In this Week's Market Rollup

The Merge rally has cooled off over the last seven days in line with shifting investor sentiment. Major long liquidations have seen the market surrender recent gains, with BTC and ETH posting double digit losses and most altcoins in the red.

Market Highlights

- The July rally came to an end this week, with both BTC and ETH posting double digit losses, falling 14.9% and 16.3% respectively.

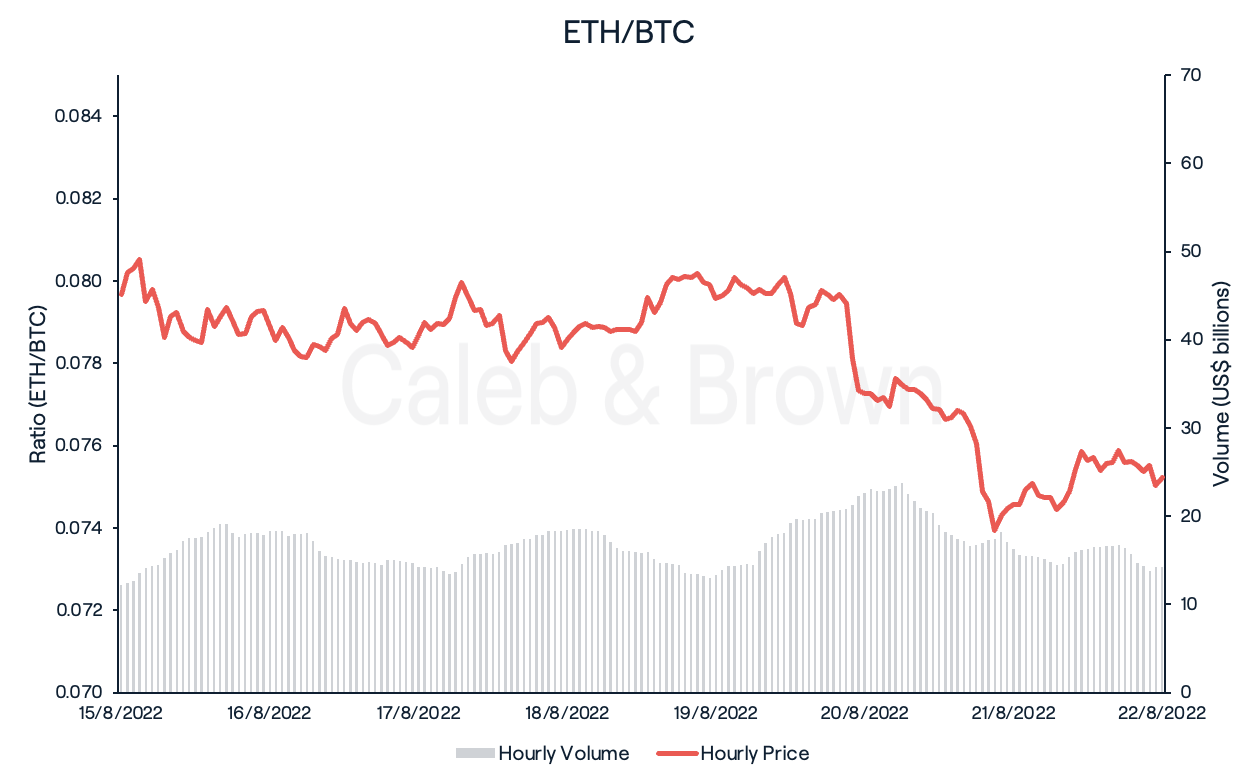

- ETH underperformed BTC for the first time in 3 weeks, losing over 7.5% in marketshare against BTC.

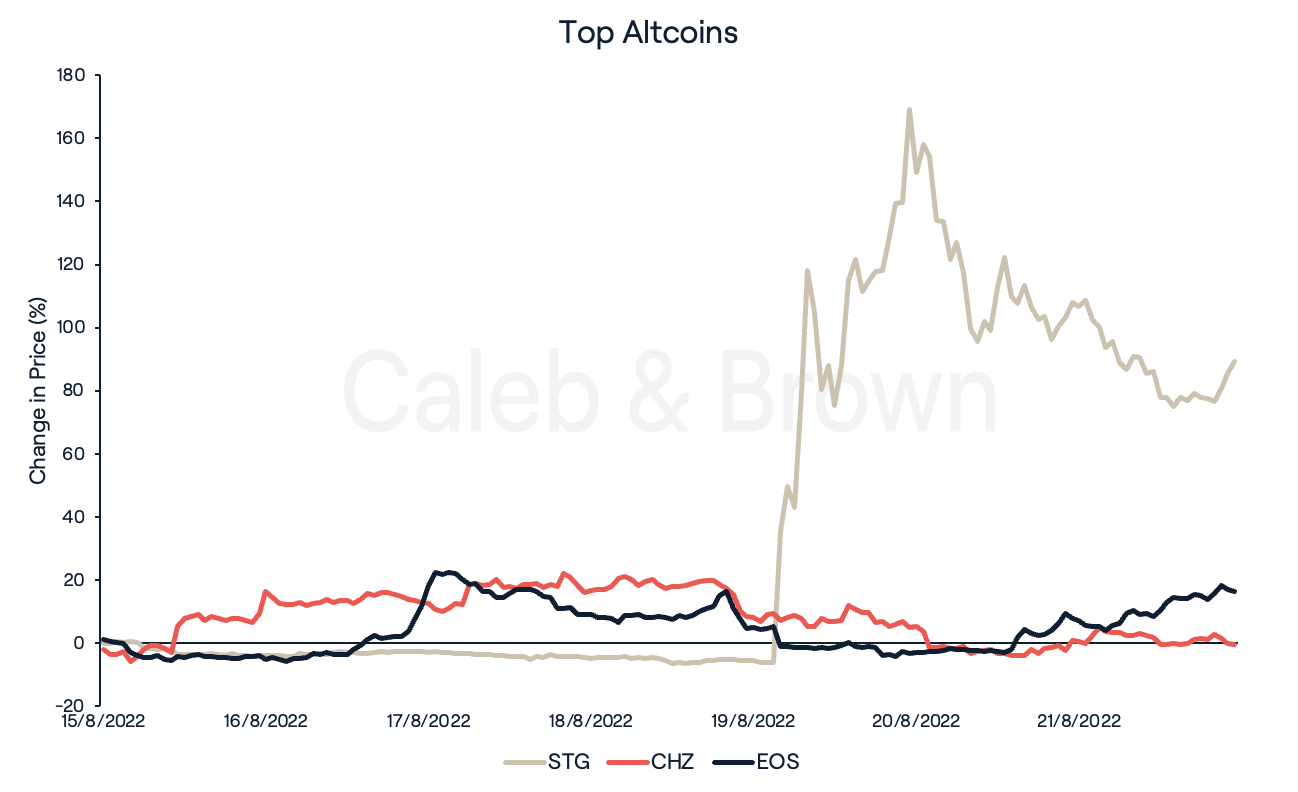

- Stargate Finance (STG), Chiliz (CHZ), and EOS (EOS) posted positive returns in a broadly negative week for altcoins.

Price Movements

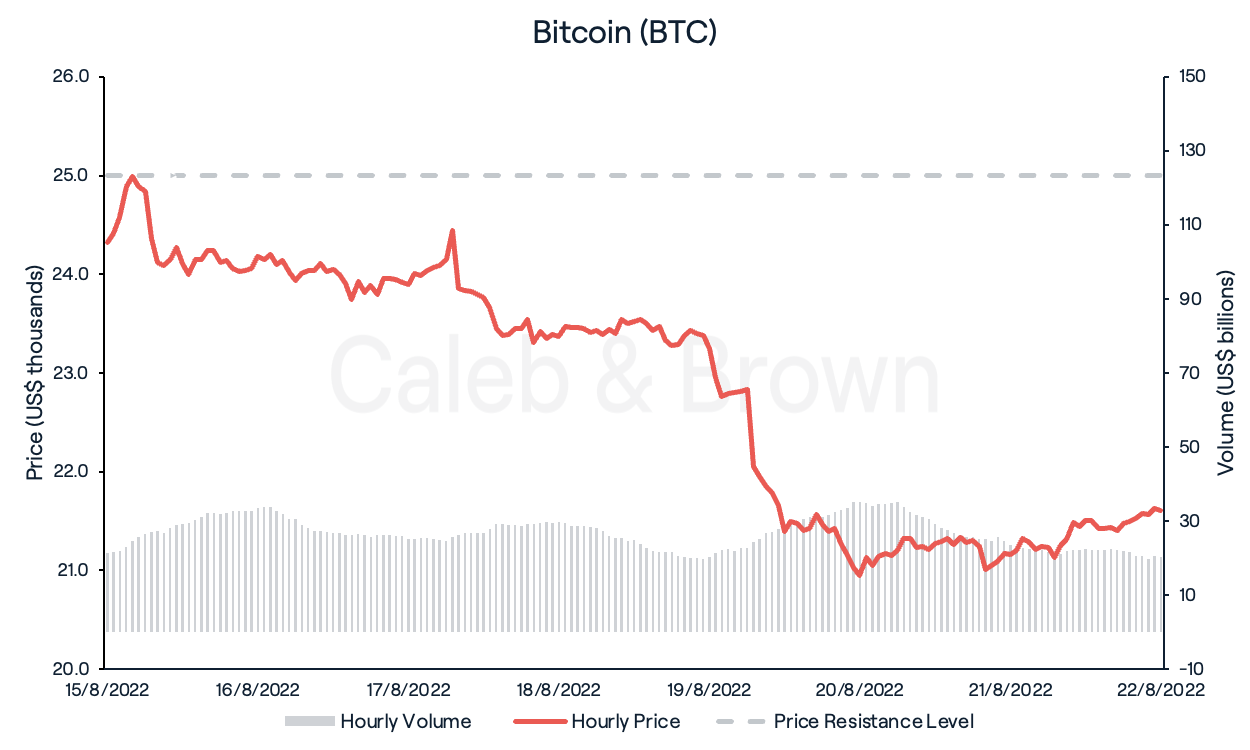

Bitcoin (BTC)

What started out as a strong week for Bitcoin (BTC), finished disappointingly thanks to some major sell offs into the weekend. Despite briefly trading above US$25,000 earlier in the week, BTC was unable to hold this level and prices fell sharply after US$210 million of long positions were liquidated on August 19. While a specific trigger for the sell-off hasn’t been identified, Bitcoin shed 14.9%, hitting a three-week low of US$20,845.

Bitcoin miners have faced challenging conditions in recent times as Bitcoin’s recent price declines and the rising cost of energy globally has put increasing pressure on their business models. Bitfarms, a publicly traded Bitcoin mining company, reported a US$142 million loss on August 15, forcing them to sell 3,357 Bitcoin to reduce their debt. Fellow Bitcoin mining company Argo Blockchain PLC also reported greater Bitcoin outflows in comparison to what they have recently mined. Argo mined 219 BTC in July but sold 887 BTC to reduce its outstanding balance of a BTC-backed loan. With energy prices falling and persistently high inflation, Q3 may see miners fall back on track towards positive returns.

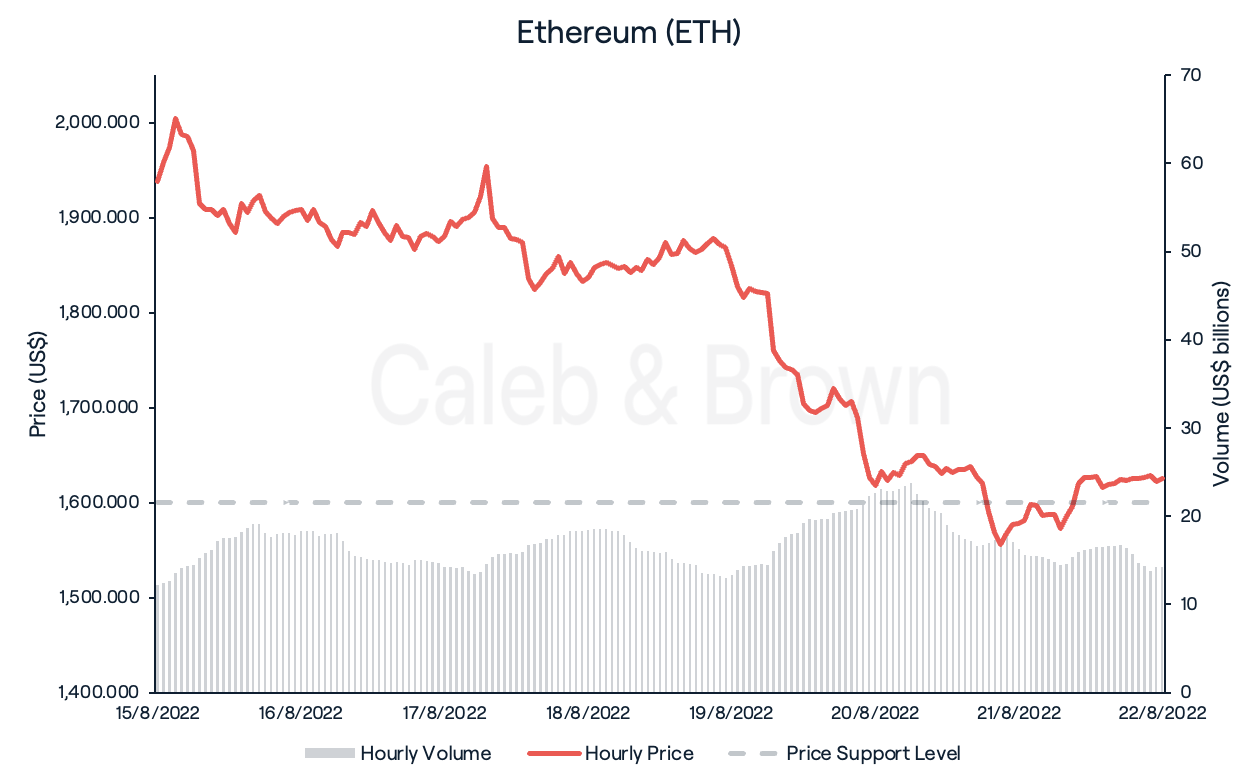

Ethereum (ETH)

The Merge rally seems to have cooled off as Ethereum (ETH) faced a significant downturn over the past seven days. In similar fashion to Bitcoin, ETH briefly flirted with US$2,000 at the start of the week before retracing with a double digit move (16.3%). Sharp declines of 10% on August 19 could be attributed to US$200 million of ETH long futures being liquidated, leading to extreme sell pressure on ETH. ETH is currently holding above US$1,600, trading at US$1,616.

This is the first time in three weeks that ETH has underperformed BTC, losing over 7.5% of its marketshare. Ethereum has outperformed the market as a whole over the past few weeks following exciting progress to its much anticipated merge to Proof-of-Stake (PoS.) The Merge is officially scheduled for Ethereum’s mainnet with predictions pointing to around September 15th.

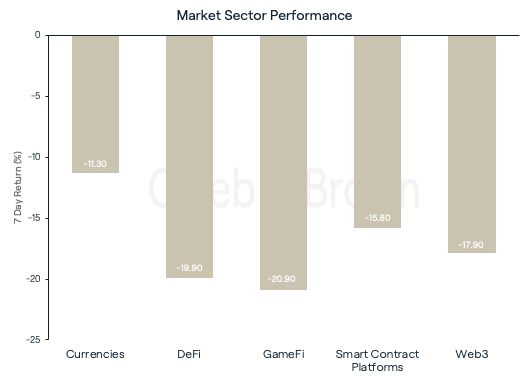

Altcoins

In a week where crypto markets surrendered gains, altcoins have bared the brunt of price declines with most assets in the red. The GameFi sector was the worst performing market sector over the last 7 days, down 20.8%. The DeFi, Web3, and Smart Contract Platform sectors also struggled, down 19.9%, 17.9%, and 15.8% respectively.

The one notable outlier to the market has been Stargate Finance (STG), which finished the week with a whopping 86% return. This price increase largely came from its listing on the global exchange Binance, which brought more attention and liquidity to the token.

Chiliz (CHZ) and EOS (EOS) also posted positive returns this week. Speculation that Chiliz is working on a bridge and staking service caused their respective token to finish the week 19% higher, closely followed by EOS with a 16.9% return.

Regulatory

Australian digital asset manager, Monochrome, has received regulatory approval to launch its spot-based crypto ETF. Monochrome is one of the first asset management firms to be authorised under an Australian Financial Services License (AFSL), offering retail investors regulated access to BTC and ETH. The ETF will trade under the name Monochrome Bitcoin ETF, ticker symbol ASX: IBTC.

Recommended reading: Why is Crypto So Volatile? Understanding Market Movements

Disclaimer: This assessment does not consider your personal circumstances, and should not be construed as financial, legal or investment advice. These thoughts are ours only and should only be taken as educational by the reader. Under no circumstances do we make recommendation or assurance towards the views expressed in the blog-post. The Company disclaims all duties and liabilities, including liability for negligence, for any loss or damage which is suffered or incurred by any person acting on any information provided.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F5gYxSUszzoqOqzUn8IdbP2%2Fd1386c7b90670e9efbd42d029e402ebd%2FWeekly_Rollup_Tiles__3_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-16T23%3A56%3A09.141Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F3Sobj38v4fuCFRecM13TFU%2F584f42d5e1994c900afd5d54dff5bf51%2FWeekly_Rollup_Tiles__2_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-11T05%3A55%3A49.785Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F29XH6Swt4hU18MVWxiKmbh%2F77a0984be554569157a7511843e65340%2FWeekly_Rollup_Tiles__5_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-03-31T22%3A10%3A27.955Z)

.png?u=https%3A%2F%2Fimages.ctfassets.net%2F4ua9vnmkuhzj%2F1vB2h7uT9UthdTfYZSWNlb%2F204632b77f5f17f594dae793972225d5%2FWeekly_Rollup_Tiles__1_.png&a=w%3D480%26h%3D270%26fm%3Dpng%26q%3D80&cd=2024-04-15T03%3A32%3A32.704Z)