Market Highlights

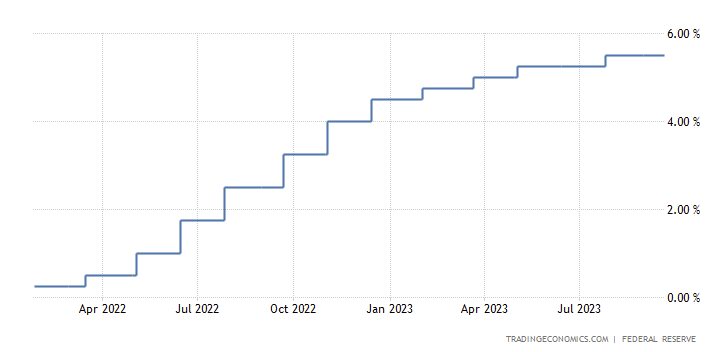

- Wednesday’s Fed policy meeting concluded with another rate hike pause, maintaining its benchmark lending rate at a 22-year high of 5.25%-5.5%.

- Ethereum network recently surpassed US$10 billion in revenue, putting it shoulder-to-shoulder with the likes of Alphabet and Meta.

- Banking giant, Citigroup launched a digital token service for cross-border payments.

- Ethereum's Dencun network upgrade may be delayed til early next year.

- SEC is reviewing applications for two spot Ethereum ETFs (exchange traded funds) - ARK Invest and VanEck.

Bitcoin

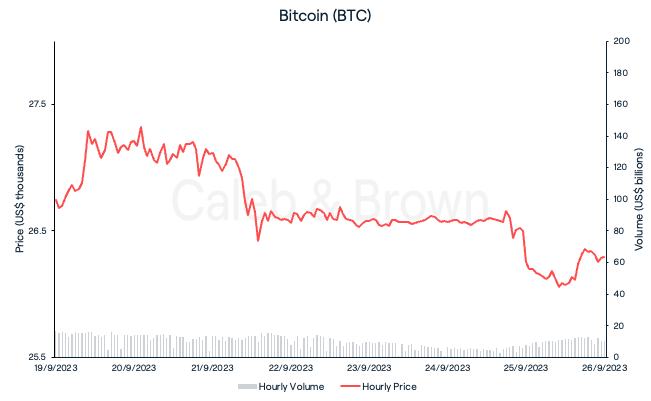

The crypto market cooled down this week for a relatively steady week of price movements.

Bitcoin (BTC) remained unmoved after Wednesday’s Fed policy meeting concluded with another rate hike pause, maintaining its benchmark lending rate at a 22-year high of 5.25%-5.5%.

While the rate hike pause stabilised prices in the short-term, the Committee reaffirmed its hawkish stance by signalling a final rate hike to 5.5%-5.75% this year, and fewer rate cuts in 2024, indicating a longer period of elevated interest rates.

A small sell-off Sunday night saw BTC fall through the support level $US26,500 and close the week at US$26,297, down 1.7%.

Ethereum

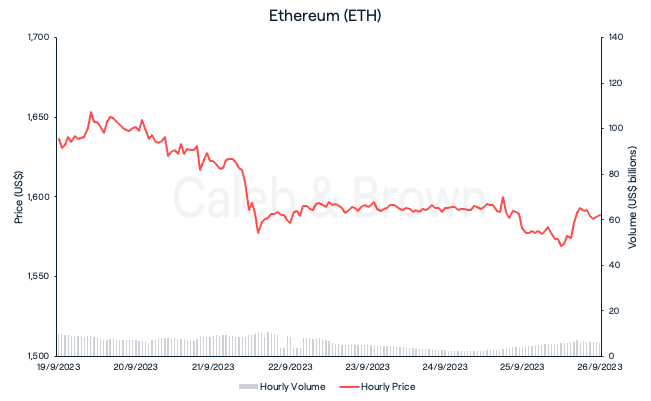

Ethereum (ETH) displayed less resilience to the Fed’s policy meeting on Wednesday, falling 1.3% on the day, and giving up all of last week’s gains. This saw the ETH/BTC ratio drop to a 14-month low of ~0.0594 and close the week at US$1,588, down 2.9% over the last seven days.

The selling pressure likely stemmed from a number of ETH whales, including co-founder Vitalik Buterin, sending US$60 million worth of ETH to exchanges this week, raising alarms for further price declines.

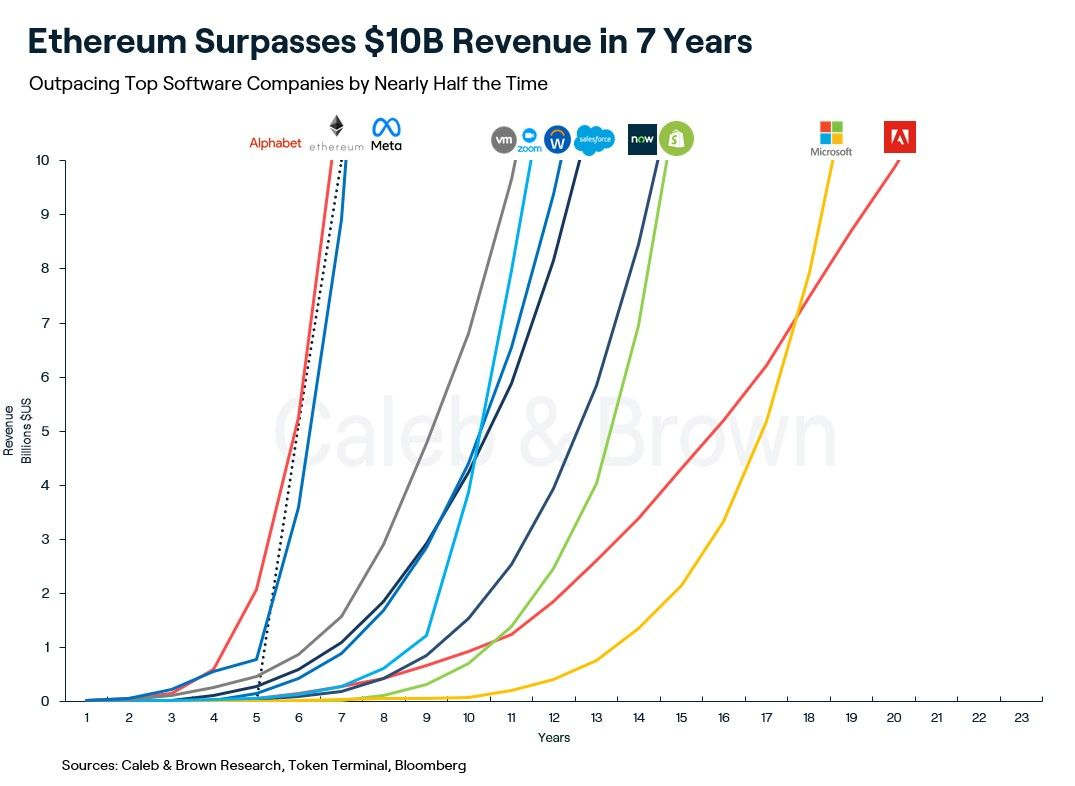

Taking a longer-term view, the Ethereum network surpassed US$10 billion in revenue in just seven years.

Since 2015, Ethereum has generated US$16.8 billion in fees with over 60.0% of this converting into revenue. This places it shoulder-to-shoulder with the likes of Alphabet and Meta.

Altcoins

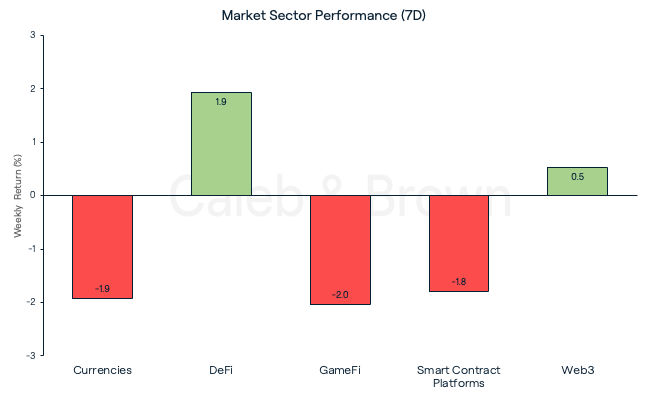

Market sectors were kept at bay this week, trading at most, 2.0% in either direction. GameFi was the worst performing sector, losing 2.0% over the last seven days, while DeFi led sector performance for the second week running, adding on another 1.9%.

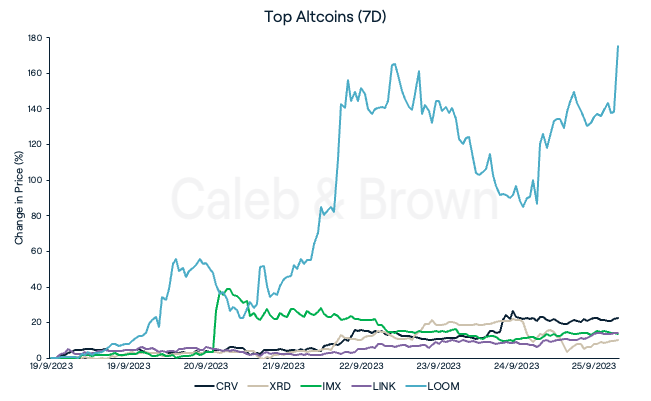

Curve DAO (CRV) and Radix (XRD) have secured top spots for DeFi, increasing by 22.5% and 10.0%, respectively. CRV’s rise in price was likely attributed to a mysterious whale wallet that has actively acquired and staked CRV tokens worth approximately US$10 million over the past few days.

Other notable performances include ImmutableX (IMX) and Chainlink (LINK) which grew 13.9% and 14.2%, respectively. IMX was up after trading volume spiked more than six times the 30-day average across South Korean exchanges, while LINK’s price surge followed the launch of its Cross-Chain Interoperability Protocol (CCIP) on Ethereum layer-2, Arbitrum (ARB)

Loom Network (LOOM) also blew up 175.3% after it was listed on exchange gate.io however a direct tie to the price surge could not be found.

In Other News

On Monday, banking giant Citigroup launched a digital token service utilising blockchain and smart contract technology to facilitate rapid cross-border payments between institutions.

- At the latest Ethereum Foundation consensus-layer meeting, Tim Beiko discussed the potential for the Dencun network upgrade to be delayed until early next year. The upgrade will introduce proto-danksharding, a technology which will enhance Ethereum’s scalability and processing speeds.

- Zilliqa (ZIL) recently announced a strategic partnership with Google Cloud, aiming to enhance the resilience and scalability of the Zilliqa blockchain, benefiting the wider ecosystem and ventures within Zilliqa Group.

- The U.S. Securities and Exchange Commission (SEC) is reviewing applications for spot Ethereum exchange-traded funds (ETFs) from two asset managers – ARK Invest and VanEck. According to the agency’s release, the SEC has sought a 45-day public comment period for both filings.

Regulatory

- After the SEC’s motion to unseal certain Binance documents in its lawsuit against Binance US was recently approved, Binance and its CEO Changpeng Zhao have fired back, filing a joint motion to dismiss the lawsuit brought against them. Binance contends that the U.S. regulator was not only overreaching in its application of securities laws to crypto assets, but that it was seeking to retroactively impose its authority on the industry.

Learn with Caleb & Brown: The Game Theory of Cryptocurrency Learn how game theory provides the economic incentive layer which makes cryptocurrencies work.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2FSwDVhaCt58bfwW0UVSnWk%2F8fe735c348d5508e15d559f473d6adce%2FWeekly_Rollup_Tiles__16_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-09-26T04%3A51%3A58.623Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)