Market Highlights

- On Tuesday, Grayscale won its appeal against the Securities and Exchange Commission (SEC) causing Bitcoin (BTC) to rally 8.0%

- Bloomberg analysts subsequently raised the spot Bitcoin ETF approval rate to 75%.

- A district judge dismissed a class action lawsuit filed against Uniswap (UNI).

- The Hong Kong Securities and Futures Commission (SFC) issued an Approval-in-Principle (AIP) to Swiss Bank, SEBA's Hong Kong regional subsidiary on Wednesday.

- Ripple Labs filed its opposition to the U.S. Securities and Exchange Commission's request for Judge Torres to certify an interlocutory appeal of her ruling regarding XRP.

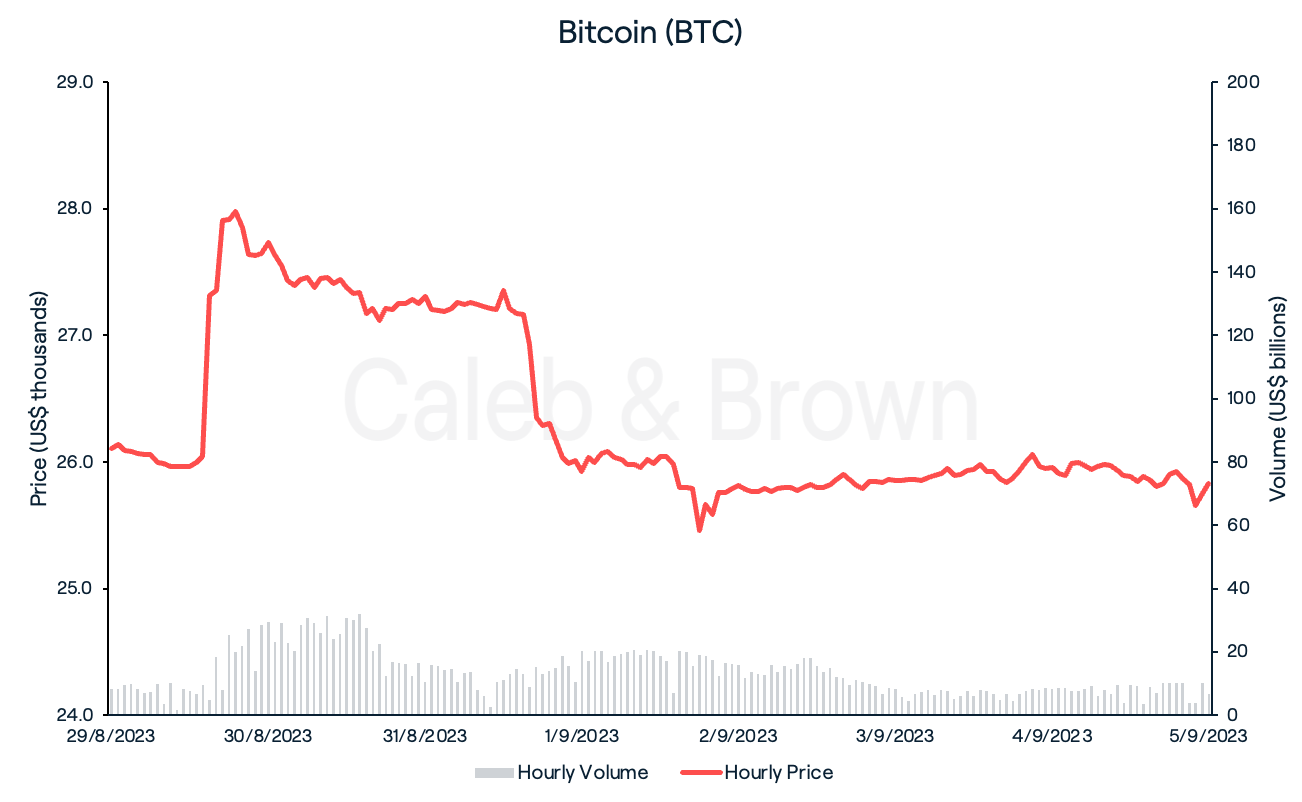

Bitcoin

It was an interesting week for Bitcoin (BTC) as it quickly surged 8.0% to a high of US$28,142 on Tuesday, after Grayscale won its appeal against the Securities and Exchange Commission (SEC). This was positive for investors as the denial of Grayscale’s spot Bitcoin ETF (exchange traded fund) would be reviewed, causing Bloomberg analysts to raise its spot Bitcoin ETF approval rate to 75.0%.

However, by Friday all intra-week gains made by BTC were erased after the SEC extended the deadline to approve or deny six ETF decisions until October.

BTC closed the week at US$25,829, down 1.1%.

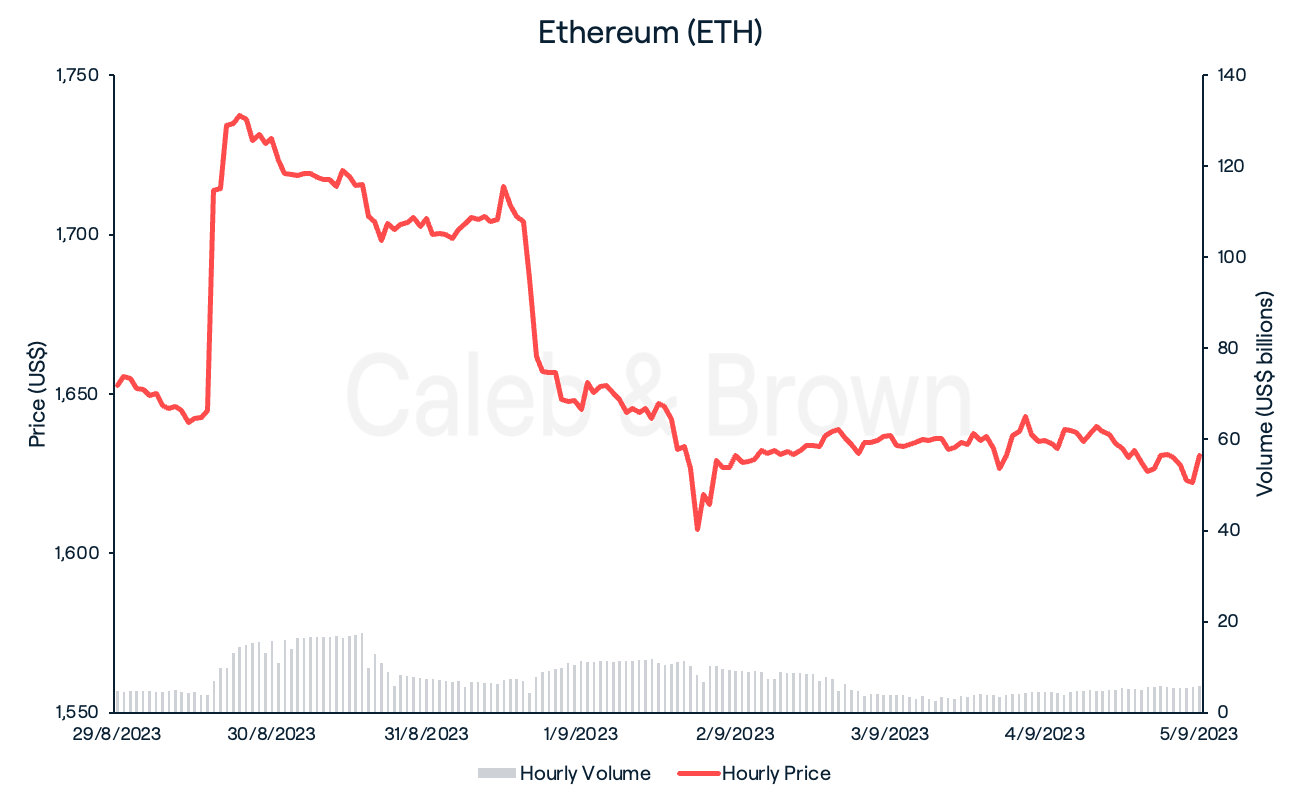

Ethereum

Ethereum (ETH) fared quite similarly to BTC this week, rallying mid-week to a high of US$1,745 before settling around the US$1,600 mark. ETH eventually closed the week at US$1.640, down 1.3% over the last seven days.

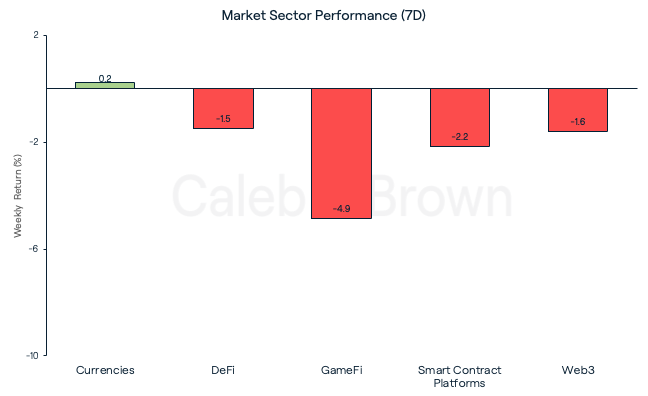

Altcoins

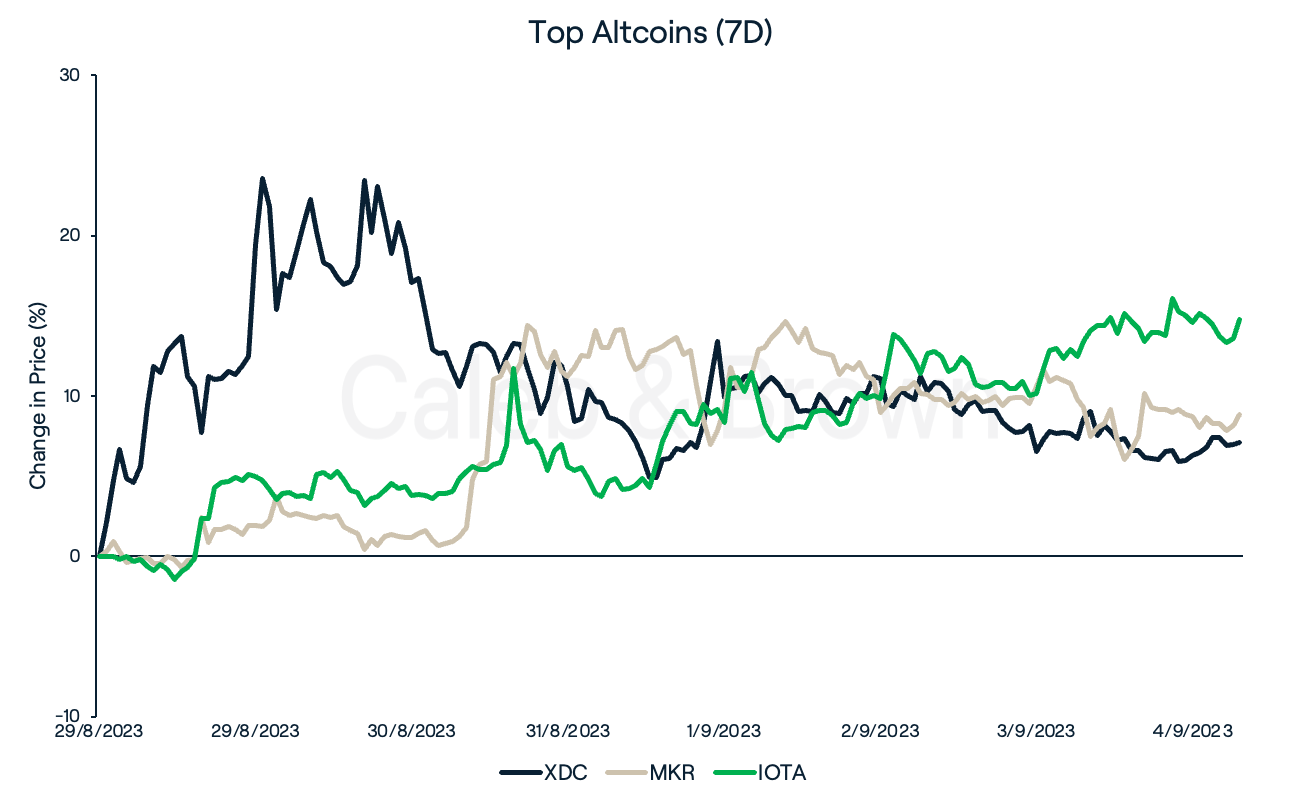

The majority of sectors were in the red this week with GameFi taking the largest hit at 4.9%. Currencies was the only sector to stay above water gaining 0.2% over the last seven days.

Amongst this week’s top performers were XDC Network (XDC) and Maker (MKR) which added 7.1% and 8.8%, respectively.

XDC surged on the news of a tokenised U.S. Treasury offering (USTY) being issued on its network while MKR rallied after its co-founder, Rune Christensen recently proposed its native blockchain to be built on Solana.

The top performer this week was the Internet of Things (IoT) focused protocol, MIOTA (IOTA) which grew 14.8% week-on-week. The price growth seems to be centred around speculation of the release of IOTA 2.0 in the coming weeks.

In Other News

After just a month since launching Chainlink’s (LINK) new Cross-Chain Interoperability Protocol (CCIP), Swift, the interbank messaging service, announced a successful round of blockchain interoperability tests on Thursday, utilising Chainlink’s CCIP. Swift aims to bridge the gap between traditional finance and blockchain the the use of tokenisation, and Chainlink as its vessel.

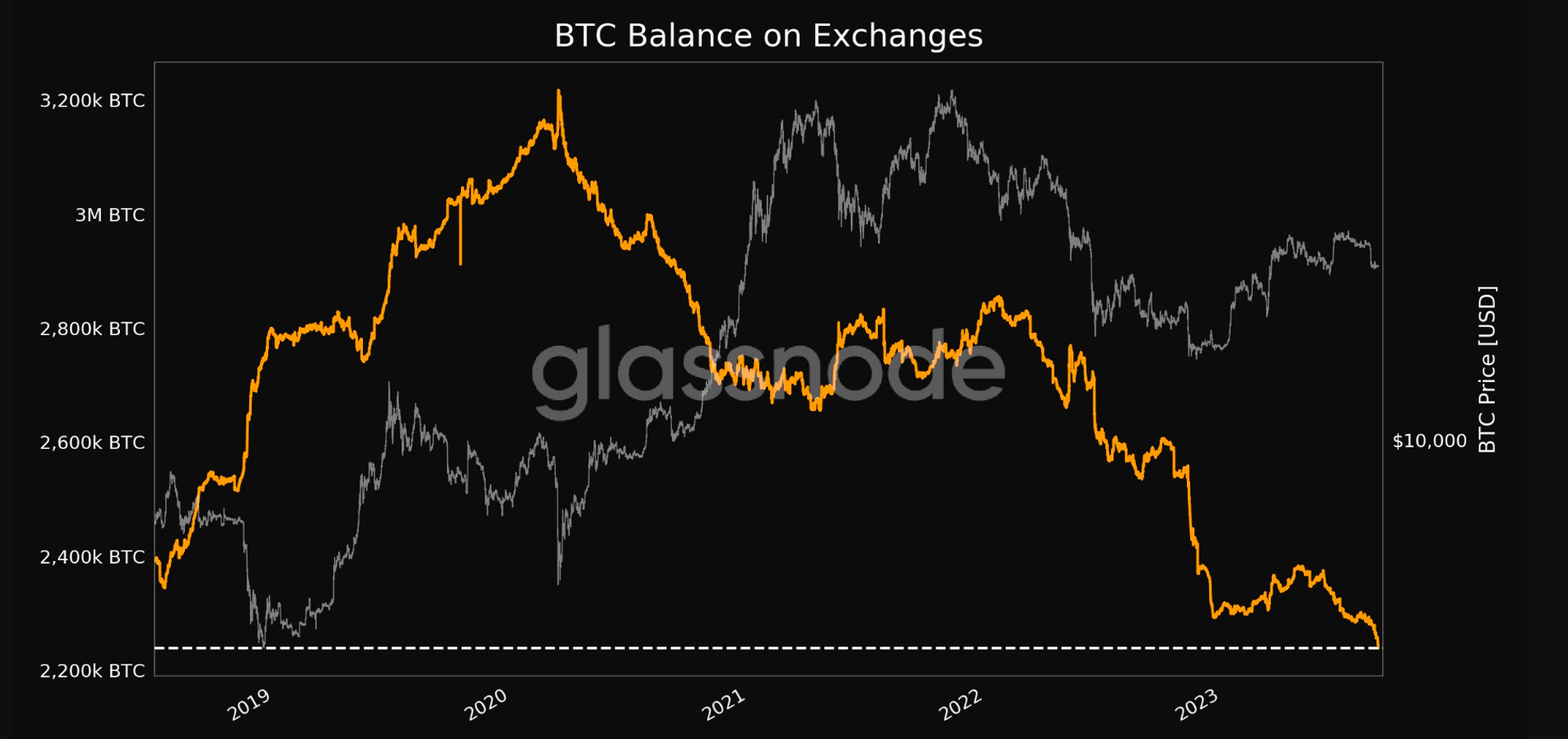

Glassnode data has revealed that BTC exchange balances have reached a five-year low, possibly indicating investors switching to a long-term investment horizon.

Regulatory

-

On Tuesday, a district judge dismissed a class action lawsuit filed against Uniswap (UNI), ruling that the individuals linked to the decentralised exchange cannot be held responsible for tokens alleged to be scams (that were traded on Uniswap), which purportedly caused losses to traders. Furthermore, she also challenged the notion that software platforms can be held liable for damage caused by third party misuse of software code.

-

On Wednesday, the Hong Kong Securities and Futures Commission (SFC) issued an Approval-in-Principle (AIP) to Swiss Bank, SEBA’s Hong Kong regional subsidiary, allowing it to deal in digital assets. This comes shortly after the SFC also issued Hong Kong Virtual Asset Exchange an AIP, with both digital asset operators on its way to acquiring full licenses.

-

On Friday, Ripple Labs filed its opposition to the U.S. Securities and Exchange Commission’s request for Judge Torres to certify an interlocutory appeal of her ruling regarding XRP. The crypto firm has argued that “the exceptional circumstances required for interlocutory appeal are absent.”

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F7maupOaUwtklPyvWchNhUg%2F8991c18de8dc710d3f450889bd64c7d0%2FWeekly_Rollup_Tiles__13_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2023-09-05T13%3A15%3A16.505Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)