s part, the SEC’s motion to unseal documents was approved.

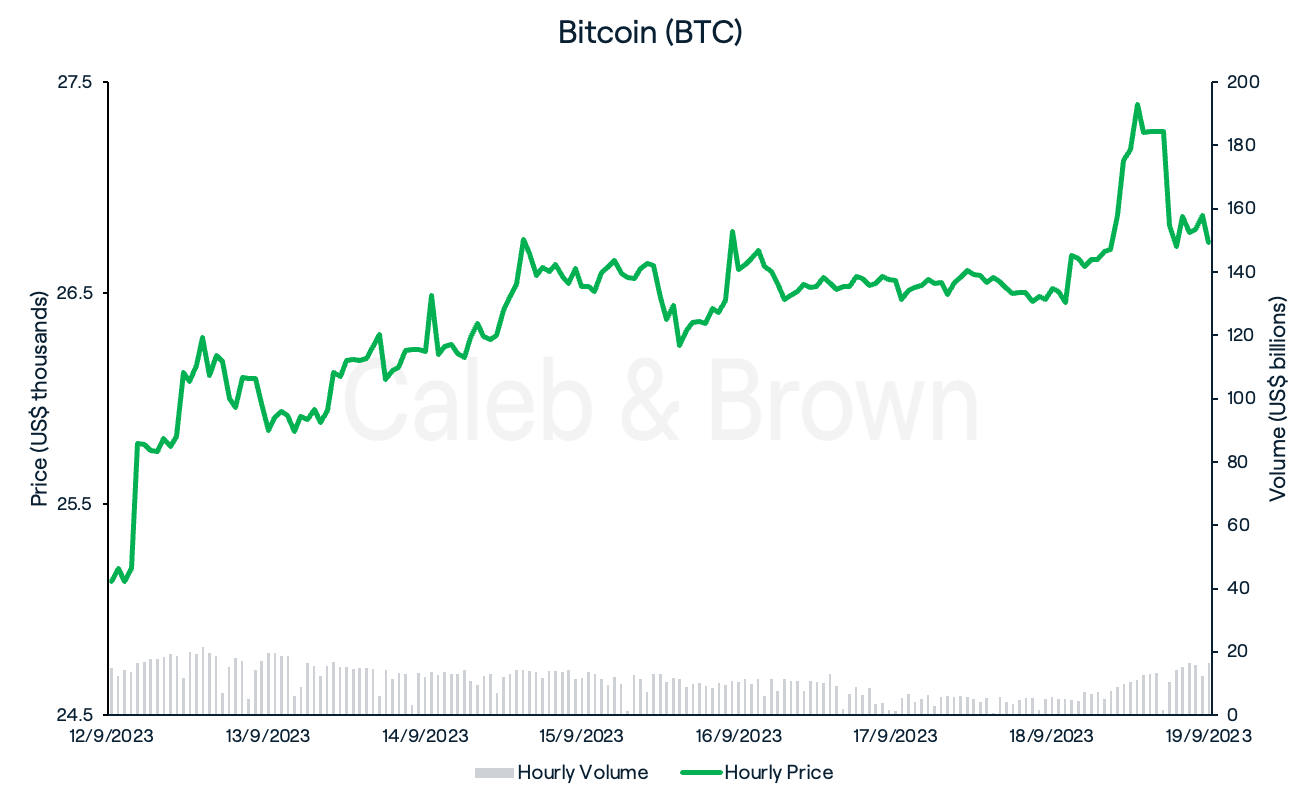

Bitcoin

Bitcoin (BTC) experienced an alarming start to the week, dipping below US$25,000 for the first time since June, as the market anticipated the possibility of the gradual liquidation of FTX’s remaining US$3.4 billion in crypto assets.

However, BTC rose steadily for the remainder of the week after Wednesday’s CPI (Consumer Price Index) report revealed CPI rose 3.7% in the 12 months through August, and 0.6% in the month of August, coming in slightly above economists’ expectations of 3.6% and 0.6%, respectively.

While Wednesday’s CPI report showed an acceleration in consumer prices for August, core inflation fell to 4.3% year-over-year in August, a noteworthy drop compared to July’s reading.

Overall, BTC closed the week at US$26,741, up a considerable 6.4% over the last seven days.

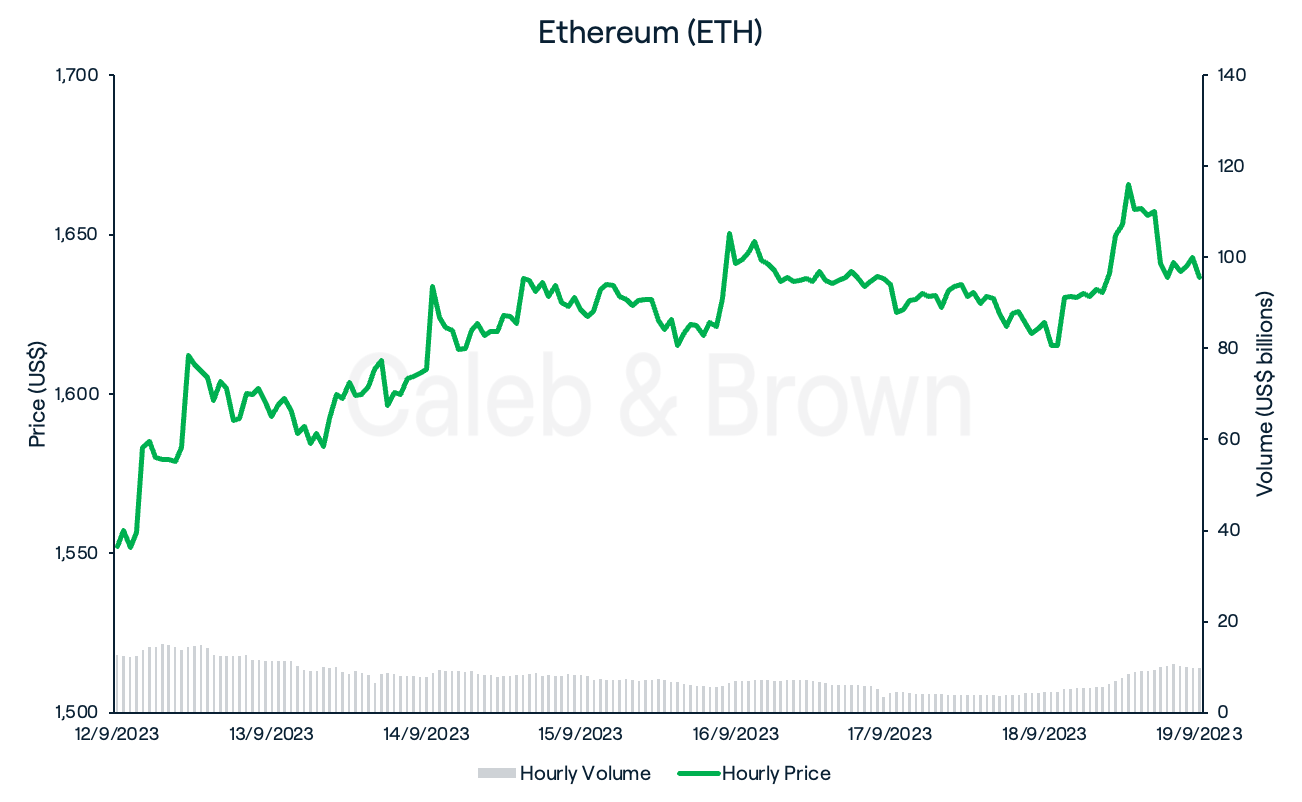

Ethereum

Ethereum (ETH) dipped nearly 4.0% to a low of US$1,531 on Monday night. While ETH also made a full recovery, Ethereum’s growth may have been hobbled by reports of its supply recently turning inflationary, (meaning more ETH is issued than burned) in one of few such periods since the Merge in September 2022.

ETH closed the week at US$1,637 for a weekly gain of 5.4%.

Altcoins

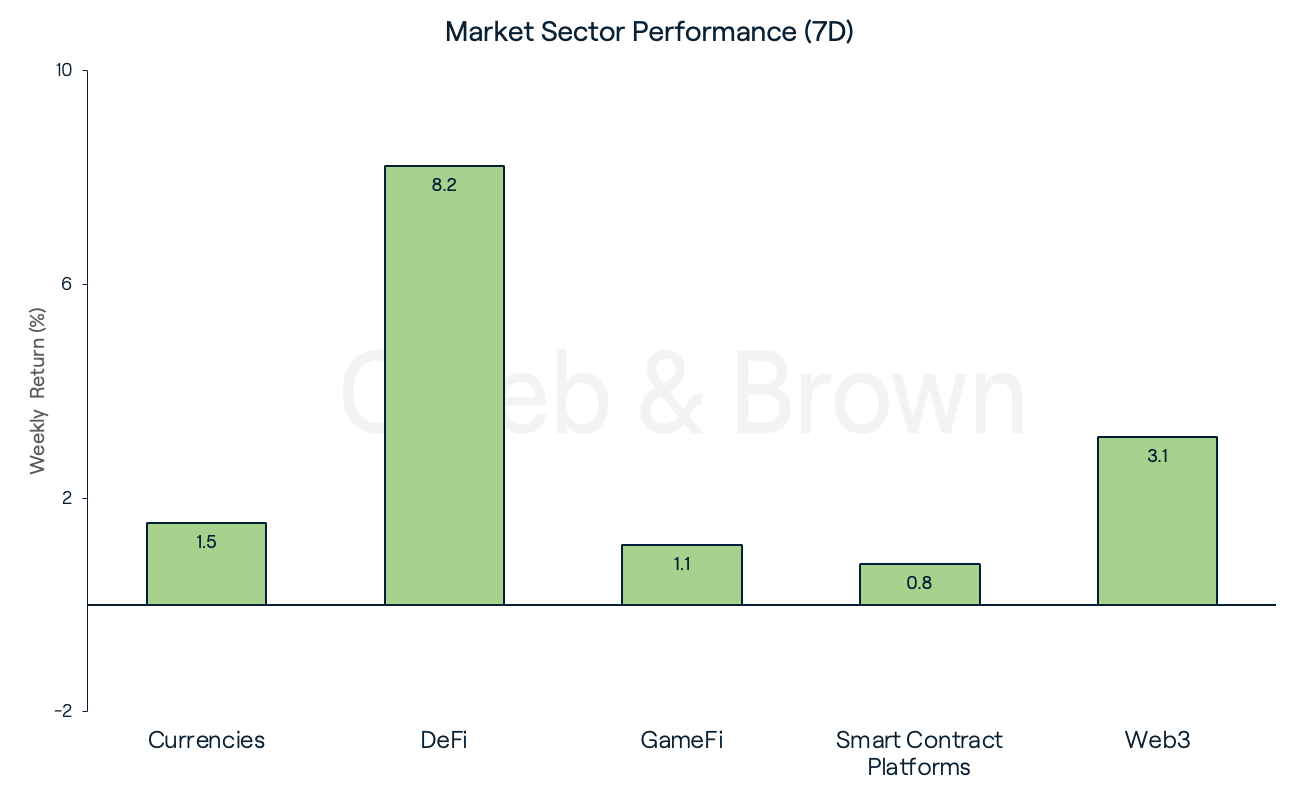

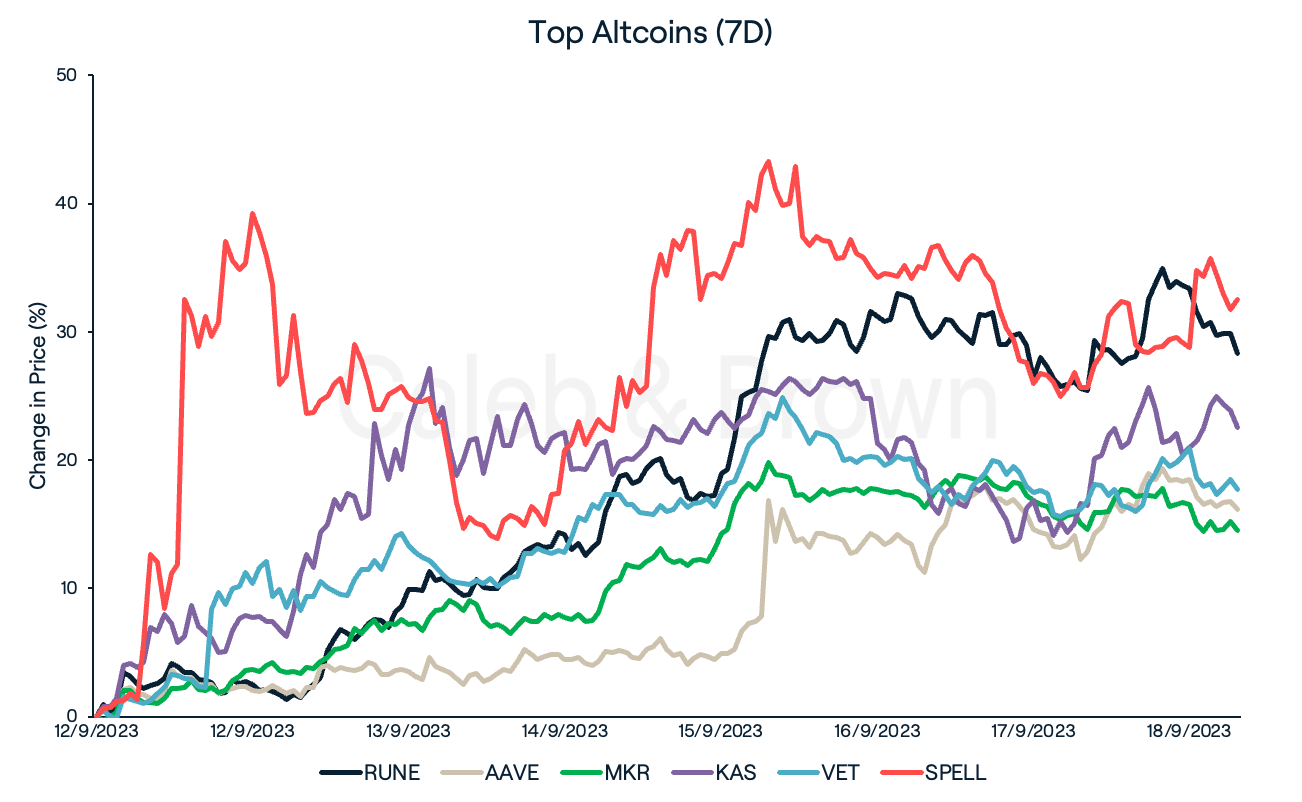

Market sectors were up across the board this week with a number of tokens securing double-digit gains. DeFi surged 8.2% week-on-week to take top spot while Smart Contract Platforms lagged behind with a 0.8% gain.

Amongst the DeFi sector THORChain (RUNE), Maker (MKR), and Aave (AAVE) added on 28.3%, 16.2%, and 14.5%, respectively. RUNE extended its rally after MetaMask, the leading self-custodial wallet, recently added support for THORChain through a new plug-in called “Snaps”.

Layer-1 protocols Kaspa (KAS) and VeChain (VET) also secured double-digit gains with each increasing by 22.5% and 17.7%, respectively. VeChain surged after being listed on major exchange, Coinbase.

Taking home top spot this week was Spell (SPELL), rallying 32.5% after a proposal to bolster liquidity across centralised ecosystems in addition to a US$1 million purchase plan, passed on Thursday.

In Other News

Bitcoin (BTC) recorded its largest daily transaction count ever on Friday, exceeding 700,000 daily transactions, and allowing it surpass Visa’s annual transactional volume.

-

On Monday, Sony subsidiary Sony Network Communications announced it was developing a blockchain network in collaboration with crypto tech firm, Startale Labs. The Singapore-based joint venture will aim to “create a global infrastructure that underpins the Web3 era, driving innovation across existing industries.”

-

Fortress Trust, the custodian of Bitcoin accumulation platform Swan Bitcoin, was hit by a security incident last week, leading to a loss of customer funds. This information was only revealed to the public after XRP’s acquisition of Fortress last week, with XRP covering losses suffered by Fortress’ users.

Regulatory

-

On Wednesday, FTX received U.S. court approval to liquidate its crypto holdings in a bid to repay its creditors. The defunct exchange holds ~US$3.4 billion in crypto assets with Solana (SOL) representing its largest holding of ~US$1.2 billion worth. Currently, the company’s plan to offload assets will cap selling to US$100 million worth of tokens per week, with an option to increase the cap.

-

The Securities and Exchange Commission’s (SEC) motion to unseal documents in its lawsuit against Binance US was approved on Friday by a district judge. The SEC cited a lack of transparency, alleging that Binance’s international entity was in control of US customer funds when it had previously agreed that it would be under the sole control of Binance’s US entity.

Learn with Caleb & Brown: Crypto Portfolio Basics: The Key to a Well-Balanced Portfolio

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F6bSkRvjN3CwqvQeqITnETN%2F0ac0ae22afb90aedb9c31336a6c6b3fd%2FWeekly_Rollup_Tiles__15_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-09-20T00%3A31%3A56.252Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)