Key Points

- Timing the market is a crypto investing strategy which involves making buying or selling decisions by attempting to predict the future market price movements of an asset - buying low and selling high.

- Time in the market refers to a passive investment strategy in which an investor holds a position for an extended period (usually a few years or more).

- Both investing strategies come with different trade-offs for different investors. More experienced crypto investors with a deep understanding of market dynamics may be in a better position to time the market with some consistency.

- But for the average or beginner investor, trying to time the market is more akin to a game of luck, and the odds aren’t in your favour. Most investors are better suited to long-term strategies (e.g. buying and holding).

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” -Peter Lynch, investor, mutual fund manager, and philanthropist

Even the greatest investors of our era willingly admit that timing the market is notoriously difficult to pull off.

While success stories are often shared of the few who timed it right, these stories are few and far between. And the stories of them doing it more than once are even rarer. A study on day traders found that over 70% of investors lose money in their first year of implementing market timing.

On the other hand, time in the market is an approach that carries less risk if done correctly. But it can test the patience of an investor, who may not see a significant profit for years.

Which one is better? Let’s explore the risks and rewards of each.

What is Market Timing?

Market timing is a strategy in which investors forecast market movements over a period of time. Using these predictions investors make certain, calculated entries into the market in an attempt to make a short-term profit, or avoid potential losses.

This strategy relies on an investor's ability to consistently predict market dips and peaks, and use that information to enter and exit the market at the most opportune times. Market timing is often used by day traders.

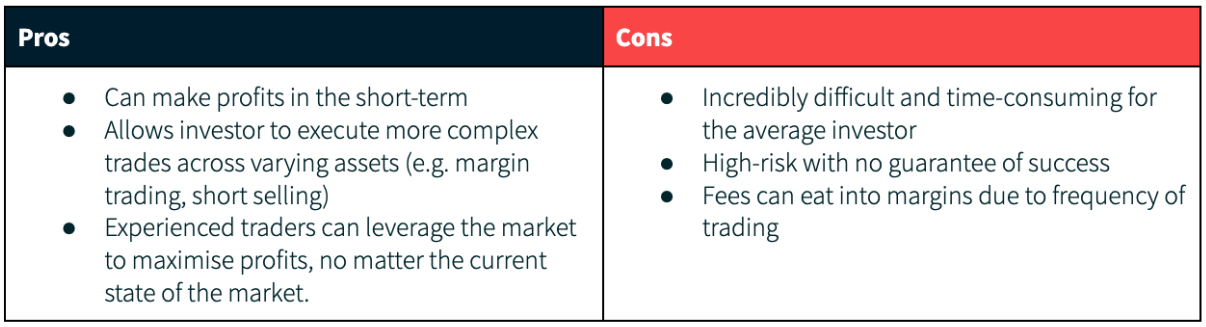

Being able to forecast the market is a skill that doesn’t form overnight. Even the most experienced investors can’t account for unpredictable circumstances that could negatively impact their strategies. Investors who time the market are regularly assessing where the market is going; tuning into trends and news that could impact the trajectory of their investments. Investors using this method usually have a good understanding of technical analysis and can use their knowledge and experience to make informed decisions.

An Example of Timing the Market

The price XRP is $0.75. An investor believes that the price will rise to $1 within the next few days due to a major event and purchases $750 of XRP (1000 XRP). A few days later the price rises to $1. The investor sells their 1000 XRP and profits $250.

Every investment carries some level of risk. The investor in the example above could have purchased more XRP, earning even more profits. But if the market turned over those few days, their losses would be equally as large.

Timing the market seeks to maximise profits. With higher reward potential, higher risk follows.

What is Time in the Market?

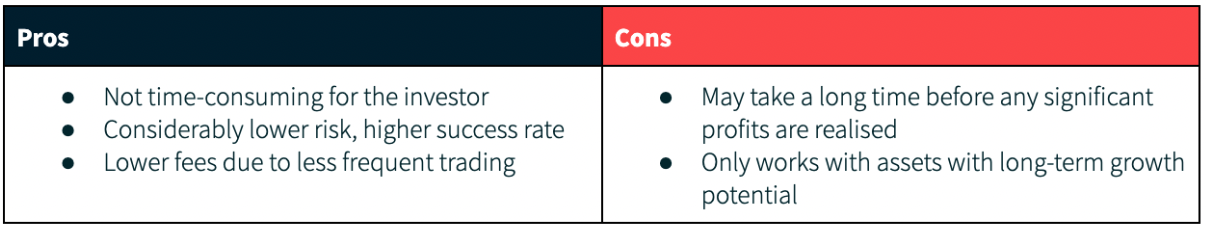

This strategy is a passive, long-term approach to investing in crypto. It requires patience, leaving assets untouched for up to years at a time (or until they realise their future potential).

In this method, investors generally buy an asset and hold it until it reaches a predetermined price target. Rather than trying to time when an asset’s price will rise, investors select an asset/project they believe will achieve long-term success and hold onto that asset regardless of market status or sentiment. When the price is right for them, they exit the market with a reasonable profit.

Although this conservative style of investing could carry lower risk than market timing, it is not completely risk-free. If the asset price falls to zero, it doesn’t matter what price you entered the market at. Your investment is a net loss.

An Example of Time in the Market

A real-life example of this strategy was used by Erick Finman. In 2011, at only age 12, he invested $1000 (gifted to him by his grandmother) into Bitcoin when the price was just $12. When the value of Bitcoin rose to $1200 in 2013, his initial investment increased by 9900%. He continued to hold on to a portion of his Bitcoin investment, eventually becoming a millionaire by age 18.

Dollar Cost Averaging

A strategy often used in conjunction with time in the market is dollar cost averaging (DCA). In addition to holding an asset for a longer period, investors also continue to invest fixed amounts of money into a crypto asset at regular time intervals (e.g. weekly, fortnightly, monthly). The investment is made regardless of the asset's price at the time of investing.

Rather than investing a large sum and being locked into a certain entry price, investors using DCA absorb some market volatility in order to make the most of peaks and dips.

When the market falls, DCA investors shoulder the impact by buying more shares at a lower price. When the market rises, these same investors end up buying fewer shares at a fixed price, yet they profit off of the previous shares they purchased. The result is a portfolio that is somewhat reflective of the price history of the asset during the investing period.

Recommended Reading: A Guide to Dollar Cost Averaging in Crypto

Timing the Market vs. Time in the Market

While they may sound the same, timing the market and time in the market are two distinct investing styles.

Timing the market is a proactive approach, where investors or traders need to be tuned into the market daily in order to determine an ideal time to buy or sell.

Time in the market is much more passive. This approach centres around the asset itself, financial research and whether it has strong fundamentals that will contribute to an increase in value in the future.

Overall, time in the market is often considered a stronger investment strategy for the average investor, especially those who don’t have much experience in crypto markets. It takes a tremendous amount of discipline and time to have a small chance of being successful at timing the market. Even experienced traders often have difficulty timing the market consistently.

Time in the market is less risky and more likely to deliver positive results consistently, but it can take a very long time to be profitable.

Hybrid Investing Strategies

Some investors choose to combine both of these methods, effectively creating a mid-term strategy over the course of a market cycle.

An investor who can effectively read and analyse market trends may purchase an asset when the price is low. Instead of trading immediately for a small profit, they’ll hold onto the investment until the price rises further down the market cycle. This combined strategy could play out over the course of a few months or a year.

Recommended Reading: Common Crypto Investing Strategies Every Investor Should Know

Pros & Cons of Timing the Market

Pros & Cons of Time in the Market

Things to Consider

When trying either of these strategies it’s important to consider the following:

Evaluate Your Portfolio Regularly

Keeping tabs on your portfolio is absolutely essential when timing the market, as it could be a good indicator of whether your strategy is working. While this is less important for those who choose to hold their investments, a periodic check-in (quarterly, semi-annual, or at your own discretion) could help investors assess whether an asset is on track to meet its long-term goals.

Be Wary of Fees

Depending on the trading platform you use, there may be various fees associated with each trade, deposit, and withdrawal. If you are trading frequently, make sure to factor in these fees as they could negatively affect your profits over time. At Caleb & Brown we have zero fees on deposits and withdrawals, and offer one transparent, flat fee on every trade, making it ideal for passive and active investors alike.

No Strategy is Completely Risk-Free

As with any investment, there is no zero-risk method. Both of these strategies incur various levels of risk. Even the most experienced investors can’t negate unpredictable events that would impact their strategy. Doing your own research (DYOR) should precede any investment. Lastly, only invest what you can afford to lose.

Recommended Reading: How to Invest in Crypto

Summary

For many investors, time in the market beats timing the market.

Timing the market consistently is incredibly difficult and it also takes a tremendous amount of energy and discipline. Whereas, time in the market requires less effort and produces more consistent outcomes.

Whatever investment style you choose, it is important to conduct thorough research. Otherwise, it is no different from gambling.

FAQs

Does time in the market beat timing the market?

Each strategy has its benefits and risks. In the short-term, timing the market may help an experienced investor maximise profits. In the long-term, time in the market could benefit investors of any experience level provided they buy an asset with long-term growth potential.

What should I look out for when choosing an asset to invest in?

When researching an asset/project to invest in, take into consideration its utility, the real-world problem it’s attempting to solve, and the project’s white paper. Other factors to consider (although they in no way indicate the future value of an asset) are: price history, ranking, liquidity, and volume.

What other investing strategies can you use in crypto markets?

For a complete list of common crypto investing strategies, check out this guide.

Make Your First Investment With Caleb & Brown

You don’t have to be an expert to start investing in crypto.

Caleb & Brown is the world's leading crypto brokerage for beginner and advanced investors alike, making your entry into the market effortless.

Our personalised broker service makes crypto investing simple. A dedicated member of our broker team is always on hand to guide you along the way, giving you the confidence you need to navigate the world of crypto. Not to mention key features such as:

- No joining or signup costs

- Industry-leading storage solutions

- 24/7 customer support

If you are ready to take the next step and invest, contact your crypto broker today.

Not yet a client? Sign up for your free consultation.

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.